What Makes A Private Investment Platform Great

Private equity investing has always been a “chamber” field open only for professional and semi-professional backers, due to risky long-term offerings, strict requirements, and cumbersome investment flows.

With the advent of crowdfunding, the niche started transforming, and now it gives green light even to individual and retail investors.

So the question is how to become a private investing crowdfunding provider? And what makes a private investment platform great?

Experience, due diligence, shareholders, high yields or maybe starting capital?

Let’s figure it out together.

What you will learn in this post:

What is private equity investing?

Private equity is a standalone investment class consisting of assets that are not listed on a public exchange.

When you invest in private equity, you may do it directly or via an investment fund; the capital is used to make an acquisition, fund new technology, expand the capital base and bolster a balance sheet.

How private investment funds work

Private investment funds typically don’t allow retail unaccredited backers to participate in deals, they deal with institutional backers that are investment-savvy and have solid expertise.

But private investing crowdfunding funds are different.

Examples of the best private crowdfunding platforms

Here is a list of the most advanced private equity investment platforms or rather investment-based crowdfunding platforms that we consider interesting to learn from. Let’s check out how they work and what makes them great.

Republic

Republic is a Fintech company combining a financial retail investment platform, a blockchain advisory service, and a private capital division. It specializes in investments in a variety of private markets, including startups, real estate, crypto, and video games.

Republic matches accredited and non-accredited investors with entrepreneurs and organises high-growth deals.

Bloomberg says that Republic is the largest private investment platform that raised $36 million from investors including Michael Novogratz’s Galaxy Digital, Broadhaven Ventures and Prosus NV and has more than 1 million users.

Unlike competitors, Republic deals with retail investors who can get in on the startup ground floor with $10 as a minimum.

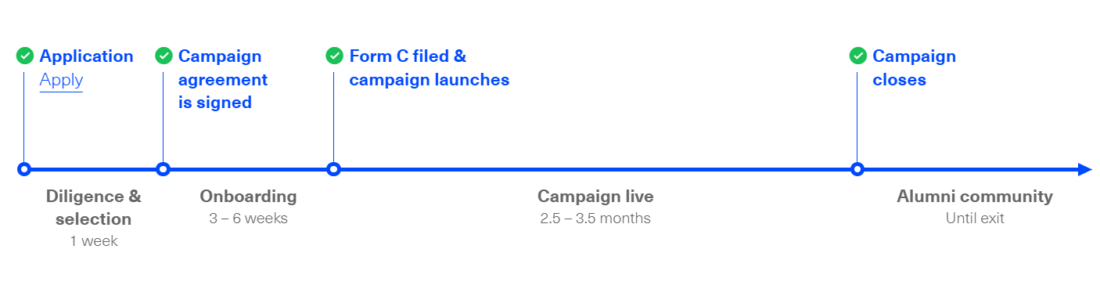

The platform carefully selects startups. The acceptance rate is only 5% out of thousands of applications.

The selection process includes initial screening, due diligence, and the final decision.

More importantly, much of Republic deals come from recommended referrals (a vast network of partners) – venture funds, accelerators, incubators, advisors, angel investors and founders.

Expertise is another advantage that attracts the platform clients. Republic was founded by alumni from AngelList and top people from the startup, venture capital and investment worlds.

Republic doesn’t charge anything for investors, there are only fees for fundraising companies.

This is what Republic answers to the question “Why do companies want to raise on Republic?”

Because of our strong and engaged network of investors, loyal partners and trusted brand, companies choose Republic over other platforms.

