From Vision to Action: Crowdfunding for Social Impact

No time to read? Let AI give you a quick summary of this article.

Impact investing challenges the traditional belief that social and environmental issues should be addressed solely through philanthropic donations, while market investments should focus exclusively on financial returns. The impact crowdinvesting market provides investors with diverse opportunities to earn income while also helping to solve social and environmental problems.

What you will learn in this post:

Overview of crowdfunding for social impact

Social impact crowdinvesting is an approach that seeks to generate positive social impact along with financial returns. It targets the capital toward business models that aim to contribute to solutions to the world’s societal challenges, improve lives, and address environmental problems.

There is no clear standard for assessing social impact investment. In most cases, projects and investors are guided by the Sustainable Development Goals 1(SDGs) determined by the United Nations.

This is a framework to address global challenges in a way that recognizes the connection between social and environmental challenges.

Impact investment ROI analysis

Even though it is believed that social impact investments are not really about generating a profit, statistics show that this belief is far from the truth. Impact investors have different expectations regarding the potential of financial return. Some intentionally invest in projects that typically deliver below-market-rate returns if such investments match their strategic objectives. Others pursue projects that may deliver competitive or high returns.

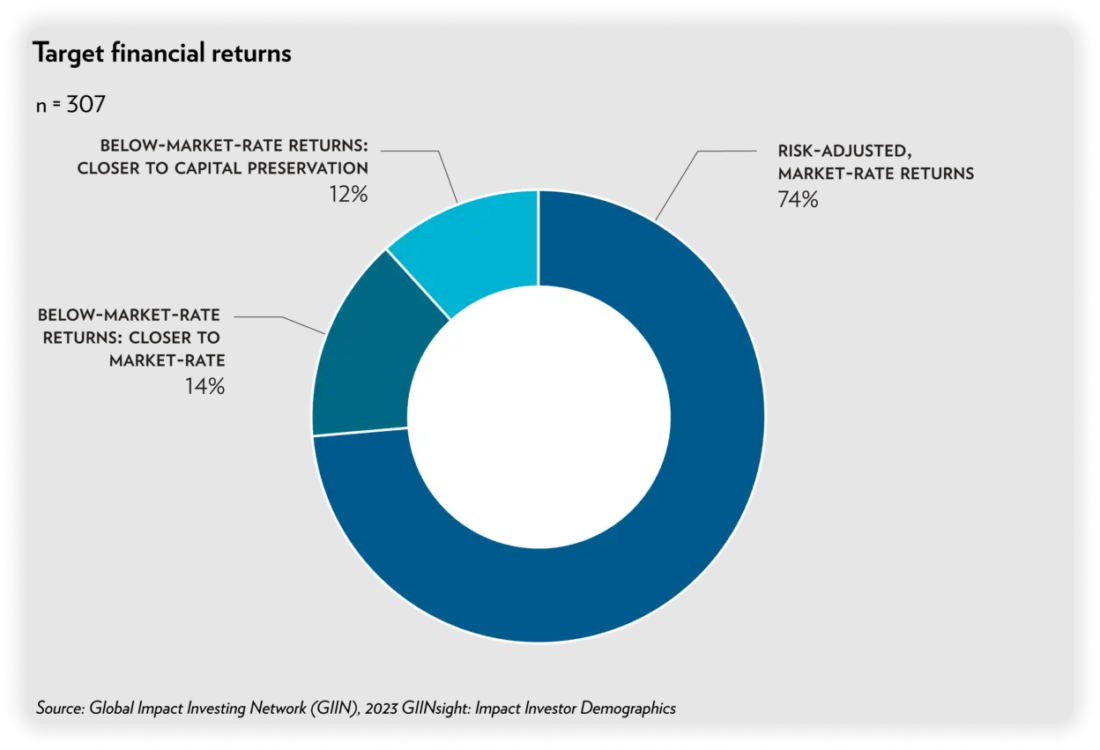

Most investors questioned in 20232 said they received market-rate returns on investment (74%). 14% of investors received below-market-rate returns close to market rate, and only 12% received below-market-rate returns closer to capital preservation.

