From Warehouses to Flex Spaces: An Industrial Real Estate Investment Platform Idea

No time to read? Let AI give you a quick summary of this article.

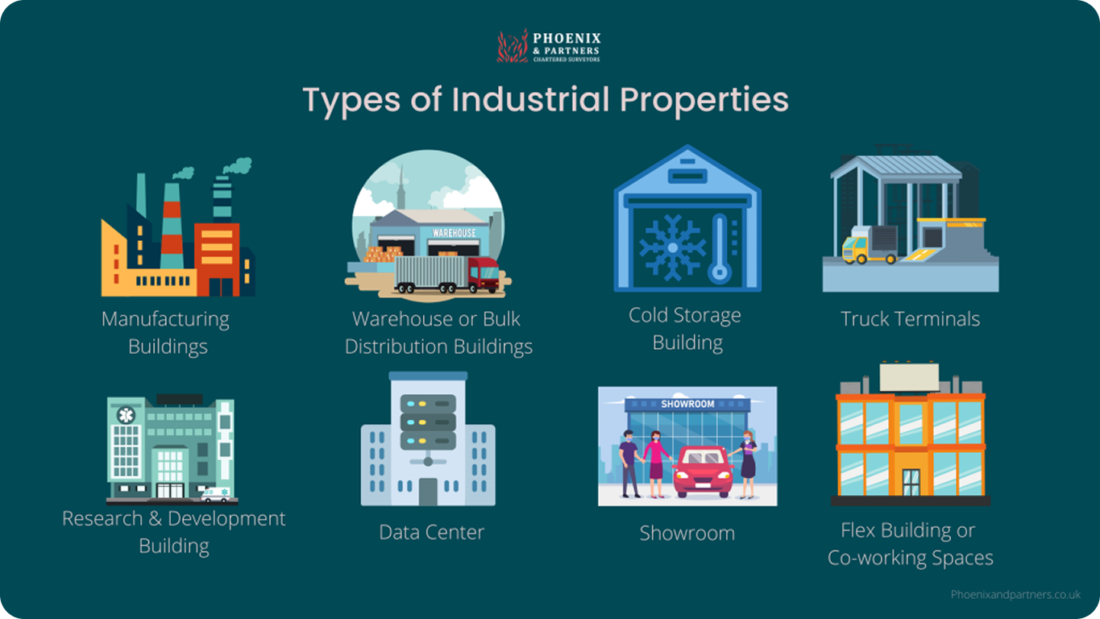

Industrial properties play a central role in modern commerce and generally fall into several categories:

- Manufacturing buildings

- Warehouses

- Research and development buildings

- Data centers

- Showrooms

- Flex buildings, etc.

Light manufacturing units and flex spaces combine office and production areas, offering versatility for small-scale production, research and development or showroom use.

Research and development facilities serve technology and biotech firms, providing adaptable lab or workshop areas alongside offices.

Heavy manufacturing properties support high-volume production with reinforced structures, power capacity, and specialized infrastructure for long-term industrial operations.

Warehouses and distribution centres function as logistics hubs, optimized for storage and bulk goods movement, forming the backbone of supply chains across multiple industries.

Growth in e‑commerce, the need for last‑mile logistics, and expanding digital infrastructure requirements drive sustained demand in industrial real estate.

Even though in the U.S., warehouse leasing activity (deal volume stagnated at roughly $22.9 billion2 in Q2 2025 and vacancy rates rose to 7.1%) slowed down, it’s a temporary pull‑back due to trade policy uncertainty rather than a structural decline. Data center demand is skyrocketing globally, particularly with AI adoption pushing infrastructure expansion.

CBRE reports3 that major institutional investors plan to increase capital deployment into European data-center real estate. The flex spaces market4 is expanding rapidly in Asia-Pacific markets like India, China, and Singapore.

For real estate investment and crowdfunding platform owners, these assets present an opportunity to tap into institutional‑grade property and deliver it in an accessible format for everyday investors.

