Who Needs Alternative Investment Software

No time to read? Let AI give you a quick summary of this article.

Alternative investment software is what private equity, venture capital, real estate development and startup investment firms use to match investors and fundraisers.

In some business models, investment firms facilitate the fundraising process and make money on fund administration, portfolio management and business development. To do their work effectively, investment and crowdfunding companies need software to manage users, transactions, documents and the overall fundraising cycle from campaign creation to fund disbursement.

What you will learn in this post:

A sneak peek into the investment crowdfunding market overview

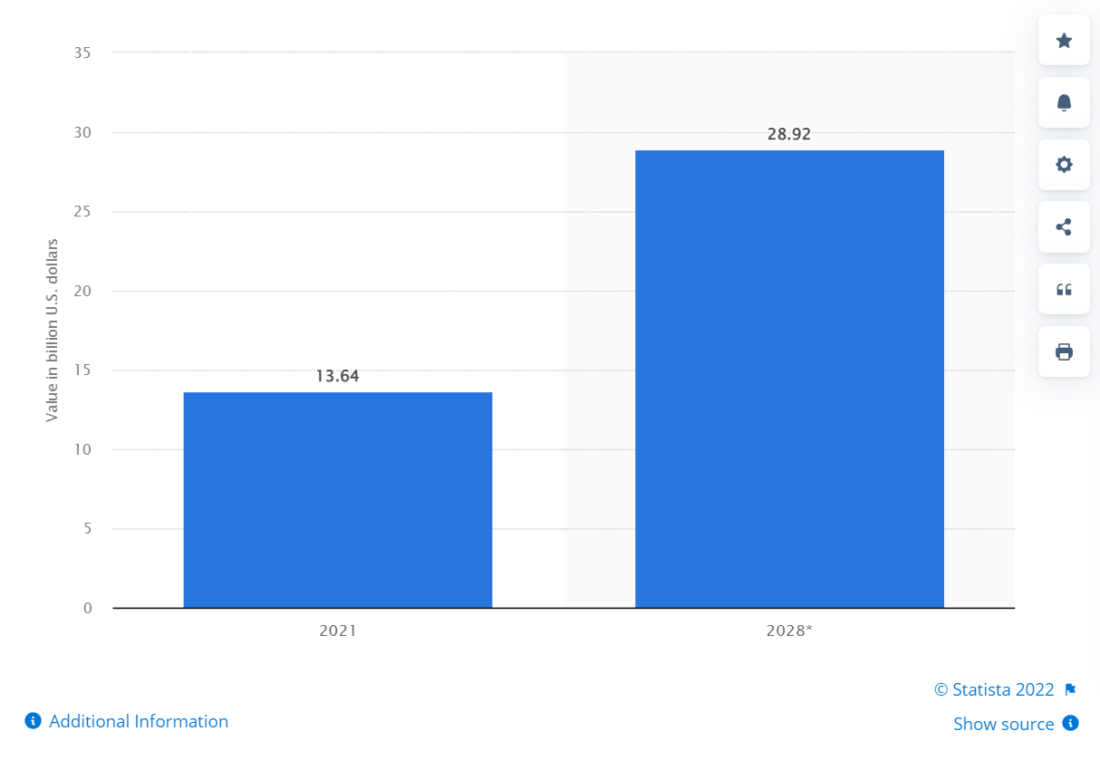

The market size of crowdfunding worldwide is going to grow by over $15 billion by 2028, according to Statista1.

It may mean that the interest in crowdfunding as an alternative funding option is increasing and attracts the attention of businesses to the sector.

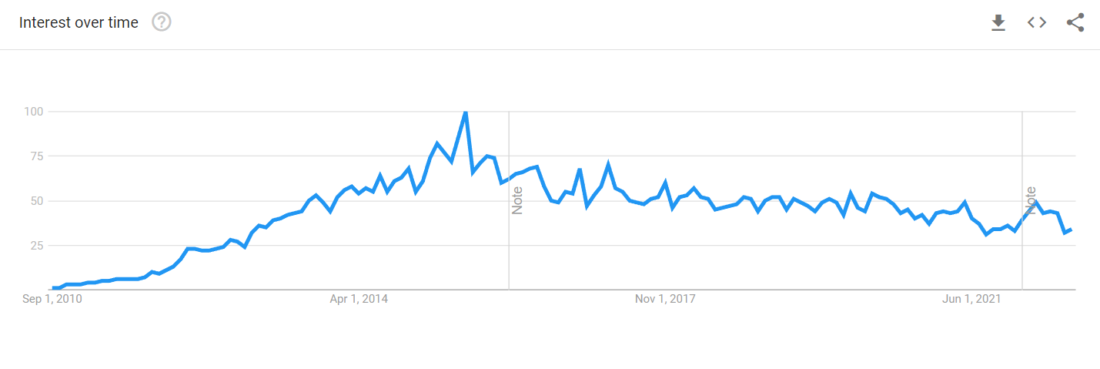

However, according to Google Trends, the interest for crowdfunding has reached its peak in 2015, then declined slightly and has been relatively stable ever since. This may be a good indicator that the industry is about to mature and become more transparent and understandable compared to what it was like in 2012.

