Republic Europe Crowdfunding Platform Overview

No time to read? Let AI give you a quick summary of this article.

Republic Europe is a prominent player in the European crowdfunding landscape. The platform has evolved from its roots as Seedrs, but since then, it has undergone significant transformations to cater to the dynamic needs of the investment community.

Republic Europe provides a diverse range of investment opportunities, catering to various investor preferences. The platform offers:

- Equity investments, where investors can purchase shares in early-stage startups to gain ownership stakes and potential dividends.

- Debt instruments which are fixed-income securities in which investors lend money to companies in exchange for regular interest payments and the return of principal upon maturity.

- Tokenized assets, such as Mirror Notes, through which investors can gain exposure to private companies without direct equity ownership. These digital securities are linked to the performance of underlying companies and are tradable on secondary markets.

- Real estate investments ranging from residential developments to commercial properties.

- Alternative asset opportunities in sectors like gaming, art and collectibles.

Both accredited and non-accredited investors can participate in the investment opportunities on Republic Europe. However, non-accredited investors may be subject to certain limitations based on their income and net worth.

The platform also accommodates institutional investors, including venture capital firms, family offices and corporate investors, providing them with access to curated investment deals.

The minimum investment amount on Republic Europe varies depending on the type of offering:

- For equity and debt offerings, the minimum investment is typically set at €10, which allows for broad access for retail investors.

- Investing in tokenized assets, such as Mirror Notes, may have different minimums, often starting at €50, to accommodate a wider range of investors.

- Investment offerings in real estate and alternative assets may have higher minimum investment thresholds.

What you will learn in this post:

Historical Background

Let’s dive deeper into the company’s story and background and explore how their journey may be relevant for new crowdfunding platforms and investment marketplaces in 2025 and beyond.

The Seedrs era

Founded in 2012 in London, Seedrs pioneered equity crowdfunding in the UK, enabling individuals to invest in early-stage startups. Over the years, Seedrs garnered a reputation for its rigorous due diligence processes and a user-friendly interface and attracted a diverse investor base. By 2022, Seedrs had facilitated investments in numerous startups and solidified its position as a leading crowdfunding platform in Europe1.

Acquisition by Republic

In 2022, Republic, a U.S.-based investment platform, acquired Seedrs2 in a deal valued at approximately $100 million. This acquisition aimed to expand Republic’s global footprint and integrate Seedrs into its broader ecosystem of investment services. Consequently, on July 10, 2024, Seedrs officially rebranded as Republic Europe.

Platform Achievements

Expansion of investment opportunities

Post-rebrand, Republic Europe has broadened its investment offerings and provided access to a diverse range of sectors3, including technology, food and beverage and real estate. This diversification allows investors to build balanced portfolios and supports startups across various industries.

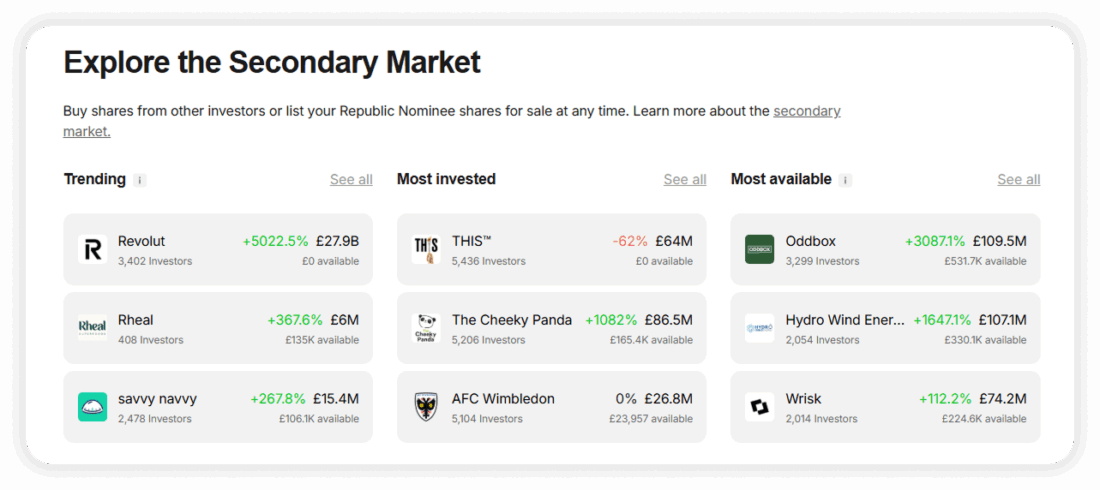

Introduction of secondary market features

One of the most critical features of Republic Europe is its secondary market, which allows investors to buy and sell shares in private companies they have invested in. This is especially helpful because private company shares usually cannot be traded easily like public stock. The secondary market allows investors to access liquidity, meaning they can potentially sell their shares before a company goes public or gets acquired.

