VC Fund Management: How it Works

No time to read? Let AI give you a quick summary of this article.

VC funds offer investors an opportunity to get into high-tier business financing and generate returns in the long-run. Venture capital firms also provide access to a network of experienced professionals who can offer advice and assistance to help businesses reach their full potential.

But how does VC fund management work, how is it regulated, how fund managers make money and what tools do they use to run their daily operations? In this VC fund management guide, we are about to find out.

What you will learn in this post:

What is a venture capital fund?

A venture capital fund1 is a pooled investment vehicle that is managed by a business entity, usually, an LLC. The fund management company is using this money to invest in other companies for profit.

The fund is usually created for around 10 years2 and invests in growth companies, expansion or buyouts.

Who invests in VC funds

Typical investors in the VC fund can be other funds, corporate investors as well as accredited investors whose income exceeds $200,000 per year individually or $300,000 per year combined with a spouse.

Retail investors don’t usually invest in VC funds simply because the entry amount3 is too high and varies from $25,000 to $100,000+. However, retail investors can invest in mutual funds where the minimum investments may start with $500 and up to $3,000+.

Where VC funds allocate money

Venture Capital firms invest in different kinds of seed deals because this is where they see most of their profits. But according to the interview with Sarah Hodges and Bilal Zuberi4, some sectors are more interesting and include biotech, sustainability, crypto, defense tech, climate tech, agriculture, supply chains and semiconductors.

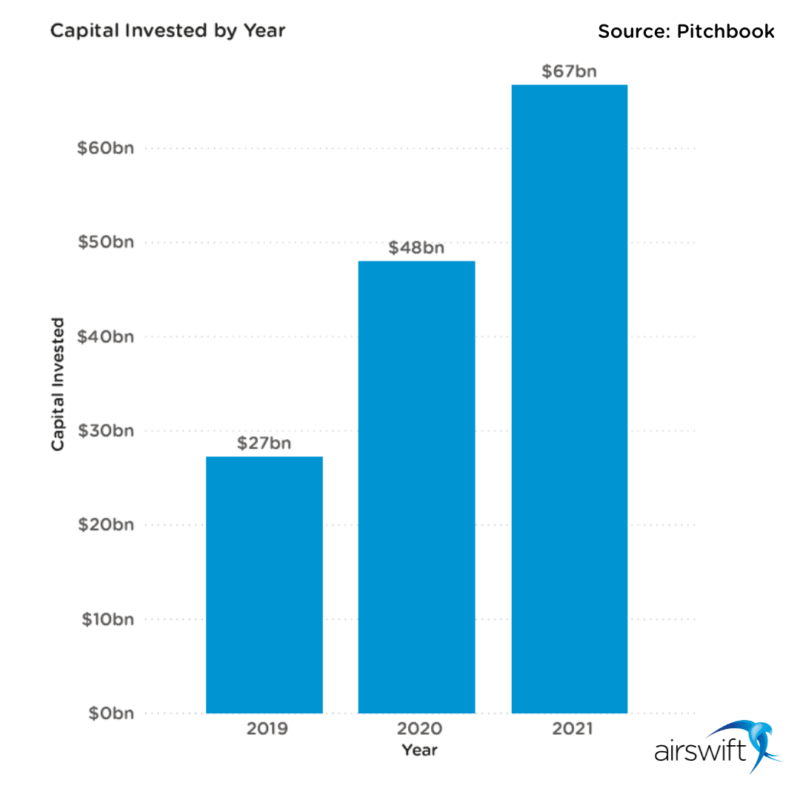

Only biotech alone has grown 148% in 3 years5. The biotech industry focuses on research and development (R&D) which may generate profits in the future. However, today’s existing investments have already casted light upon this industry and allowed many companies to come out of the shadows.

In the meantime, sustainability has been hyping all around in Europe6, Canada7, USA8, Saudi Arabia9 and Africa10 with the development goals set for 2030 and beyond. Governmental support alongside the private business interest leads to more capital allocation in the above-mentioned agriculture and climate tech.

Venture capital firms come first to the party and create interest in certain industries, but how do they work and manage capital?

How does VC fund management work

Venture capital funds are operated by a management company whose goal is to fairly and professionally distribute pooled capital into the selected investment instruments and generate profits in the long-run while making everybody happy.