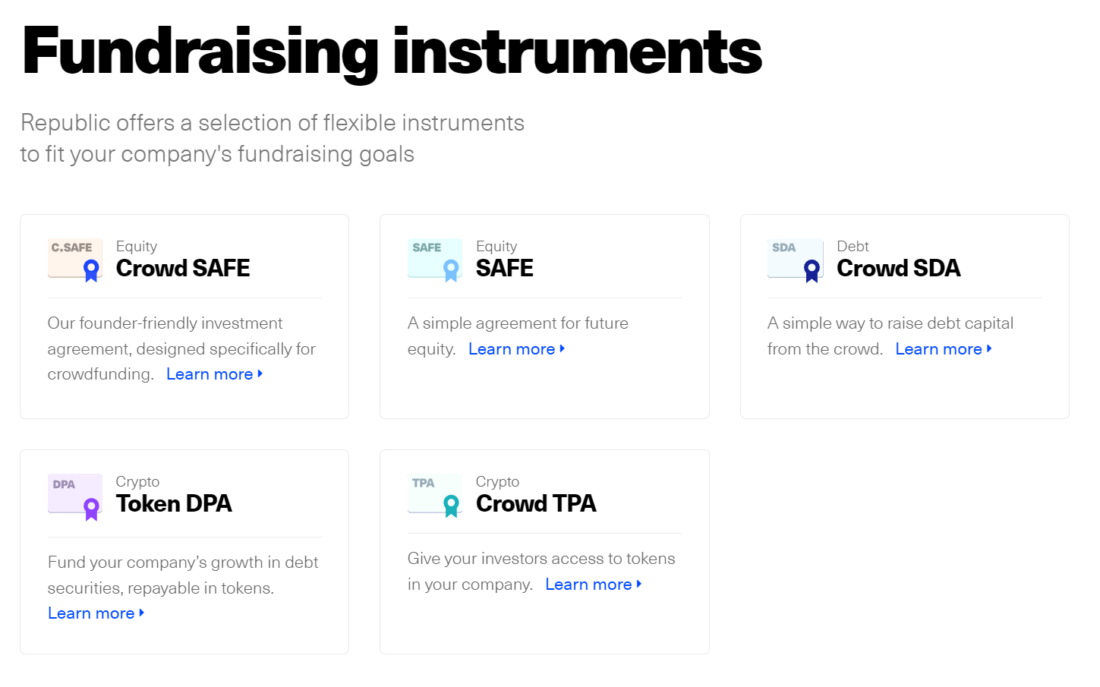

The verdict: what makes Republic great? Opportunities for retail backers, thorough due diligence process, flexible investment instruments.

Moonfare

Moonfare is an international, innovative digital wealth platform providing individual investors with access to top-tier private equity funds.

Importantly, Moonfare works only with professional and semi-professional investors. Being backed by a group of professionals from the private equity ecosystem (KKR, Apax Partners, J.P. Morgan, BlackRock, Amazon, Microsoft, N26 and Google), the company has raised $185 million in funding to date.

In November, Moonfare raised $125M in Series C led by Insight Partners to accelerate global growth. In September, Moonfare exceeded €1 billion assets under management, doubling its assets in only 8 months.

The provider collaborates with the world’s best private equity companies: The Carlyle Group, Warburg Pincus, Apax Partners, Lexington Partners, Cinven, etc.

Funds like those offered on Moonfare have generated an average IRR of 19% — outperforming the S&P 500 by 13%.

