Crowdfunding and Real Estate Asset Tokenization

No time to read? Let AI give you a quick summary of this article.

Crowdfunding using blockchain is another way to utilize this almost versatile technology. Because of blockchain decentralization, transparency, irreversibility, and a high level of security, it becomes a promising technology to build a crowdfunding platform with. In this article, we are going to review its potential for building blockchain crowdfunding platforms and tokenize real estate.

What you will learn in this post:

Real Estate Tokenization in a Nutshell

According to Deloitte1, asset tokenization in crowdfunding is a new trend in financial technology. Tokenization stands for the process of creating a property, object, or share-related token which confirms the ownership right.

To put it simpler, tokenization implies the process of right and/or property transfer by exchanging fungible or non-fungible tokens. This approach allowed for creating new business models in crowdfunding, so let’s find out what asset tokenization means for investors and fundraisers.

How Does Asset Tokenization Work in Crowdfunding

Let’s suggest there is a blockchain-based crowdfunding platform that raises money for real estate object development. Using this platform, investors can buy property-related tokens (PRT).

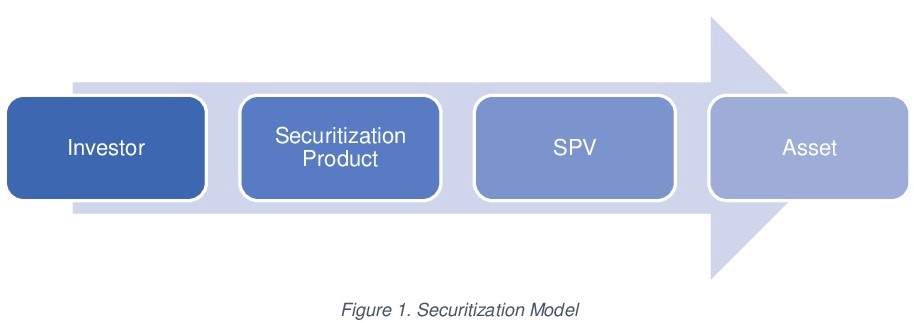

When the targeted amount is raised, the property owners transfer the property to a Special Purpose Vehicle (SPV). This is a separate legal unit of an organization with a separate legal status, and its own assets and liabilities. Next, the SPV issues property-related tokens and transfers them to the investors according to their contribution.

Also read: How to start a real estate crowdfunding platformAs for the legal regulation of real estate asset tokenization in crowdfunding, to date, virtual tokens and the securities they embedded can be sold according to the Regulation D. Under the Reg D 504, the company may offer and sell an unlimited number of tokens to an unlimited number of investors but the offering is limited to $10 million in a 12 months period. In contrast, under the Reg D 506(c) the offering amount is unlimited, but there are certain investor limits3.

The Benefits of Using Blockchain for Crowdfunding

Used for crowdfunding, blockchain networks allow for creating a stable, secure, and transparent ecosystem. These are three features retail and professional investors are looking for. Below are more benefits of using blockchain technologies for crowdfunding projects.

- Transparency. Decentralization and transparency are core benefits of blockchain-powered networks. Investing in real estate with tokens allows for achieving ultimate transparency since each participant of the deal may review the previous transactions with this token, get a clear idea of the ownership rights and the rights of the person/company they would like to make a deal with. Blockchain-based crowdfunding platforms can make increased transparency their competitive edge.

- Accessibility. Real estate tokenization and the use of this approach in crowdfunding make investing in real estate more accessible for everyone. Since tokens are highly divisible, the investors may get started with an affordable sum. For crowdfunding platforms, it means more opportunities for attracting investors and fundraisers.

- Automated compliance. The use of smart contracts – a kind of pre-developed agreement with unchangeable conditions allows for achieving automated legal compliance for each transaction within the platform. This is also a way to streamline the transaction, avoid intermediaries and reduce the administrative burden involved in buying and selling.

The Risks of Building a Blockchain-Based Crowdfunding Platform

Blockchain crowdfunding is quite a promising business idea since the nature of blockchain perfectly fits the specifics of the crowdfunding business and its customers’ expectations. Still, there are some risks you have to take into account when deciding on developing a crowdfunding platform powered by blockchain.

- Diverging legislation. Equity-based blockchain crowdfunding is regulated differently in different countries. The processes of buying and selling equities, using blockchain, and running a crowdfunding business are regulated separately, so, to date, there is a need for a more clear regulatory framework.

- Security. Blockchain networks are highly secure, still, they aren’t 100% immune. Most concerns around blockchain cybersecurity are focused on private keys generation and management.

- The choice of the technology provider. The choice of the platform to build a crowdfunding website based on blockchain matters as well. To date, there are two leading solutions on the market for this purpose.

Blockchain-Based Crowdfunding Platforms Overview

Creating a crowdfunding platform based on blockchain is already a competitive edge. To date, there are not so many businesses using blockchain for crowdfunding so developing an even more unique value proposition is an opportunity to join this market while competition is relatively low but the popularity of blockchain and crowdfunding mix is growing.

To get started with UVP development, let’s briefly review the blockchain crowdfunding platforms existing on the market.

- WeiFund6. This platform is powered by smart contracts. Using a pre-developed template, a startup initiator may launch a campaign almost instantly. Contributing to the campaigns is easy as well.

- KickICO7. This is an Ethereum-based crowdfunding platform powered by an ICO contract generator. The platform has already raised $500m in Ether.

How to Build a Crowdfunding Platform and Power It With Blockchain?

There are several ways to start a crowdfunding platform, and using a niche-specific crowdfunding software can be most effective for your business.

You may start with LenderKit – a white-label crowdfunding solution that integrates with any blockchain provider. We can help you set up a prototype platform or build a fully-custom one and enable asset tokenization through a third-party solution.

One of the distinctive characteristics of LenderKit is that it’s highly customisable and can be tailored to the crowdfunding legislation of different countries.

Connecting your crowdfunding platform to the blockchain ecosystem and empowering it with smart contracts, and access tokenization opportunities is easier when you work with niche experts in crowdfunding and alternative fintech solutions.

Conclusion

Using blockchain for crowdfunding is a top-notch opportunity to provide investors and startup initiators with a safe place to meet each other and sign safe and transparent deals. LenderKit, in turn, is a full-cycle crowdfunding software with flexible integrations and functionality.

If you’d like to build a blockchain-based crowdfunding platform, reach out to us to discuss your project requirements.

Article sources:

- PDF (https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-service...)

- Real estate tokenization legal structuring

- SEC Harmonizes and Improves “Patchwork” Exempt Offering Framework

- TokenD — a processing center for digital assets.

- Polymath | Tokenizing the Global Financial System

- WeiFund - Decentralized Fundraising

- Ethereum-Based Platform for Crowdfunding