In July 20254, Republic Europe made the secondary market even more flexible and user-friendly. They added a feature that lets investors indicate the price at which they want to buy shares. This means that instead of accepting whatever price is available, investors can set their target price. It helps them plan and make smarter investment decisions.

With this new feature, shareholders can better estimate their potential returns and see if selling or buying shares is worth it. It also makes the marketplace more transparent because everyone can see what other investors are willing to pay.

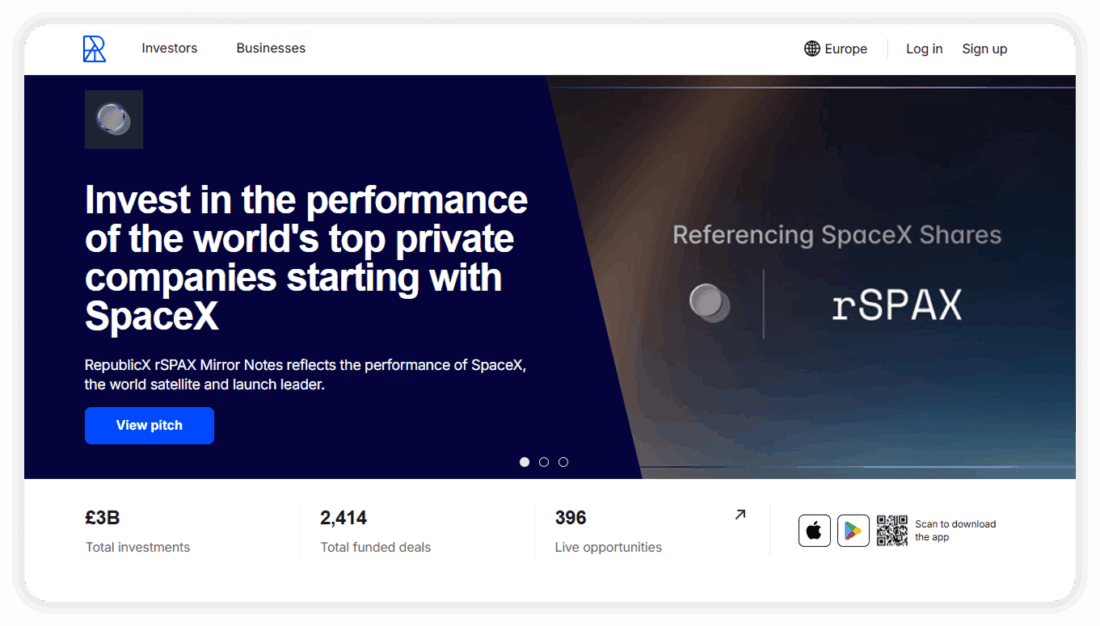

Launch of Mirror Notes

In August 2025, Republic Europe introduced Mirror Notes5, a novel investment instrument aimed at providing exposure to private companies without direct share ownership. These are a special kind of financial product that lets investors participate in the growth of private companies without actually owning their shares.

Think of Mirror Notes like a window into a company’s success. Instead of buying stock directly, investors buy these debt-based instruments designed to “mirror” the company’s performance. For example, if the underlying company, such as SpaceX, does well, the value of the Mirror Notes can increase. This means investors can earn returns based on the company’s success.

Mirror Notes work by tracking specific events, such as an IPO (when a company goes public) or a major acquisition. When such events happen, investors holding Mirror Notes may receive payouts reflecting a portion of the company’s gains. This makes Mirror Notes an accessible way for more people to invest in private companies without needing to deal with the complexities of owning actual shares.

