What’s New in Farmland Crowdfunding?

No time to read? Let AI give you a quick summary of this article.

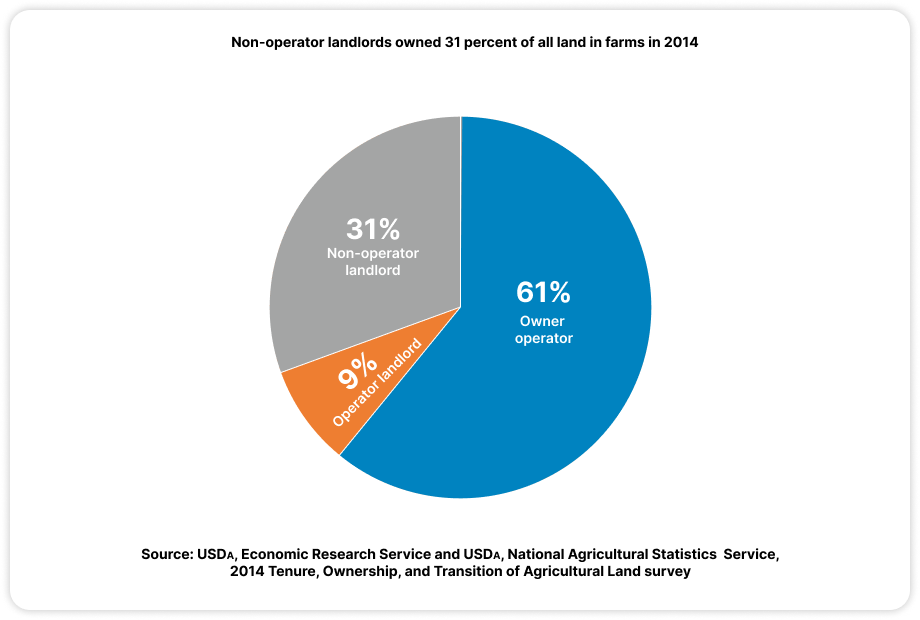

The rapidly growing world population and rising demand for food, sustainable agriculture and farming processes optimization make farmland a valuable investment with the potential for solid returns. In 2014, over 31% of farmland was owned by entities not involved in farming.

They were renting the land to other farm operators. Since then, this share has been increasing constantly, and with the growth of the popularity of crowdinvesting, this opportunity became affordable to anybody.

What you will learn in this post:

How farmland crowdfunding compares to other asset classes

Farmland is in many regards more promising for a long-term investment compared to other asset classes.

Yield

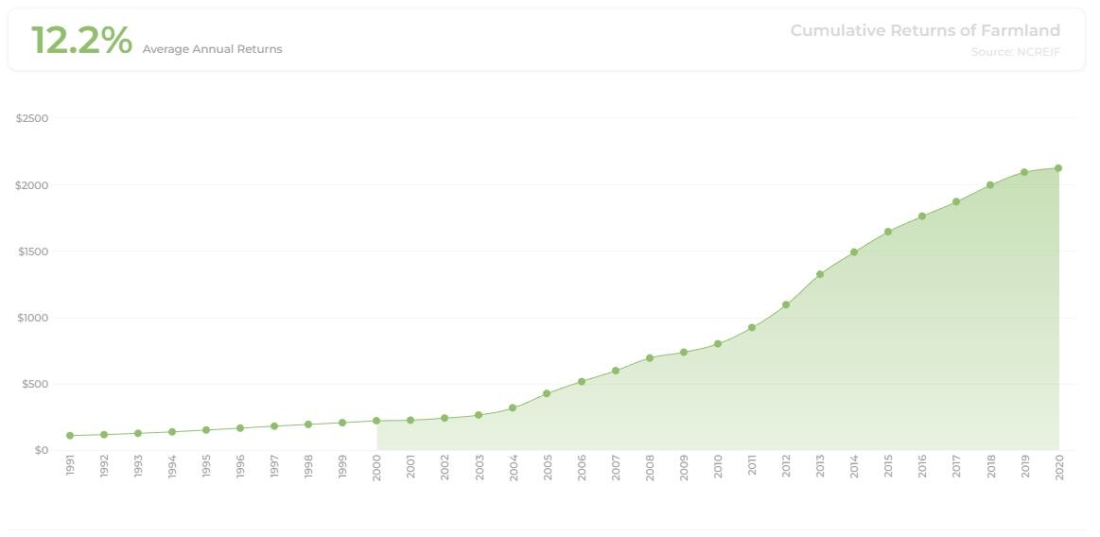

Since 1990, cumulative returns on farmland have been positive. According to AcreTrader1, U.S. farmland returns have offered average returns of 12.24% which makes this asset class a very competitive product for investors and an attractive niche crowdfunding platform opportunity.

