Private Equity CRM Software: How Does it Work?

No time to read? Let AI give you a quick summary of this article.

In private equity, relationships, data-driven strategies and timely decisions are crucial to select and nurture investment projects while maximizing profits and minimizing operational friction.

Alongside many other tools, Private equity CRM software is what helps private equity companies keep in touch with the key stakeholders, monitor important activities and build efficient workflows.

What you will learn in this post:

Unique challenges faced by private equity firms

The need for any software, including a CRM for private equity, comes from a need to solve challenges, move deals through the pipeline, improve business performance and maximize revenue. Here are the main needs and challenges of private equity companies:

- Relationship management: each private equity business is built on relationships with investors, advisors, stakeholders, and other participants. Especially, with a growing interest to attract retail investors2, the numbers can outweigh the efficiency of old systems thus making private equity firms switch to more robust tools.

- Complex structure of deals: in private equity, you don’t deal with simple transactions but with financial complexities, diverse equity structures, and nuanced exit strategies. Keeping up with the updates, follow-ups and scheduled events to remind stakeholders of the next steps is what private equity managers need to deal with on a daily basis.

- Analysis of big volumes of data: the success of a private equity firm relies on its ability to process and analyze huge volumes of data accurately to detect potential investment opportunities and get performance metrics of investment portfolios.

- Regulatory compliance: private equity investment firms often operate cross-border and are exposed to global and local regulations. Maintaining additional communication and document management in the compliance segment is quite challenging without a private equity software solution.

- Continuous due diligence: while each private equity performs initial due diligence, it is also necessary to conduct ongoing due diligence3 because market conditions and regulatory requirements constantly change.

- Documentation and reporting: keeping documentation in order is needed not only for the internal purposes of a company, but also for investors and regulators. Periodic reporting in prescribed formats and with the right data is imperative, and it shall be delivered promptly and accurately.

Why use private equity CRM software

Considering all the private equity challenges, it becomes clear why robust private equity software can play a pivotal role in private equity business development. Here is what such private equity CRM software shall offer.

Building relationships with investors and stakeholders

The task of a good private equity CRM is not only to store data and sort information but also to help nurture and manage relationships with investors. Statistics say that 59% of businesses that use a CRM4 have observed significant improvements in customer retention, and private equity is not an exception.

This is why it is crucial to choose a CRM that allows you to monitor relations with industry leaders, venture capital funds, advisors, and other relevant people and companies.

The most common features to look for are:

- Interaction logging: All interactions (emails or meetings) are automatically recorded so that no detail is lost.

- Communication history: The software compiles the entire communication into a narrative offering insights into discussions and decisions.

- Contact list auto-updates: The software automatically monitors contact lists and refreshes them to ensure the company always reaches the right person at the right place.

Integration opportunities

Good private equity CRMs do not live in isolation but can integrate with other platforms and tools like Cap tables, Mailing providers, Reporting, etc.

For example, 4Degrees5 integrates with CapIQ6, Pitchbook7, Preqin8 and Crunchbase9. Through those integrations, it is possible to get information about the company’s size, its financial condition, transactions, and similar.

Features to look for:

- Seamless synchronization: A properly developed CRM system synchronizes with integrations seamlessly and ensures consistent data flow.

- Centralized operation center: all integrations shall be available from a single point to be monitored and managed effectively.

Data processing and analysis

In the constantly evolving industry, an ability to swiftly collect, analyze, and interpret relevant data makes a difference between a successful deal and a lost opportunity. This is why proper CRM software knows how to turn raw data into actionable insights.

Features to look for:

- Centralized data repository: It lies in the core of the CRM, and is neatly organized and easily accessible.

- Insight processing: CRM not only stores the data but processes it and turns numbers and patterns into actionable insights.

- Data access in real-time mode: CRM ensures that teams work only with the most recent data.