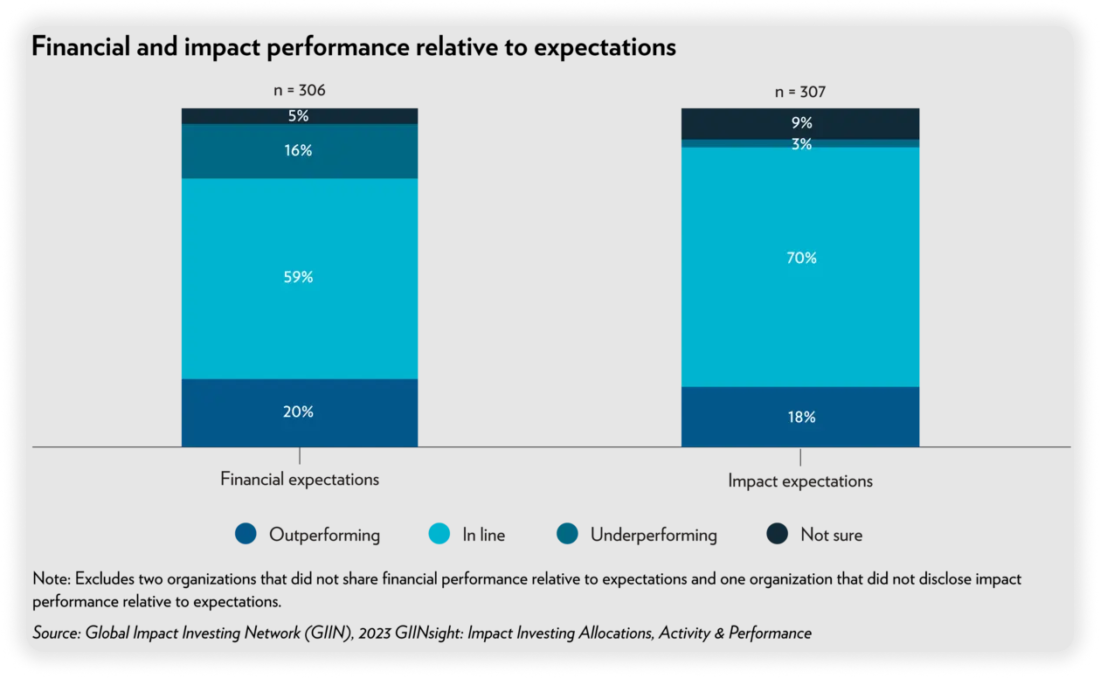

They also noted that the performance of their portfolios meets or exceeds expectations for both social and environmental impact and financial return, with investments expanding to emerging markets.

In Europe, there are several initiatives aimed at supporting social impact projects, investors, and platforms that facilitate fundraising processes. So, the European Social Innovation and Impact Fund3 was created to support the ramp-up of early-stage social enterprises. Its central mission is to provide financial support for micro-, small-, and medium-sized businesses by helping them access finance. European Investment Fund (EIF)4 offers support to the emerging sector of intermediaries that focus on activities to achieve social impact. EIF implements the following tools in this field:

Social Impact Accelerator (SIA)5: it operates as a fund of funds and invests in social impact funds that target social enterprises across Europe.

EFSI Equity Instrument6: It makes available additional resources to support initiatives in a variety of fields including impact investing.

Top social impact crowdinvesting platforms

Here are the leading social impact crowdfunding platforms that connect investors with projects aimed at making a positive difference.

The Impact Crowd

The Impact Crowd7 is an investment-based crowdfunding platform registered with the SEC and is a member of FINRA.

It brings individual investors together to support entities and businesses aligned with ESG (environmental, social, and governance) and environmental principles. The platform hosts a diverse range of offerings and allows all types of individual investors to participate.

For a business to be eligible to seek funding, it shall demonstrate how it meets at least one of the criteria and state the positive impact intended by the business.

