5 Types of Investment Software and How to Choose One

There are many providers of investment management software, but choosing the right one for your business might be a bit challenging. The matter is that each provider understands investment management software in its own way and develops it accordingly. The complexity adds up when investment software providers want to catch up with the latest trends and optimize around keywords that people are searching for.

You can’t tell for sure which solution is right because all of them write more or less the same thing. It’s only after a few calls and endless emails you can truly understand what the software is capable of.

Here, we will try to demystify the main types of investment management software, check what it’s being used for, and finally, review the investment software providers to facilitate your research.

What you will learn in this post:

Investment-Based Crowdfunding Software

If you are more into crowdfunding or alternative investment management where project owners can raise funds from multiple investors, this software type is for you.

Investment-based crowdfunding software helps you manage a full cycle of capital raising operations from investor onboarding to fund disbursement and work with donation, debt and equity offerings.

Usually, these vendors focus on a specific market, but can also offer a versatile crowdfunding software that adheres to multiple regulatory frameworks and ensures extensive customizations.

LenderKit

LenderKit is an investment-based crowdfunding software provider launched in 2017. The company caters to the needs of investment businesses and entrepreneurs who are thinking about launching a platform for private fundraising, loan management, real estate crowdfunding, equity crowdfunding or donation-based crowdfunding.

LenderKit combines software expertise with custom development services to help investment companies create crowdfunding platforms and work with project owners and investors on a scale.

The software comes with a set of readily available features that allow businesses to launch an investment platform in the USA, Europe, the UK, or the MENA region.

There are 3 major white-label crowdfunding and investment software packages available to choose from – Basic, Pro and Enterprise that fit different businesses at various stages of development.

The pricing depends on the selected subscription package as well as the level of customizations needed to ensure the platform fits your requirements and has all of the necessary third-parties to run your online investment platform.

CrowdEngine

CrowdEngine is a US-based alternative investment software provider launched in 2014. The company focuses on offering all types of all-in-one investment marketing and capital-raising solutions. These solutions are fully customizable so that clients can use or make any design, workflow, or custom dashboard.

Crowdengine offers many features including built-in dashboards, analytics and reporting, deal management, third-party integrations and functions that one may need.

The compliance engine supports all major US regulations such as Reg A, Reg CF, Reg D, and most state crowdfunding laws.

FundraisingScript

FundraisingScript is an Indian-based investment-based crowdfunding software provider launched in 2011. The company is helping its clients to build full-fledged user-friendly state-of-the-art websites with all the necessary third-party integrations. The solutions are cost-efficient, can be customized to match the client branding, and come with built-in regulatory compliance features.

Investment Portals

If you are a fundraiser seeking funding and want to work with your own pool of investors, an investment portal is your best choice. Here are some investment portals you may choose from.

DealMaker

DealMaker is a cloud-based company that helps growing companies raise funds by offering hosting and management services and inviting investors to deals.

DealMaker assists companies in need of funds to launch their deals, manage, and close them. The portal also helps with inviting investors and handling all the paperwork.

SyndicationPro

SyndicationPro is one of the most efficient real estate fundraising software that provides syndicators with all the needed tools to raise capital and manage investors in a single place. SyndicationPro offers its clients a robust CRM, investment management portal, and investors portal, thus allowing them to launch an investment portal and start raising funds in minutes.

Investment Management Software

These solutions are similar to those offered by investment-based crowdfunding software providers. The major difference between this software type and the previously mentioned one is the management capabilities, advanced reports, triggers and task management.

Katipult

Katipult is a cloud-based infrastructure that helps investors, private equity funds, and wealth management firms to handle private equity deals faster and more efficiently. It brings together investors, investment advisors, and compliance specialists on one platform to handle deals easily.

Since its launch, Katipult has managed over 3,500 deals and raised over $4 bln.

