Crowdfunding API: How it Works

There are several types of Crowdfunding APIs that are available on the market. Some of them are made for clients, while others are documented for the API providers themselves aka for “internal use.”

In the first scenario, crowdfunding API is used to build or modify a crowdfunding platform by the end customer such as an investment company that is launching its own marketplace.

And in the second scenario, a crowdfunding platform development agency has made an API available for third-party service providers like payment gateways and identity verification companies.

What you will learn in this post:

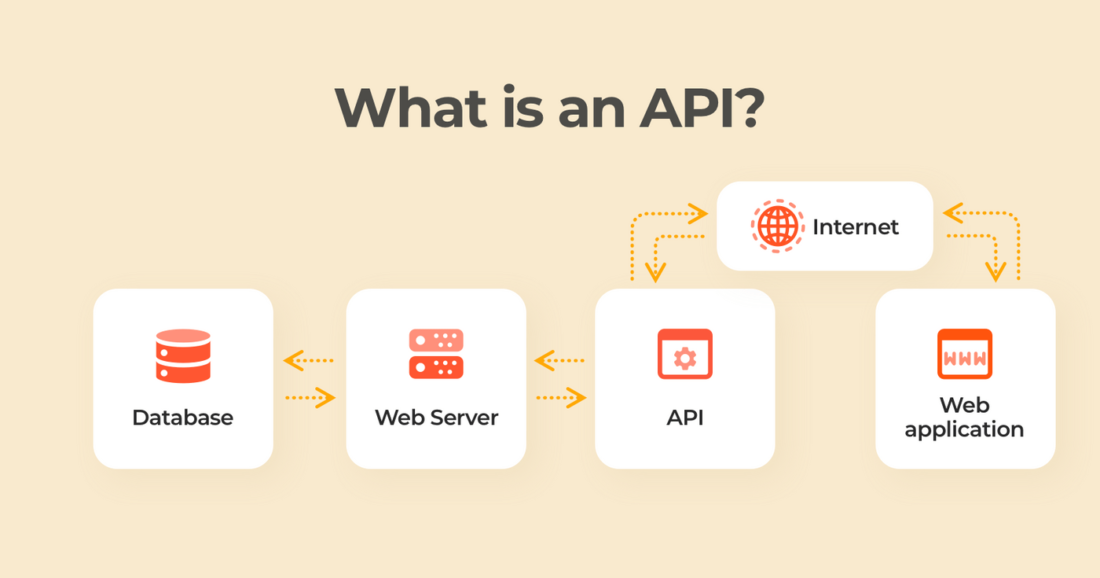

What is a crowdfunding API?

A crowdfunding API can be used to either create a new crowdfunding platform or complement an already existing platform with the required functions, or add a customizable crowdfunding tool to an application.

Crowdfunding APIs for clients

Crowdfunding API providers like Thrinacia or FundraisingScript may be interesting for CTOs or developers working on a crowdfunding platform’s front-end, because the back-end is usually accessible by the provider only.

With this type of an API you pay a subscription to get access to the standard crowdfunding flows like user registration, campaign creation, money processing, payouts, etc.

These crowdfunding APIs are suitable for a particular jurisdiction which they focus on, however, some may probably be modified depending on the crowdfunding software agency’s business model.

One thing that makes such providers stand out is the ability to customize web pages and certain functionality that is run on the front-end. You can hire external crowdfunding freelancers or even a crowdfunding website development agency to build your platform further.

Crowdfunding solutions like these are suitable for early-stage businesses, one-time and regular fundraisers who have the audience but don’t want to pay expensive fees to the crowdfunding platforms.

Crowdfunding API providers ensure the entire workflow that involves the investors and companies interacting with the crowdfunding portal.

Campaigns

A fundraiser can create a new campaign upon providing the following information:

- Company ID

- The name and the description of the new campaign

- Target amount, minimum and maximum, if available

- Currency

- The campaign close date

Further, the campaign creator can update the campaign, manage, close it, finalize a successful or an unsuccessful campaign, or cancel a fundraising campaign.

Investors

A potential investor can register as an investor by providing:

- Name, surname, and business name if available

- Fiscal code

- Investor type

- Address, along with the postal code, city, and country

- Email and phone

- Attach documents and agree to risk notices

Every investor is represented by an independent object and has its own data field. The fundamental distinction between investors is in their type: a physical investor who is an individual, or a company which is a legal entity.

Orders

An order is one of the main concepts in crowdfunding. In the crowdfunding API kit, an order is a representation of the actual “subscription order” which is placed by an investor on the crowdinvesting portal.

An order is created upon providing the following information:

- Investor ID, Campaign ID, and Company ID

- Investor Account

- Order amount (the number of shares the investor will receive if the campaign is successful), order description

- Item price per unit, quantity of items.

