Crowdfunding as an Alternative Investment Class for Wealth Managers

No time to read? Let AI give you a quick summary of this article.

Wealth management is a comprehensive financial service designed to address the needs of high-net-worth individuals and families. Unlike standard financial advisory services, wealth management offers a holistic approach and covers various facets of a client’s financial life.

Wealth management involves a consultative process1 where advisors engage deeply with clients to understand their economic expectations, risk tolerance, and personal circumstances.

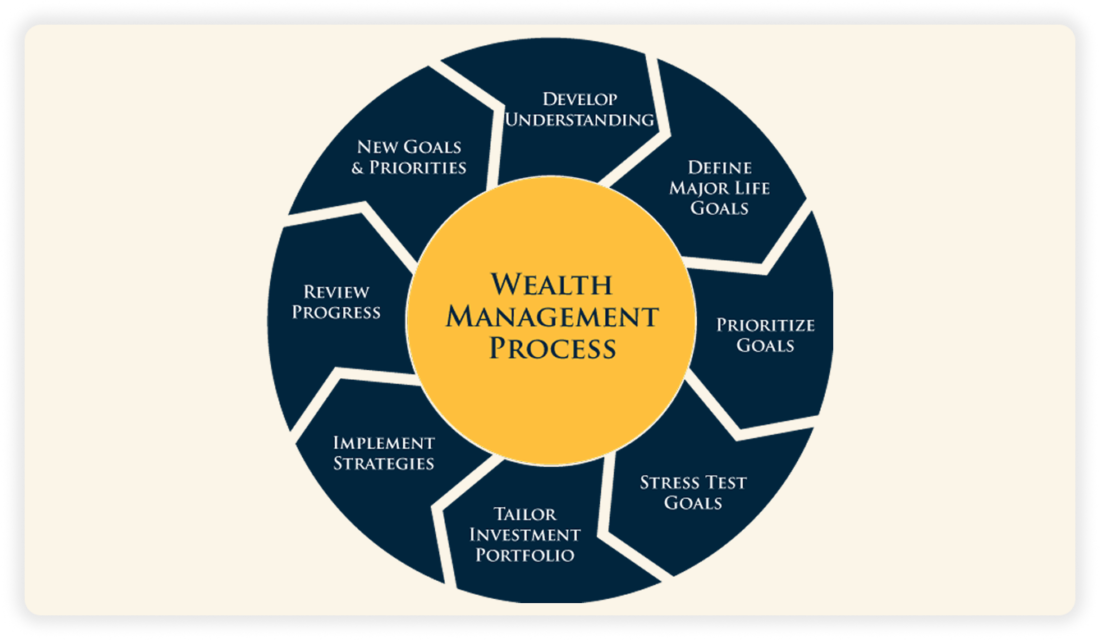

The wealth management process typically includes the following steps:

- Develop understanding: It starts with the initial conversations to learn about the client’s family, values, and what’s most important to them.

- Define major life goals: Discuss and identify primary goals and dreams for the future.

- Prioritize goals: Help clients prioritize their goals based on importance and feasibility.

- Stress test goals: Simulate various market conditions to assess the robustness of the financial plan.

- Create investment portfolio: Create an investment strategy to ensure long-term profits.

- Implement strategies: Implement the investment plan, construct a diversified portfolio.

- Review progress: Regularly monitor and review the plan’s progress and make adjustments as necessary.

- Adapt to new goals and priorities: Update the plan to reflect changes in the client’s circumstances or objectives.

This structured approach ensures that all aspects of a client’s financial well-being are addressed and provides clarity and confidence about the client’s financial future.

What you will learn in this post:

Challenges in wealth management

Despite its comprehensive nature, wealth management firms encounter several challenges such as volatility, regulatory changes, growing client expectations, technological advancements, and fee compression. To address these challenges, wealth managers turn to alternative investment types. Alternative investments encompass asset classes outside traditional stocks, bonds, and cash, including private equity, hedge funds, real estate, infrastructure, and commodities.

For example, in 2023, more than 77% of advisors2 were either incorporating or evaluating model portfolios for alternative investments, with nearly 47% using them as their primary tool for allocation decisions. In 2025, these numbers increased to 92% and 91%, correspondingly.

Client demand

Individual investors hold 54% of the $289 trillion3 in global assets under management but account for just 16% of allocations to alternatives. This disparity highlights a significant opportunity for wealth managers to introduce alternative investments to their clients.

Crowdfunding: An alternative investment class

Crowdfunding can help wealth management firms to address the existing challenges and open the doors to alternative investment. Here is why.