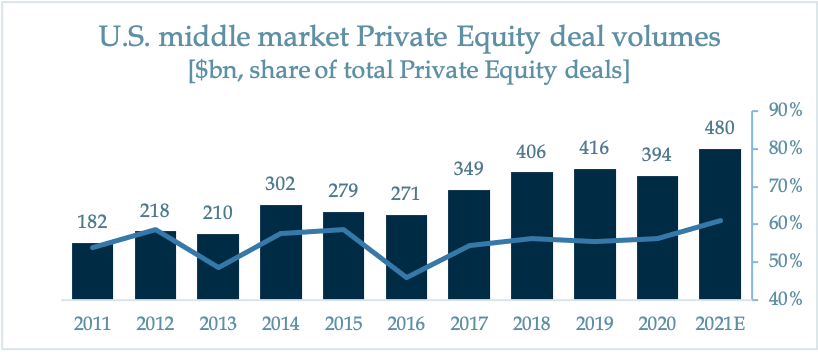

The arguable stability of the crowdfunding market may attract more private equity and venture capital firms to the sector and use alternative investment software to automate deals and investor relations.

Businesses that can benefit from alternative investment fund management software

There are some businesses such as private equity firms, venture capital firms, and even real estate development companies that can get competitive advantages from launching an alternative investment platform.

Normally, companies turn to crowdfunding when their investors’ pools are not sufficient to fund all their projects which applies more to small- or middle-size companies, or when a company decides to explore new markets and expand its services.

Private equity firms

Private equity firms started exploring the possibility of using white label crowdfunding software solutions such as those offered by LenderKit long ago, but the need for digitizing the businesses became more apparent when the COVID crisis of 2020 hit the world.

What’s interesting is that private equity didn’t lose the market share and, in fact, many platforms only gained more deals during the tough times for startups.

Digitizing the private equity business by using a crowdfunding platform helps to make the business scale to meet the market demands, boost the brand image, and expand its reach by addressing new ways to raise money for established companies and startups with potential.

Along with it, a PE company can profit from reaching a wider range of projects and investors.

Venture capital firms

Venture capital firms have already started using crowdfunding in a very unconventional way for such a type of business: they started raising funds for themselves – to pay management fees, organize more events, attract more investors, etc.

Normally, it is done through third-party services. But such services charge at least 2-3% management fees, along with payments for investment management and fees of the third parties.

For a big venture capital firm, these amounts can reach to approximately $200,0003 and more – the money that can be spent on the company’s needs.

That’s why using a white-label alternative software to launch an own crowdinvesting platform is reasonable. Add such benefits as attracting more investors and expanding the market reach to many more projects, and the reason why a venture capital firm may need to have its crowdinvesting platform becomes apparent.

Real estate development companies

Over time, finding funds for more projects to undertake might be difficult, and the own pool of investors might not cover the needs of a real estate development business anymore. In such a case, implementing a crowdfunding platform provides the company with access to new investor pools. It means more money for new projects.

Also read: How to Start a Real Estate Crowdfunding PlatformLaunching an own alternative investment platform is reasonable if a company is thinking about expanding its reach outside of the geographic or strategic areas that appeal to traditional investors. Using white-label investment software to launch a crowdfunding platform is a viable option to find new backers asap.

Another advantage that an own alternative investment service can provide is access to more liquidity. This benefit is more specific to companies that work with non-liquid projects.

Such projects are vulnerable to economic and natural factors and are often not completed on time. That’s why sometimes, investors shy away from illiquid projects that don’t start bringing income asap. Here is when the use of a crowdfunding platform is especially beneficial: a real estate development agency can launch crowdfunding campaigns for projects that are illiquid.

The main benefit of investing in a crowdfunding campaign for investors is the opportunity to trade investments. It makes such a way of funding more sustainable than looking for funding sources in a traditional way.

When it comes to projects that require significant investment, in most cases, only accredited investors can access them. Crowdfunding opens the investor pool to the wide public and enables almost anyone to invest. Thus, it allows for more partial owners than traditional ways to invest.

Building an alternative crowdinvesting portal versus using white-label investment software

What are the reasons for a business to invest in the development of its own crowdfunding portal if one can launch a crowdfunding campaign on one of those popular platforms?

If it is a one-time venture, most likely, there is no need to develop an own platform. But if you are planning to delve into a new market sector and stay there, having your own platform for alternative investments will help you to avoid several pitfalls and get some benefits that would not be available otherwise.

Risks you avoid when using your alternative crowdinvesting software

Using a third-party crowdfunding portal is connected with risks when it comes to long-term projects such as investing in real estate, for example. The company that owns the portal may go bankrupt or may be targeted by regulators and closed. Even though there are mechanisms to get the invested funds reimbursed, it might take time and be troublesome.

In most cases, if your company doesn’t raise the minimum limit of funds, the campaign is considered as one that didn’t reach its fundraising target. Investors get their funds back, and you would need to consider other ways to find the needed funds. If you have your own fundraising platform, you may set up your own rules or you may use it as an additional investment source to those funds raised from the pull of your accredited investors.

How to launch your own crowdinvesting platform with LenderKit

If you are a business owner looking to launch your own crowdinvesting portal, LenderKit white label crowdfunding platform solutions are worth considering.

You can choose whether you prefer your platform to work with one investment flow or multiple ones such as debt, equity, rewards and donations.

The solutions come with an extensive out-of-the-box set of features which allow you to quickly launch a functional crowdfunding platform prototype and scale further. We fully customize the investment solution depending on your business needs and expectations.