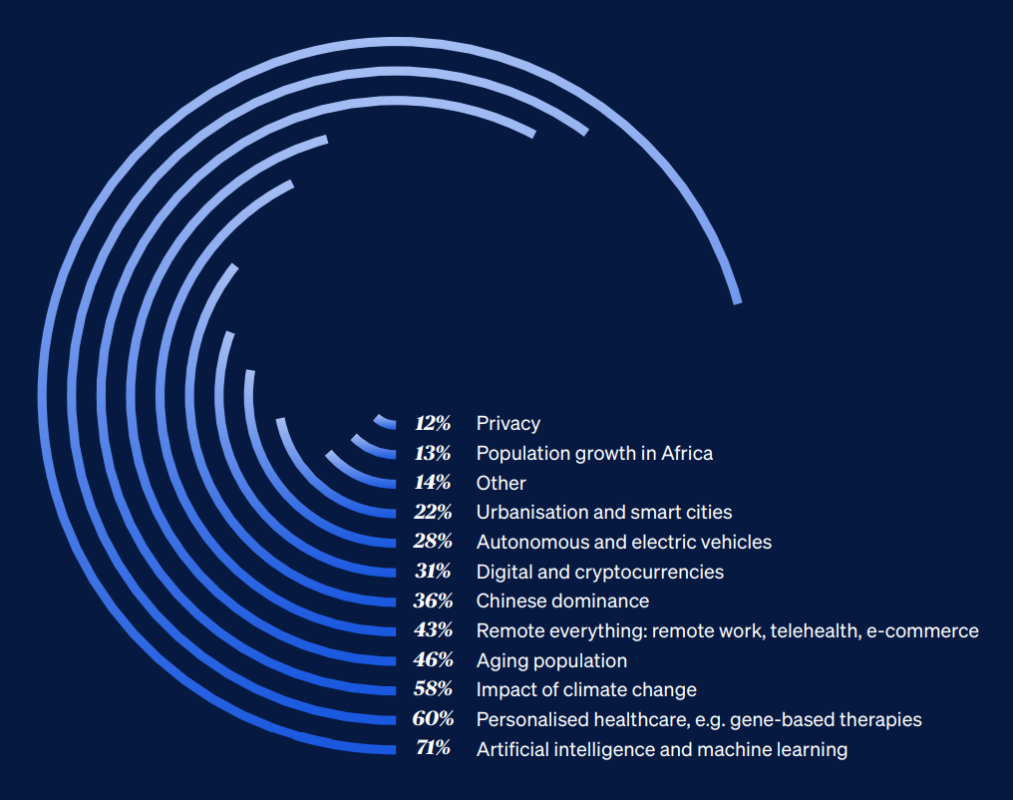

According to the Moonfare survey, Illiquidity and investment minimums are twotopics where Moonfare is doggedly innovating.

Moonfare has a built-in secondary market for investors to sell their stakes, optimize the investment portfolio and get rid of illiquid investments.

Moonfare investor community can offer their existing allocations to buyers in a structured auction that happens twice per year.

The platform has been dealing with the largest and longest-running operator of private equity secondary funds globally, Lexington Partners.

Every deal is accompanied by the Moonfare team member to ensure efficient and optimal outcomes for all parties.

The verdict: what makes Moonfare great? Collaboration with trusted investment funds, high yields, and the secondary market.

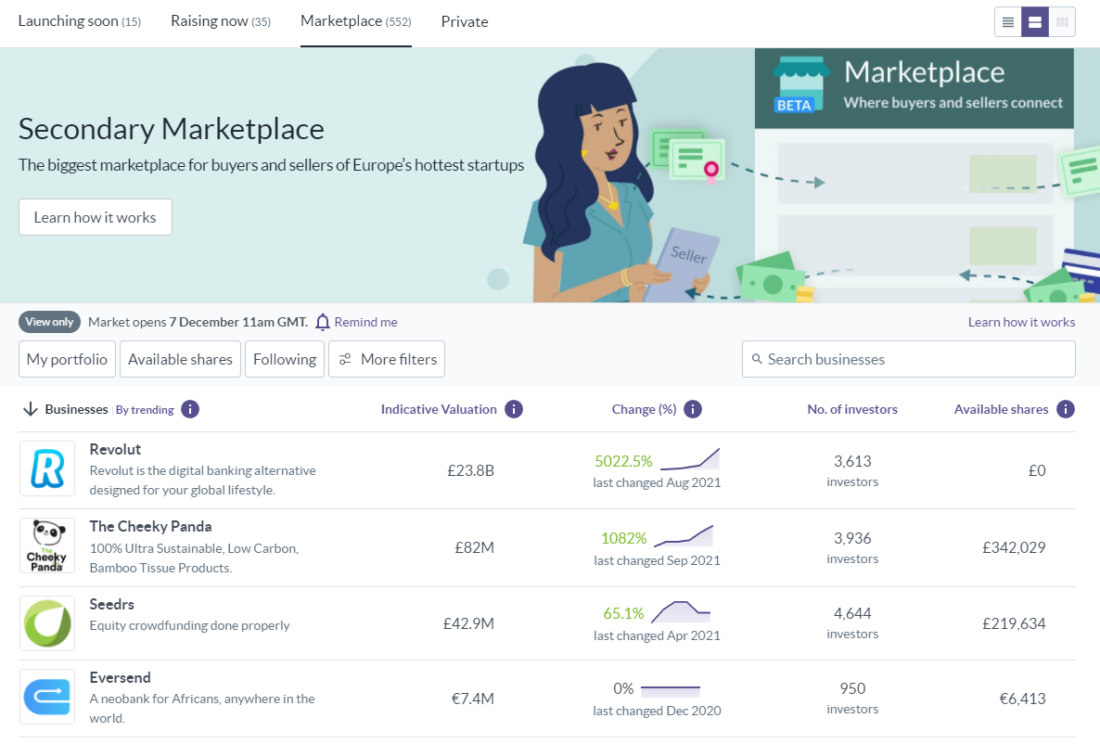

Seedrs

Seedrs is considered to be the leading equity crowdfunding platform and the most active funder of private companies in the UK.

Also read: How to Build a Crowdfunding Platform Like SeedrsThe company deals with all types of backers (a high net worth investor, a sophisticated investor, or an everyday (restricted) investor) and companies who intend to grow and generate returns.

Featured sectors: crypto, B corporate, European businesses, women-led startups, sustainability, travel, leisure and sport.

