Prypco Mint Review: Dubai’s First Tokenized Real Estate Platform

No time to read? Let AI give you a quick summary of this article.

Dubai’s real estate market has long been very attractive for global investors because of its high-end infrastructure, strategic location, investor-friendly policies and consistently rising property values1.

As of 2024, the city continues to attract billions in real estate transactions annually2, with foreign investors3 accounting for a substantial portion of that volume. However, traditional barriers such as high entry costs, legal complexity and limited liquidity have excluded many from participating in this dynamic market.

What you will learn in this post:

What is Prypco Mint and how does it work?

Prypco Mint4 represents a significant advancement in real estate investment within the Middle East and North Africa (MENA) region.

This first-of-its-kind, regulated platform is launched in collaboration with the Dubai Land Department (DLD), the Virtual Assets Regulatory Authority (VARA), the Central Bank of the UAE and the Dubai Future Foundation and offers a novel approach to property investment through tokenization.

Main features and offerings

The platform distinguishes itself from other real estate investment platforms in Dubai by offering the following opportunities.

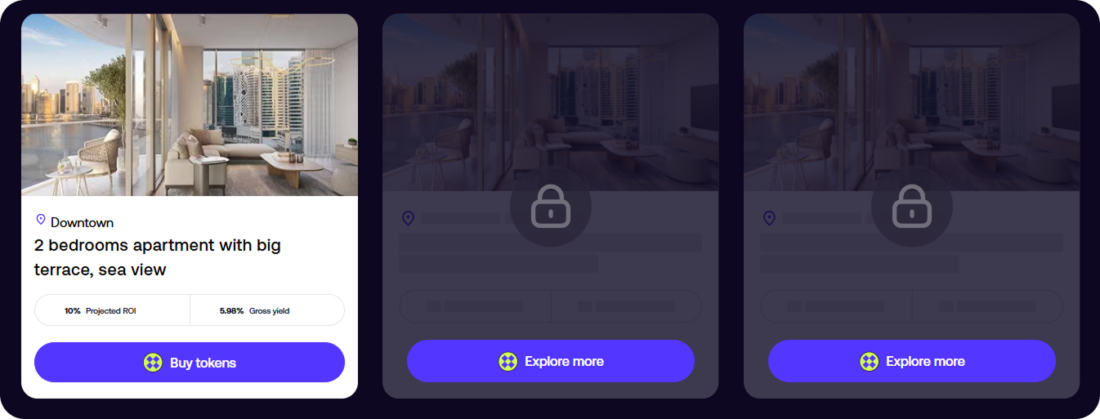

1. Fractional ownership

Prypco Mint digitizes the title of property into tokens and allows investors to buy fractional shares of premium, ready-to-own Dubai real estate. Each token represents a defined percentage of the property’s value. For example, an investor can gain partial ownership of a Dubai residence for as little as AED 2,000 (roughly $540)5. This model breaks down capital barriers and offers a way to diversify into real estate without locking in large sums of money.

2. Regulatory oversight

The platform operates under stringent regulatory frameworks:

- Dubai Land Department (DLD)6: Oversees the physical real estate assets.

- Virtual Assets Regulatory Authority (VARA)7: Regulates the digital aspects of the platform.

- Central Bank of the UAE8: Monitors financial transactions and ensures that investor funds are held in regulated client money accounts and are released only when the title of property is transferred to the client.

In its initial phase9, the project is restricted to ready-to-own properties, with tokenization allowed only through firms licensed by the Virtual Assets Regulatory Authority (VARA). Before a property is listed, the Dubai Land Department reviews and verifies its pricing to ensure fairness and transparency.

3. Blockchain Integration

Prypco Mint utilizes XRP Ledger10, which helps the platform to ensure secure, transparent, and efficient transactions. This blockchain integration enhances trust and traceability in the investment process and ensures that tokenized title deeds are synchronized with official property records.

4. Transactions in local currency

All transactions are conducted in UAE Dirhams. It helps to avoid the complexities and volatility associated with cryptocurrency transactions during the pilot phase. It also ensures regulatory compliance and investor protection.

