5 Best European Countries for Crowdfunding Platforms

With the introduction of pan-European crowdfunding regulation, existing crowdfunding platforms, as well as new businesses, are disputing about the best location to register an investment platform.

Since in some locations ECSP rules have been more or less welcomed and even adopted into the planning strategy for the nearest future, it’s now the point of interest of where it’s cheaper and less stressful to start and run a crowdfunding business.

For crowdfunding platforms, the harmonization of the crowdfunding regulations in Europe means an opportunity to perform their operations in all state members without acquiring licenses in each of them.

However, even though the regulation is valid in all state members, some aspects are still regulated by national authorities. These aspects determine how beneficial it is to open and run a crowdfunding business in a specific country, including pricing, taxes, reporting requirements, and so on.

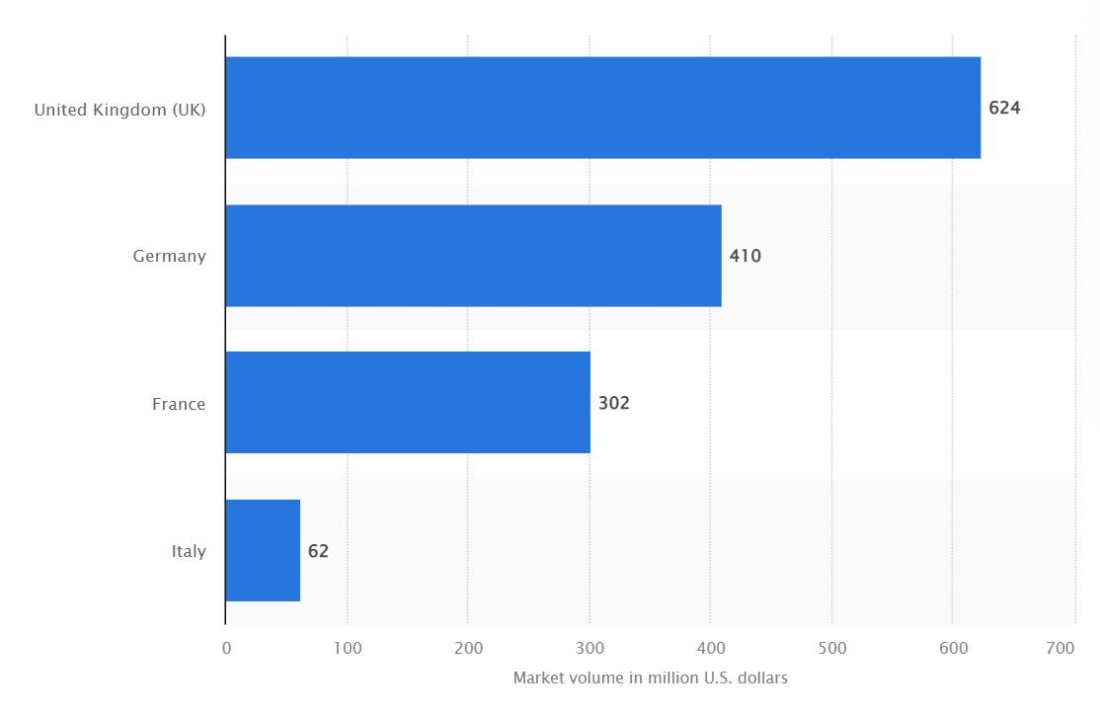

According to Statista, the majority of equity crowdfunding platforms operate in Germany, France, and Italy.

However, in the interview with Crowdfund Insider, Florence de Maupeou also mentioned Belgium, Spain, and the Netherlands as potential markets that are most favorable for starting a crowdfunding marketplace in Europe.

What you will learn in this post:

Germany

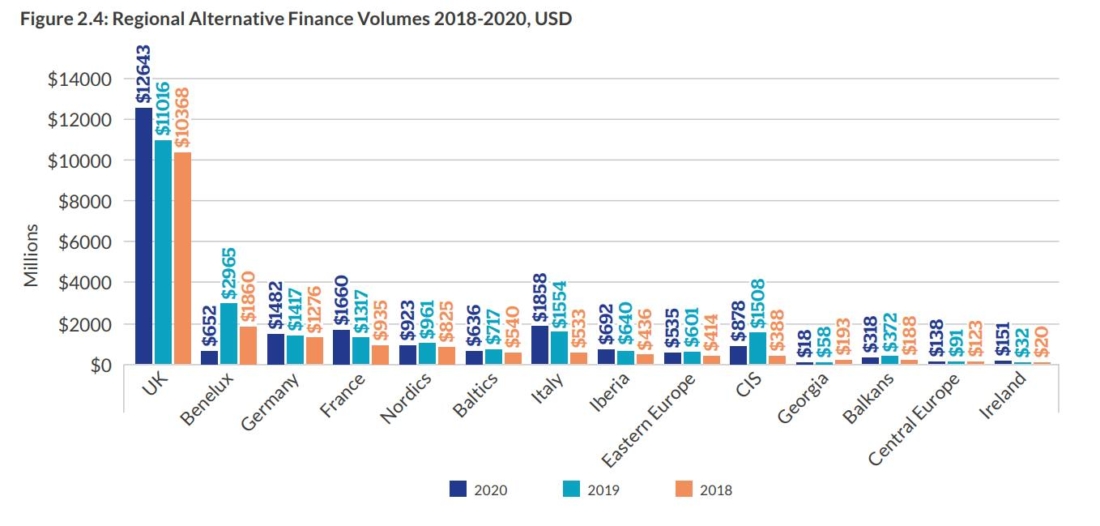

The rapid growth of the crowdfunding market in Germany, from approximately $272 million in 2015 to over $1,482 million in 2020, demonstrates that conditions in the country are favorable for crowdfunding.