For investors that are looking for ways to diversify their portfolio and considering other assets alternative to real estate, farmland crowdfunding can prove to be an interesting tool with constant returns.

Volatility

Compared to such assets as stocks, commercial property, and even gold, farmland is distinguished by very low volatility.

Moreover, farmland is not correlated2 with these and some other major asset classes such as private real estate or bonds. So, investing in it will help you to make your portfolio less volatile, too.

Hard Asset

Farmland is a hard asset. It is a tangible asset whose value grows over time. In this regard, it can be compared to real estate and gold.

But real estate depreciates over time if not upgraded, and a few months of lost rent can place a property in default and lead to significant losses. In the case of land, it doesn’t happen.

Inflation Hedge

By investing in farmland, you protect yourself from the declining power of money during inflation periods because this asset maintains its value or grows in price over time. Even compared to gold which historically has been considered an excellent inflation hedge, farmland can protect your investment portfolio better during inflation periods than gold does.

The main reason farmland has a better inflation hedge is that it is used to produce commodities such as grain and corn, for example, and their price grows with inflation. Thus, the land value grows, too.

Average Annual Return

The average annual return on investment is 11% if you choose farmland which is much higher than the AAR on investment in commercial property (8%), bonds (6.4%), gold (6.5%), or CDs (2.6%).

Historically, investment in farmland has been profitable even during market recessions and downtimes.

How investors make money on farmland crowdfunding

The main reason why investors turn to farmland is that this asset has a long history of delivering solid returns. Those returns are formed in two ways:

- The farmland you’ve invested in grows in value and thus, your share’s price increases, too.

- You can rent the land to farmers and collect annual rental payments.

Whatever option you choose, you can count on a constant and relatively stable income.

Why farmland crowdfunding is an attractive business opportunity

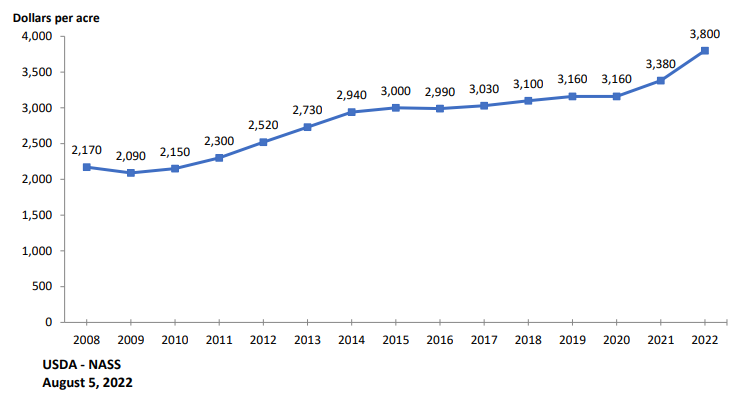

Since 2008, the average value of U.S. farmland has grown from $2,170 to $3,800 per acre. So, the increase of the investment value over these 14 years is over 46%, with only 2 years that show the downward price movement. And in the cash rent yields, the growth rate is even higher.

There are several factors that cause the price growth for farmland:

- The population of the world is increasing, and thus, the demand for food is growing. Grain, corn, and other products are produced by farmers on arable land. With the growth of prices for these products, the prices for the resource – land, are increasing, too.

- The area of arable land is decreasing3 by 1-3% every year which is another factor that pushes the price of productive land upward.

Where farmland crowdfunding platforms get customers

Most farmland crowdfunding platforms collaborate with accredited investors because they can invest more money in the projects and are easier to work with due to their skills and knowledge of the industry. However, farmland investing platforms may actually attract both retail and high-net-worth investors, depending on the platform’s strategy.

