Overview of the Crowdfunding in UK: Regulations, Platforms, Trends

No time to read? Let AI give you a quick summary of this article.

The crowdfunding industry in the UK has been developing for almost 10 years. It has evolved from simple donations and rewards to advanced models shaping the rest of the world.

In 2012, Tim Breedon published the Breedon Report1 where he was calling on the UK government 2to bridge the gap of £59bn in funding SMEs by 2016.

Right at that moment CrowdCube and Seedrs appeared on the landscape.

4 years later the alternative finance market size in the UK reached the point of $6.8bn3 generating 57% of the total alternative finance volume.

For a couple of years, the UK became the leader in crowdfunding with the strongest regulatory framework.

This article presents the diverse and vibrant crowdfunding for business in UK and provides a brief overview of the market trends, major players and regulations.

What you will learn in this post:

Crowdfunding in the UK: the past, COVID-19 and perspectives

The impact of the coronavirus pandemic on business has outperformed even the global financial crisis (GFC).

The entire industries such as travelling and hospitality were frozen. Investment crowdfunding wasn’t an exception.

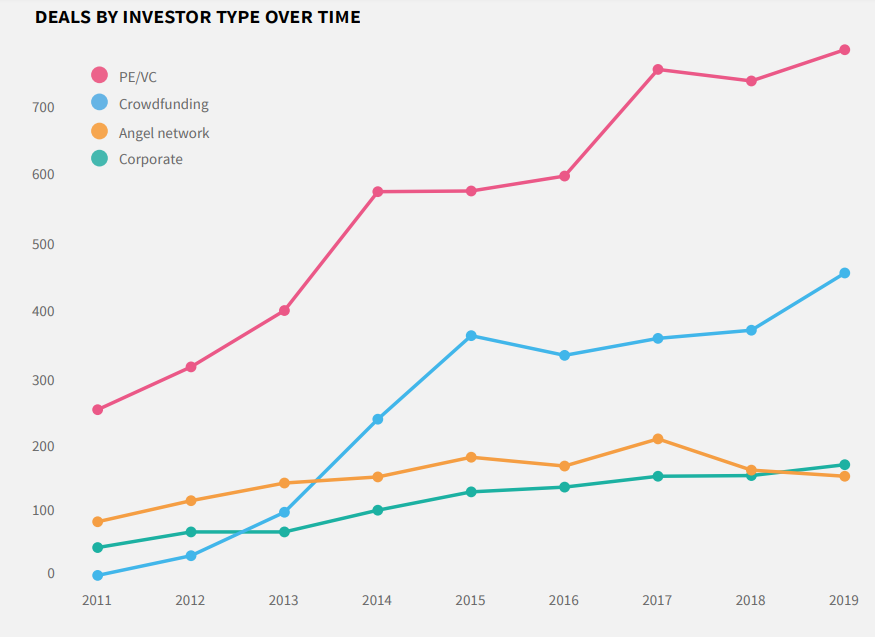

The previous years (2018-2019) were record-breaking for crowdfunding platforms in the UK:

- the fundraising providers remained one of the most active investors alongside private equity firms and venture capitalists;

- 2019 was the busiest year on record for these platforms, with 424 deals by UK companies involving crowdfunding platforms4;

- the UK occupied 67.7% of the global crowdfunding market;

- the largest alternative finance model in the UK was P2P business lending accounted for $2.5 billion in 20185;

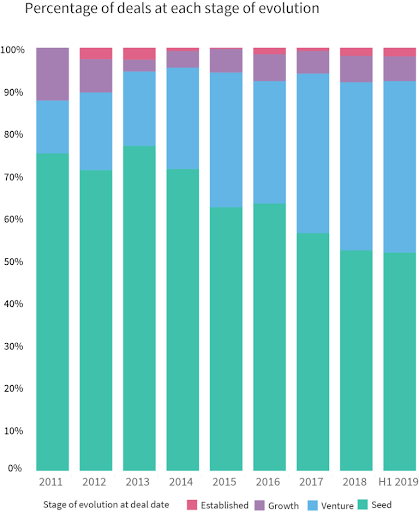

- the majority of crowdfunding deals were into early Seed-stage companies;

- Fintech and AI were gaining momentum with a growing number of deals (14 and 10 deals respectively6);

