How to Start a Crowdfunding Business in Australia

No time to read? Let AI give you a quick summary of this article.

Australia has always been the subject of dreams for those who love warm climate, wild animals, and a stunningly beautiful ocean. And if you wish to start your business in crowdfunding, it’s among the top countries to choose from! According to the Cambridge Center for Alternative Finance, Australia is the 7th among the top-30 crowdfunding1 countries in the world.

By and large, crowdfunding in Australia is really a promising business line, and in this article, we will talk about how to launch a crowdfunding platform in this country and touch upon the Australian crowdfunding regulations, market conditions, existing platforms, and tools to build your crowdfunding platform.

What you will learn in this post:

A Word on the Australian crowdfunding market

Though the Australian crowdfunding market constitutes only 0.38% of the global one, it is actually more than 1.1 billion dollars.

In terms of business development, Australia has a lot of different crowdfunding platforms that focus on both debt and equity financing.

However, Australia is not about super growth rates of the crowdfunding market. The yearly growth rate is rather small and makes up for only about 1.57%. For countries that are among the first 10 positions in the above mentioned rating, it’s outstanding, and the second-slowest speed is 4.8% (Canada).

However, this year’s rate is substantially different from the previous ones’. According to the Equitise Industry Report 20212, the overall amount of money raised through all crowdfunding platforms in 2021 increased by 125% as compared to the previous year, and this increase equals $46 million.

The Australian crowdfunding market unites all types of crowdfunding platforms. There are both investment- and non-investment crowdfunding platforms here, and the most interesting for retail investors. In Australia, retail and institutional or wholesale investors play a critical role in project financing.

According to the survey, 98.5% investors are retail3, however, the 1.5% of the professional investors are responsible for the 33,5% funds raised on crowdfunding intermediaries.

Successful Australian crowdfunding businesses you can learn from

If you want to start a crowdfunding business in Australia, you should be aware of competitors, which are quite numerous and strong here. For instance, among debt- and equity-based crowdfunding platforms, it’s reasonable to know about these players:

Birchal 4– one of the first crowdfunding websites in Australia, the platform, which helped more than 100 small businesses and startups to raise $65 million in total. The company arguably has the largest community of investors in the country and the simplest and fastest investment process.

Equitise 5– is another leading equity crowdfunding platform in Australia which is available for ordinary people due to free investing, i.e., investing without having to pay any commissions for the service. At the same time, crowdfunding with Equitise is safe, as all the companies-fundraisers are thoroughly checked.

Billfolda 6– is on the market for many years, offers exceptionally thorough check of the companies-fundraisers and at the same time very low fees for the service.

SocietyOne 7– the leading debt crowdfunding platform in Australia, which helped to lend $1 billion as counted in January 2021. The company focuses on helping leading shareholders and supporting reliable borrowers and has gained many awards, including RateCity Gold Award 2020 and Mozo Experts Choice Awards 2017.

Prospa 8– founded back in 2012, this debt crowdfunding website has helped to fundraise almost $99 million in total, aiming primarily at helping startups and small businesses.

RateSetter 9– an Australian debt crowdfunding company with 800,000 customers and a good service score. The company is a trading name of Metro Bank and is aimed at ordinary people or the so-called retail investors.

This list of Australian crowdfunding entities must give you a rough insight into the key crowdfunding platforms in the region you’re going to compete with. But what rules do they operate under? Let’s dive into the Australian crowdfunding regulation.

Study crowdfunding legislation in Australia with your attorney

The legislation and regulations for crowdfunding businesses can sometimes confuse and in a sense even stop business founders from proceeding to build their ventures. Australian crowdfunding regulations seem transparent, but you should probably consult an experienced crowdfunding attorney before launching your business.

To start a crowdfunding business in Australia, the founders will need to get several important documents:

- an AFS10 (Australian financial services) license

- Australian credit license (if the future business will deal with providing personal loans)

And aside from getting those licenses, it’s also necessary to know that the Australian Securities and Investment Commission (ASIC11) is in charge of businesses of this type. Every transaction within a crowdsourcing entity is monitored by the Corporations and Markets Advisory Committee (CAMAC12). This institution suggested Australian government introduce these limitations for retail investors:

- $10,000/year – maximum sum allowed to invest in a startup via investment crowdfunding

- $2,500 as a maximum per one investment

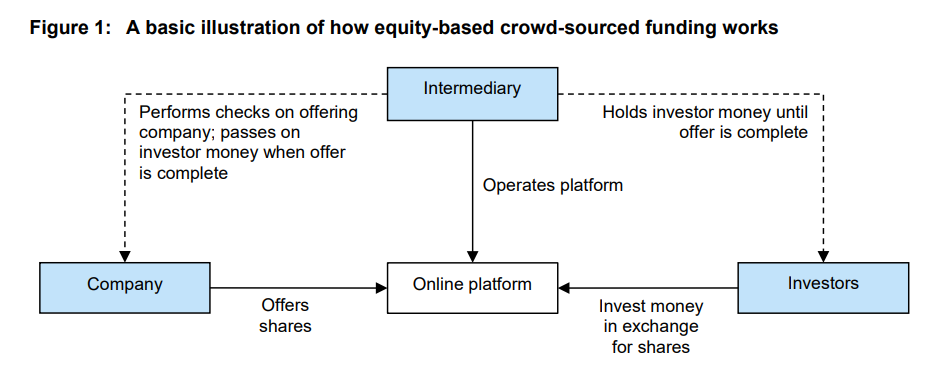

ASIC also provides the guide for crowdfunding intermediaries in Australia13 which outlines various requirements that crowdfunding platforms need to follow to get licensed and run their business lawfully:

- CSF regime in Australia

- Advertising requirements

- Money management

- Data protection requirements

- Obligations when dealing with retail investors

- Risk management, etc.

Explore crowdfunding software for operating private capital raising business in Australia

Today, it’s rather hard to find a business with no special software for it, and the crowdfunding business is no exception. Creating a website, managing investors and fundraisers, investments and payments, reviewing the overall statistics on a project – this all is absolutely necessary to manage your crowdfunding company successfully.

This all can be done within a crowdfunding software solution.

LenderKit is a flexible crowdfunding and investment management software which helps you manage full-cycle private capital raising from user onboarding to investment settlement and money distribution.

Adaptable to any regulatory body, we can tailor LenderKit to fit Australian crowdfunding regulations as we already have the regulations-management module in the system.

The best part about LenderKit is that everything is customizable from the interface look to adding new features in the admin back-office.

To learn more about LenderKit crowdfunding software for the Australian market, book an online demo with our fintech specialist.

Article sources:

- Crowdfunding Statistics Worldwide Market Update 2023

- Raising capital? Aussie crowdfunding surges 125pc

- PDF (https://download.asic.gov.au/media/5555060/rep657-published-9-april-2020.pdf)

- Birchal

- SLOT QRIS: SITUS SLOT GACOR MALAM INI DEPOSIT QRIS TERPERCAYA 2025

- Australian Equity Crowdfunding | Billfolda

- Australia's Leading Digital Finance Platform | SocietyOne

- Business Loan Specialist | Business Loans and a Business Account | Prospa

- RateSetter | Simple personal loans tailored to you

- AFS licensees | ASIC

- Crowd-sourced funding | ASIC

- CAMAC

- RG 262 Crowd-sourced funding: Guide for intermediaries | ASIC