Once submitted, this data cannot be changed.

Once an order is created, it can be managed directly from the platform. The order management involves the following steps:

For PUT orders:

Waiting – when the investor confirms that they will send the money (this is a typical step to follow if it requires some time for the funds to arrive, for example, if the funds are sent via bank transfer).

Failed – if the transaction authorization is refused. The system discards any money-in flow related to that order.

Canceled – this operation is called when the order is declared null. Order cancellation has regulatory effects and can be performed only in accordance with regulation. After the order cancellation, all the funds are returned to the investor, and the operation cannot be undone.

For GET orders:

Created – when the order is created

Waiting – when the order is confirmed but the funds were not accounted

Accounted – the order is accounted

Splitted – the order is placed in the company’s account

Incorrect amount – the order is paid with an incorrect amount

Failed – the order is failed

Expired – the order has expired.

Order Payments

This component is responsible for the actual payments associated with an order. Here, the following components are distinguished:

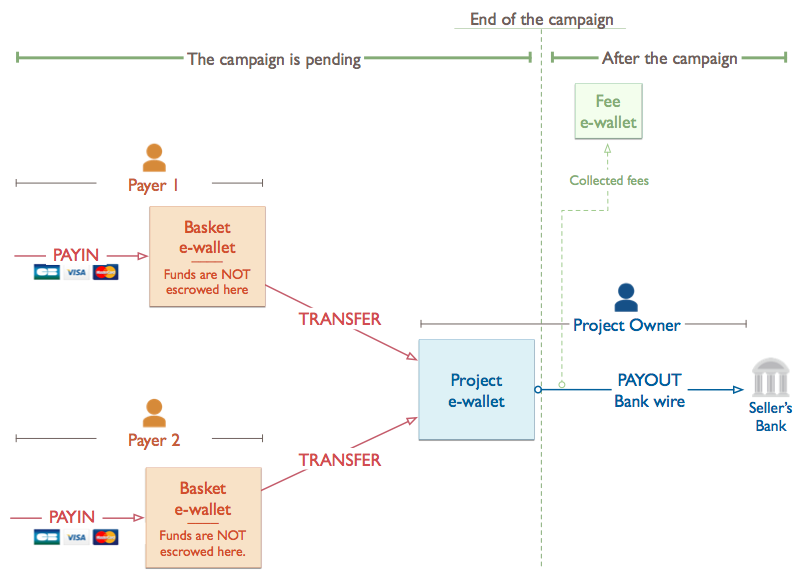

Moneyins – the reception of money from an investor via a specific channel. Here, the platform shall interact with crowdfunding payment gateway APIs.

Moneyouts – the internal money flow associated with the order. The money received from an investor is transferred to the account associated with the campaign, and fees are transferred to a fee collection account.

Refunds

Refunds cannot be created explicitly. They are created automatically by a system in the following cases:

- When an accounted order is canceled by the order creator.

- When a crowdfunding campaign is unsuccessful, it is finalized, and the funds are refunded to investors.

Refunds are performed via the related moneyin channel. For example, if the payment was made via a bank card, the refund will be processed to the same bank card. If the payment was made via a transfer, the refund will be processed via a bank transfer, too.

Such API kits are normally offered by development companies to their clients. The available solution can be further customized to match the business image.

Crowdfunding APIs for internal use

The companies that offer custom crowdfunding software solutions normally do not offer an extensive API kit for the clients.

Instead, they have use-specific API solutions that differ from one platform to another.

Such APIs can be used by developers or other businesses that want to integrate some functions on their websites or platforms.

The most common Rest APIs enable multiple functions and services such as:

- Micro-banking, insurance, and investment services and automate data-sharing with any third-party application such as a Payment Gateway or KYC solution

- Provides an end to end server side application that supports the technical back office requirements for client-side applications

- Contains private financial back office functions

- Provides functionality for investor onboarding and registering, and so on

So, these APIs, even though they exist and look the same as the APIs for clients, are not the same. Because these crowdfunding APIs are used by the crowdfunding platform development agency itself or by third-party service providers.

How to build your investment crowdfunding platform?

So, when building your own crowdfunding website, you have several options:

You can do it from scratch — hire specialists to develop the entire platform’s functionality, implement the required integrations, complete all the registration procedures and ensure the legal compliance of all the processes.

You can subscribe to a crowdfunding API kit to develop a simple crowdfunding marketplace or a “one-time” fundraiser page.

Alternatively, you can rely on the expertise of existing crowdfunding software providers such as LenderKit, white-label investment software with full front-end and back-end customization will help you reduce the time, costs to build and facilitate your compliance with regulatory requirements.