EIS vs SEIS vs Non-Eligible Deals: What Your Platform Should Support

No time to read? Let AI give you a quick summary of this article.

When building or scaling a UK crowdfunding platform, it is important to understand the operational and compliance differences between SEIS, EIS, and non-eligible deals.

One of the most strategic choices is whether to support Enterprise Investment Scheme (EIS) deals, Seed Enterprise Investment Scheme (SEIS) deals, and/or non‑eligible deals (for example, ordinary equity investments that don’t carry EIS/SEIS tax relief). Each deal type affects your business model, workflows, investor base, and legal responsibilities.

Here’s a practical guide on how to choose what deal type to support and how to manage them effectively.

What you will learn in this post:

EIS, SEIS, and non‑eligible equity: What’s the difference?

EIS (Enterprise Investment Scheme) and SEIS (Seed Enterprise Investment Scheme) are UK government-backed schemes that encourage people to invest in early-stage companies. Investors get tax relief in exchange for risk; in return, companies that qualify must meet strict criteria.

| SEIS (Seed Enterprise Investment Scheme) | EIS (Enterprise Investment Scheme) | |

| Stage/age of company | Very early-stage startups, typically less than 3 years old | Growth-oriented companies, up to 7 years old (or 10 years for knowledge-intensive companies) |

| Employees | Fewer than 25 employees | Up to 250 (or 500 for knowledge-intensive companies) |

| Gross assets | Below £350k (pre-money asset cap) | Up to £15 million+ |

| Investment cap | Up to £250,000 lifetime | Around £5 million per year, £12 million lifetime (higher for KICs) |

| Investor tax relief | 50% income tax relief | 30% income tax relief, plus possible capital gains deferral |

| Risk management/loss relief | Loss relief available; must hold shares ≥3 years | Loss relief available; must hold shares ≥3 years |

| Compliance requirements | Must meet strict SEIS rules; risk of tax relief being withdrawn if rules are broken | Must meet EIS rules; tax relief withdrawn if rules are breached |

| Investor appeal | Attractive to high-risk-tolerant investors seeking early-stage opportunities with large tax incentives | Appeals to broader investors, including experienced angels and family offices; moderate tax incentives |

SEIS (Seed Enterprise Investment Scheme)

The Seed Enterprise Investment Scheme (SEIS) is designed for very early-stage UK startups. The companies are normally less than three years old, with fewer than 25 employees1 and assets under £350k. It allows companies to raise up to £250,0002 in lifetime investment while offering investors 50% income tax relief and loss relief, but they have to hold shares for at least three years. This generous tax relief compensates for the risk of investing in very nascent companies.

SEIS deals tend to attract high-risk-tolerant investors: early‑stage angels, micro-funds, and first-time backers who are looking for early opportunities.

EIS (Enterprise Investment Scheme)

The Enterprise Investment Scheme (EIS) supports growth-oriented UK companies that are up to seven years old (or ten for knowledge-intensive companies). The number of employees is up to 250 (500 for KICs)3 and assets up to £15 million.

Companies can raise around £5 million per year, with a £12 million lifetime cap (£20 million for KICs. EIS offers investors 30% income tax relief, possible capital gains deferral, and loss relief if shares are held for at least three years.

These deals attract a broader range of investors, including family offices, serial angels, and professional investors who are comfortable with early-growth companies.

Non-eligible deals

Non-eligible deals do not carry any of these tax-relief benefits. They are straightforward equity investments (ordinary shares, no special scheme). Non-eligible deals may appeal to investors who are less motivated by tax relief (or not eligible), but are betting on business traction, potential upside, or secondary market exit. These deals may also attract corporate investors or non-UK-resident investors who may not get SEIS/EIS benefits.

What flow to choose?

By offering a mix, your platform can diversify your investor base. SEIS gives you entry-level deal flow, EIS brings more sophisticated backers, and supplementing with non-eligible deals helps bring in companies that don’t meet the criteria but are strong, promising businesses.

Operational differences in managing platforms that offer different deals

Managing various deal types presents unique operational challenges. SEIS and EIS deals require careful checks, documentation, and ongoing tracking to ensure compliance and maintain investor tax relief. Non-eligible deals are simpler but still need proper workflows and due diligence.

SEIS/EIS eligibility checks

Before listing any SEIS or EIS deal, verify that the company meets all scheme requirements. This includes checking the company’s age, number of employees, asset levels, and type of business activity. Proper vetting ensures investors remain eligible for tax relief and prevents HMRC issues later.

Advance assurance support

Many startups apply to HMRC4 for Advance Assurance5 to confirm eligibility before fundraising. Platforms can guide founders through the process, help them prepare and submit accurate applications.

Documentation & tax certificates

Once a round closes, platforms have to handle a series of forms and filings. This includes SEIS1/EIS1 applications for HMRC, followed later by SEIS3/EIS3 certificates that investors use to claim their tax relief. This is why a platform needs to have all workflows that allow it to generate, track, and deliver all applications and certificates to investors.