Market volatility

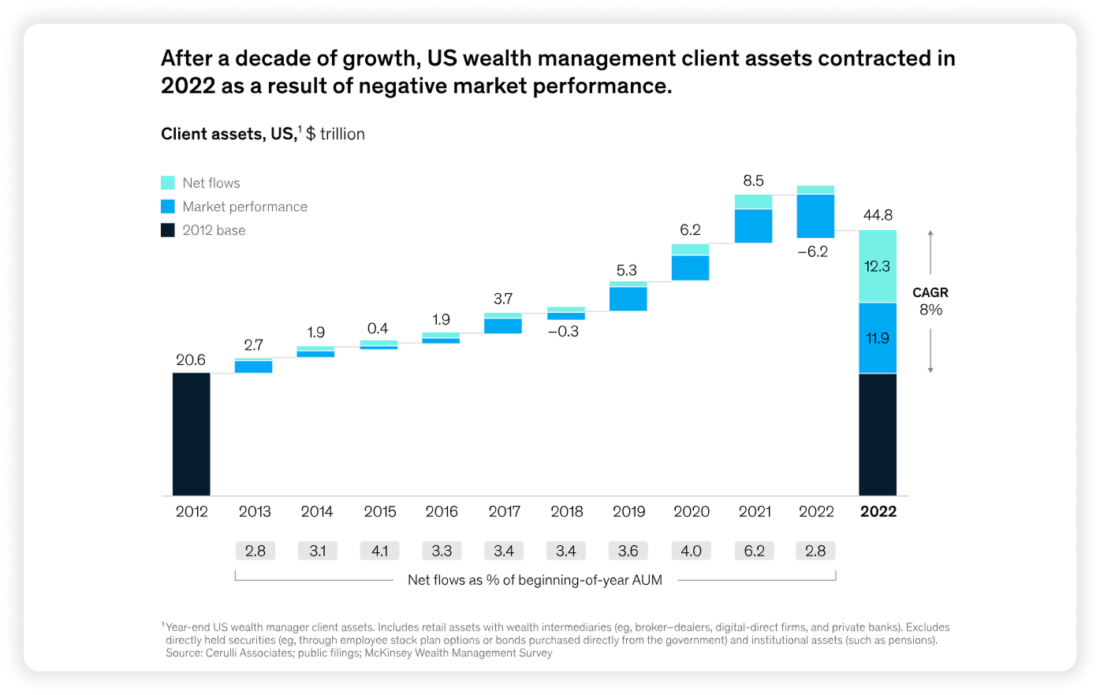

Fluctuations in financial markets4 can significantly impact investment portfolios. For example, after a decade of growth, the assets of the US clients of wealth managers decreased in 2023 due to negative market performance.

Market volatility, driven by economic indicators, geopolitical events, and investor sentiment, introduces uncertainty that can erode asset values.

Crowdfunding allows access to alternative investments, such as startups and real estate projects, which may not be directly correlated with traditional markets, thereby enhancing portfolio diversification and potentially reducing overall volatility.

Regulatory changes

The financial industry is subject to an evolving regulatory landscape5. Regulatory bodies continually update policies to enhance transparency, protect investors, and maintain market integrity. Wealth management firms must stay informed about these changes and adapt their practices to ensure compliance. It requires ongoing investment in compliance frameworks, staff training, and, in some cases, restructuring of services to align with new regulations.

Crowdfunding platforms often operate within specific regulatory frameworks, providing wealth managers with structured investment opportunities that adhere to current laws, thereby simplifying compliance processes.

Client expectations

High-net-worth clients often have high expectations for personalized service and high investment performance. They want to get tailored solutions that address their unique financial situations and goals. To meet these needs, wealth managers need to offer customized strategies and have a deep understanding of each client’s preferences and objectives.

Crowdfunding enables clients to invest in projects that resonate with their personal interests or values, fostering deeper engagement and satisfaction with their investment choices.

Technological advancements

The rapid pace of technological change presents both opportunities and challenges for wealth management firms. Clients increasingly expect digital solutions that offer convenience, real-time access to information, and seamless service delivery. Globally, 25% of investors6 would consider leaving wealth managers who fail to modernize and adopt new technologies.

This is why firms must invest in new tools and platforms, such as robo-advisors, artificial intelligence, and blockchain technologies. Integrating these technologies can enhance operational efficiency and client engagement but requires substantial investment and a strategic approach to implementation.

Crowdfunding platforms leverage advanced technology to facilitate investments, and by partnering with these platforms, wealth managers can offer clients innovative investment opportunities while benefiting from the platforms’ technological infrastructure.

Fee compression

Increased competition and the evolution of low-cost investment alternatives7 such as automated investment platforms and robo-advisors have pressured traditional fee structures. This environment challenges wealth management firms to demonstrate their value proposition clearly, reassess their pricing models, and emphasize the benefits of personalized advice and active management to justify their fees.

Crowdfunding investments often have lower minimum investment requirements8, allowing wealth managers to offer clients access to alternative investments without significant capital engagement, thereby enhancing the value proposition.

How LenderKit empowers wealth managers in alternative investments

LenderKit provides a robust and customizable white-label investment software to streamline market entry for wealth managers exploring crowdfunding as an alternative investment class.

Our white-label crowdfunding platform software supports equity crowdfunding, debt investments, real estate-backed fundraising and SME lending — allowing you to build a platform that aligns with your clients’ investment preferences and regulatory requirements.

With LenderKit, you can:

- Expand investment offerings – give high-net-worth individuals and institutional investors access to exclusive private market deals.

- Maintain regulatory compliance – LenderKit has in-built compliance tools, but can also be adapted to different jurisdictions or new requirements.

- Save time and money – avoid building from scratch with a scalable solution designed for alternative investments.

- Enhance client engagement – offer a seamless digital investment experience with a user-friendly interface and automated investor onboarding.

Whether you’re looking to create a new alternative investment platform or integrate crowdfunding into your existing wealth management services, LenderKit provides the flexibility and tools to support your business growth.

Interested in exploring opportunities? Get in touch to see how LenderKit can work for your firm.

Article sources:

- Consultative process

- More than 77% of advisors

- Alternative assets becoming key battleground for wealth managers - Professional Wealth Management

- US wealth management: Amid market turbulence, an industry converges

- Wealth management sector on the rise, but challenges are piling on - Funds Europe

- Wealth managers find it tough to fulfil clients’ technological needs

- Wealth Management Trends To Watch In 2025

- Lower minimum investment requirements