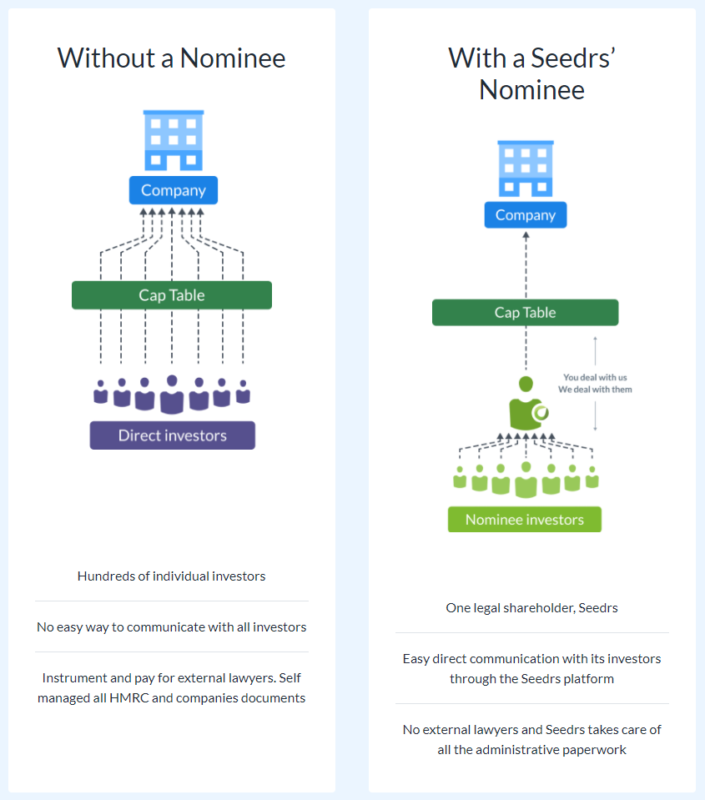

Seedrs was the first crowdfunding company to launch a secondary marketplace. The platform works as a bulletin board where backers express an interest to sell or buy shares held under the Seedrs Nominee Structure during a Trading Cycle.

The Seedrs’ due diligence process is based on 6 key components: verification, due diligence, access, contractual protections, compliance, and post-investment oversight.

They say that those fundraisers who reach Seedrs are reliable by default, as Seedrs’ due diligence requirements are “enhanced scrutiny”.

Interestingly, a year ago Crowdcube & Seedrs announced a merger to create the world’s largest private equity marketplace that would democratize private investments and give more options to backers and businesses. But in March 2021 the merger was terminated due to the findings of the CMA.

For sophisticated backers, Seedrs offers access to exclusive investment opportunities through the Private Deal Room.

High-profile VC funds you may invest in with Seedrs: Passion, Seedcamp, Augmentum.

Startups get various services from Seedrs: from access to the Academy to the cap table and equity management.

Titanbay

Titanbay is a new player on the private equity market. The platform was launched a year ago and announced as “the next-generation online platform enabling investors to access and invest in a selection of top-tier private equity funds”.

With Titanbay, sophisticated backers, private banks and GPs can invest in top-tier private equity, venture capital, and real estate funds.

The company is supported by PE professionals and industry veterans such as CVC Capital Partners, Oaktree, EQT, Atomico.

The combined industry experience of investors and advisors is 100 years.

Small-scale qualified investors can reach the same opportunities as large institutional backers with low investment minimums and low fees.

Titanbay supports investors with a proprietary portfolio analysis tool to reach balance and increase liquidity.

Titanbay may provide a secondary market among our investors, facilitating early liquidity.

The company’s partnership programme is designed for wealth managers to give them broader access to best-in-class funds.

Wrapping up private equity crowdfunding

Getting back to the original question, let’s rephrase it to “What makes a crowdfunding private investment platform credible?”

“Great” is probably not the most appropriate assessment of a private equity investment platform, as it’s very subjective. Some may fancy Seedrs because of its secondary market, others like Republic and its low fees.

So, speaking about the main attributes of reliable private investment platforms, we should name these:

- Investor profiles (sophisticated and non-sophisticated)

- Thorough due diligence

- Expert team with a background in private investment markets

- Access to exclusive high-profile VC funds

- Of course, secondary market

- Flexible instruments (probably a combo of investment crowdfunding and private crowdlending)

- “Big shots” among partners and investors (just to know that you’re in a good company)

If you’re looking to build a private equity crowdfunding platform to enter the private capital raising niche and serve private investment clients, reach out to us at LenderKit.

LenderKit is white-label private investment management software for private deal management and match-funding. We offer out-of-box solutions for starters and established businesses and can help you build a custom private equity investing platform.