- during 2019, Seedrs was recognized to be the most active UK investor;

- despite the digital nature, the majority of investments were made into London-based entrepreneurs and their ideas;

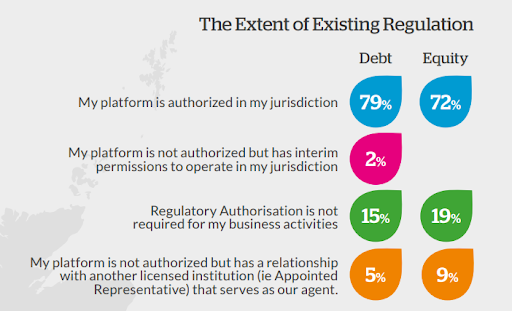

- almost all the platforms were authorized by FCA: 79% of crowdlending providers and 72% of investment crowdfunding companies.

So, long story short, the local crowdfunding market was booming with a prevailing number of p2p lending platforms and investments in early-stage companies.

In its report, Beauhurst published the predictions7 made by top managers and co-founders of Seedrs8, Crowdcube9, and SyndicateRoom10 for this year.

Seedrs was going to become a full-scale platform for investing in private companies. Crowdcube contemplated the idea of changing the focus to sustainability, insurtech, legaltech, healthtech and edtech projects.

SyndicateRoom planned to continue investing via their new fund Access EIS and become “early backer of every single future British unicorn”.

How did crowdfunding platforms perform during the pandemic? If it wasn’t the global lockdown, each would achieve the goal.

In July, Crowdfund Insider11 reported about the 15% decline in the FinTech sector during Q2 2020.

During Apr-Jun, £57m was raised via investment crowdfunding. To compare, in Q2 2019, this number was £112m.

Seedrs reported a decline in the community funding while Crowdcube didn’t reach the target volume of pitches launched on the platform.

Notably, although the crowdfunding volume has dropped, the number of active investors has grown. Staying at home, people continued supporting projects such as Freetrade12 and the Cheeky Panda13.Freetrade, the smart app for private investments, managed to raise €7.8 million from more than 8,000 people less than in a week. And all this happened amid the COVID-19 outbreak!

How are crowdfunding platforms combating the coronavirus impact?

Seedrs has launched online pitching events. Crowdcube provided businesses with quicker access to funds. Crowd2Fund relaunched platform with new credit model and website.

Funding Circle introduced a set of new measures to overcome the financial crisis, in particular:

- risk monitoring enhancement;

- collections and recovery capability improvements;

- advanced resilient portfolios.

Despite the negative trend, providers see positive changes in the industry landscape, which may turn the market upside.

These changes mainly refer to the growing popularity of forward-looking projects and backers who are ready to support innovation.

Top UK crowdfunding fundraisers: who runs the show

P2PMarketData constantly updates the list of top p2p lending and equity funding platforms14.

We’ve selected a few operating in different niches.

Funding Circle UK15

Funding Circle is the leading originator of small business loans on behalf of retail investors and other financial institutions. The company’s market share is 38.37% with £6.2b lent to businesses and 57,000 borrowers.

The company offers unsecured business loans from £50,001 up to £500,000. To help clients cope with the outbreak, Funding Circle launched the Coronavirus Loan Scheme (CBILS)16 with affordable rates (1.8%-7.4% APR) and no upfront or early settlement fees.

Zopa17

Being the oldest market player, Zopa had evolved from the first p2p lending portal to a new digital bank18. Now the company offers a wide range of products: from personal loans and credit cards to car finance.

Lenders can take an advantage of the Innovative Finance ISA scheme with projected returns between 2.3 – 5.6%, free taxes up to £20,000 and easy transfers from existing ISAs.

CrowdProperty19

Before the crisis, crowdfunding for property in UK was developing at a breakneck speed. Alongside other companies, CrowdProperty helps professional property developers survive during hard times.

Borrowers choose between funding proposals (development finance, refurbishment finance, bridging finance, development exit finance and auction finance) or can request a blended offering.

For backers, there are several investment options (standard lending, tax-free IFISAs, pensions lending and auto-invest). The last option is for those interested in maximum money diversification and reduced concentration risk.

