Real Estate Crowdinvesting Business Overview

No time to read? Let AI give you a quick summary of this article.

Real estate crowdinvesting has been around for at least 10 years now but in the past years, it has experienced significant growth. In the sector that has become more competitive, crowdinvesting platforms were looking for ways how to best structure their business and offer both investors and sponsors acceptable conditions.

As a result, two different residential and commercial real estate crowdfunding models emerged:

- Direct crowdfunding

- SPV-based crowdfunding

They differ by their approach to the “three Rs” – return, risk, and relationships between investors and sponsors. In the table, you can see how these two models tackle the “three Rs”:

| SVP-based | Direct | |

| Return | Can be lower due to expenses connected with an SPV creation and management | Depends on the sponsors’ income in the future |

| Risks | – Property-level – Sponsor – Platform | – Property-level – Sponsor |

| Relationship | No direct relationship | Direct |

Now, let us have a closer look at every “R” for each crowdfunding business model.

What you will learn in this post:

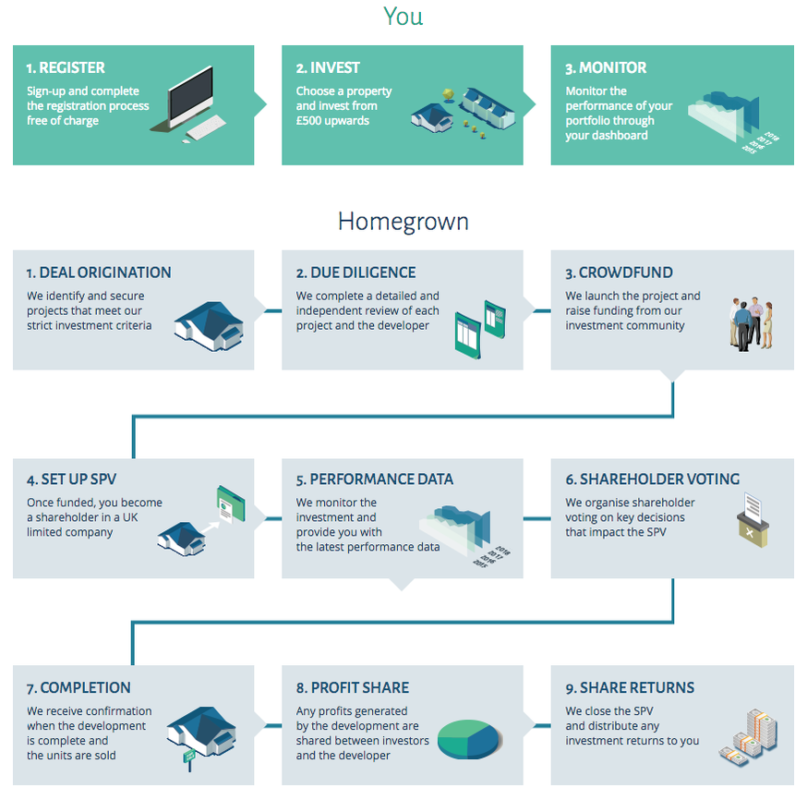

SPV-based crowdfunding

An SPV, or Special Purpose Vehicle, is a subsidiary, a legal entity created by a parent company. While an SPV may come in different forms, in real estate crowdinvesting, SPV is a private limited company created by a crowdfunding platform. This legal entity is used to collect funds from investors and transfer them to a sponsor once the crowdfunding campaign is over. The raised funds are moved in a single transfer, so, for a sponsor, it looks like the funds were invested by one investor (an SPV).

When the income is generated, investors receive their share via the platform, too.

An SPV in real estate crowdfunding performs a very limited set of functions:

- It is responsible for administering the shares issued during the crowdfunding campaign.

- It maintains records of shareholders who have participated in a specific crowdfunding round.

- It sends the raised funds to the sponsor.

- It issues reports to both the sponsor and the investors.

- Performs taxation-related activities upon an income to the SPV.

A real estate crowdinvesting SPV doesn’t affect the results of a crowdfunding campaign such as the number of shares an investor owns, the income share, or whatever. An SPV is just a mechanism to receive investments and issue the shares to the investors.