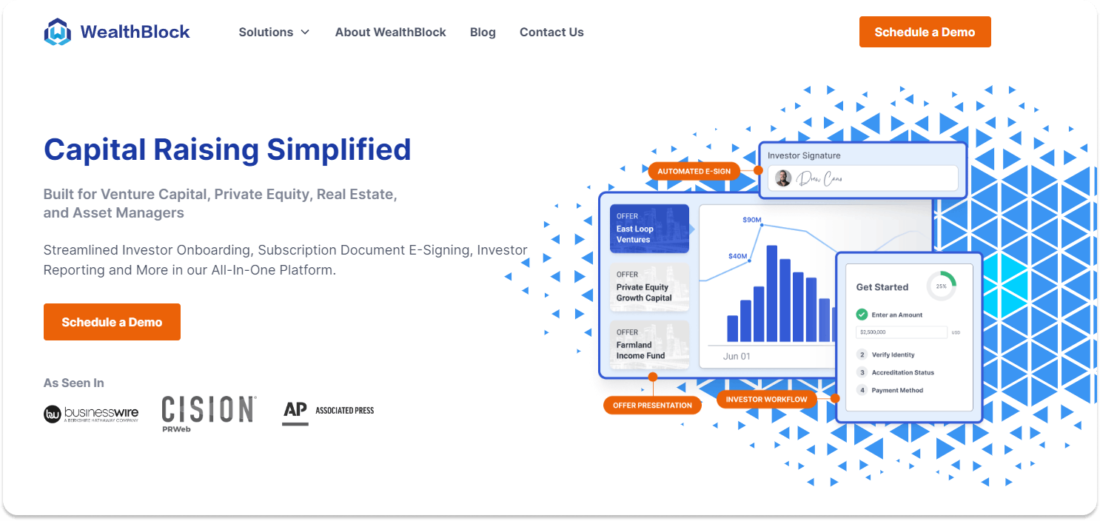

WealthBlock

WealthBlock is a white-label investment platform that offers all solutions to help private fund managers handle deals in venture capital, real estate, private equity, and asset management.

It allows to digitize investor onboarding, automate subscription documents E-signing, create investor dashboards, statements and reports, streamline deal management, investor onboarding and reporting, and portfolio updates.

The platform offers a 30-day money-back guarantee, if the subscription is canceled within this period, the platform issues a full refund.

Portfolio Investment Software

Portfolio investment software providers offer solutions that facilitate investor search and onboarding as well as offer features to monitor and manage investment portfolios ensuring their top performance and compliance with legislation.

If you are managing an investment portfolio, you may want to look at the following solutions.

eFront

eFront is a cloud-based platform that helps funds in the management of their operations by offering tools for:

- reporting

- accounting

- asset servicing

- fund administration.

The platform also provides a portal where investees can collect data directly from portfolio companies, store it for future activities, and display this data to ensure transparency among shareholders.

DynamoSoftware

DynamoSoftware is an end-to-end cloud-based platform that provides industry-tailored solutions for investment management, data management and reporting. The platform assists fund administrators, endowments, foundations, pension funds, VC funds, real estate investment firms, funds of funds, family offices, and similar businesses to increase the productivity of deals, manage their investments, and be fully compliant with the legislation.

Real Estate CRM Software

Real estate CRM software is the best choice for real estate development companies to manage tenants, investors and projects. It’s mostly used for daily operations management, marketing and communication.

Ascendix

Ascendix is an advanced marketplace for property listing and deal rooms. It offers:

- A property listing portal to market all listings

- A brochure and report generation tool

- Secure deal and collaboration rooms

- Robust SalesForce and AscendixRE CRM integrations

- A document storage space

- An email marketing tool.

Users can also browse and use filters to pick and check the best properties and request additional information about the available listings. They can also draw a map to find a property within the selected area or locate the property on a map by using a satellite view.

DoorLoop

DoorLoop is a property management software that helps to manage, grow, and automate properties in over 100 countries. It helps property owners and managers automate rent collection, run custom reports, track all cash flows, handle maintenance requests and vendors, find new tenants or owners, fill vacancies in record time, and perform all other actions connected to property management.

It allows keeping property owners and investors happy with a special owner portal, distributions, reports, and transparency.

Final thoughts

Choosing the investment software vendor to start your online business is a complicated task. At some point you may even want to consider choosing between building your own investment platform vs using ready-made investment software solution.

At LenderKit, we offer a ready-made solution with potential for customizability and development, so don’t hesitate to reach out to us to discuss your project idea and see what we can provide.