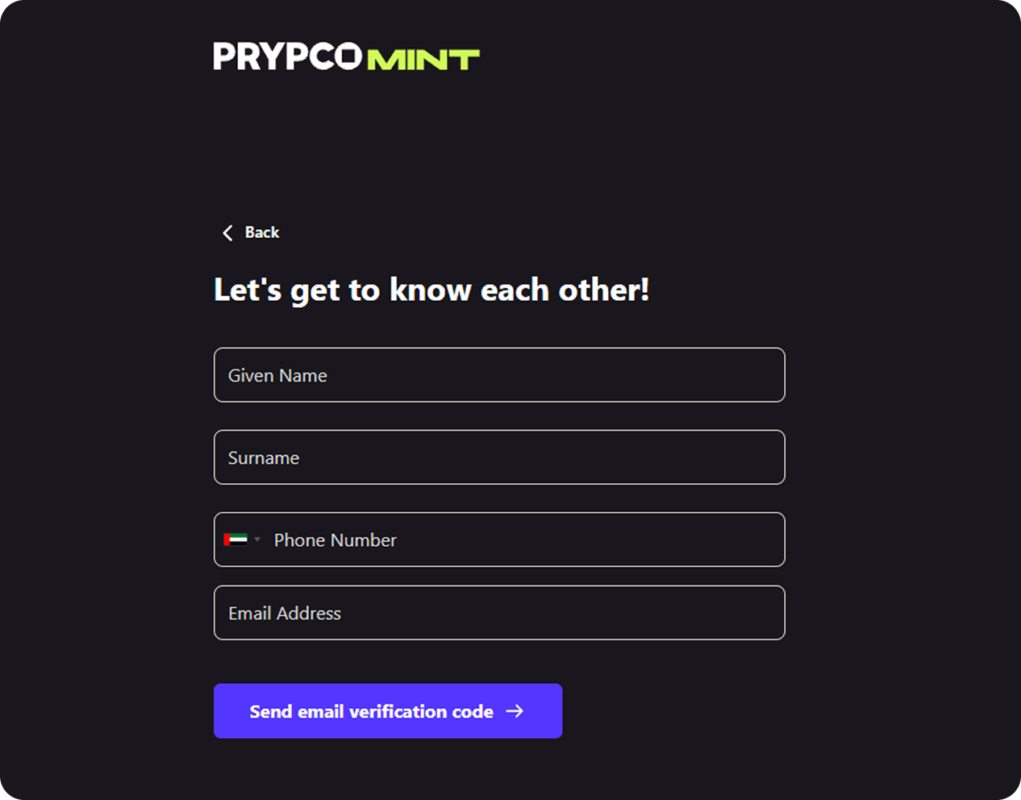

How to create an account on Prypco Mint

- Visit the platform4.

- Register: Click on the sign-up option and provide your personal details11, including:

- Full name

- Nationality

- Contact information (email and phone number)

- Employment status

- Valid Emirates ID

- Complete KYC verification: Upload necessary documents for identity verification, such as:

- A clear copy of your Emirates ID

- A recent utility bill or bank statement for address verification.

- Top up your wallet: Once your account is verified, you can fund your Prypco Mint wallet using UAE Dirhams (AED). Note that cryptocurrency transactions are not permitted during the pilot phase.

- Start investing: Browse available tokenized real estate projects and invest with a minimum amount of AED 2,000.

Upon completion, investors receive a legally recognized Property Token Ownership Certificate issued by the DLD, granting the same rights as traditional property ownership.

The platform plans to expand globally in future phases, which may include broader access beyond UAE residents. 12

Can Prypco Mint become a new benchmark platform?

Prypco Mint’s inaugural property listing was fully subscribed within 24 hours and attracted 224 investors from over 40 nationalities13.

The average investment amount was AED 10,714. Notably, 70% of these buyers were first-time investors in Dubai property.

This indicates strong demand for accessible, tech-enabled real estate opportunities.

How to launch your investment platform in Dubai

If you’re inspired by Prypco Mint and want to launch a similar platform or a more traditional fiat-based investment or crowdfunding platform — check out white-label investment software offered by LenderKit.

LenderKit provides customizable software and custom development services to help businesses launch new investment platforms globally, including Dubai.

We’ve helped many clients in UAE and Saudi Arabia to create competitive platforms including Forus, Tala, Blomal, Awaed and others.

Our software comes with pre-built features that can further be extended, customized and tailored to your unique platform requirements:

- Investor onboarding

- Client portals

- Deal management

- KYC/AML checks

- Payment processing automation,

- Document management

- Analytics and more.

We have experience partnering and working with tokenization providers, so we could help you launch a platform like Prypco Mint.

How to get started with LenderKit:

- Fill in the contact form

- Initial call to discuss project needs

- Proceed with an out-of-box solution or commit to a custom platform development

- Our team will conduct project scoping and analysis called a discovery phase

- Finalize the roadmap for development

- Develop, release and maintain

Building on a ready-made framework and leveraging our fintech knowledge will help you save the development time and costs compared to the development from scratch.

If you are interested to learn more about the LenderKit offer and discuss your project requirements, don’t hesitate to reach out to us.

Article sources:

- Dubai Real Estate: Strong Growth & Positive Outlook for 2025 | M&M Real Estate

- Dubai Land Department - Dubai’s Real Estate Sector records AED761 billion in transactions in 2024

- Foreign investment in the Dubai housing market, 2020-2024 - Eutax

- PRYPCO Mint

- PRYPCO Mint

- Dubai Land Department - Home

- Virtual Assets Regulatory Authority (VARA)

- CBUAE | Central Bank of the UAE

- Dubai Land Department Launches First Licensed Tokenized Real Estate Platform Via Prypco Mint - Construction Business News Middle East

- Dubai Launches First Official Real Estate Tokenization Platform Prypco Mint

- 3 Steps to Invest in PRYPCO Blocks (From as Low as AED 2000) - PRYPCO

- DLD unveils tokenised real estate project via 'Prypco Mint'

- PRYPCO Mint’s First Property Fully Funded In One Day - Construction Business News Middle East