Considering that the functions of an SPV are limited, you might be wondering what are the reasons to use it. The creation of a special purpose vehicle in real estate crowdfunding is suitable if a company:

- Wants to reduce the number of investors listed in the capitalization table of the company in order to avoid triggering the Exchange Act Reporting Requirements1. According to the Exchange Act, any company with more than $10 million in assets and more than 500 non-accredited investors must report financial information. Those reports are time-demanding and may require additional auditing procedures which might be a burden for some companies, especially startups. If a company uses an SPV for crowdfunding purposes, it brings all the investors under one cap.

- Is planning to raise funds from institutional investors in the future. Institutional investors request a copy of the company’s capitalization table, and long cap tables are less attractive for institutional investors. If a company raises funds via an SPV, it looks in the capitalization table as if the investment was made by one investor – the SPV.

Regarding the taxes, every year when revenues or expenses occur, an SPV issues K-1s2 to all members, and the members shall pay taxes accordingly. But in our case, an SPV is created for crowdfunding purposes only. So, the only year the investors get the K-1 is the year when any income or disbursement is made.

For real estate crowdfunding platforms, an SPV means an opportunity to access a large number of small investors who would not be able to invest otherwise. A platform also gets subscription fees, administration fees, ongoing asset management fees, exit fees, and so on.

It looks for now that using an SPV model is beneficial for both a crowdfunding platform and a sponsor. However, if it were like this, the direct model would not exist. So, here are the main drawbacks for both investors and sponsors in using an SPV crowdinvesting model.

Returns

Some residential and commercial real estate crowdfunding platforms charge fees to both sponsors and investors. For investors, it is important to understand that all these fees will be considered when the company starts getting income, and they will impact the overall return on investment.

Risks

Investing in real estate is connected with risks, and in the SPV model, investors bear the following risks:

- Property-level risk: real estate value fluctuations, tenant failure, etc.

- Sponsor risk: as long as investors are investing not in a sponsor company but in an online marketplace, and then, the marketplace invests in the sponsor, the investor has to rely on both the marketplace and the sponsor. This extra link adds risks.

- Platform risk: if the platform has issues, the invested capital might either be lost, or the return on it might be significantly lower than expected.

Relationship

There is no direct communication between investors and a sponsor, therefore, no relationship is established between these two parties. A sponsor doesn’t know who has invested and how much they have invested, therefore, the sponsor cannot invite loyal investors in case another investing opportunity opens. For investors, it is also important to know in what project they invest in, and this is absent in case they are using a platform with an SPV crowdinvesting model.

Direct equity real estate crowdfunding

In the direct real estate crowdfunding model, investors invest directly with an individual sponsor.

Return

The crowdinvesting platform doesn’t create an additional legal entity for real estate crowdinvesting business and thus, doesn’t bear additional expenses that would influence the return on investment otherwise.

For investors, it means more income in the future. Also, the majority of real estate crowdfunding platforms that apply the direct investment model do not charge fees to investors to join the platform’s network which means fewer expenses.

Risks

When direct real estate crowdfunding is used, investors bear two risks only:

- Property-level risk connected with the tenant performance, fluctuations of asset value in the market

- Sponsor risk connected with the inability of a sponsor to perform according to the business plan.

The investors don’t bear the platform risk because here, the platform provides the infrastructure and the services needed to perform transactions but doesn’t manage any funds. Therefore, there are no risks for investors connected with the marketplace viability.

Relationship

Investing directly means establishing relationships with the sponsor. The marketplace here serves as a matchmaker to connect investors and sponsors and helps both parties by streamlining communications. The sponsor has full access to investors’ information as well as for investors, it is important to know their sponsor. The only way to establish a proper relationship is to invest directly.

Final thoughts on commercial real estate crowdfunding

So, what equity real estate crowdfunding model is better? It all depends on the platform’s target audience and the comfortable business structure that the platform has experience with.

Using the LenderKit investment software, you can adopt either model without excessive expenditures and be sure that it is legally compliant because all features are customisable. LenderKit offers you a set of out-of-the-box features that will cover the basic needs of your platform or we can fully adjust the design and platform’s functionality to fit your business needs.