Crowdfunding in Kenya: What You Need to Know

Kenya has a long-lasting tradition of community self-help, which involves community members giving funds for social needs or emergencies. This form of crowdfunding is called “harambee” which means “let us pull together,” and is a donation rather than an investment.

However, donation-based crowdfunding didn’t get the expected development in Kenya, most likely because people have to build trust to donate, and in the case of crowdfunding platforms in Kenya, that trust was lacking. This is why, probably, donation-based crowdfunding is represented in its main share by internationally operating platforms that have a proven track record and have built trust around the world, such as Kickstarter, Indiegogo, and Patreon, though the latter is not a crowdfunding platform.

The newly launched donation-based platforms such as ChangiaBoreshi, Drofund, and some more ceased their activities soon after their launch. At present, the most active donation-based local platform is M-Changa which enables donating directly from mobile devices.

One of the most notable equity-based platforms was a crowdfunding platform launched in 2015 by Lelapa Fund that specialized in equity investments. While Lelapa was oriented at African SMEs, most of the deals were Kenyan. The idea was to enable the African diaspora to invest in African-based businesses. The platform was approved by the regulators, and later, LelapaFund specialists developed expertise in crowdfunding regulation and wrote a regulatory framework that could serve local regulators. Since 2018, Lelapa has ceased its operations to work for the African Crowdfunding Association and enable crowdfunding on the entire continent.

Debt- and equity-based platforms were almost not present in the Kenyan crowdfunding market until authorities introduced crowdfunding legislation.

What you will learn in this post:

Crowdfunding regulations in Kenya

In 2022, The Kenyan Capital Markets Authority (CMA) and the Cabinet Secretary for National Treasury and Planning, introduced the Capital Markets (Investment-Based Crowdfunding) Regulations. The Regulations clearly define all the market actors and set out their responsibilities and liabilities.

Requirements for investment-based crowdfunding platforms

According to Kenyan crowdfunding regulations, all crowdfunding platforms need to obtain a license issued by the CMA and bear most of the responsibilities for transactions performed on the platform. To apply for a license, a platform operator shall submit:

- Evidence of the financial soundness and capital adequacy that would confirm the financial position of the company, such as audited financial statements, bank statements, or whatever may be applicable.

- Detailed information on the website, such as its capacity, security measures, etc.

- Details on the outsourcing arrangements of the platform with third-party service providers.

- Procedures used to verify investors and project owners.

- Risk management framework, including details on the procedures of fraud detection and the prevention measures.

When a project issuer offers securities in return for funds, a platform shall make an offer document that shall indicate all the offer details of the offer and how the funds will be handled. This document is submitted to the Crowdfunding Regulatory Authority in Kenya, and the project can start raising funds only when approval from the Authority is received. If the target amount is not raised, all the invested funds are returned to the investors within a maximum of 48 hours without any deductions.

The minimum capital requirements to be licensed are also established. So, companies with a minimum paid up share capital of KES 5 mln (approx. $32,000) and KES 10 mln (approx. $64,000) are allowed to apply for a license of a platform operator for investment crowdfunding.

To close the operation, a platform shall notify the CMA at least 30 days in advance and ceasing of operations is possible only after the regulator makes sure that neither investors nor project issuers are disadvantaged.

Platforms are prohibited from offering investment advice and promising guaranteed returns to investors. Neither are they permitted to raise funds on their own platforms to expand their operations.

Requirements for crowdfunding participants

Crowdfunding participants are defined as investors and issuers (project owners).

Not any business is permitted to raise funds through an investment-based crowdfunding platform. Only micro, small, and medium companies and startups are allowed to do so. An operating company needs to have a minimum of two years of excellent track record and good corporate governance. For a startup, it is enough to have an excellent track record and good corporate governance. A startup is considered an entity that has been in the business not more than 10 years and develops an innovative product or service.

The maximum permitted sum to raise is KES 100 mln (approx. $702,000), but a company may apply to the CMA to increase the limit.