What you will learn in this post:

Industrial real estate investment platform use cases

If you are planning to launch an industrial real estate investment platform, you should understand the market and the specific sectors in which there is growing demand. Here are some niche fields in which a crowdfunding platform may succeed.

Warehouses and logistics hubs

E‑commerce and supply chains need last‑mile logistics and distribution centers. Institutional investors like Goldman Sachs5 are pouring hundreds of millions into last‑mile warehouses in Australia alone, expecting expansion to billion‑dollar portfolios. A new platform could structure offerings around logistics‑oriented assets near major metropolitan zones.

Flex spaces

Flex spaces are small‑scale industrial units combined with light manufacturing or flexible office space. They serve SMEs and growing operations that need scalable, affordable space. In the USA only, vacancies for this segment are very low (around 3.4%)6, and the demand for them is growing, as are leasing prices. This is why industrial real estate investment platforms can delve into this sector to diversify their investment offerings.

Data centers and digital infrastructure

Data centres are now a critical digital infrastructure, and investors are keen. Bain and others forecast demand growth7 at ~16% CAGR through 2031 due to AI, cloud growth, and big data needs. Industrial real estate crowdfunding platforms that target digital infrastructure projects can attract institutional and accredited retail capital.

Top industrial property investment platforms

While many platforms offer mixed real estate deals, only a few specialize in commercial and industrial opportunities. Here are some of the most popular of them.

EquityMultiple

EquityMultiple is a leader in CRE crowdfunding. It offers access to industrial properties (warehouses, flex buildings), alongside offices, hotels, and residential assets. It co‑invests in every deal and has delivered historically strong returns (average IRR ~17% in fully realised deals) for accredited investors starting at about $5,000 minimum investments.

CrowdStreet

CrowdStreet8 is another major marketplace that focuses on commercial and industrial projects, such as offices, logistics centers, and multi‑family developments, with deal minimums more suitable for accredited investors (e.g., $25K).

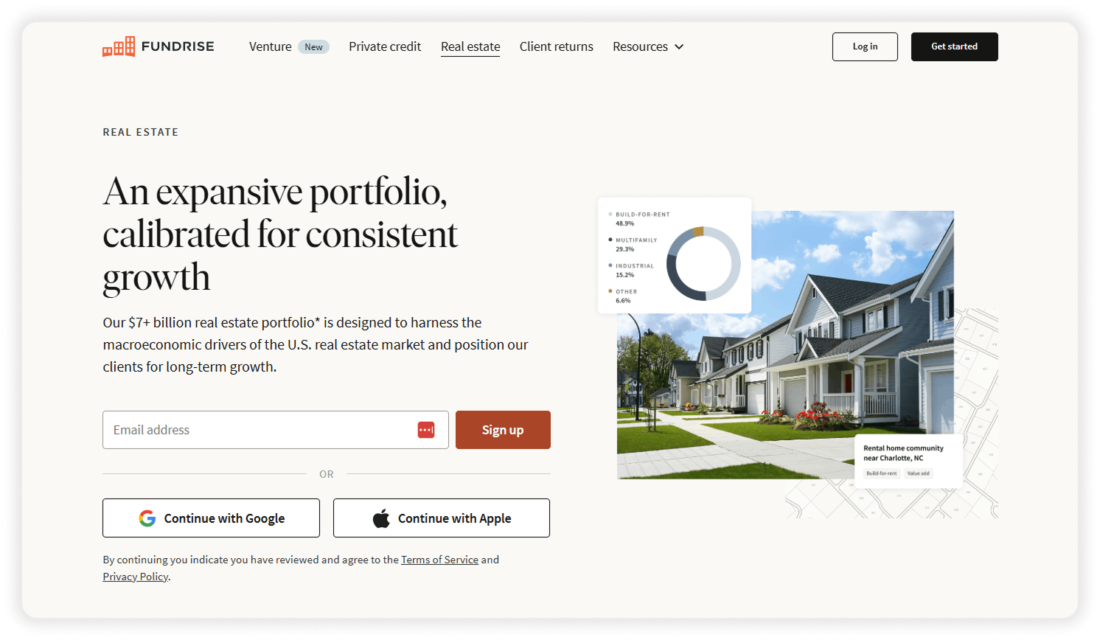

Fundrise

Fundrise9 provides more accessible access (including to industrial sectors) for non‑accredited investors via managed REITs and portfolios. However, investors aren’t offered an opportunity to pick individual industrial property deals directly.

