Top 10+ Best KYC Providers for Fintech Platforms

No time to read? Let AI give you a quick summary of this article.

Know-Your-Customer or KYC is an integral part of the onboarding process for investment platforms. Not only does it allow for compliant operations, but also keeps your user base clean and safe.

If you’re working with transactions, your platform may also need a payment gateway. The thing with payment processing tools is that they also provide KYC/AML checks, so sometimes you’re fine with having only a payment gateway integrated.

However, if you want extra security, faster and fancier onboarding process, enhanced due diligence, then here’s a list of top 10 KYC providers for fintech platforms.

What you will learn in this post:

1. iDenfy: perfect for fintech businesses that need a full stack with AML, KYB, and fraud detection

iDenfy is one of the best KYC providers in the market, with a high 4.9 score in industry reviews. It gives fintech platforms everything they need for compliance in one place: user onboarding, biometric identity checks, document verification, and built-in AML screening. It performs checks against sanctions lists, politically exposed persons (PEPs), and adverse media.

The platform supports identity verification in more than 200 countries and accepts common documents such as passports, national IDs, and driver’s licenses.

What makes iDenfy especially useful is its hybrid approach. Most verifications are handled automatically by AI, but human review is available when extra accuracy is required. Ongoing monitoring is also part of the service, which helps fintech platforms stay compliant when regulations change and their user base grows.

2. Jumio: for large banks and regulated startups

Jumio is one of the best enterprise KYC solutions. It brings together ID document checks, facial biometrics, and AML screening in a single platform. The system can verify government-issued IDs from over 200 countries and delivers results in real time.

It’s a strong option for companies with users around the world and many different document types to handle. Jumio also uses machine learning to spot fraud more accurately over time, which is especially valuable for platforms that onboard large numbers of users every day..

3. VerifyInvestor: for platforms that work with accredited investors & KYC

VerifyInvestor is different from typical KYC providers. Its main focus is on verifying accredited investors and qualified clients, which is required in private investment offerings such as Reg D 506(c). While it does include basic KYC and AML checks, its real strength is confirming whether an investor meets the legal income and net-worth requirements.

This makes VerifyInvestor suitable for platforms where simply confirming identity isn’t enough. In these cases, platforms also need to prove that investors are financially eligible. That’s a different type of compliance compared to traditional KYC, which mainly focuses on identity checks, fraud prevention, and AML screening.

4. Sumsub: perfect for fintechs and crypto platforms

Sumsub1 is one of the best KYC providers. It offers identity verification, AML screening, KYB checks, ongoing monitoring, and fraud prevention in one platform.

What really stands out is flexibility. Platforms can customize verification rules and workflows to match their exact compliance needs. This is especially helpful for crypto exchanges, DeFi projects, and other fintechs with more complex requirements.

Many teams like the level of control Sumsub gives them. It lets them improve the onboarding process without having to build custom compliance logic from scratch.

5. Trulioo: for enterprises with global reach and business onboarding

Trulioo is a perfect option for fintech platforms that work across borders. Its Global Identity platform2 connects to hundreds of trusted data sources worldwide, allowing companies to verify both individual users and businesses through KYB checks.

One of Trulioo’s main benefits is its simplicity. It offers a single API and built-in tools for business verification, which reduces integration work and vendor complexity. This makes it easier for fintechs to onboard and manage corporate or institutional clients without having to deal with multiple providers.

6. Veriff: for platforms that need fast consumer onboarding

Veriff3 is known for fast, automated identity checks that work well for a global audience. It uses AI and document confidence scoring to catch issues early and reduce the need for manual reviews.

The platform is easy to integrate and supports a wide range of ID documents from many countries. Because of this, Veriff is a good choice for fintech apps that want to onboard users quickly and scale without creating extra friction.

