Launching a Stocks & Shares ISA vs IFISA Crowdfunding Platform

No time to read? Let AI give you a quick summary of this article.

Individual Savings Accounts (ISAs) have long been a cornerstone of the UK’s personal finance landscape. They offer individuals a tax-efficient means to save and invest.

Among the various ISA options, Stocks & Shares ISAs and Innovative Finance ISAs (IFISAs) stand out for investors who are looking for potentially higher returns through exposure to equities and peer-to-peer lending or crowdfunding, respectively.

However, they both come with certain risks and limitations, and platforms that offer these services need to comply with strict regulatory requirements.

What you will learn in this post:

What are stocks & shares ISAs?

A Stocks & Shares ISA allows individuals to invest in a diverse range of assets, including individual stocks, corporate and government bonds, unit trusts, investment trusts, and exchange-traded funds (ETFs).

Any UK resident aged 18 or over who has not opened or contributed to another ISA of the same type in the current tax year can open both an IFISA and a Stocks and Shares ISA.

It is important to understand their risks (both investment options are suitable for medium or high-risk profile portfolios), and choose an ISA that aligns with your risk profile.

Additionally, the remaining annual ISA allowance affects eligibility. If an investor has already used the full £20,000 allowance1 for the current tax year, they cannot add further funds until the new tax year.

The main advantage of this ISA is that any capital gains or income generated from these investments are exempt from UK income tax and capital gains tax. This makes it an attractive option for those with a higher risk tolerance who aim for long-term growth through exposure to the stock market.

Additionally, Stocks & Shares ISAs offer a relatively high potential return that starts with 4% per annum and upward.

It’s essential to recognize that investments within a Stocks & Shares ISA can fluctuate in value, and there is a risk of losing capital.

What are IFISAs?

In contrast, an Innovative Finance ISA (IFISA)2 enables investors to lend funds through peer-to-peer (P2P) lending platforms or invest in crowdfunding projects.

Introduced in April 2016, IFISAs were designed to provide a tax-efficient wrapper for P2P loans. They allowed individuals to invest directly in loans to consumers or businesses and receive interest payments without tax deductions. The potential return of investing in an IFISA is 4%-8% per annum.

While IFISAs offer the potential for attractive returns, they come with higher risks3, including borrower default and lower liquidity compared to traditional investments. Moreover, these investments are not typically covered by the Financial Services Compensation Scheme (FSCS), meaning investors may not have recourse if the platform fails4.

Stocks & shares ISAs vs IFISAs comparison

Here’s a table that compares stocks & shares ISAs to IFISAs:

| ISA type | Product type | Annual limit | Eligibility | Risk profile | Estimated returns | Benefits |

| Stocks & Shares ISA | Investment | £20,000 | Aged 18 and more | Medium to high | 4%+ | Higher potential returns than IFISA |

| IFISA | Investment | £20,000 | Aged 18 and more, better for experienced investors | Medium to high | 4%-8% | Less volatile than Stocks & Shares ISA |

Platforms that offer stocks & shares ISAs and IFISAs

Several platforms cater to investors interested in Stocks & Shares ISAs.