Regulatory Concerns

The launch of Mirror Notes by Republic Europe has drawn attention from regulators6 and industry experts. Some organizations are concerned about how these new investment products fit into existing crowdfunding rules.

The Crowdfunding Professional Association (CfPA)7, a group that represents crowdfunding platforms and investors, has publicly voiced its worries. They argue that Mirror Notes are very different from traditional crowdfunding. Normally, crowdfunding is meant to help small businesses raise money directly from investors and to support the local economy. Mirror Notes, however, are synthetic financial products that don’t involve buying actual shares in the company, which some see as moving away from the original purpose of crowdfunding.

The CfPA also pointed out several specific risks. First, there’s dual-layer risk, which means that the investment carries risks both from the underlying company and from the structure of the Mirror Notes themselves.

Second, there could be regulatory misalignment, as current crowdfunding laws were not designed with these types of instruments in mind. Also, there are investor protection concerns because these products are more complex and may be harder for typical investors to fully understand before investing.

Recent Developments

Enhanced secondary market functionality

Republic Europe has been working hard to improve its secondary market, which is the place where investors can buy and sell shares they already own in private companies. Normally, when people invest in startups or private businesses, they have to wait a long time, sometimes years, before they can cash out their investment. The secondary market helps solve this problem by giving investors a chance to trade their shares earlier, providing more flexibility and liquidity.

One of the most useful updates came in July 20258, when Republic Europe added a feature that allows investors to set their own buy prices. Before this, investors could only see shares listed for sale and decide whether or not to purchase at the offered price. Now, with the buy-price feature, investors can post an offer showing the price they are willing to pay. This makes the market more open and transparent, because buyers and sellers can clearly see each other’s expectations.

These improvements do more than just make trading easier: they also help investors feel more confident. By being able to set their price, investors gain a sense of control over their decisions. Sellers, on the other hand, can see what buyers are willing to pay and adjust their listings accordingly. This creates a more balanced and dynamic marketplace where both sides have the tools to negotiate fairly.

Strategic partnerships

According to the Republic Annual Report 20249, the broader Republic group initiated several meaningful partnerships to strengthen its technology and liquidity infrastructure:

- Microsoft: Partnered with Republic on an incubator program to support AI startup founders.

- Google: Collaborated to provide startup services and hosted a Republic Europe alumni event at Google’s Startup Hub.

- INX: A SEC-registered Alternative Trading System (ATS), partnered with Republic to facilitate enhanced secondary trading across asset classes, including private equity, sports, film and commodities.

How to create a crowdfunding platform like Republic Europe with LenderKit

Building a crowdfunding platform similar to Republic Europe requires careful planning, regulatory compliance and robust technology. One of the fastest and most efficient ways to achieve this is by using LenderKit, a turnkey crowdfunding software solution designed for equity, debt and reward-based crowdfunding platforms.

Before you start, it’s crucial to define the type of crowdfunding platform you want to build. Using LenderKit, you can choose from multiple models: equity or debt crowdfunding, or any other type that you may want.

LenderKit provides a fully customizable white-label crowdfunding platform that includes:

- Investor dashboards – to track investments, portfolio performance and liquidity events.

- Issuer dashboards – to manage campaigns, financial reporting and communications.

- Secondary market features – similar to Republic Europe, allowing trading of existing shares or tokenized securities.

- Compliance and KYC/AML modules – to verify investors, check eligibility and comply with local securities laws.

LenderKit’s platform is designed to scale, so you can add new investment types, expand to multiple countries and integrate features like tokenization, blockchain-based assets and automated reporting.

To discuss details, please get in touch with our team.

Article sources:

- Leading crowdfunding platform in Europe

- Seedrs Officially Becomes Republic Europe - Investor Guide - Republic Europe Insights

- Access to a diverse range of sectors

- Republic Europe's Secondary Market Now Offers Investors To Indicate Buy Price | Crowdfund Insider

- Republic Europe Adds New Mirror Notes To Investment Platform | Crowdfund Insider

- Crowdfunding Professional Association (CfPA) Slams Republic's "Mirror Token" Offerings | Crowdfund Insider

- Crowdfunding Professional Association – CfPA – for all stakeholders in the Crowdfunding community

- Secondary Market is opening for the last time in May - Republic Europe Insights

- Annual Report ’24 — Republic