Fund management software

Democratize access to institutional funds for high net worth and retail investors with LenderKit – a white-label fund management software.

- Regulations-friendly

- Fully-customizable

- Out-of-box features

- Market-proven

Launch your private capital raising platform or fund of funds

Attract more retail and professional investors

If you have an existing customer base, LenderKit will help you digitize and automate operations as well as provide tools for attracting new clients.

Work with wealth managers

Boost your wealth manager relations and run daily fund management platform operations using the LenderKit fund management software.

Create and manage campaigns

Create private and public capital raising campaigns and allow certain or all investors take part in the offerings and invest.

Software for fund management and private capital raising

Crowdfunding for funds

Crowdfunding comes in various shapes and sizes one of which is crowdfunding for funds. It allows investment platforms attract the required capital to take part in the bigger funds as well as provide investors with access to private fundraising.

Whether you want to start a fund of funds investment platform or a private equity platform, LenderKit may just be the right software you’re looking for.

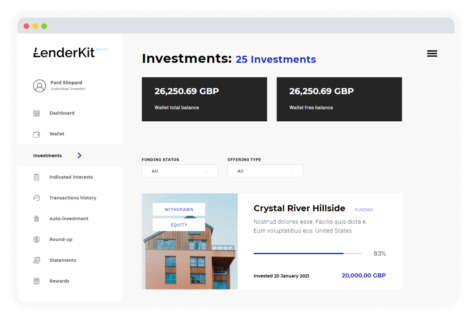

LenderKit fund management software

We’ve launched several private equity and fund management platforms in the UK, US and MENA region. Our clients choose us for:

- Rich out-of-box features

- Full-cycle deal management

- Investor and Admin portals

- Everything is customisable

- Access to source code upon request

- In-built regulations for ECSPR, SEC/FINRA

- Online and offline payments support

- Document management

Why work with LenderKit

LenderKit provides Basic and Enterprise packages that adhere to your business needs. One is for testing the waters and the other allows you to launch your unique fund management platform for years to come.

The software has everything you need from user onboarding to fund disbursement. And if you need something extra, our team can help you with adding integrations for automated payment processing, accounting, tax-advantaged investing, analytics and more.