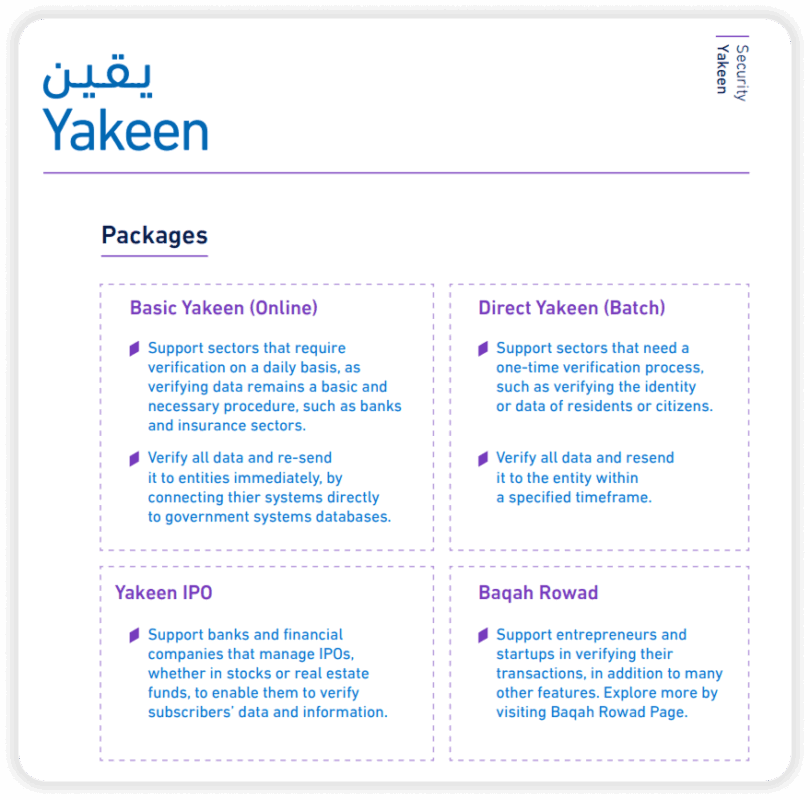

7. Yakeen: Government identity verification in Saudi Arabia

Yakeen4 is a government-backed identity verification service used by banks, fintech platforms, and other regulated institutions operating in Saudi Arabia. It is not a commercial KYC platform, but an official service that allows institutions to verify customer identity data against government records.

Through Yakeen, regulated entities can verify core customer information, such as name, national ID details, and address, in real time using data from the National Information Center.

Yakeen is formally referenced in the Saudi Central Bank (SAMA) rulebook as an approved source for electronic identity verification. It’s typically used as part of customer onboarding and compliance workflows where confirmation of official identity data is required.

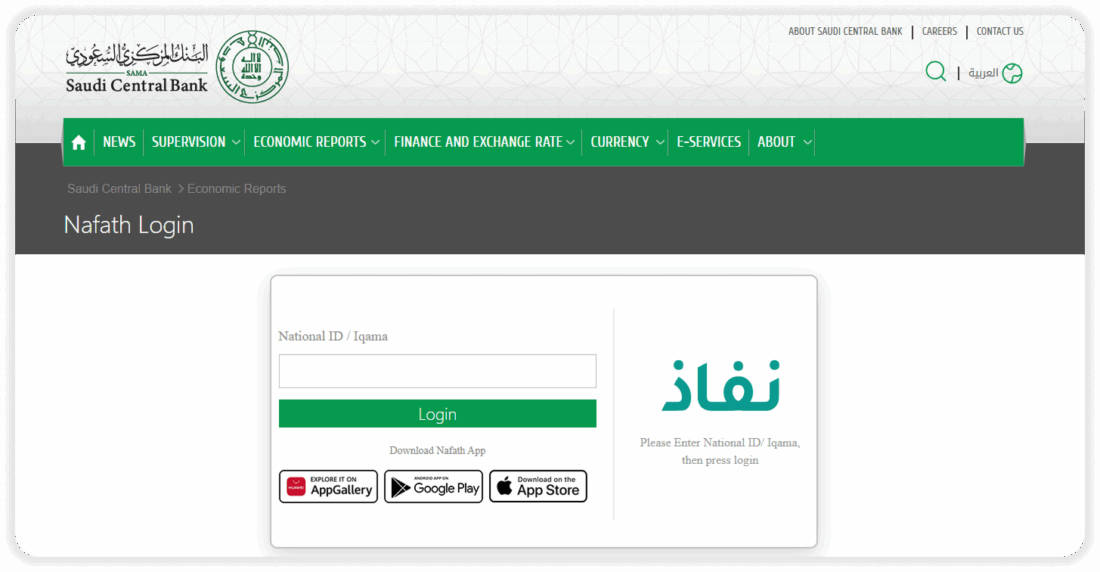

8. Nafath: National digital identity and authentication in Saudi Arabia

Nafath5 (Unified National Access) is Saudi Arabia’s national digital identity and authentication system. It is a government-operated service connected to the Absher platform6 and is used to securely access government and approved private-sector services.

In fintech and regulated environments, Nafath is primarily used for user authentication and consent-based identity confirmation, rather than full KYC data verification. It provides a single, unified login experience and supports advanced authentication methods, including biometric verification.

Fintech platforms integrate with Nafath through approved technical integrations and APIs, enabling secure, real-time authentication without building proprietary login or biometric infrastructure.

9. Onfido (a part of Entrust): for platforms that combine AI with human review

In 2024, Onfido7 was acquired by Entrust and is now part of its identity verification portfolio.

Entrust focuses on digital identity, security, and trust solutions for businesses. It offers solutions for identity verification, authentication, data protection, and secure access management. It uses document verification and biometric checks to confirm user identities. The platform also includes fraud signals and data checks that help meet KYC and AML requirements.

The solution is flexible and easy to fit into existing onboarding flows. It offers tools to adjust verification steps, simplify ID uploads, and review results in one place. It is cloud-based and designed for straightforward integration, so fintech teams can add identity verification without major technical changes.