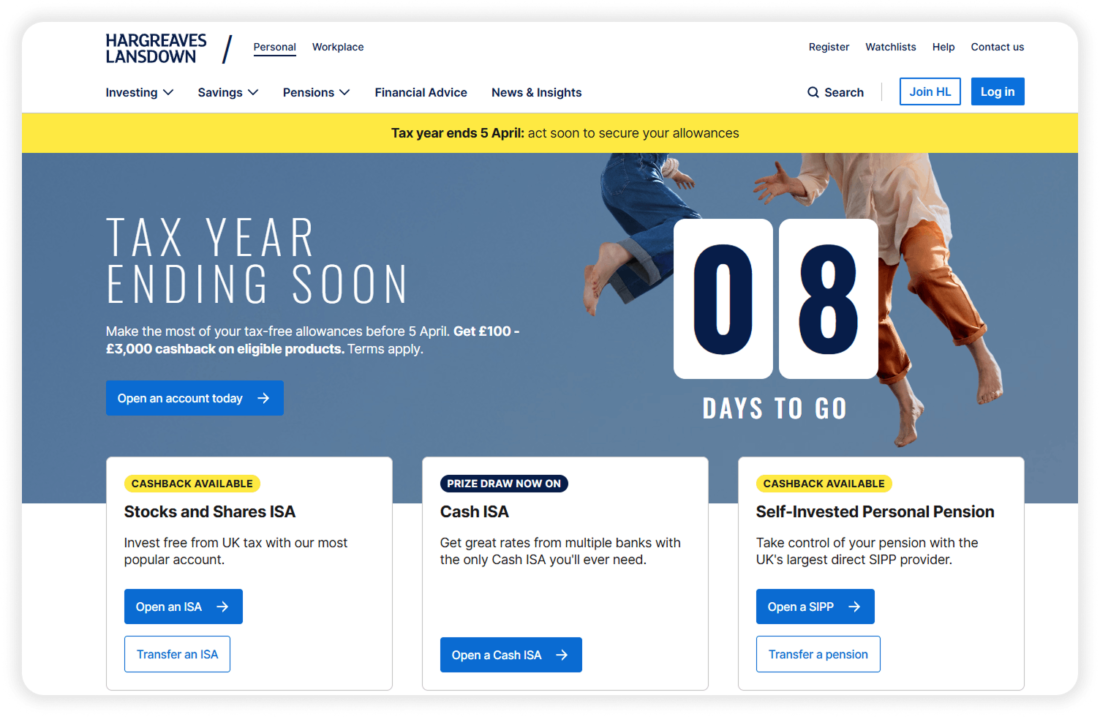

Hargreaves Lansdown

For instance, Hargreaves Lansdown5 is recognized as one of the UK’s leading investment and savings platforms. It offers a wide array of investment options within their Stocks & Shares ISA. The platform provides access to numerous funds, shares, and investment trusts, and allows investors to build a diversified portfolio tailored to their risk appetite and investment goals.

Triodos Bank

For IFISAs, platforms like Triodos Bank6 provide opportunities to invest in bonds with organizations delivering positive change. The platform allows investors to earn tax-free interest while supporting ethical initiatives. Triodos focuses on sustainable and socially responsible investments and is appealing to investors who prioritize environmental and social impact alongside financial returns.

Regulatory framework

The Financial Conduct Authority (FCA)4 oversees both Stocks & Shares ISAs and IFISAs and ensures that platforms adhere to regulations designed to protect investors. For Stocks & Shares ISAs, the FCA’s regulations focus on investment management practices, client asset protection, and ensuring that firms provide clear and accurate information to investors.

Regarding IFISAs, the FCA has implemented specific rules to address the unique risks associated with P2P lending and crowdfunding. In March 2016, the FCA published Policy Statement PS16/82, which introduced changes to the FCA Handbook. One of the changes was the requirement concerning the segregation of client money on loan-based crowdfunding platforms and the Innovative Finance ISA. These changes aimed to enhance consumer protection and ensure that firms have robust systems in place for handling client money. The policy statement emphasized the importance of clear communication to investors about the risks involved in P2P lending and the need for firms to conduct thorough due diligence on borrowers.

How to launch your stocks & shares ISA or IFISA crowdfunding platform

Launching a platform to offer Stocks & Shares ISAs or IFISAs involves several critical steps:

- Regulatory compliance: You need to get authorization from the FCA. For this, you need to demonstrate that your platform meets stringent standards for operation, such as the implementation of adequate systems and controls, financial stability, and appropriate risk management procedures. The minimum capital requirement varies from £75,0007 to £750,0007, depending on the activities that the platform will perform. The application process is usually processed within 6-12 months if the company submits all documentation.

- Technological infrastructure: Develop a secure, user-friendly online platform capable of handling investments, transactions, and client communications effectively.

- Partnerships: For Stocks & Shares ISAs, establish relationships with fund managers and brokers to offer a diverse range of investment options. For IFISAs, collaborate with credible borrowers or projects that align with your platform’s focus.

- Risk management: Implement robust procedures to assess and manage investment risks2, ensuring transparency and investor confidence. This includes conducting thorough due diligence on all investment opportunities, monitoring ongoing performance, and having contingency plans in place for potential defaults or market downturns.

White-label crowdfunding software by LenderKit

For those interested in setting up their own Stocks & Shares ISA or IFISA platform, LenderKit provides a customizable white-label crowdfunding platform software to streamline the investor onboarding, deal structuring and transaction processing.

We offer a compliance-ready investment software, to help businesses launch new crowdfunding and investment platforms while reducing development costs and accelerating the market entry, making it a viable option for fintech platforms aiming to enter the ISA market. To find out how it works or discuss details, please get in touch with our team.

Article sources:

- IFISA vs Stocks and Shares ISA | CARLTON Bonds

- PDF (https://www.fca.org.uk/publication/policy/ps16-08.pdf)

- Investing in Innovative Finance ISAs | FCA

- PDF (https://www.fca.org.uk/publication/consultation/cp14-09.pdf)

- Shares - prices and news on over 8,000 stocks and shares

- Triodos Bank

- A step closer towards the new UK capital regime for investment firms | Insights | Ropes & Gray LLP