Key LenderKit features

LenderKit is a white-label crowdfunding and investment software equipped with a comprehensive suite of features from investor and issuer onboarding to deal management and funds disbursement.

In addition to the core business logic it also comes with pre-built integrations, secondary market and allows for extensive customizability.

High-level software components that LenderKit provides

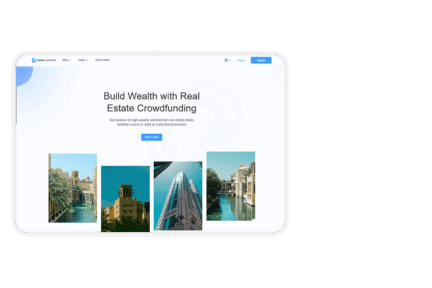

Marketing website

Launch a simple crowdfunding website to build your search presence (SEO) and attract first users to your platform.

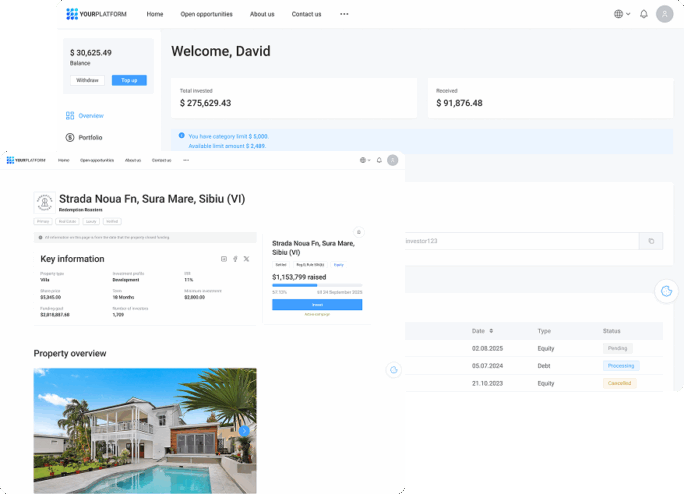

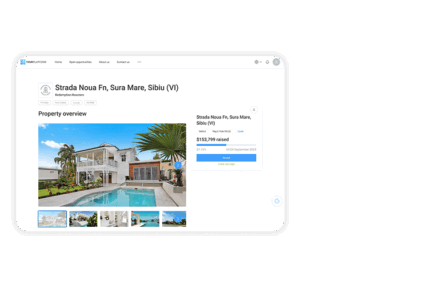

Investor portal

Turn website visitors into investors, providing them access to a comprehensive investor portal after through onboarding and KYC checks.

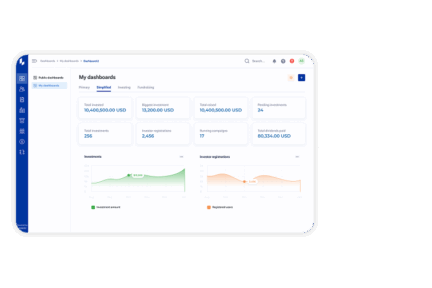

Powerful back-office

Manage your daily crowdfunding platform operations from investor onboarding to capital raising, transaction tracking and reporting.

Investment flows which LenderKit supports

LenderKit covers both investment-based and non-investment based crowdfunding models.

Each model has a unique flow and functionality which can be customized according to your needs. You can also combine different investment flows in one platform and offer flexible services to your investors and fundraisers.

- Equity crowdfunding

- Debt crowdfunding

- Donation crowdfunding

- Rewards crowdfunding

Powerful features in your investment platform software

Discover even more LenderKit features

Capital Raising Tools

- Debt Investment Flow — Enable investors to fund debt deals with structured repayment terms.

- Equity Investment Flow — Sell shares or units to investors through regulated equity rounds.

- Rewards for Offerings — Add perks or incentives to encourage participation in campaigns.

- Donation Fundraising Flow — Accept donation-based support without securities or repayment obligations.

- Indicated Interest — Gauge investor interest before launching a full offering.

Compliance Support

- GDPR Compliance Support — Manage user data responsibly and adhere to EU privacy laws.

- ECSPR Compliance Support — Operate under ESMA-compliant crowdfunding rules.

- SEC / FINRA Compliance Support — Run a compliant U.S. funding portal or broker-dealer.

Transactions Management

- Offline Payments Management — Record wire transfers, manual payments, and offline contributions.