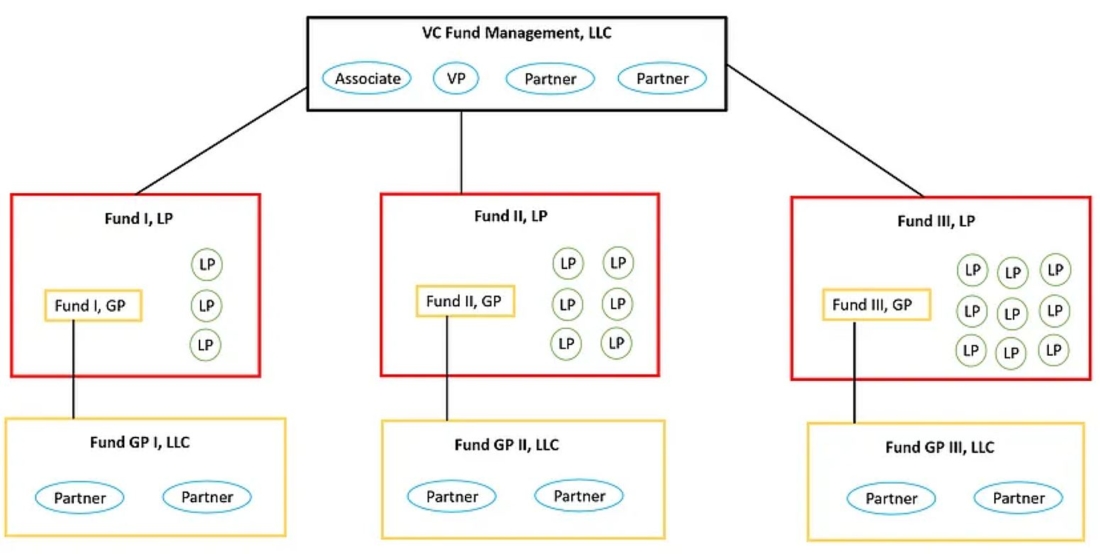

Funds can have different structures. Depending on the fund’s capital amount, goals and operational preferences, the management company may work with investors directly or build a whole network of funds with their own investors, thus becoming a fund of funds.

According to Trey Calver11, startup and VC attorney, here’s what a VC fund structure looks like:

VC fund managers are responsible for multiple ongoing operations and processes1:

- Raising money from investors

- Finding investment opportunities

- Overseeing accounting and tax management

- Managing legal aspects

- Distributing money on the fund’s maturity or when profits are generated

How venture capital funds make money

For the services that the VC fund managers provide, they charge a 2/2012 fee which is 2% of an annual commission and 20% of the profit-sharing commission. But there’s also a 3/30 VC fund fee structure and other forms of commissions which could be charged depending on the services and whom they are provided to.

If the fund managers are working with companies they invest into, they’ll also charge all sorts of fees for the operational work, including document management and filing, consulting, etc.

VC fund regulations

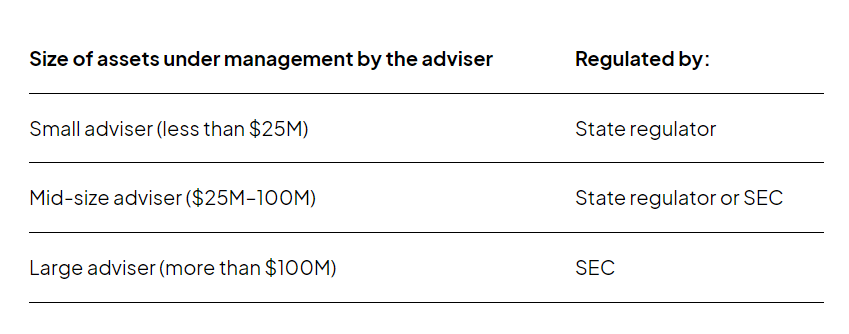

In the US, venture capital funds are regulated by the SEC and raise capital under regulation D or regulation S. According to the VC regulations guide written by Carta13, most funds are private and exempt from the SEC regulation. Instead, the regulations are applied to the fund manager or the fund’s investment adviser.

Depending on the size of the fund, either SEC or state regulations apply.

Private funds can have less than $150 million in assets under management, may only raise capital from accredited investors and are not allowed to raise from the general public or retail investors. Usually, the funds include less than 1,999 investors to avoid SEC registration under the conditions for exemption in Sections 3(c)(1) or 3(c)(7)14.