Capital Rise20

It’s another property investment platform from The Foggy Albion. CapitalRise raise funds for UK property professionals at a minimum investment at £1,000 through equity- and debt-based investments.

It works with a large range of real estate types; residential, commercial, industrial, self-storage, hospitality, and retail.

From launch in 2016 up to August 2020, the provider managed to originate loan facilities for £87m and repay £29m of invested capital and returns.

By the way, CapitalRise is an ongoing JustCoded’s project. Our initial objective was to build a robust back-end and a user-friendly front-end of the platform integrated with several third-party solutions. Now we help the company update and extend the platform functionality.

Got interested in how to build a website like CapitalRise? Check our guides on the crowdfunding business costs and crowdfunding software in UK.

Seedrs21

Seedrs is one of the equity-based crowdfunding startups enabling all types of investors to invest in businesses.

Backers can take part in equity, fund or convertible campaigns22 launched via Seedrs. Equity campaigns are the simplest way to get started with Seedrs. You select a project and support it. If it hits the target, you become a shareholder.

For those who don’t want to put all the eggs in one basket, there are fund campaigns. Investors seeking instant opportunities opt for convertible schemes with the ability to donate today and convert investments into equity.

FCA’s regulation for crowdfunding: how to enter the market

Every provider of p2p and equity crowdfunding in UK must meet the FCA’s requirements.

The body has detailed guides on laws and rules for both niches23, check them if you’re planning to enter the market.

Regulatory framework for crowdlending in the UK:

- authorization by FCA and other permissions, depending upon the activities the provider undertakes;

- minimum capital requirements: €50,000 or a percentage of loaned funds;

- ability to provide all types of loans (p2p, p2b, secured and unsecured loans);

- no max amounts for loans and investments;

- full disclosure of information requirements & risk warnings;

- obligation to follow KYC rules;

- business continuity requirements.

Summary of rules for crowd investing:

- platforms should work only with clients who meet certain criteria (high net worth or sophisticated investors, backers who confirm they will take regulated advice or invest less than 10% of their net assets in certain security);

- obligation to run appropriateness assessment.

Resume

Despite the negative impact of the global outbreak, the UK remains the largest P2P lending and equity crowdfunding market in the European region:

- The market is mature and saturated, p2p lending platforms raising seed capital for startups dominate over equity-based crowdfunding companies.

- FCA is the main regulator of debt-based and investment crowdfunding relations; it doesn’t control the activity of rewards and donations.

- Real estate fundraising is a fast-developing niche with advanced forms and models.

- New trends in UK crowdfunding – support of AI, insurtech, legaltech, healthtech and sustainable development.

If you’re looking for a crowdfunding software provider in London, UK, or in Europe, check out LenderKit.

Article sources:

- Improving business access to finance - GOV.UK

- Crowdfunding: A brief history

- Alternative finance market by region in Europe 2020| Statista

- PDF (https://www.beauhurst.com/wp-content/uploads/2020/02/The-Deal-2019_WEB.pdf?ut...)

- PDF (https://www.jbs.cam.ac.uk/wp-content/uploads/2020/08/2020-04-22-ccaf-global-a...)

- The UK crowd funding landscape in 2019 so far | Beauhurst

- We asked 3 experts what lies ahead for crowdfunding | Beauhurst

- Invest online in startups via equity crowdfunding | Republic Europe

- Just a moment...

- Invest smarter and gain access to EIS and SEIS tax relief | SyndicateRoom

- UK Report Claims Investment Crowdfunding Declined By 15% In Q2 But More Investors Are Backing Early Stage Firms | Crowdfund Insider

- Stock trading (zero commission) & investment app | Freetrade

- Cheeky Panda Bamboo Toilet Paper, Join the Bamboo Revolution

- Alternative Investment Statistics | P2PMarketData

- Fast, Affordable Small Business Finance

- CBILS Loans | This Scheme Is Now Closed

- Zopa | Easy banking - current accounts, loans & savings

- Zopa launches new digital bank, offering consumers a compelling alternative when they need it most

- Reliable Property Development Finance | CrowdProperty

- Property Investment in London and the Home Counties | CapitalRise | CapitalRise

- Sign Up To Invest

- Types of Campaigns | Republic Europe Help Center

- PDF (https://www.fca.org.uk/publication/policy/ps19-14.pdf)