AR Crowdfunding License: FCA Appointed Representatives Regime Update

No time to read? Let AI give you a quick summary of this article.

FCA published an Appointed Representatives Regime Update1 in August, 2022. What does it mean for crowdfunding platforms in the UK and why is this update important?

All crowdinvesting businesses in the UK need to register with an FCA. There are a few ways to do that:

- Directly with the regulator

- Getting an AR license

Platforms that have more experience with the regulations, have more time and money usually consider licensing a crowdfunding platform with an FCA.

In contrast, crowdfunding businesses that want to launch quickly “without facing regulatory challenges” pursue umbrella compliance.

What you will learn in this post:

What is an appointed representative?

The FCA defines an appointed representative2 as a:

person who is party to a contract with an authorised person which permits or requires him to carry on certain regulated activities

Many legal firms offer the umbrella compliance or appointed representative services in the UK and help businesses to launch crowdlending and crowdinvesting platforms easier.

Issues with the AR Regime in the UK

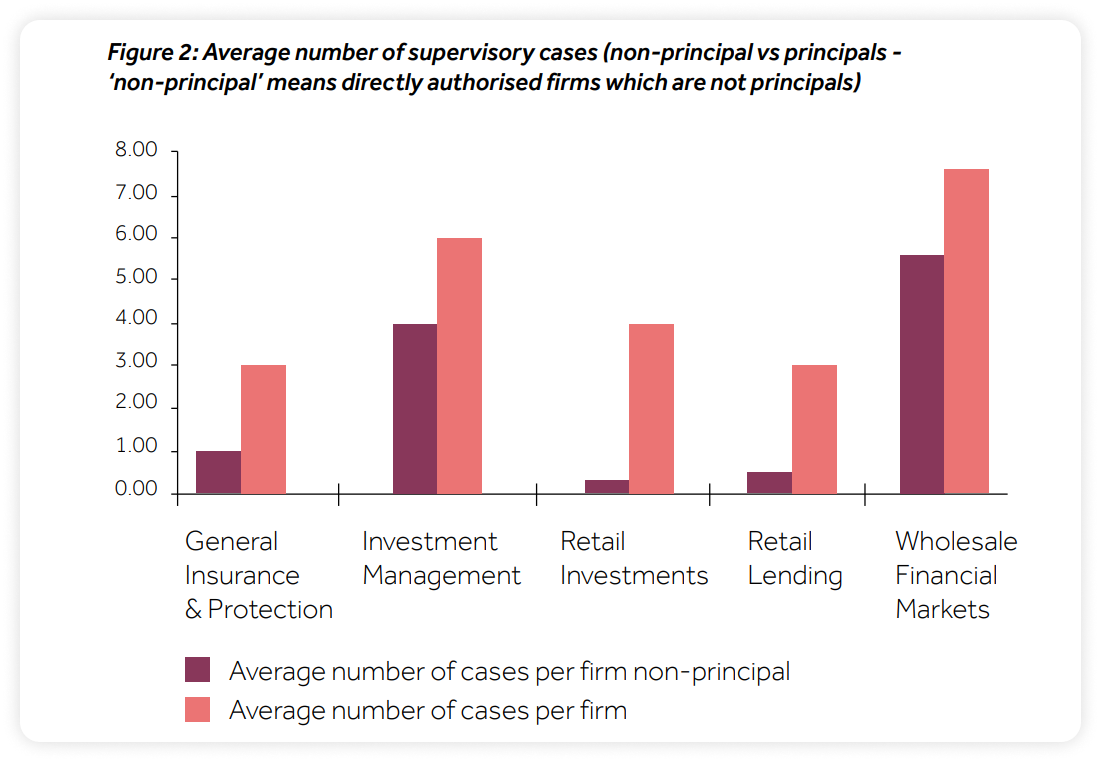

However, the AR regime raised concerns of the regulator. The FCA identified that the AR regime was misused which resulted in mis-selling and even frauds. “Principals and ARs account for more than 60% of the total value of recent claims to the Financial Services Compensation Scheme”, the regulator states in its press release3. It also claims that “on average, principals cause 50 to 400% more supervisory cases than non-principals”, as indicated in the chart.

The regulator stated significant challenges that the AR regime was facing:

- Insufficient governance, weakness of due diligence processes and oversight: principals were not always effective in overseeing their ARs’ activities. It led to increased risks to investors and breaches from the ARs side because companies tended to perform regulated activities that were not permitted by a principal.

