Raising Capital For Crowdfunding by Crowdfunding

All businesses need money to cover operational costs, pay for services, consulting or equipment as well as allocate funds for growth and scalability. Crowdfunding platforms are not an exception.

On one hand, it may seem like a strange phenomenon that a crowdfunding platform would raise money on another crowdfunding platform, but it happens so often that it’s hard to avoid and miss on this alternative finance option with an opportunity to gain competitive insights.

What you will learn in this post:

Why raise capital on a crowdfunding platform?

There are many reasons for crowdfunding platforms owners to raise money on other investment marketplaces including:

- Receiving the money and gaining more exposure

- Analyzing competitors and improving their own services

- Understanding the customer perspective and tweaking the value proposition

Let’s talk about each of these points in more detail.

Get the funding

Businesses of different caliber use crowdfunding because it allows them to get the necessary exposure while also receiving the alternative capital. The funds may come at cheaper rates or with more flexible requirements and options that businesses find more appealing compared to other funding sources.

So, the ultimate goal may be just as plain as getting that money for starting a crowdfunding business, covering expenses, business operations or development.

However, there can also be a more interesting perspective.

Analyze competitors

Analyzing competitors is crucial for businesses to stay relevant, introduce competitive pricing options, service packages and products.

Online crowdfunding platform owners may analyze the competitor’s website to find as much info as possible, then they can review the investor portal while keeping their eye on some fancy tech features that could be used to improve their own website and platform. But that could only give so much.

Going through the fundraising process on your competitor’s platform would provide much more insight into how the customer services, paperwork, operations, and communication work.

This would allow them to close the gaps in their own customer service and provide better services to their clients.

Experience the customer perspective

Knowing how your clients feel may not be super easy if you haven’t gone through the fundraising process yourself. By raising capital on a competitor’s platform, you can put yourself into the client’s shoes and understand all the pain points and questions that may arise in the process.

When the funding is completed, whether successfully or not, you will inevitably come out with a rich bag of experience and knowledge that you can share with your clients and build stronger value propositions.

Examples of crowdfunding by platform owners

If you check the market regularly, you can really find a lot of examples of lending platforms raising alternative funding on investment marketplaces such as CrowdCube, Seedrs, StartEngine and SeedInvest. There may be more platforms, but here are some of the samples that we’ve been able to find, so let’s analyze them more closely.

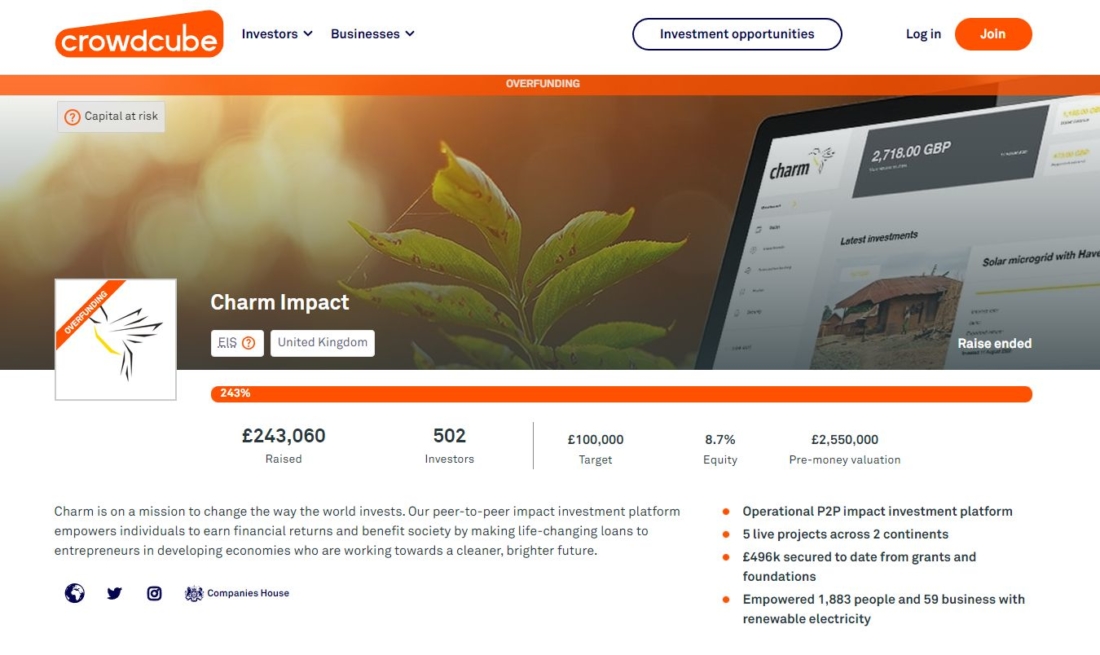

Charm Impact on CrowdCube

Charm Impact is a peer-to-peer impact investment platform that connects individuals with entrepreneurs in developing countries, allowing them to get a financial return for their investment while also making a positive impact in the world by providing life-changing loans to these businesses and helping them create jobs, fuel innovation, and generate a more sustainable future.

In 2020, Charm Impact raised almost £250,000 on CrowdCube, a UK-based equity crowdfunding platform which has now expanded to Europe. The Charm Impact campaign attracted over 500 investors which funded £143,000 more than the initial target amount of £100,000.

