Transforming the World Through Crowdfunding for Tech Startups

No time to read? Let AI give you a quick summary of this article.

In the constantly evolving environment, many bright minds have innovative ideas that could transform the world or a specific industry. But for most of them, the lack of funds is an obstacle to turning their ideas into reality.

Tech startup crowdfunding comes to help by offering an opportunity to pull funds from the public and make the idea come true.

However, from the vast number of projects, only 22.4% are successful1, and only some of them eventually become unicorns – companies with a valuation of over $1Bln. The term unicorn was initially used by a venture capital investor — Aileen Lee, and the reason for such a name was that such companies are difficult to find.

Now, there are almost 240 unicorns2, and some of them started their way by raising funds on the best crowdfunding platforms for tech startups.

Here is the list of top tech projects that relied on crowdfunding for tech startups to get funds for their launch and development.

What you will learn in this post:

Revolut, equity-based crowdfunding campaigns on CrowdCube and Seedrs

Revolut4, a FinTech company that has revolutionized the way people manage and move money around easily, was launched in 2015. And just one year after its launch, the company launched an equity-based crowdfunding campaign on Crowdcube5. In this campaign, Revolut offered 2.39% of its equity and raised £1,007,050 from 433 investors, with the largest investment of £5,000.

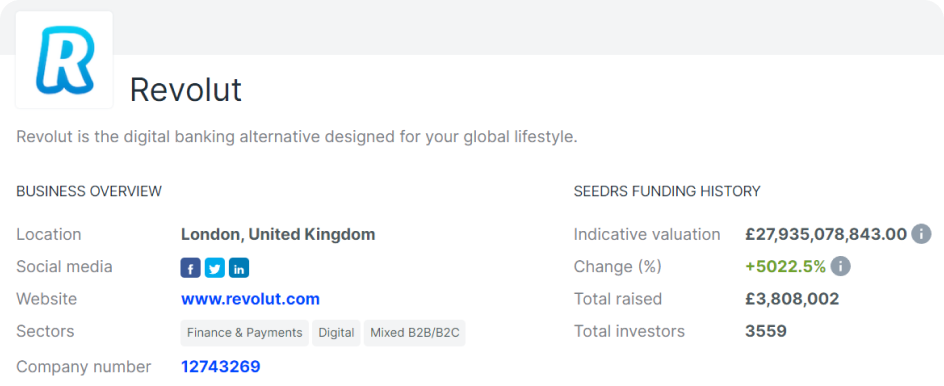

In 2017, Revolut launched another equity-based crowdfunding campaign, this time, Seedrs6 was selected as a platform to raise funds.

1.36% of the company’s equity was offered to investors, and within a couple of months, £3,808,002 was raised from 3559 investors. It is worth noting that since then, the value of a share has increased by 5022.5%.

UNITI, an equity-based crowdfunding campaign on Pepins (former FundedByMe)

UNITI7 is the first Swedish electric car manufacturer and the first Swedish equity crowdfunding unicorn. UNITI started as a research project at Lund University in 2015. Later, the project developed and became a company whose focus was to use new technologies to reduce the impact on climate.

In October 2016, UNITI launched its first equity-based crowdfunding campaign on FundedByMe8. The campaign was marked by immense success from the very start. Within 36 hours, UNITI raised more than EUR 1,200,000 from 570 investors from 29 countries.

At the time when UNITI launched its crowdfunding campaign on FundedByMe, it was valued at EUR 9,800,000, and in 2018, the company’s value soared to over EUR 1,100,000,0009, making it the first Swedish unicorn that was raising money through equity crowdfunding.

TriNet Zenefits, an equity-based crowdfunding campaign on Wefunder

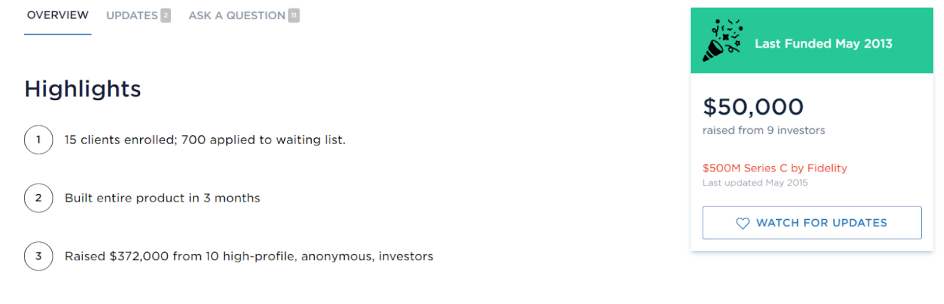

Zenefits, now TriNet10, is an award-winning HR management platform that paved its way to success through crowdfunding. In 2013, Zenefits raised $50,000 from 9 investors on WeFunder11.