Sophisticated and retail investors are permitted to invest in crowdfunding deals (but some platforms may limit access to deals to sophisticated investors only). Retail investors may not invest more than KES 100,000 (approx. $ 706), but platforms may also impose limitations on the minimum investment sum.

A sophisticated investor in Kenya is defined as one who:

- Has a license under the Capital Markets Act.

- Represents a collective investment scheme or an authorized scheme.

- Is a bank, a subsidiary bank, an insurance company, a pension or retirement fund, or similar.

- Is an individual, company, partnership, association, or trustee acting on behalf of a trust.

Perspectives for crowdfunding in Kenya

The introduction of new legislation gave a significant boost to the development of debt- and equity-based crowdfunding.

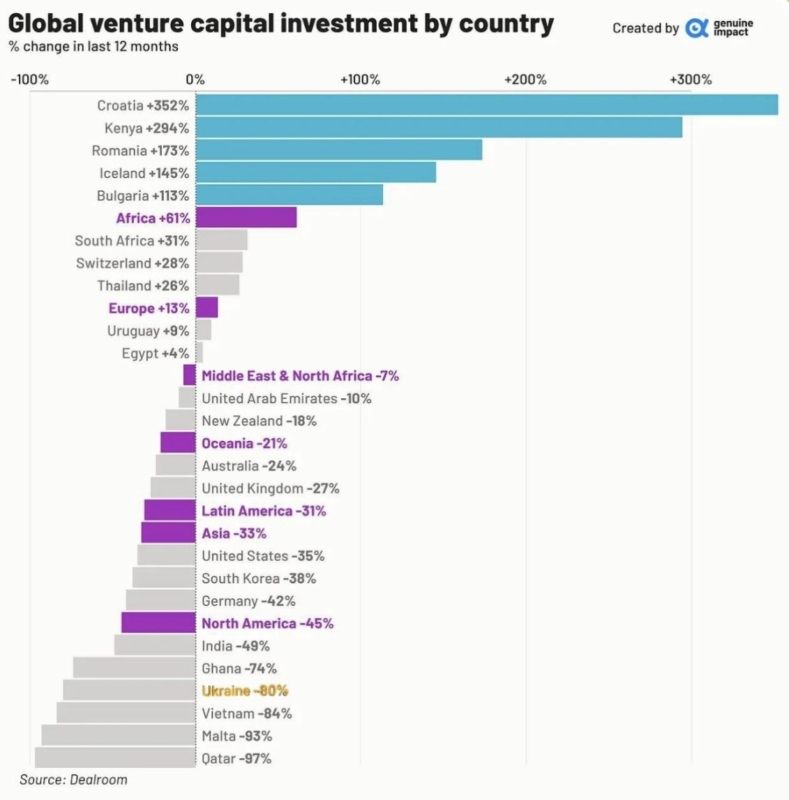

Over the past years, Kenia has been one of the fastest-rising countries over the past couple of years in terms of percentage growth for Venture Capital investments.

GoGetta, one of the leading equity-based crowdinvesting platforms in Africa, expressed its interest in opening a business in Kenya after the legislation was introduced. This platform allows everybody to invest in equity in Africa with approx. $57, and to ensure that Africa can benefit from the billion-dollar worth crowdfunding industry. Considering that the debt- and equity-based crowdfunding sectors are practically not covered in the country, and the demand for them is high, it is expected that more platforms will move their operations into the Kenyan market.

How to create an investment-based crowdfunding platform with LenderKit

If you are thinking about opening an investment- or donation-based crowdfunding platform in Kenya, now may be the right time to do so. LenderKit can help you to launch your platform asap with our white-label crowdfunding software solution.

Using LenderKit investment software, you can automate private placement deal flow, build a loan management platform, and scale your investment business in any industry, be it real estate, agriculture, green energy or other types of SME financing. An extensive set of readily available features enables you to launch a fully-functional investment platform in Kenya and apply for a license from a local regulator.

To see how LenderKit all works and share your project requirements, feel free to contact our sales team.