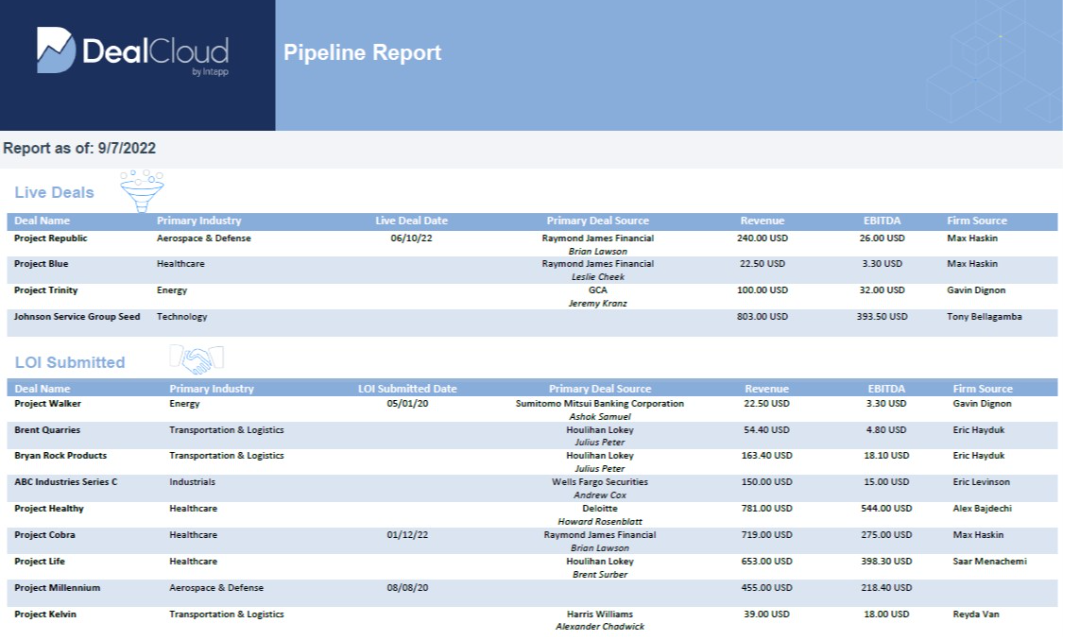

Real-time reporting

Instant access to real-time data and the possibility to generate a report based on it with one click help a lot in managing the business, and getting a clear picture of deal statuses, investment performance, and other metrics at any moment you may need it.

The must-to-be features are the following:

- Tailored templates: The software shall offer a suite of customizable templates to allow private equity firms to create reports that cater to their specific needs.

- Instant report generation: To make wise decisions, timely data is needed. This is why good CRM software should be able to generate instant reports based on preselected data.

Scalability

A growing business adds more operational pressure and starts managing more assets, investors, monitoring more portfolios as well as storing and analyzing data. The CRM software shall be able to grow together with the firm by providing consistent service and ensuring adequate performance regardless of the size of the company.

The most common features to look for are:

- Seamless portfolio inclusion: companies diversify their portfolios, and CRM systems shall be able to incorporate new businesses to ensure that all assets are tracked and managed.

- Management of a growing number of investors: Over time, the number of investors grows, and the CRM shall be able to manage increasing numbers of investors.

- Seamless tool integration: When a company grows, most likely, it will need new tools to handle all the business processes. The CRM shall enable an opportunity to integrate new tools and set them up easily.

Conducting due diligence

A properly organized due diligence process can safeguard a private equity firm and its investors from hefty financial and legal repercussions. This is why pick a CRM that allows you to organize and track the procedures of each division (legal, financial, and HR), with you being able to keep an eye on every task and who is handling it.

Relationships databases

The best CRMs centralize and organize data about investors, portfolio companies, and other stakeholders. With neatly organized data, private equity firms can not only maintain detailed profiles and access their investor database but also monitor investors’ behavior, expectations, and preferences, and develop their strategies based on identified insights.

Customizability

Each private equity firm has its own way of operating and usually opt for a customizable CRM solution that allows for custom processes, fields, visuals, notifications and other features.

How to choose private equity CRM software

There are a lot of private equity CRM software options on the market, which is why choosing one may be a difficult task. To pick the right CRM, you need to pay attention to the following details.

Cost vs functionality

Most CRMs are costly, and the more tools and features you add, the pricier it gets. The private equity CRM software costs10 normally range from $20 – $100 per user per month to $40,000 – $70,000 annual license subscriptions.

This is why it is important to check carefully what functionalities you really need and start with them. It will allow you to reduce costs and avoid a situation when you have a lot of tools but don’t use even half of them.