While this doesn’t look like a significant achievement compared to other successful campaigns, that campaign catalyzed significant investments later by attracting over $66 mln from such top-tier investors as Andreessen Horowitz and Institutional Venture Partners.

Investors who had backed Zenefits on WeFunder gained over %4,000 of unrealized return13 just one year later. It means that those who invested $5,000 at that time, ended up with $200,000.

Monzo, equity-based crowdfunding campaigns on Crowdcube

Monzo Bank Limited14 is a British private bank, one of the first new app-based banks in the UK. Initially, it operated only through a mobile application and a prepaid debit card. However, when banking restrictions were lifted in 2017, the bank started offering a full range of services.

Monzo was raising funds in several equity-based crowdfunding campaigns on Crowdcube.

During the first campaign in 201615, the bank offered %3.33 of its equity and raised £992,990 from 1,877 investors. The minimum investment was just £10.

The next crowdfunding campaign16 followed the next year in 2017. %2.83 of the bank’s equity was offered, and Monzo managed to raise £2,392,840 from 6,484 investors. The minimum investment was again very low, just £10.

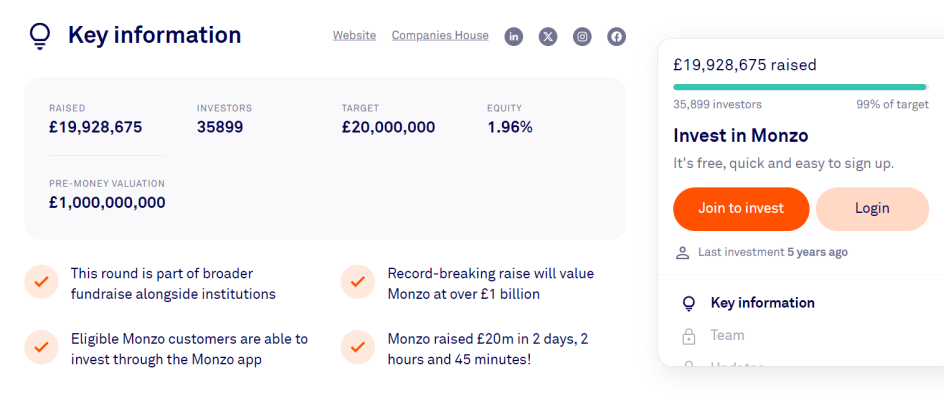

The last and the most successful campaign17 was held in 2018 again on Crowdcube.

During this campaign, %1.96 of Monzo’s equity was sold to 35,899 investors for £19,928,675. From this money:

- over £2,000,000 was raised from those who had invested in the bank previously

- almost £18,000,000 was invested within less than 3 hours

- almost £7,000,000 was invested during the first 5 minutes of the campaign.

How to launch an innovation crowdfunding platform with LenderKit

Developing an investment platform for tech startup crowdfunding is a challenging and demanding task. This is why if you are thinking of creating one, you may want to consider a white-label tech crowdfunding software from LenderKit.

With LenderKit, you can create an investment-based or donation crowdfunding platform that will be customized to meet your branding, business needs, and regulatory requirements. You can also combine several investment flows in one platform to offer your investors and clients a wider range of opportunities.

To see how the solution works, you can request a demo, and to discuss details and find out what would work for you, please reach out to our sales team.

Article sources:

- Crowdfunding Statistics - By Country, Industry and Funding Amount

- Crowdfunding Unicorns - the first ones are here! Find out more...

- Just a moment...

- Just a moment...

- Just a moment...

- Seedrs

- Casino utan svensk licens 🎖️ Bästa casinon utan Spelpaus

- FundedByMe

- UNITI becomes the first Swedish equity crowdfunding unicorn - Pepins

- HR Solutions, Payroll, and HR Outsourcing | TriNet

- WeFunder

- Wefunder

- Zenefits $500m Series B nets 4,000% unrealized return to Wefunder investors | Crowd Investing | Wefunder Blog

- Monzo | Your New Favourite Bank

- Just a moment...

- Just a moment...

- Just a moment...