Tracking of holding periods

Investors must often hold their shares for a minimum of three years to retain SEIS/EIS tax benefits. Platforms should implement tracking or alert systems to notify investors about the holding period because leaving early can void tax relief. Proper tracking helps prevent accidental loss of tax relief and avoids disputes. This adds another layer to your operational oversight.

How to manage non-eligible deals

Non-eligible deals are simpler to operate. They do not require HMRC filings or tax-related forms, and there’s no minimum holding period. However, platforms still need to manage standard corporate documentation, share issuance, and reporting, as well as conduct thorough due diligence on the company. This ensures investor protection and maintains platform credibility.

Deal flow quality and risk management

From a platform’s point of view, it is important to offer all types of deals. For example, SEIS deals are very early-stage and higher risk, but the raises are usually small. That makes them easier to list, manage, and offer to a broad range of investors.

EIS deals are for companies that are more established and have a clearer growth path. These are attractive to follow-on investors because the risk is more manageable than with tiny startups.

Finally, non-eligible deals don’t give tax relief, but they often involve more traditional startups or scale-ups and can be more profitable for investing. Listing these can raise your platform’s profile with VCs and experienced investors.

Supporting all three types lets your platform create a tiered funnel: very early startups under SEIS, growth-stage companies under EIS, and more mature or non-qualifying companies through standard equity.

UX & flow examples for multi-product crowdfunding

To support different deal types, your UK crowdfunding platform needs a clear and simple user experience. Here are some tips on how you can make it.

- Clearly label deals as “SEIS-eligible,” “EIS-eligible,” or “Standard deal.” Use icons or short tooltips to explain what that means. For example, “50% income tax relief” for SEIS or “30% + CGT deferral” for EIS.

- Add small explainers, such as a collapsible box that shows benefits, risks, and minimum holding periods.

- Ask investors if they’re eligible for SEIS/EIS during signup and show only the deals that apply.

- Offer a tax relief calculator so they can see how much relief they’d get for their investment.

- Give clear guidance on holding periods, with warnings if they try to exit early.

- Include HMRC Advance Assurance forms in the onboarding or fundraising checklist.

- Automate certificate management: generate SEIS3/EIS3 certificates for investors after the round closes.

- Track compliance, such as ensuring funds are used correctly and within scheme rules.

Platforms that support SEIS-, EIS-, and non-eligible deals

Here are some UK crowdfunding platforms that support all types of deals.

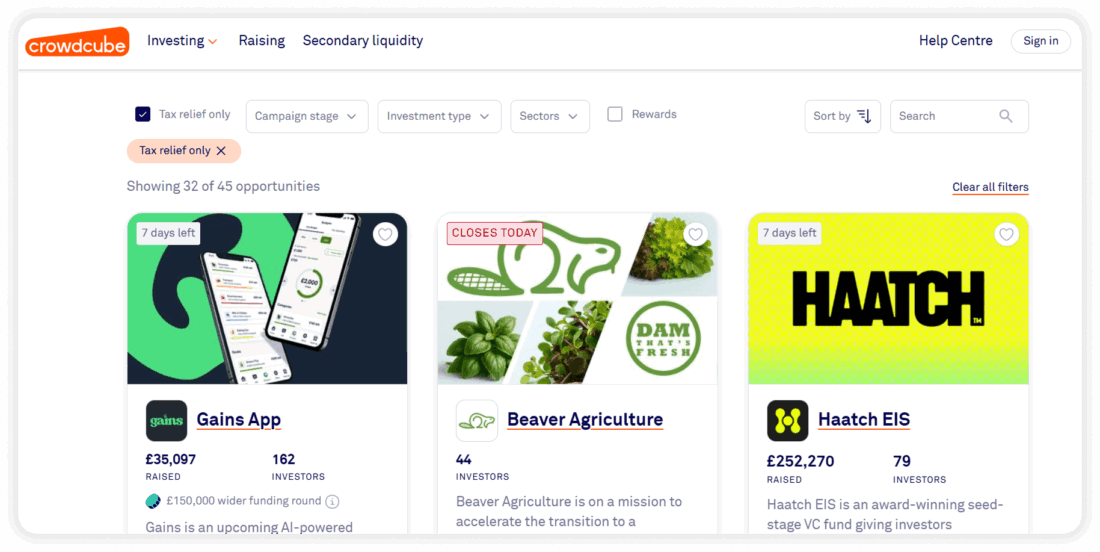

Crowdcube

Crowdcube6 is a well-known equity crowdfunding platform that supports both SEIS and EIS-eligible deals. Their investor materials explain how these tax relief schemes work, and their legal process accommodates the full SEIS/EIS workflow, including advance assurance and the required share-issue terms. Crowdcube also supports standard equity rounds for companies that do not qualify for SEIS or EIS.