Tracking private equity metrics

A comprehensive private equity dashboard with insightful analytics gives your company an overview of your deal flow and the performance of your business. Among the most common metrics, you shall be able to track:

- Liquidity

- Cash flow

- Expenses

- Multiple on invested capital (MOIC)

- Internal rate of return (IRR)

- Industry-related metrics

Along with traditional metrics, it is becoming important to track environmental, social, and governance (ESG). Some CRMs such as Dial11l11log11 already include tracking of ESG metrics such as energy use, greenhouse gas, carbon emissions, regulatory issues, and waste generation, among others, because investors and governments are placing more value on environmentally- and socially-friendly companies.

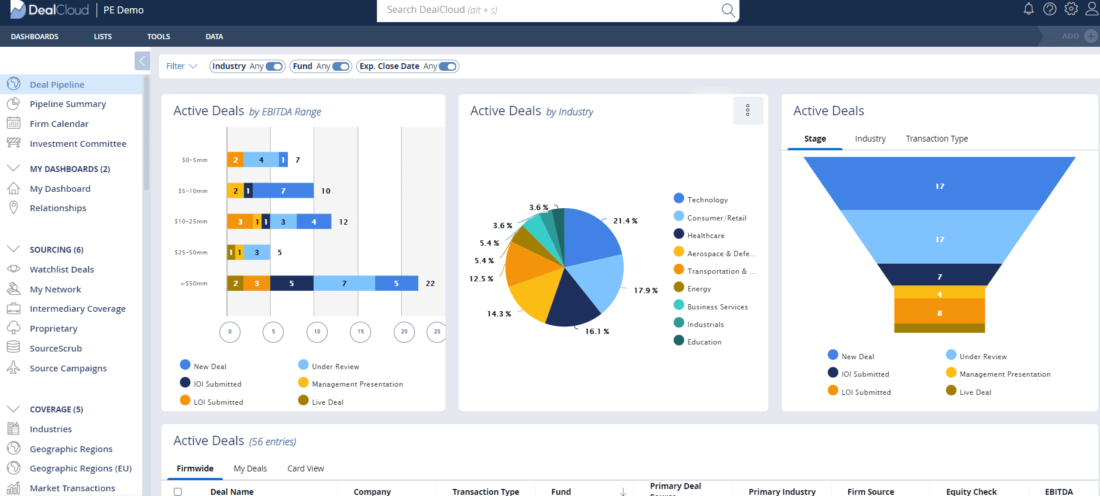

Clear visualization and dashboards

The CRM software shall be perfect in terms of visualization. It has to include dashboards where you can capture, analyze, and visualize all relevant data.

Top private equity CRM solutions

Private equity is a specific industry with its requirements and demands, this is why it is better to choose dedicated private equity CRM software. To facilitate your research, here are the top 5 private equity CRM solutions to choose from.

DealCloud

Data-powered private equity software from DealCloud12 is designed specifically for private equity firms to facilitate the execution of PE deals at the highest level. It can be easily configured to align with the portfolio management process and business development and to suit all PE firms’ needs independently of their size and investment type.

The DealCloud CRM allows private equity firms to categorize, tag, organize, and report on companies, contacts, deals, and other relationship data. It adapts to each PE firm’s flow and way of managing business.

No matter whether a PE firm is big or small, geographically focused or not, DealCloud helps not only to find the right investors and close a deal but also to manage the entire flow. With it, you can count on the following benefits:

- Private equity analytics

- Relationship management

- Deal and pipeline management

- Business development activity tracking

- Intermediary and lender coverage

- Fundraising

- Portfolio monitoring and reporting

- Big data analysis

- Legal documentation management

- Compliance and risk management, among others.

One of the distinctive and very useful features of DealCloud is its one-click tear sheets.

PE firms have to create recurrent reports (weekly, monthly, quarterly, etc.), and with this feature, they can automate the report generation process. These reports include deal pipeline updates, industry reports, fundraising status reports, and other information that can be retrieved and arranged in a report with one click.

The DealCloud CRM solution is industry-specific and has all the needed setups to match the needs of any PE firm. However, it also has some disadvantages.

The license cost of $50-$70,000 for a team of 30 members is rather high, and considering that all setups and customizations shall be made by the DealCloud team, it becomes even more expensive to manage the CRM.