- Internal Wallets — Let investors hold balances, reinvest, withdraw, or track funds in one place.

- Lemonway Payment Gateway — Facilitate payments through Lemonway’s regulated infrastructure.

- Hyperpay Payment Gateway — Support payments for MENA-based users via Hyperpay.

- ANB Banking Services — Connect investment flows to ANB bank accounts in Saudi Arabia.

Onboarding Automation

- Investor Categorization — Classify users into retail, sophisticated, or professional types.

- Investor Groups — Assign investors to groups with specific access or offering visibility.

- Private Data Room for Offerings — Share confidential documents with approved investors only.

- Appropriateness Test Configuration — Assess investor knowledge and risk appetite automatically.

- Jumio KYC Integration — Verify identity documents through automated KYC checks.

- Yakeen KYC Integration — Validate Saudi nationals’ identity via government databases.

- Absher NIN/Iqama Verification — Verify national ID and residency for investors in Saudi Arabia.

Documents Management & Automation

- DocuSign Digital Signature — Let investors sign agreements electronically and securely.

- File Storage and Management — Organize platform documents and control access.

- Amazon S3 Object Storage — Store documents reliably in Amazon’s cloud storage.

- MinIO Hybrid Storage — Host files on a private or hybrid storage infrastructure.

Quality of Life Integrations

- Google reCAPTCHA AntiBot Protection — Prevent bot signups and ensure real user traffic.

- Google Tag Manager Integration — Manage tracking tags without development.

- Social Login — Allow logins via Google, LinkedIn, or other social accounts.

- Application Performance Monitoring (Sentry) — Track platform errors and performance issues.

- Google Analytics for Offerings — Measure offering views, engagement, and conversions.

- Mailchimp E-mail Automation — Automate investor emails and nurturing sequences.

- SMS Authentication via Twilio — Add SMS-based two-factor authentication.

- Google Authenticator — Provide app-based 2FA for stronger security.

- IP Geolocation — Block or tailor access based on user location.

- Slack Notifications — Receive instant admin alerts via Slack channels.

- Deewan SMS for KSA — Send SMS updates through a KSA-compliant provider.

- Unifonic SMS for MENA — Deliver SMS authentication and alerts across MENA.

Additional Modules

- Transaction Fee Settings — Configure platform-wide fees for various actions.

- Repayment Schemes for Offerings — Configure offerings with custom repayment schedules.

- Multi-language & Translations Support — Offer the platform in multiple languages.

- Custom Fields Management — Add unique data fields without coding.

- Offering Visibility for Different Users — Show or hide deals based on user type or group.

- Public Offering Comments — Allow public discussion and Q&A on offerings.

- Contact Form Configuration — Customize inquiry forms for different user flows.

- Platform Branding Management — Adjust colors, logos, and branding styles.

- Content Management System — Manage page content, menus, and static sections.

- Company Members Management — Add and manage team members within company profiles.

- File Manager — Upload and organize platform files and media assets.

- Platform & Offering Agreements — Maintain contract templates for users and offerings.

- Web Browser Notifications for Admin — Push real-time alerts to platform administrators.

- Custom Offering Fee — Apply offering-specific fees beyond global settings.

- Administrative Portal Permissions Management — Define staff roles and access rights.

- Internal Investor Portal Notifications — Deliver system updates directly within the investor portal.

- User Block List Management — Restrict or block specific users from platform access.

- Admin Dashboard Management — Customize and monitor key metrics in the admin dashboard.

- Offering Followers — Let investors follow offerings and receive activity alerts.

Beta Features

- Debt Auto-Investment Flow — Allow investors to automatically allocate funds based on preferences.

- Secondary Market — Enable trading of investments for increased liquidity.

- Mangopay Payment Gateway — Handle multi-currency payments through Mangopay’s wallet system.

- North Capital Payment Gateway — Enable compliant U.S. escrow and transaction processing.

- Polymesh Blockchain Integration — Tokenize assets or record transactions on blockchain.

- Cap Table Support — Track ownership, shareholders, and investment rounds.

Potential payment gateway integrations for your platform

Our crowdfunding software integrates with the industry leading payment gateways, KYC/AML providers, document signature and filing automation providers.

We have partners in different markets including the USA, UK, Europe and the MENA region and will consult you on the technical integration with the third-party provider of your choice. We can also recommend some providers which we have already worked with to empower your crowdfunding platform.

You can integrate any third-party provider through an API.