- Staff in similar roles in a principal company and an AR have to comply with different rules: the staff of a principal follows the Senior Managers and Certification Regime4, while the staff of an AR follows the Approved Persons Regime5. It caused misunderstandings and confusion.

- Risk of consumer harm is increased in ARs: principal firms with ARs were responsible for more complaints than companies with a direct license.

FCA’s updates to the Appointed Representative Regime

In December 2021, the FCA published a paper6 where the process changes to the Appointed Representative regime were collected. And in August 2022, the FCA came up with a Policy Statement with the rules to improve the regime by making it safer for investors.

Here is the summary of the most important changes to the regime.

Principals need to provide the following information to the FCA on both potential and existing ARs.

- The reason why a principal wishes to appoint the AR.

- What activities that the AR is permitted to perform.

- Whether the AR provides services to non-accredited investors. This information shall be provided 30 calendar days before the new appointment is made.

- Whether the AR is a part of a group. If yes, the principal shall provide the name of the parent undertaking.

- Whether the AR specialists or team members will be contracted by the principal to perform portfolio management or dealing activities. If yes, it is needed to explain the reasons for such a decision.

- Whether the AR had a different principal. If yes, there shall be an explanation of why the relationship was terminated.

- Details of the financial arrangements made between the principal and the AR.

- Whether the AR performs any non-regulated businesses or activities. If yes, the nature of such a business or activity shall be indicated.

- The expected revenue from regulated and non-regulated activities within the first year after the appointment.

Principals will have to check the accuracy of details on their ARs on an annual basis. They will have to report all changes to the FCA.

All these changes mean that principals have to ensure sufficient resources before appointing an AR to be able to assess the AR and to ensure the ongoing monitoring and enforcing the AR compliance with the requirements. That’s why first of all, a principal needs to assess its own resources such as people, technology, tools, facilities, and so on, at least every 12 months.

If a principal detects an issue with an existing AR, this issue shall be solved asap. If the issue is detected with a potential AR, the appointment can succeed only after the issue is solved. If for any reason, it is impossible to find a solution, the AR relationship is to be terminated. If after some time, the AR grows, and it becomes impossible for the principal to oversee it, the appointment shall be terminated, too.

The FCA is also going to supervise the principal firms. It will also be more attentive to companies applying for a license because they will be able to appoint ARs later.

Some Improvements and Clarifications Are Following

The FCA is going to work with HM Treasury7 to determine potential ways of further reforming the AR regime. Among the most important proposed changes are:

- The scope of regulated services that AR can access

- Requirements that a company shall comply with to operate as a principal

- Extension of the Senior Manager and Certification regime to AR, and some other details that shall be clarified.

Feedback on these proposals is still awaited. Once received, it will lay the foundation for further regime modifications.

Along with these proposals, some more clarifications are needed.

For example, the statement about the appointment termination when the AR becomes too large doesn’t specify how it shall be determined: based on the growth rate of the AR, its size compared to the size of its principal, whether non-regulated activities shall be considered, and what other factors shall be taken into account. Also, it is unclear whether the AR shall look for another, a bigger principal, or it shall apply for a license on its own.

For now, it is unclear how overseas ARs shall be handled. While it is clear that they pose more risks, they also deliver certain benefits such as access to innovative technologies, bringing new businesses to the UK, allowing greater geographical reach, and similar.

The new rules take effect on December 8, 2022, after a four-month transitional period that was needed for the companies to prepare for changes. Additionally, the regulator will continue working on improvements to ensure the regime update provides all the information needed for a swift and painless shift.

LenderKit white-label crowdfunding software

Whether you’re launching a crowdfunding platform to register directly with the FCA or want to get an AR license from a legal firm, you can easily use our white-label crowdfunding software.

Apart from having extensive experience with launching crowdfunding platforms in the UK, our crowdfunding software is fully customisable. We can change front-end and back-end to fit your needs and business processes, but the software supports full-cycle deal management, payment automation and identity verification out-of-box.

Learn more about the LenderKit crowdinvesting software in the UK and get in touch with our fintech strategist for more information.

Article sources:

- PDF (https://www.fca.org.uk/publication/policy/ps22-11.pdf)

- FCA Handbook

- FCA confirms new rules to improve oversight of Appointed Representatives | FCA

- Senior Managers and Certification Regime | FCA

- Approved persons | FCA

- PDF (https://www.fca.org.uk/publication/consultation/cp21-34.pdf)

- HM Treasury - GOV.UK