Surging Solana: The Rising Star of Alternative Investing in Blockchain

Blockchain technology is becoming increasingly important for all industries, including alternative investing. However, the role of different blockchains and their impact differ. So, the Solana ecosystem accounts for over 40% of investors’ interest while Ethereum takes the second place with slightly over 12% of investors’ interest. Other blockchains either operate as Layer 2 solutions for the Ethereum blockchain or have no significant impact on the market.

Why are alternative investment platforms so interested in blockchain solutions? What are the reasons for Solana’s popularity and is this blockchain going to keep its leadership position? Let’s delve into the details.

What you will learn in this post:

Blockchain in alternative investments

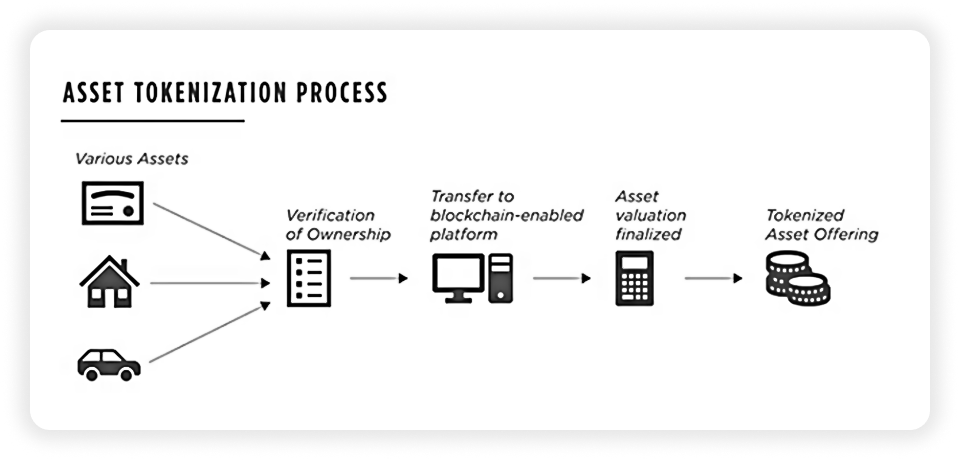

The Solana blockchain can be used to tokenize real-world assets such as real estate, equity, art pieces, etc. Tokenization is a process of issuing digital unique representations of a real thing on a blockchain.

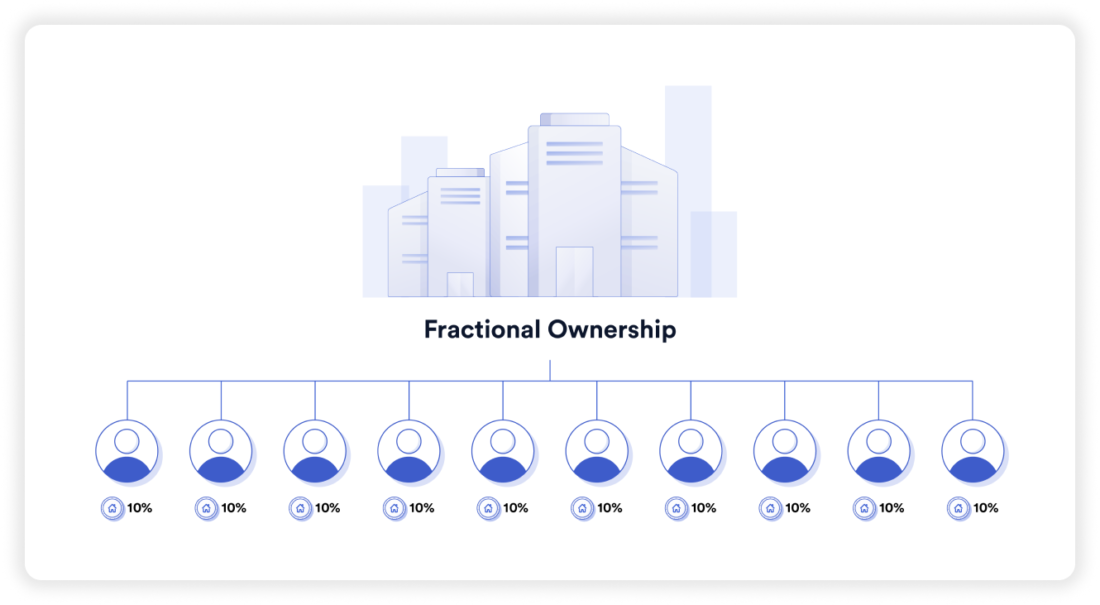

In most cases, when we speak about alternative investing, we shall also mention fractionalization. For example, some assets such as real estate are very expensive and only a limited number of investors can afford to invest in them.