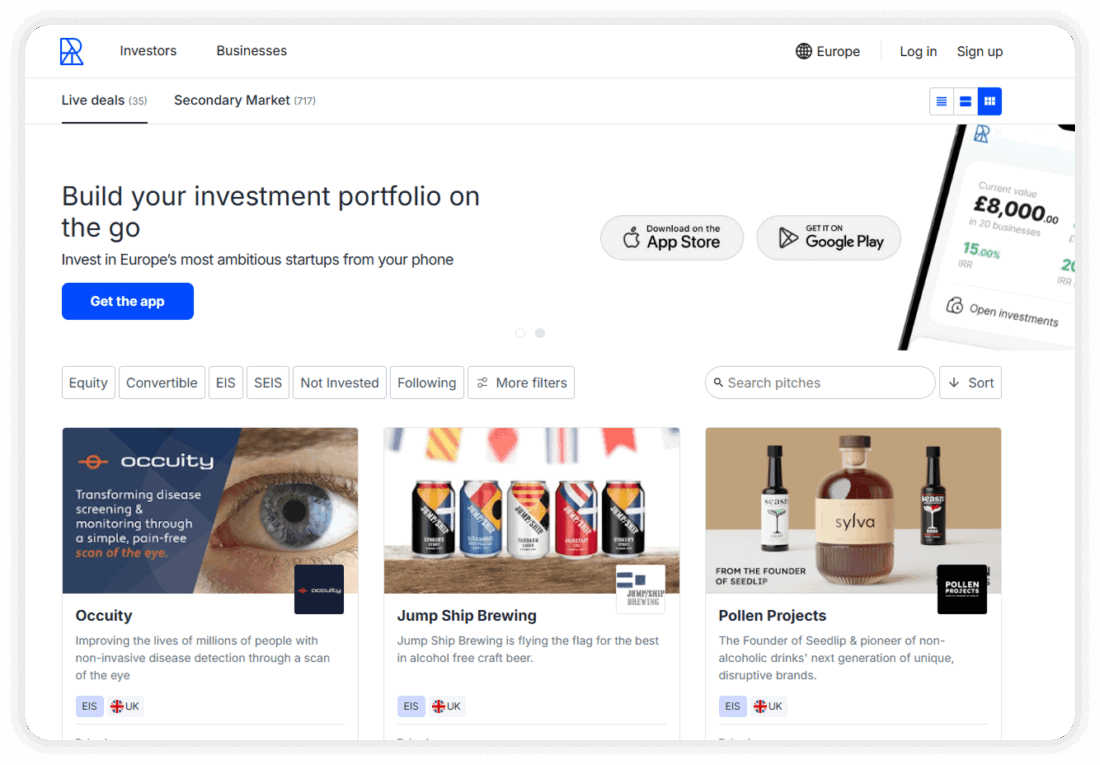

Republic Europe (formerly Seedrs)

Republic Europe supports SEIS and EIS‑eligible campaigns: for example, the Sustainable Accelerator7 on Seedrs holds funds in escrow until SEIS/EIS‑eligible startups are selected. Investors also receive clear guidance and documents designed to support tax-relief requirements.

Republic Europe can also run standard equity rounds for companies that do not fall under SEIS or EIS.

Crowd for Angels

This platform8 supports both SEIS and EIS tax relief for equity investors. It allows small investment amounts, starting from £25, and offers a flexible approach overall. In addition to equity, it also provides access to shares and crowd bonds, covering both equity and debt deals. The SEIS/EIS benefits apply only to the equity investments.

Build an investment platform with LenderKit

If you want to launch a custom crowdfunding platform that would support all types — SEIS, EIS, and non-eligible deals — check out LenderKit.

LenderKit provides white-label crowdfunding and investment software for businesses in the UK, Europe, USA, Canada and the MENA region.

Our crowdfunding software comes with a pack of ready-made features for investor onboarding, due diligence, capital raising, campaign launch and deal management. Catering to fintech businesses, who are looking to build their own platform, we provide a one-stop-shop solution that’s entirely scalable.

We could add support for both SEIS and EIS deals on your platform, from simple tagging on the front-end to more robust back-end functionality.

If you’re interested to see the software demo and discuss your platform requirements, don’t hesitate to reach out to us.

Article sources:

- SEIS vs. EIS explained - what's the difference? | Swoop UK

- Seed Enterprise Investment Scheme: A guide to SEIS | SeedLegals

- A start-up guide to SEIS and EIS - SETsquared

- HMRC online services: sign in or set up an account: Sign in to HMRC online services - GOV.UK

- Advance Assurance for SEIS and EIS

- Crowdcube Guide to EIS

- Republic Europe Offering Sample: Sustainable Accelerator

- Crowd for Angels | UK Crowdfunding Platform