Dubai as a Crypto Hub: What the New DFSA Framework Signals for Investment Platforms

No time to read? Let AI give you a quick summary of this article.

The Dubai Financial Services Authority’s (DFSA) updated Crypto Token Regulatory Framework1, which came into force on 12 January 2026. This step is very important for investment platforms, institutional participants, and digital asset service providers looking to build in the Dubai International Financial Centre (DIFC).

In this article, we explain what the updated DFSA framework entails, how it differs from prior approaches, and how investment platforms can apply for authorization to operate in Dubai.

What you will learn in this post:

How crypto is regulated in Dubai

Dubai has built a regulatory environment that supports innovation and investment without sacrificing oversight. Instead of applying a single set of rules to all digital assets, the city uses different regulatory regimes depending on where the activity takes place.

- DFSA in the DIFC: The Dubai Financial Services Authority regulates financial services within the Dubai International Financial Centre, a globally oriented financial free zone designed for banks, investment firms, and institutional players.

- VARA in the rest of Dubai: The Virtual Assets Regulatory Authority2 oversees virtual asset activities outside the DIFC.

The updated DFSA framework is crucial for investment platforms because it governs the use of Crypto Tokens for custody, trading, investment products, and advisory services within the DIFC.

Key changes in the DFSA’s 2026 Crypto Token Framework

Here are the most important updates from the DFSA’s revised regulatory regime and what they mean.

Firms are now responsible for token suitability assessments

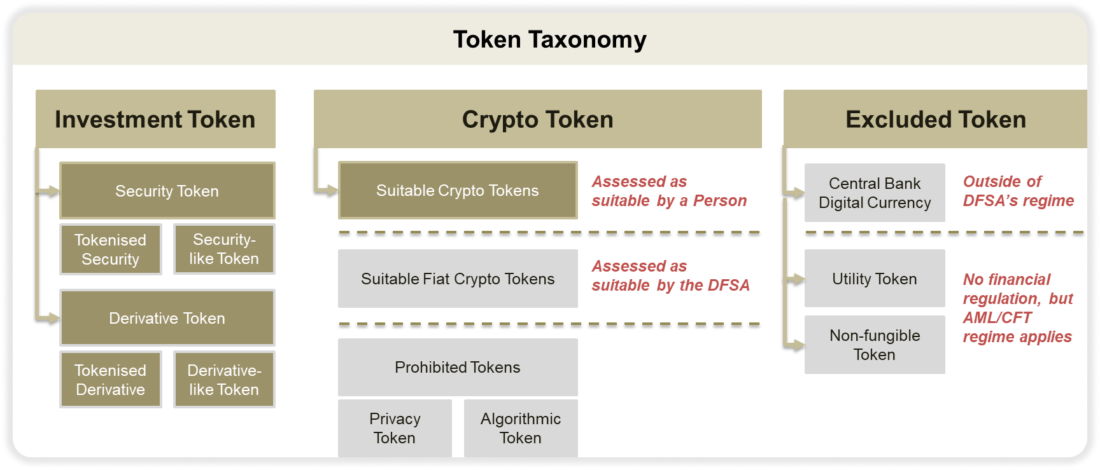

One of the most important changes is that firms providing financial services involving Crypto Tokens are now directly responsible for assessing whether those tokens meet the DFSA’s suitability criteria3. In the past, the DFSA published a list of “Recognised Crypto Tokens” that firms could rely on. That list has been removed.

Under the new framework, firms are required to carry out their own assessments, document how each token was reviewed, and clearly explain why it meets the DFSA’s suitability requirements.

At the same time, the DFSA has drawn clear boundaries: certain categories of tokens remain prohibited, including privacy-focused tokens and algorithmic tokens. These assets cannot be offered or supported, regardless of a firm’s internal assessment.

More investor safeguards and governance requirements

The updated DFSA Crypto Token framework strengthens investor protection by setting clear obligations of the companies in relation to investors. Now, firms that deal with crypto tokens have to comply with the following requirements.