Multiple platforms from abroad also try to get into the German market and attract German investors which also means that the German market is important for the industry.

After the EU Regulation on Crowdfunding Service Providers (the ECSPR) was adopted, it appeared that it couldn’t be applied in Germany seamlessly. So, Germany needed to make some modifications to the existing regulatory framework. The major changes to crowdfunding platforms’ operation were the following:

- With the adoption of the ECSPR, platforms aren’t considered regulated credit institutions as it was previously, and therefore, do not require a special license to manage loans.

- Private limited companies’ shares were excluded from crowdfunding campaigns because, in Germany, the transfer of private limited companies’ shares is subject to notarization, therefore, shares are not considered a suitable instrument for crowdfunding.

In general, the legal framework in Germany was elaborate enough to adopt the ECSPR. Therefore, it is expected that the existing crowdfunding platforms can continue their operation and new platforms can be launched without major disruptions.

France

France is the second-popular country for crowdfunding business. According to Florence de Maupeou, Directrice générale, of Financement Participatif France (FPF):

…on a French level, the crowdfunding sector has experienced a nice growth over the past 10 years. It almost reached a collective of €2 billion in 2021, with 84% growth

While Florence de Maupeou insists that the ECSPR might impact the crowdfunding business development in the country negatively, there are some details from which crowdfunding platforms are going to benefit.

According to the French Crowdfunding Legislation accepted in 2014, crowdfunding platforms were regulated depending on the type of activities they used to perform:

A platform working with financial securities issued by an unlisted company should be registered with the OARIS as a crowdfunding advisor (conseiller en investissement participatif, CIP). Such a platform was regulated by the French Financial Markets Authority.

If the mentioned platform chooses to get the status of an investment service provider (ISP), it shall get approval from the French Banking Authority (Autorité de contrôle prudentiel et de résolution, ACPR). A crowdfunding platform in France is allowed to offer all types of financial instruments and might work abroad and is regulated by both the French Financial Markets Authority and the ACPR.

With the ECSPR adoption, all registered platforms receive passporting rights that have enabled them to operate abroad without getting special permissions and licenses as it was earlier.

However, the changes in the threshold for raising funds dropped from €8 million to €5 million per 12 months with the adoption of the ECSPR crowdfunding, and it might have a negative impact on the crowdfunding business in France.

Finally, the distinction between sophisticated and unsophisticated investors was introduced while earlier, French platforms used to treat all the investors equally. The new distinction between different types of investors is something French platforms will have to adopt.

Even though some changes were introduced to the existing regulation, France stays an attractive country to start a crowdfunding business there.

Also read: Will European Crowdfunding Platforms Adopt Tokenization?Italy

Italy has adopted comprehensive legislation on crowdfunding in 2013 and further, it was amended and modified to respond to the market demands. At the moment when the ECSPR was developed, the Italian crowdfunding market showed substantial specialization and segmentation. Italian crowdfunding platforms were able to compete successfully with the biggest international crowdfunding portals.

The ECSPR aligns with the requirements that existed in the country. Earlier, Italian crowdfunding platforms had a threshold of raising to €5 million within 12 months, there was a distinction between sophisticated and unsophisticated investors, platforms had to operate via payment service providers or banks to manage and store the funds of investors.

Therefore, the major points were not changed with the ECSPR adoption. It means there will be no business disruptions and misunderstandings during the transition period.

Considering that Consob, the Italian crowdfunding regulator, has adopted a two-year Implementation plan to adopt the current crowdfunding regulation to the ECSPR, the transition to the new regulation shall be smooth.

Spain

The first crowdfunding platforms in Spain were launched in 2010, and only in 2015, the first crowdfunding regulation was adopted. Within the regulation, the distinction between accredited and non-accredited investors was made and the limitations were set for both groups, and a framework for different crowdfunding types was created. In general, Spain was considered one of the best countries to launch a crowdfunding business due to legislation loyalty.

With the ECSPR adoption, Spain expects a new influx of crowdfunding businesses and fundraisers. The implementation of the Key Investment Information Sheet is going to increase the attractiveness of crowdfunding by providing more depth and quality of information to investors.

Crowdfunding platforms in Spain used SPVs before to organize investors as shareholders of the company in a cap table. However, with ECSPR, there can be certain challenges regarding the “indivisible assets” which crowdfunding service providers will have to adjust for.

In regards to secondary trading in Spain, the regulation also allow this, so there’s no problem with liquidity whenever required.

The Netherlands

The introduction of the ECSPR has created a new legal framework for crowdfunding platforms operating in the country. Among the benefits delivered by the harmonized pan-European legislation, the following ones are worth mentioning:

- Trading in secondary markets via bulletin boards was permitted.

- It is not required anymore to provide information about the project owner in advance. The platform shall take care of the Key Investment Information Sheet, and it shall be updated during the crowdfunding campaign.

However, requirements for non-sophisticated investors became stricter in comparison to those that existed earlier.

While launching a crowdfunding platform in the Netherlands might seem beneficial, one shall consider the cost of obtaining a license. Now, it can reach up to €100k, and it is the price for a one-time application only. Other than that, the conditions in the Netherlands are beneficial, especially for launching a platform that focuses on renewable energy projects.

Bottom line

Want to start a crowdfunding platform in Europe and need crowdfunding software? Check out LenderKit solutions – they come with an extensive set of out-of-the-box features that satisfy the basic needs of your crowdfunding platform and customize both the design and functionality of the platform.

We’ve already developed the ECSP regulations compliance module to prepare for the updated regulations, but we can tweak them to fit your specific regulatory requirements.

If you’d like to learn more about starting your crowdfunding marketplace in Europe with LenderKIt, reach out to our fintech strategist for the live demo.