The Rise and Fall of Funding Portals: Why Some Are Exiting the Space

No time to read? Let AI give you a quick summary of this article.

Crowdfunding portals have democratized investment opportunities and enabled startups and small businesses to raise capital from a diverse pool of investors. Established under the Jumpstart Our Business Startups (JOBS) Act of 20121, these platforms were designed to facilitate equity crowdfunding. They allowed companies to secure funds from both accredited and non-accredited investors.

However, recent trends show a decline in the number of active funding portals2, with several exiting the space.

This article explores the rise and fall of Reg CF funding portals, examines their initial promise, the challenges they face and the factors that contribute to their diminishing presence.

What you will learn in this post:

The emergence of funding portals

The JOBS Act aimed to stimulate economic growth by easing securities regulations, thereby making it more accessible for small businesses to obtain capital. Title III of the Act3 introduced Regulation Crowdfunding (Reg CF)4 and permitted companies to raise up to $1.07 million annually through SEC-registered intermediaries known as funding portals or broker-dealers. These portals provided a platform for entrepreneurs to present their business ideas to potential investors and helped to bypass traditional funding ways such as loans.

In the early years, the number of funding portals grew steadily. By September 2023, there were 88 FINRA-regulated funding portals5. These platforms offered a streamlined process for companies to raise capital and for investors to diversify their portfolios by supporting emerging businesses.

Challenges faced by funding portals

Despite their initial success, funding portals have encountered several challenges that have hindered their growth and sustainability.

Regulatory compliance and oversight

Funding portals are subject to stringent regulations imposed by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Ensuring compliance requires significant resources, and even minor infractions can lead to severe penalties. For instance, in 2019, FINRA expelled a funding portal and barred its CEO6 for making false or misleading claims to investors and failing to conduct required background checks. Such enforcement actions highlight the high stakes involved in operating a funding portal.

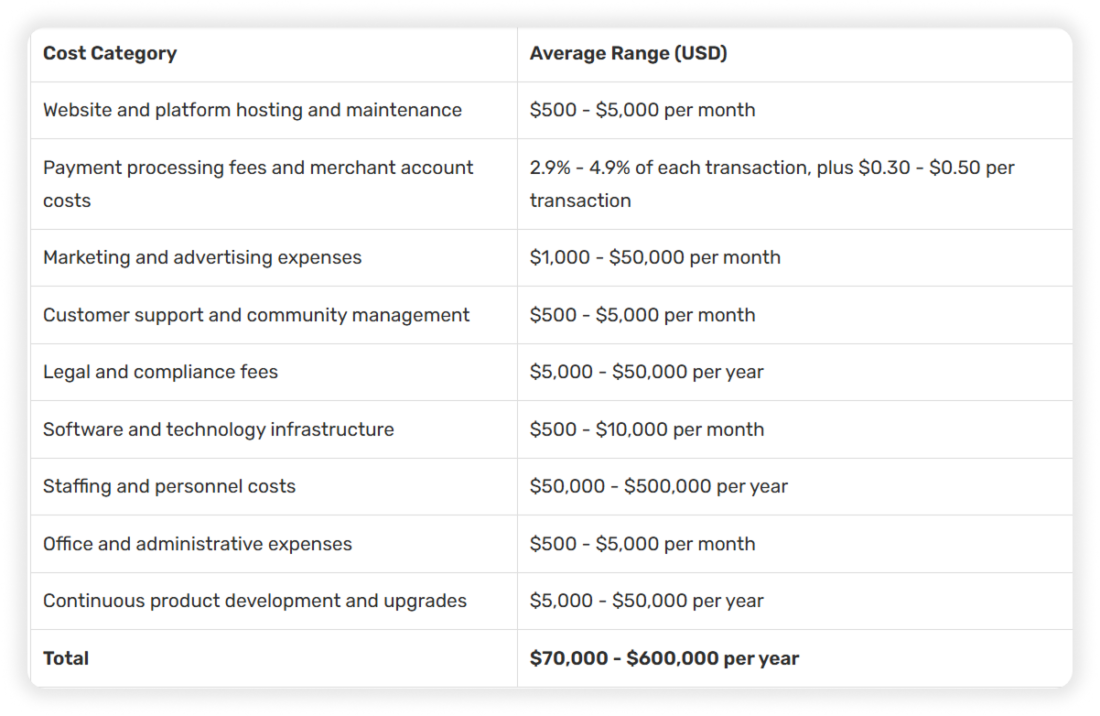

Operational costs and sustainability

Maintaining a funding portal7 involves considerable expenses, including technology infrastructure, legal fees, and compliance costs.