Put proper governance in place

Firms are required to assign clear responsibility for Crypto Token activities at the senior management level, maintain internal controls, and document decision-making processes.

Safeguard client assets through compliant custody models

Where firms hold or control client Crypto Tokens, they must ensure secure custody arrangements, proper segregation of client assets, and strong key management practices.

Provide clear and honest disclosures to investors

Firms must clearly explain the nature of supported Crypto Tokens, their risks, and relevant characteristics4. Communications must be fair, clear, and not misleading.

Monitor token suitability on an ongoing basis

Token assessments are not a one-time action. Firms need to continuously monitor supported Crypto Tokens, update their internal assessments, and stop offering tokens that no longer meet suitability criteria.

For Dubai investment platforms, these rules mean building strong compliance, risk, and disclosure processes from day one. Crypto investment services are expected to meet standards similar to those applied in traditional financial markets, with real accountability and transparency.

Proportionate reporting and supervision

The DFSA has adjusted reporting requirements5 so they match real-world risks and market conditions, rather than applying the same heavy reporting burden to every firm. The goal is to keep oversight effective without slowing down legitimate business activity.

This means investment platforms are not required to file unnecessary reports, but they must be ready to provide information when risks increase or when the DFSA requests it.

Do the platforms need authorization from the DFSA?

Platforms have to be authorised by the DFSA to operate under the updated Crypto Token framework, and the new rules do not allow crypto investment activity on an unregistered basis within the DIFC.

New applicants must apply under the revised framework, and existing authorised firms that add Crypto Token activities have to apply for a variation of permission. A compliant DFSA application is not a simple form. It is a complete package that proves the platform can operate safely and responsibly. If you are a platform owner, be ready to provide the following.

1. Business model and scope

You have to clearly explain what crypto services you will offer, who your clients are, and how crypto fits into your wider business. Vague or overly broad descriptions are a common reason applications are delayed.

2. Token suitability framework

You need a written process showing how you assess, approve, reject, and monitor crypto tokens. This includes excluding prohibited token types and reviewing tokens on an ongoing basis.

3. Governance and accountability

The regulator wants to see who is actually responsible. You need to show clear roles for the board and senior management, decision-making processes, and fit-and-proper checks for key individuals. Titles alone are not enough.

4. Risk and compliance controls

You need to demonstrate how you manage crypto-specific risks such as volatility, custody, technology failures, and financial crime. Generic policies copied from traditional finance are usually rejected.

5. Custody and asset protection

If you touch client assets, you are required to explain where they are held, how keys are secured, how assets are segregated, and whether custody is internal or outsourced.

6. Client disclosures

All client-facing documents have to clearly explain risks, products, terms, and complaint handling. Disclosures must be easy to understand and not promotional or misleading.

7. Financial and operational readiness

You need to show adequate capital, funding plans, IT systems, security controls, and business continuity arrangements. The DFSA wants to be sure that you can operate without putting clients at risk.

8. Reporting and regulator interaction

You need systems for record-keeping, internal monitoring, responding to DFSA requests, and notifying the regulator of material changes. Ongoing supervision is now a part of the model.

There is no “light-touch” or sandbox-style exemption for live crypto investment platforms in the DIFC. The updated DFSA framework makes it clear that crypto investment activity is treated as a regulated financial service, with entry standards similar to those applied to traditional investment firms.

How to launch an investment platform in Dubai with LenderKit

If you are looking to launch a platform under the DFSA regime, white-label crowdfunding and investment software by LenderKit.

While not directly offering tokenized assets or crypto infrastructure, it definitely supports more traditional ecosystems and alternative finance platforms.

The LenderKit software has all the elements the DFSA expects to see: defined investment workflows, investor onboarding, governance controls, disclosures, reporting and audit-ready records.

LenderKit is designed for regulated environments enabling clearer applications, faster regulator conversations, and a business model that is credible from day one.

To discuss details, please get in touch with our team.