10. GBG: suitable for companies that need broad data intelligence and identity confidence scoring

GBG8 is a long-established provider in the identity verification and compliance sector. The platform helps fintech companies verify users, reduce fraud, and meet KYC and AML requirements. GBG supports document checks, biometric verification, and identity data matching across many countries, which is suitable for platforms with international users.

The system is flexible and can be integrated in different ways. Verification workflows can be adjusted to meet specific compliance needs. GBG is a good option for fintech platforms that need identity verification they can rely on as they scale.

11. Shufti Pro: for global fintech platforms that need scalable KYC, KYB, and fraud prevention

Shufti Pro is a strong KYC provider for fintech platforms operating across multiple regions and regulatory environments. It offers a full identity and compliance stack, including KYC, KYB, AML screening, document verification, biometric face checks, and ongoing monitoring — all within a single platform.

One of Shufti Pro’s key advantages is global coverage. The platform supports identity verification across 250+ regions and is trained on thousands of document types worldwide. This makes it especially suitable for fintechs, crypto platforms, payment processors, and marketplaces onboarding users from different jurisdictions.

Shufti Pro relies on AI-powered verification for speed and scalability, while still allowing for enhanced due diligence when higher-risk users are detected. It supports advanced fraud prevention features such as deepfake detection, synthetic identity checks, and lifecycle-based re-verification, helping platforms stay compliant as user risk profiles evolve.

Another benefit is flexibility in deployment. Shufti Pro can be integrated via a single API, lightweight SDKs, or deployed on-premise or in private cloud environments, which is useful for companies with strict data residency requirements. Custom verification workflows allow fintech teams to tailor onboarding rules without building compliance logic from scratch.

12. FOCAL (by Mozn): for fintechs and banks operating in emerging markets, especially MENA

FOCAL is an AI-powered risk and compliance platform designed for fintechs, lenders, and financial institutions operating in emerging markets. Built by Mozn, FOCAL focuses on AML compliance, fraud prevention, and customer due diligence, with particular strength in the Middle East and North Africa (MENA) region.

The platform covers core compliance needs such as identity verification, customer screening, sanction and watchlist checks, transaction monitoring, and customer risk scoring. What differentiates FOCAL from many global KYC providers is its deep regional alignment. It combines global AML standards with localized data sources and regulatory expertise, helping platforms meet country-specific compliance requirements without overcomplicating onboarding.

FOCAL relies on an AI-driven risk engine to reduce false positives and speed up compliance decisions. By analyzing customer behavior, financial signals, and transaction patterns in real time, the platform helps compliance teams onboard users faster while maintaining strong risk controls. This makes it especially useful for lending, payments, and capital markets platforms where decision speed directly impacts growth.

How to choose a KYC provider for your investment platform

Choosing the right KYC provider is not easy. It depends on where you operate, what you offer, and how strict your regulatory obligations are.

Define a country of operation

If your platform serves users in multiple countries, you need a provider with strong global coverage. You may consider solutions like Trulioo, Jumio, and iDenfy, because they are built to handle different regulations, document types, and data sources across regions.

Formalize user qualification criteria

Not all platforms need the same level of verification. Some only need basic identity checks and AML screening. Others, especially investment platforms, also need to confirm financial eligibility. For example, VerifyInvestor focuses on accredited investor verification, which goes beyond standard KYC and looks at income and net worth.

Consider verification speed and depth

Fast onboarding improves conversion, but deeper checks reduce risk. Providers like Veriff and Onfido work well when speed is more important. Platforms with higher regulatory exposure may prefer providers such as Sumsub or Jumio, which focus more on detailed compliance and monitoring.

Explore national identity verification systems

In some markets, government-backed digital ID systems can simplify compliance. If you operate in Saudi Arabia, services like Yakeen and Nafath can be part of your onboarding process.

Check if your payment gateway already offers KYC

If your platform integrates a payment processing solution, your payment provider may already have their own verification, so you don’t need a separate tool. However, sometimes payment gateways don’t have a standalone KYC solution, so you might need a separate service.

Launch an investment platform with future-proof infrastructure

If you’re looking to start an investment platform or crowdfunding platform with KYC/AML and payment processing infrastructure, check out LenderKit.

LenderKit already supports well-known KYC providers used across fintech and investment platforms.

This includes identity checks, AML screening, KYB and accredited investor verification.

Depending on your business model country of operation, you can use existing integrations or request a custom one.

If you would like to see how this works in practice or discuss your use case, please contact us.

Article sources:

- Leading Identity Verification Service - 2025 G2’s Top Pick | Sumsub

- Global Identity Verification Solutions | Trulioo

- AI-Powered Identity Verification | Drive Growth - Veriff

- Yakeen

- PDF (https://sdaia.gov.sa/en/Services/ServicesGuidelines/SingleSignontoGovernmentP...)

- Absher

- Identity (ID) Verification Solutions | Entrust

- GBG | Identity Verification and Fraud Prevention Solutions