The revenue generated from facilitating crowdfunding campaigns often doesn’t offset these costs, especially for smaller portals. This financial strain has led some platforms to reassess the viability of their operations.

Market competition and consolidation

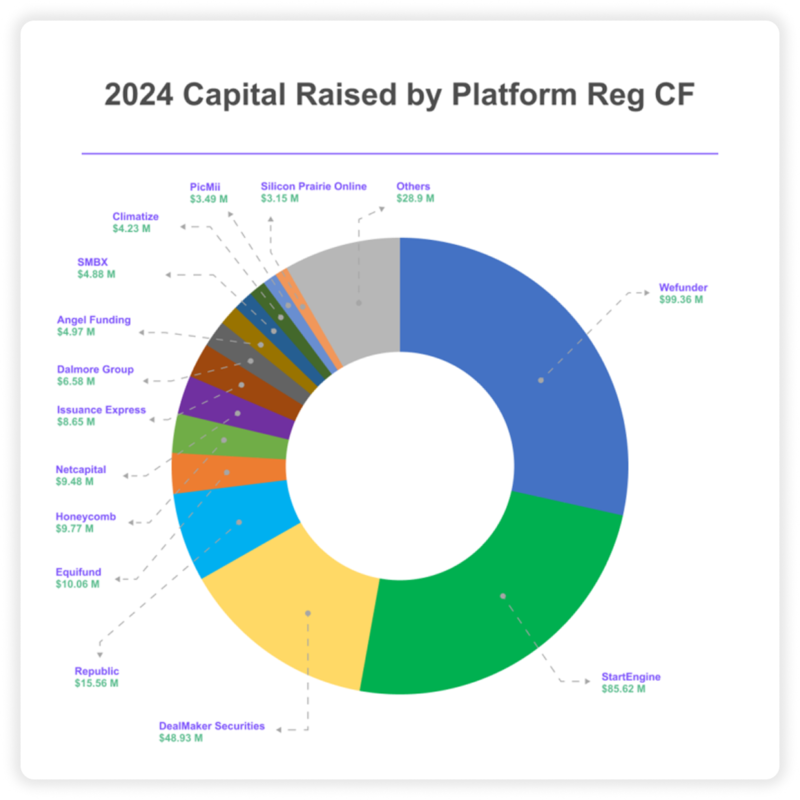

The crowdfunding industry has seen significant consolidation8, with a few major platforms dominating the market.

In 2024, the top three platforms — Wefunder10, StartEngine11, and DealMaker Securities12 — accounted for nearly 67% of all Reg CF capital raised.

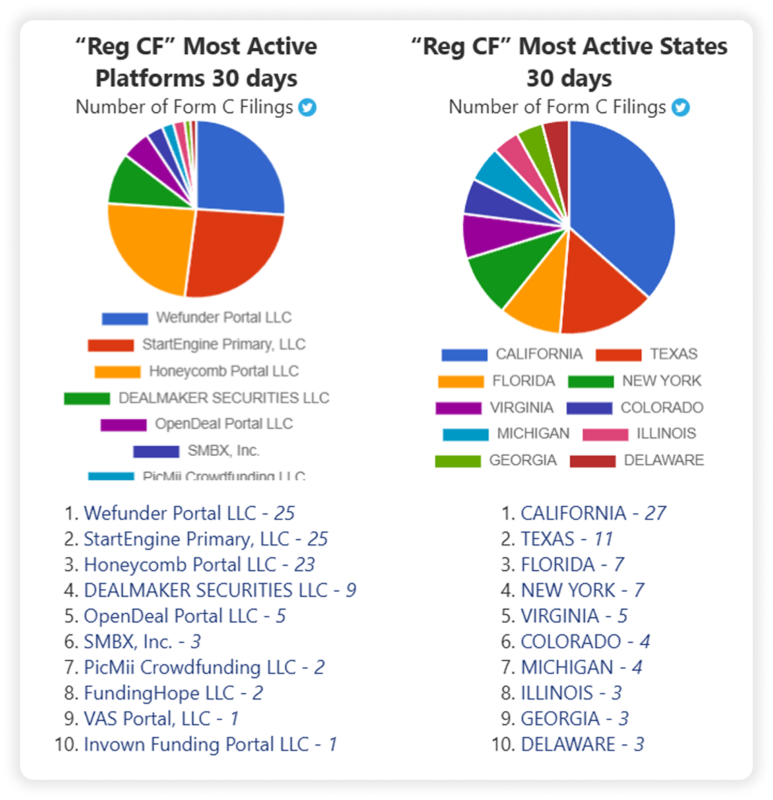

In 2025, the same trend is observed, with Honeycomb Portal entering the list of leaders.