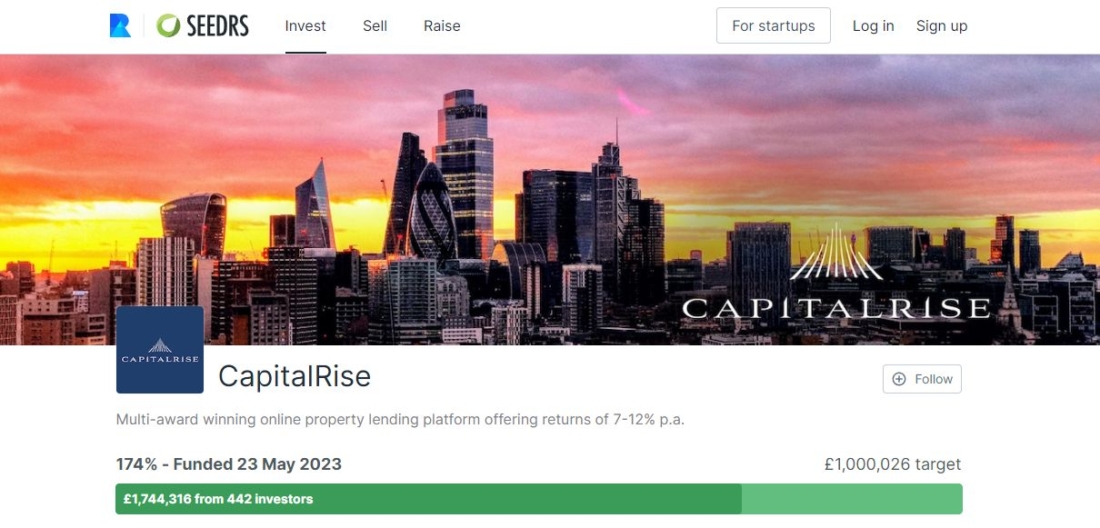

CapitalRise on Seedrs

CapitalRise is an FCA-regulated online investment platform offering real estate investment opportunities in prime London locales like Chelsea, Mayfair and Kensington. The CapitalRise property investment platform is designed and built by experienced developers and investors.

CapitalRise is regularly crowdfunding on Seedrs to scale their operations in the target locations. In 2023, they raised over £1,740,000 which is the result of a 174% overfunding from 442 investors.

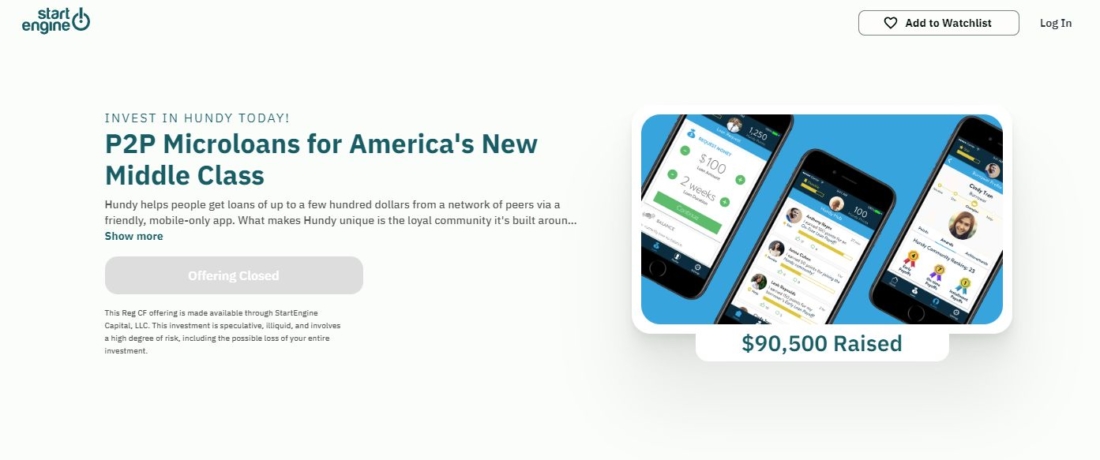

Hundy on StartEngine

Hundy is a P2P microloans mobile-only app that connects people with a network of peers who provide loans up to several hundred dollars. But what makes Hundy special is the strong, loyal community that it has cultivated around praising good character – both to lenders and borrowers alike.

In 2019, Hundy raised $90,500 on Seedrs. The Hundy crowdfunding campaign was funded by 135 investors where the minimum investment amount was only $100. They also offered a 12% interest rate for investors that took part in the campaign.

Marketlend on SeedInvest

Marketlend is a web-based marketplace lender dedicated to reducing needless paperwork and increasing transparency for both investors and businesses. The platform provides a full range of services including acquiring, originating and servicing trade accounts by helping businesses access creditworthy investors in an auction format.

The company also provides an extra layer of security through their trade credit insurance risk protection. This ensures businesses can use credit with greater confidence, and investors can rest easy knowing they have a degree of protection.

In 2017, Marketlend raised $151,000 on SeedInvest, an online investment platform that has recently been acquired by StartEngine.

How to use this information

As you can see, investment firms, crowdfunding platforms and P2P lending marketplaces are regularly raising money on like-minded platforms. For some, it provides the required capital while for others it may also offer invaluable insights into the competitor processes, operations and customer service.

So, if you are running your own crowdfunding platform and wondering where to raise money for your business development, considering these marketplace may be a viable options.

And if you don’t have your platform yet, but are looking to launch a competitive crowdfunding marketplace, check out LenderKit.

LenderKit is a white-label crowdfunding software provider that has Basic, Pro and Enterprise product tiers that will fit your business stage and requirements. The investment software offers everything you need to get started, get licensed, run and scale your online crowdfunding business successfully.

To learn more about how LenderKit works and what it provides, schedule an online demo by filling out the contact form.