Considering the most comprehensive suite of tools and setups, new users need time to learn how to handle CRM.

Xpedition

Xpedition13 is a cloud-based CRM platform designed specifically for private equity. The solution is tailor-made to integrate with any existing data and technology. It seamlessly integrates with existing Microsoft and third-party applications which makes it highly adaptive and intuitive. With it, private equity firms get the following tools.

- A fundraising and investor relations app to track raising funds, including the performance of each fund and investment that has been made.

- A deal-flow app to build and manage the entire deal pipeline, and monitor the deal stage and status.

- A powerful Business Intelligence to analyze data sets and to provide investors with valuable insights to make wise decisions.

- A briefing app to enable stakeholders to negotiate and sign contracts.

This CRM platform is among the best ones as it covers all the needs of a private equity firm. However, it is very complex, and it is not for beginners.

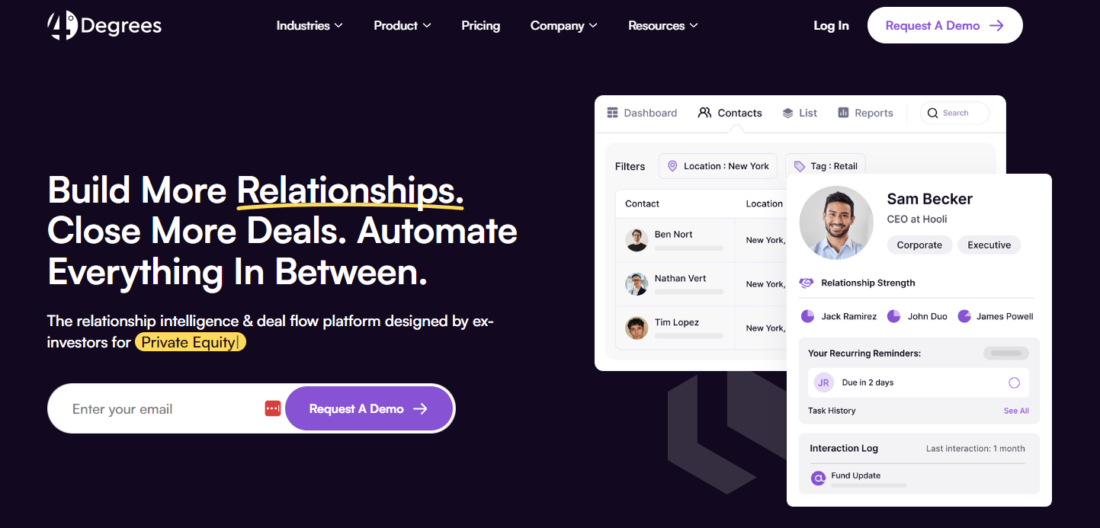

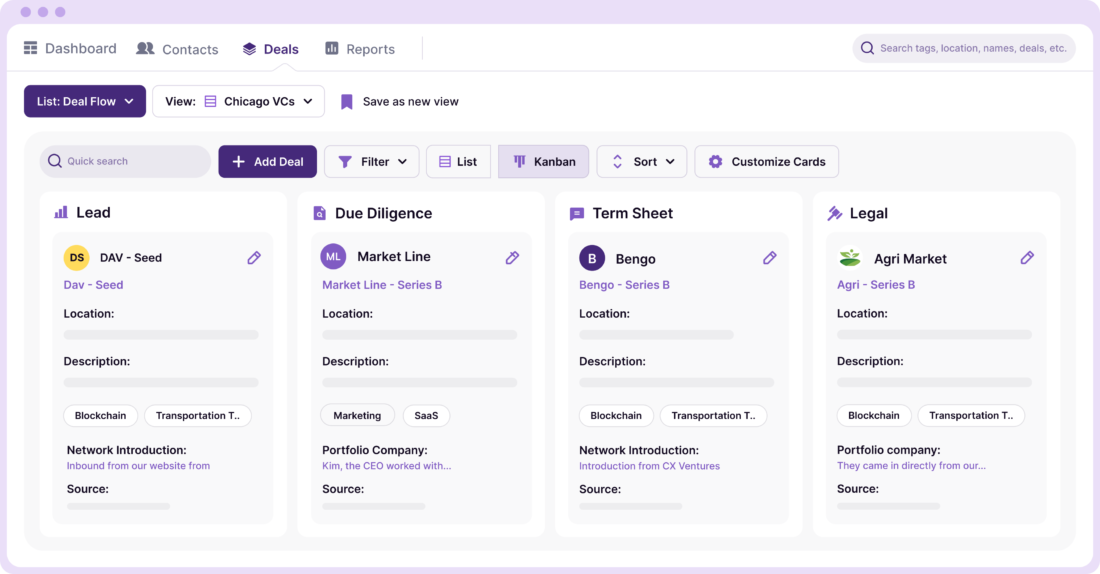

4Degrees

4Degrees14 offers a full-feature CRM, a relationship intelligence and deal flow platform built exclusively for private equity firms.

It allows to capture data on potential deals, portfolio companies, and many more things depending on configurations, download data about a company from third-party sources, customize reporting views, and perform other activities needed to manage deals.

Gmail & Outlook plugins enable you to add updates on deals directly from your inbox, follow up by setting reminders, and view previous interactions. With it, you can work with LinkedIn to look for warm contacts, and save profiles, or you can use the Chrome extension to get the info about ongoing and past deals, check investors who have previously dealt with you, and similar.

4Degrees’s comprehensive reporting engine helps you to instantly visualize the status of deals and the most important metrics. You can schedule reports to be generated at a specific time with specific intervals and sent to relevant people.

Dialllog

Dialllog15 is private equity CRM software for a full investment lifecycle. This is one of a few CRMs that focus on investor relationship management and workflow in a sleek integrated way.

This is the only software that allows organizing teamwork by workflows. All configurations, permissions, and integrations are designed to work for smaller companies and large-scale businesses. Email integrations are not just connected mailboxes but they deliver real-time 360 context about any project and relationships, not only details about who knows whom.