However, dividing such an asset into fractions allows more people to invest in it. One can own a fraction, several fractions of an asset, or even all the fractions which equals owning the entire asset.

With blockchain technology, tokens can be programmed to include ownership rights, rules to ensure asset issuance, transaction history, dividend distribution and whatever else is required. For example, one can program tokens to be issued to specific parties only or not to be traded during a lock-up period or to meet any other issuer’s requirement.

Here are some cases of how Solana can be used for alternative investing.

Real estate

With blockchain-based tokens, it is possible to tokenize property and allow investors to diversify their portfolios by investing in various real estate assets. Tokens that represent fractions of an asset can be traded on specialized marketplaces, with more buyers and sellers being able to participate in transactions. This means that real estate becomes a liquid asset (normally, it is considered illiquid) which in turn opens more investment opportunities to people who may not have had access to it previously.

Private equity

Private equity can also be tokenized, just like real estate. In this case, instead of owning equity in a company through a stock certificate, an investor owns the same equity through a token on the Solana blockchain.

These tokens can be traded on blockchain-based platforms. Considering the fact that not all alternative investment platforms offer trading in secondary markets, this is a significant benefit that makes investing in equity more attractive. Additionally, it can reduce the costs and time needed for traditional securities trading.

P2P lending

When a loan is tokenized, it can be programmed to include all relevant data such as ownership rights, loan payment history, interests and repayment schedule, and other relevant information. Smart contracts can collect and distribute repayments and deliver real-time reporting to the platform and regulators.

Why Solana blockchain?

Solana takes the leadership position when speaking about the blockchain application for alternative investment. It is determined by several factors.

Solana is one of the established blockchains that was launched as a better alternative to the Ethereum blockchain. Even though there are other alternatives, they are far not as popular as Solana and Ethereum, this is why it is reasonable to compare these two main competitors rather than focus on other less relevant solutions.

Scalability

Ethereum is one of the oldest blockchains that was developed when blockchain adoption was low. This is why it used to face significant scalability issues and relied on Layer2 solutions to solve them. Solana is a newer blockchain designed to specifically address the challenges Ethereum used to face, including the one of scalability. This is why it is often referred to as “Ethereum killer”.

Transaction fees

Another problem was high transaction fees. Paying over $30 for one transaction on Ethereum was a common thing, while on Solana, one transaction costs $0.003 – $0.005 which was incomparably lower.

Transaction speed

The Ethereum blockchain used to process 15-30 transactions per second while Solana is able to handle around 65,000 transactions per second.

Impact on the environment

Ethereum used to utilize the proof-of-work consensus mechanism, it relies on mining to confirm transactions and is extremely energy-consuming. Solana uses a proof-of-history consensus mechanism and doesn’t need mining. Thus, Solana is an environmentally-friendly blockchain.

Ethereum upgrades: will Solana keep the leadership position?

Even though in the past, Ethereum faced numerous problems and had to deal with lots of controversies, after a series of upgrades, this blockchain has eliminated the main issues. Now, it is absolutely environmentally friendly, can handle around 100,000 transactions per second, and the fees on Layer 2 solutions dropped to several cents.

After the Ethereum upgrades, Solana has lost the benefits it used to rely on in competing with Ethereum.

Additionally, the Solana blockchain is known for constant outages, network congestions, and even high rates of failed transactions – details that may be highly unfavorable for somebody considering launching a blockchain-based alternative investing platform. Ethereum, on the contrary, is known for being a reliable and consistent ecosystem that develops to meet market demands. This is why in the future, a probability is high that Solana will lose its leadership position to Ethereum.

Start an alternative investment platform with LenderKit

It is still a long way to blockchain mass adoption, especially in such a sensitive industry as alternative investment. Lack of specialists, high development costs, and a need to comply with constantly changing regulatory requirements are other challenges that you may face when developing a crowdinvesting platform that works with tokenized assets.

Whether you are looking to launch a custom tokenization platform or want to stick with fiat investment opportunities, check out white-label investment software by LenderKit.

We work private equity firms, VCs, real estate investment companies, entrepreneurs and startup investing firms and help them launch alternative investment platforms easily and cost-efficiently. To learn more about how LenderKit works, reach out to us and let’s discuss your project requirements.