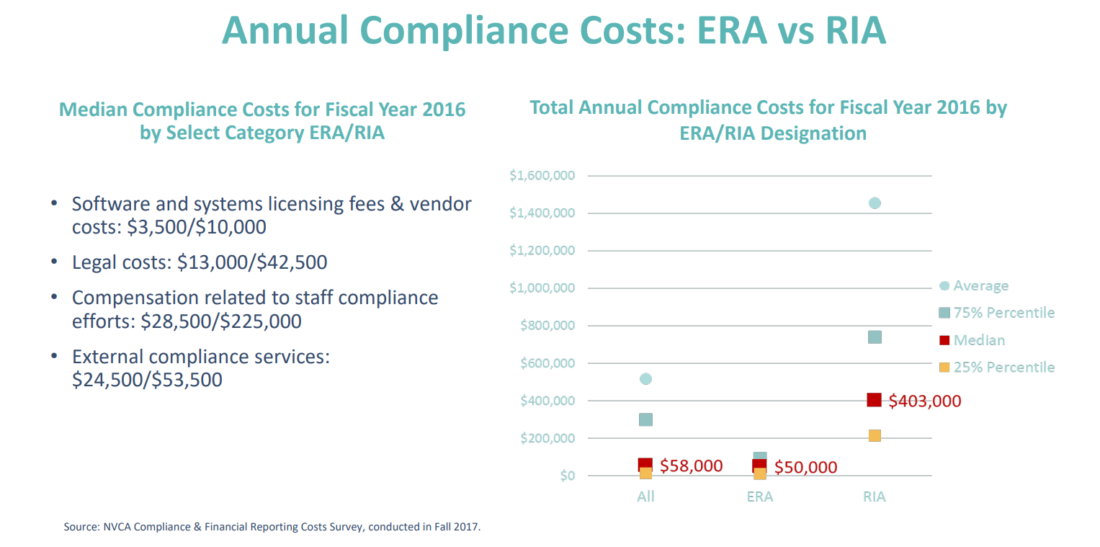

The SEC has calculated compliance, staff and software costs for VC funds as of 2016.

According to the SEC brochure15, VC funds spend around $10,000 on software, $42,500 on legal aspects, $225,000 on compensation for staff in the compliance department and also $53,500 on external compliance services.

What software VC fund management companies use

Venture capital firms use various software and tools to help them ease operation management, document management, investor relations, deal management and compliance.

Some of the most popular solutions on the market include:

- Carta for cap table management

- Anduin Fund Subscription for investor engagement tracking

- eFront for all-in-one operations management

These and other online VC management software solutions help to solve daily business tasks quickly and easily.

While some venture capital firms rely on ready-made solutions with little customizations, others may opt to more flexible VC fund management software like LenderKit.

LenderKit is white-label private equity, crowdfunding and alternative fund management software that’s been around for a while now. The company has developed integrations with the major payment providers, identity verification solutions and adapted for the USA, European and the MENA regions.

If you’re looking for a flexible VC fund management software solution, LenderKit has got you covered. The software offers:

- Smooth investor onboarding

- Deal management

- Data rooms

- Role-based access and permission settings for every team member on your platform

- Modules for regulations compliance according to the SEC/FINRA in the USA and ESCPR in Europe

- Investment performance tracking

- Company management

And the best part about it is that LenderKit investment software is fully customizable, so that you can truly build the platform you’re looking for.

If you’d like to learn more about how LenderKit software works and how it can help you run a more sustainable and efficient VC fund management business, reach out to our fintech strategist and book an online demo.

Article sources:

- What is a Venture Capital Fund? | AngelList Education Center

- Life Cycle of a VC Fund and Capital Allocation | Seraf Investor Portal

- Minimum Investment: What it is, How it Works, Examples

- Where will venture capitalists look next?

- Biotech industry trends: key updates and emerging technologies

- Sustainable Development Goals - European Commission

- Canada and the Sustainable Development Goals - Canada.ca

- USA

- Saudi Vision 2030

- PDF (https://www.upl-ltd.com/downloads/africa-sustainability-report.pdf)

- A Look Under the Hood of Venture Capital Firms

- What is the 2% and 20% VC fee structure?

- Venture capital regulations

- PDF (https://www.govinfo.gov/content/pkg/COMPS-1878/pdf/COMPS-1878.pdf)

- PDF (https://www.sec.gov/spotlight/sbcfac/2020-02-04-presentation-vc-fund-definiti...)