Its other distinctive feature is a sleek and clutterless design that allows users to be focused on the things they are doing. The onboarding takes just several days instead of several months like in the case of other CRM solutions.

The CRM software is highly customizable, and the cost of $75 per user is very affordable.

Altvia

Altvia16 is one of the most effective private equity CRM solutions. It is developed on top of Salesforce and is packed with plenty of tools and features to meet any needs of a private equity firm.

The solution consists of three main elements:

- A CRM platform for workflows, management of contacts, and relationships mapping

- Deal rooms

- AI-powered analytics.

Among the main benefits, one can distinguish the rich visual analytics, excellent workflow automation, collaboration tools, the availability of all relevant third-party integrations with a possibility for more options, a built-in report generation tool, and a high customization level.

The main disadvantage is that it runs atop Salesforce and thus, it may slow down when performing more advanced operations. Also, if you’ve had a negative experience with Salesforce, most likely, it will be repeated with Altvia.

How to launch a private equity platform with LenderKit

If you are thinking about launching a comprehensive private equity platform without excessive expenses and hassle, consider white-label private equity software from LenderKit. LenderKit offers a comprehensive private placement software designed to streamline the entire investment process from investor onboarding to campaign management.

LenderKit software can be paired with integrations to facilitate your online payment processing, funds custody, due diligence and to automate all financial, verification and reporting operations from user onboarding to fund disbursement.

If you want to see how the product works, please feel free to schedule a demo or get in touch with us.

Article sources:

- What is Private Equity Deal: Structure, Flow, Process (Guide)

- 9 Key challenges private equity firms face in 2024 | Ontra

- What is Private Equity Deal: Structure, Flow, Process (Guide)

- The Ultimate List of CRM Statistics for 2025 | FounderJar

- The Modern Private Equity CRM: The 7 Must-Have Elements - 4Degrees

- Access Denied

- Introducing the 4Degrees PitchBook Native Integration - 4Degrees

- Preqin | Alternative Assets Data, Solutions and Insights

- Crunchbase

- Top CRM platforms for Private Equity investors in 2023

- Choosing the Best CRM for Private Equity [+Top 7 Picks]

- Intapp DealCloud

- Private Equity CRM - Xpedition

- The Intelligent CRM For Relationship-driven Teams

- Private Equity CRM for Entire Investment Lifecycle | Dialllog

- Altvia | Fund Management Software For Fundraising, IR & Deal Teams