Investors can start with investing as little as $100. The investor gets the financial securities such as shares of stock, debt, or another form of equity in the business.

La Bolsa Social

La Bolsa Social8 is the first social impact investment platform in Spain. The platform was launched in 2014 and since then, it has offered investors an opportunity to lend funds to businesses seeking to make a positive social impact. One can start investing with EUR 50, and the expected return is about 8%. Another option is to become a shareholder in one of the projects.

Non-accredited investors are permitted to invest not more than EUR 3,000 per project, and not more than EUR 10,000 per year. Accredited investors are not limited in the sums of their investments.

Projects that achieve their fundraising goal pay a fee of up to 6% of the sum raised, and further, they pay a yearly fee of EUR 500 for five years. If the funding goal is not achieved, the project will only pay a EUR 1000 fee for publishing the campaign.

Trine

Trine9 is a Swedish crowdinvesting platform launched in 2015. It allows individual investors to invest in solar energy in growing markets thus allowing companies to scale to provide stable and clean energy to communities, and investors to get a profit. The minimum investment is only EUR 25, and some investments come with different types of investor protection. The investment protection allows investors to get up to 50% of their investments if a borrower defaults on a loan.

New investors can get their first investment guaranteed at EUR 100 as long as other guarantees don’t apply.

The average loan duration is 60 months, and with a network of over 14,000 investors, Trine has already ensured a total funding volume of over EUR 91 mln. The average return on investment is 6%.

LITA.co

LITA.co10 is a France-based social impact crowdinvesting platform that operates in France, Belgium, and Italy. With a minimum investment of EUR 100 and a network of more than 30,000 investors, the platform allows all to invest in companies with a positive environmental and social impact.

The platform was launched in 2014, and since then, it has ensured the financing of over EUR 150 mln for businesses in the social impact and environmental sectors. The advertised return varies from 2% to 11% and depends on the project and investment type. The platform offers crowdlending and crowd equity investment models.

LITA.co charges a 1-3% fee from the amount invested, no other fees are applied. The platform also offers reporting and provides tax certificates to benefit from tax deduction.

Goparity

Goparity11 is a Portuguese P2P lending platform that connects individual investors and companies with sustainable businesses for economic, social, and environmental impact. The platform was launched in 2017 and since then, it has helped businesses to get funding of over EUR 26 mln for development and scaling.

The minimum investment is just EUR 5, so practically anybody can invest and see the investment grow. The platform offers a EUR 5 bonus on the first investment for all new investors.

The average loan duration is 36.87 months, and the advertised return on investment is 5.44%. Registration, investing, and topping up the wallet do not imply any fees. Selling the investment on the secondary market has a fee of 1% on outstanding principal. For an immediate withdrawal of funds, the investor pays EUR 0.50, and for external confirmation of balances, a fee of EUR 25 is applied.

Projects pay a commission of 3% to 4.5% for loan processing, along with a loan servicing fee of 1%, and in case a loan is defaulted, the project covers all the costs incurred by the platform to recover the funds.

How to start a social impact crowdinvesting platform with LenderKit

If you are planning to launch a platform that connects investors with businesses working in the social impact sector, check out white-label crowdfunding software for social impact investing by LenderKit.

Our crowdinvesting software comes with a comprehensive set of readily available features which allows you to launch a prototype or a full scale investment platform right away. We also have all required third-party integrations for money processing, KYC/AML compliance, e-sign and more, so if they fit your market and business model, you save on building the integrations from scratch because you already have them in your platform.

Don’t hesitate to reach out to us and see how you can launch your social impact investing platform with LenderKit.

Article sources:

- THE 17 GOALS | Sustainable Development

- What you need to know about impact investing - The GIIN

- Press corner | European Commission

- Social Impact investing

- Page not found

- EFSI Equity instrument

- The Impact Crowd

- Bolsa Social: inversiones de impacto

- Trine

- Lita : investir dans les entreprises qui changent la société.

- Impact investing through crowdlending | Goparity