These platforms confirm demand for industrial property investment via crowdfunding but also reveal a gap between retail (low‑minimum, fund‑based) and institutional‑style direct deal access.

Challenges to market entry as a new platform owner

Even though the industrial real estate market looks promising, platform owners shall understand clearly all the challenges that they will have to face. Here are the main of them.

Regulatory complexity

Platforms need to verify investor accreditation where required, follow KYC/AML procedures, and provide transparent disclosures.

Illiquidity

Industrial real estate is a long‑term asset and not easily sold. Platforms should make this clear upfront and consider solutions like secondary trading markets or defined hold periods to manage investor expectations.

Sponsor quality

Investor trust depends heavily on the sponsor’s track record and underwriting expertise. Co‑investment structures, where the sponsor invests alongside backers, plus full transparency, can significantly strengthen confidence.

Market cycles

Asset values in industrial real estate can fluctuate with shifts in supply and demand. Platforms can reduce volatility by diversifying portfolios across property types, sectors, and geographies.

Demand signals and market timing

Even with some global economic challenges, industrial real estate remains central to long‑term investment strategies. Short‑term issues, such as slower trade flows or a temporary rise in vacancies, do not change its solid long‑term benefits. Demand for both data centers and logistics facilities continues to be strong in most regions. The growth of e‑commerce, AI, and cloud infrastructure supports it.

Investors worldwide increasingly direct capital into industrial and digital infrastructure as part of broader alternative‑asset diversification strategies. This trend is supported by the rapid growth of the crowdfunding market, which is projected to expand from USD 15 billion in 2024 to USD 370 billion by 2033. These forecasts suggest now is a strong time to launch an industrial real estate crowdfunding platform.

How to launch an industrial real estate investment platform with LenderKit

Starting an industrial real estate investment platform begins with clarifying your investment model, regulatory framework and target investor profile. Will you cater to accredited investors under Regulation D or open the door to non‑accredited investors using Regulation CF or similar frameworks in your jurisdiction?

LenderKit supports multiple regulatory structures, making it easier to set up a base platform and connect investor verification, KYC/AML checks and payment processing modules needed for legally sound operations from the tech side.

Once your structure is defined, LenderKit’s white‑label crowdfunding software allows you to build a fully branded platform where investors can browse industrial real estate deals, review offering materials and commit capital.

The system includes both investor-facing features for seamless onboarding and a powerful back office for managing deals, monitoring investment progress, processing payouts and keeping all documentation in order. Automated workflows reduce manual work, while real‑time dashboards improve transparency and trust.

Marketing and deal flow are equally important. LenderKit can be integrated with external CRM and marketing tools so you can build a pipeline of investors and keep them engaged with relevant opportunities. You can segment your audience and match them to the right offerings.

With the projected surge in industrial and digital infrastructure demand, a well‑designed platform built on LenderKit can help you capture a share of this expanding market and offer investors access to institutional‑grade opportunities in an accessible, compliant format.

To find out details, please get in touch with our team.

Article sources:

- A Quick Guide To Industrial Leasing in the UK | Phoenix & Partners UK

- $22.9 billion

- CBRE reports

- The Rise of Flex Spaces in Corporate Real Estate

- Our company keeps high security standards and one of our security tools has flagged this request as potentially malicious.

- Small-Bay Industrial 2025 Trend Report: Micro-Flex Is Booming

- Data Center Infrastructure Market Experiences Growth of 10.20 billion by 2031 at CAGR of 16.1% | The Insight Partners

- - YouTube

- Invest in private assets like private credit