To attract investors and investment projects, crowdfunding platforms rely on several marketing channels:

- SEO

- Social media

- Networking

- Events & webinars

- Partnerships with banks, aggregators

- Collaborating with farmers, etc.

Best farmland crowdfunding websites

If you want to invest in farmland, you need to choose a reliable farmland investing website with suitable offerings. Here’s our list of the major platforms working with farmland crowdfunding projects.

FarmFundr

FarmFundr4 specializes in investing in farmland devoted to specialty crops. The platform works with accredited investors only, and the minimum investment range is $10,000.

While the majority of platforms invest in the underlying farmland and collect rent payments from farmers, FarmFundr claims to have an even more active position. After each year’s crop is harvested, the platform pays investors accordingly.

Bravante Farm Capital

Bravante Farm Capital5 focuses on purchasing land in a very specific area: the California Central Valley. Those lands have access to water and thus, their value is expected to grow exponentially.

The company purchases dozens of small farms in the mentioned area to create large-scale ranch networks and create constant and predictable income flows.

Bravante Farm Capital invites accredited investors to join them with a minimum investment of $25,000.

FarmTogether

FarmTogether6 is a crowdinvesting platform that specializes in farmland. It requires its investors to be accredited.

When you invest with FarmTogether, you receive a share of a limited liability company that owns the underlying land. This approach provides investors an opportunity to own small parts of different farms and thus, allows them to diversify their portfolios. By buying shares of farms located in different parts of the country, they can also add geographic diversification.

AcreTrader

AcreTrader enables investors to purchase shares in the entity that owns a farm. Each entity is divided into shares equivalent to 1/10 of an acre. Thus, if you buy 10 shares, your ownership represents the equivalent of 10 acres of farmland and thus, you get your dividends based on it.

Investors hold ownership for 5-10 years. After this period expires, the farm in question is sold, and each investor gets his principal and any appreciation over the mentioned period.

The platform works with accredited investors only.

Farmfolio

Farmfolio is one of those rare crowdinvesting platforms that focus on farmland and collaborate with both accredited and non-accredited investors. It enables those who are interested in land to directly purchase and own top-class farmland in Colombia.

For now, the platform’s main attention is on top-producing farms with perfect climatic conditions that allow for year-round growing.

The direct land ownership program is called Land Ownership Titles (LOT). The farmland purchased by investors is a part of a bigger farm. As landowners, they are part of a Farm Owners Association (FOA) that acts independently on Famrfolio on behalf of each landowner. The FOA management has extensive experience in hiring and supporting farm management teams who take care of everything on the farm.

The main benefit is that by investing with Farmfolio, you get a direct share in an already functioning farm.

The main drawback is that a minimum price of a LOT can be very high (as much as $300,000) which means that in most cases, only accredited investors can participate in the offerings listed on the platform.

FarmLand Riches

Farmland Riches7 is not a crowdfunding platform but a resource where investors can get all the needed information about crowdinvesting in farmland:

- Platform reviews

- All types of guides on investing in farmland

- Platform comparisons

- All about REITs

Even a Farmland Returns Calculator is available there to help investors to analyze historical returns on farmland vs other major assets.

Start a farmland crowdfunding platform with LenderKit

LenderKit offers you white-label crowdfunding software that helps you to save costs on development and launch your farmland crowdinvesting platform asap and attract more customers.

If you are just testing the waters, you can start with a farmland crowdfunding platform prototype and further scale it to an MVP or a fully-operational platform. We offer basic out-of-box solutions and can also completely redesign and rebuild the software to fit your business needs, regulations and market purposes.

If you want to learn more about the LenderKit white-label crowdfunding software for farmland investing, reach out to our fintech strategist to book an online demo.

Article sources:

- Average U.S. Farmland Investment Returns | AcreTrader

- Farmland's Lack Of Correlation To Major Asset Classes

- Farmland Investing During Economic Uncertainty | AcreTrader

- FarmFundr | Agriculture Crowdfunding Investment Farms

- Farmland Crowdfunding Platforms: A Real Estate Investor's Guide - Bravante Farm Capital

- FarmTogether - Invest in US Farmland

- Investing Simple - No Finance Degree Required.