This concentration makes it challenging for smaller portals to attract issuers and investors, and this forces some of them to exit the space.

Regulatory ambiguity and inconsistency

Operators have expressed concerns about inconsistent regulatory interpretations and enforcement. David Duccini, CEO and founder of Silicon Prairie, noted challenges with FINRA’s oversight8, citing high staff turnover and inconsistent application of rules across funding portals. Such regulatory ambiguity can create operational uncertainties for portal operators.

The decline of funding portals

These challenges have contributed to a noticeable decline in the number of active funding portals. By June 2024, the number had decreased to 8413, with 39 portals having exited the market. This trend suggests that the funding portal model, as initially conceived, may not be sustainable for all operators.

Several notable platforms have ceased operations or transitioned away from the funding portal model:

- TruCrowd: Once a FINRA-regulated funding portal, TruCrowd announced its immediate cessation of operations in January 202514, after prolonged struggles to maintain its platform.

- Mainvest: Previously a prominent platform for Main Street businesses, Mainvest shut down in 202415. This reflected the difficulties faced by niche crowdfunding platforms in sustaining operations amidst market consolidation.

- Silicon Prairie: This platform transitioned from a dual registration as both a funding portal and a broker-dealer to solely operating under its broker-dealer license. The decision was influenced by the desire to reduce redundant regulatory burdens and operational costs8 associated with maintaining both statuses.

The future outlook for crowdfunding

The evolution of the crowdfunding landscape suggests a move towards models that offer greater flexibility and sustainability. While the traditional funding portal model faces challenges, the broader crowdfunding industry continues to adapt.

Regulatory reforms

In 2024, the SEC’s Small Business Capital Formation Advisory Committee16 recommended updating audit requirements for investment crowdfunding to reduce costs and expand access to early-stage capital raising. Such reforms aim to make crowdfunding more accessible and less burdensome for small businesses.

Technological innovations

The integration of advanced technologies, such as blockchain and smart contracts, can enhance the efficiency and transparency of crowdfunding platforms. These innovations can streamline processes, reduce operational costs, and build investor trust.

Diversification of offerings

Platforms are offering a wide range of investment opportunities, including real estate, renewable energy projects, and niche markets. This diversification caters to varied investor interests and can attract a broader audience.

Enhanced investor protections

As the industry matures, there is a growing emphasis on implementing robust investor protection measures17. This includes improved due diligence on issuers, clearer disclosures, and mechanisms to mitigate fraud.

How to build a crowdfunding portal with LenderKit

Despite the decline of funding portals, equity crowdfunding remains a vital component of the startup financing ecosystem. This is why those who enter this market, shall look for the most convenient Reg CF white-label crowdfunding software to launch a platform such as the one offered by LenderKit.

LenderKit offers flexible white-label crowdfunding software that comes equipped with all the necessary features. It allows businesses to deploy their portals quickly without extensive development.

With LenderKit, a crowdfunding portal can support any investment flow — whether equity crowdfunding, peer-to-peer lending, real estate crowdfunding, or a combination of multiple models. This flexibility ensures that businesses can implement the most effective fundraising structure for their target investors and issuers.

Additionally, LenderKit comes with all essential integrations, including payment processing services, KYC/AML verification, compliance management, and investor onboarding tools. These built-in features help ensure a seamless and compliant investment experience for both issuers and investors, reducing the operational burden on platform operators.

To find out how it all works and discuss details, please get in touch with us.

Article sources:

- Jumpstart Our Business Startups (JOBS) Act

- The Decline of FINRA-Regulated Funding Portals: What’s Happening and What It Means | Crowdfund Watchdog

- PDF (https://www.sec.gov/files/2017-03/RegCF_WhitePaper.pdf)

- SEC.gov | Crowdfunding

- Reg CF: There Are Currently 88 FINRA Regulated Funding Portals | Crowdfund Insider

- Dream On—FINRA Issues Its First Litigated Enforcement Action Against a Crowdfunding Portal - Business Law Today from ABA

- Crowdfunding Platforms Business Plan Template & Example [Updated 2025]

- David Duccini, CEO And Founder Of Silicon Prairie, Explains Why He Canceled Funding Portal Status, Expectations For Crowdfunding Industry | Crowdfund Insider

- 2024 Investment Crowdfunding: Trends, Stats, and Platform Rankings

- Wefunder

- StartEngine

- DealMaker | Raise Capital Online

- The Number Of FINRA Regulated Funding Portals Declines | Crowdfund Insider

- TruCrowd Shuts Down | Crowdfund Insider

- Mainvest shut down in 2024

- Small Business Capital Formation Advisory Committee

- How Regulations are Shaping the Landscape of Crowdfunding