How to Launch a Private Investment Platform

No time to read? Let AI give you a quick summary of this article.

Developing a private investment platform is a smart move for firms that want to raise capital more efficiently, digitize their operations, tap into new markets and keep investors engaged.

A robust private investment platform will help your team:

- Present deals more effectively

- Streamline investor relations, communication and experience

- Establish brand trust

- Speed up and optimize routine tasks

- Provide a solid foundation for growth locally and internationally

The cost to create an investment platform usually falls between $100,000 – $400,000 and takes about 3-12 months to go live.

In this article, we will explore a high-level step-by-step process of how to launch an investment platform that meets 2026 standards and mitigates risks, private equity challenges and sets you for a smooth launch.

What you will learn in this post:

Choose your investment platform type

Before defining features or technology, it’s important to clarify what type of private investment platform you’re launching. Different investment strategies follow different fundraising models, investor expectations, and operational workflows.

The table below outlines the most common private investment platform concepts at a high level.

| Platform type | Typical use case | Key characteristics |

| Private equity | Closed-end funds investing in private companies | Capital commitments, capital calls, distributions, waterfall calculations, LP reporting |

| Venture capital | Early- and growth-stage company investments | Portfolio tracking, valuations, cap table visibility, LP communications |

| Private credit / debt | Loan-based investments and yield strategies | Interest schedules, repayments, predictable cash flows, income distributions |

| Real estate | Property-backed investments and syndications | Asset-level reporting, rental income, expenses, periodic distributions |

| Fund-of-funds | Allocation across multiple funds or strategies | Consolidated reporting, multi-layer transparency, allocation tracking |

| Regulated investment platforms | Reg D, Reg A+, or EU-regulated offerings | Investor eligibility checks, onboarding automation, disclosure management |

While these platform types differ in structure, they all rely on the same core foundation: compliant onboarding, secure investor access, transparent reporting, and scalable infrastructure.

Once you define your platform type and target investor profile, you can move forward with designing an MVP that matches your strategy and regulatory requirements.

In this article, we’ll use a private equity investment platform as a practical example to walk through the full process — from MVP definition to a fully operational platform. While the specifics may vary across investment models, the underlying principles and infrastructure apply broadly across private investment platforms.

Start with MVP requirements

A private equity platform is a versatile tool, so it’s easy to go crazy on it and start adding up features that will quickly drain your budget and demotivate further development.

It’s better to get started with a well-rounded MVP (minimum viable product) checklist which you could generate with ChatGPT or similar tools and further refine it with the help of an internal or external consultant.

The results that you’re gonna get this way will be the most generic advice in the world, but this is gonna be something. A list of requirements is what any IT development company will ask anyway, so you can come prepared.

An alternative approach would be checking out existing solutions and figuring out what they can offer and at what cost.

Private equity software providers have probably already outlined everything you need and even more. Of course, there’s a risk of purchasing the features that you don’t need, but it can give you a clear picture of what a market-ready solution may look like.

Normally, a private equity platform MVP should enable a manager to fundraise, onboard LPs (limited partners), execute capital calls and provide reporting.

So, here’s a quick checklist of private equity platform features that you may want to consider for your MVP:

- Investor dashboard

Provide investors and fund managers with access to investment data through the dedicated dashboards which may show commitment amounts, cash flows, IRR1, MOIC2, TVPI3 and NAV4.

You can consider using Anduin5 or Carta’s6 APIs for that. - Investor onboarding

Implementing a clear user registration and onboarding flow with modern identity verification tools like Passthrough7, Alloy8, Persona9, Jumio, iDenfy, etc. - Capital calls and payments

For the MVP you can start with manual initiation of capital calls, management of payment confirmations and payment tracking. If you have too many users, consider automating the process to avoid human error and streamline operations. - Document management

Enable document vaults for NDAs, LPAs, subscription agreements, sub-fund agreements and side letters.

You could automate document management with DocuSign10. - Reporting and analytics

Start with the basic functionality like PDF generation or CSV reports of the existing data or build real-time performance charts in your platform. - Administrative portal

Make sure the fund manager tools are available and can be used for communication, investor segmentation, permissions and distribution tracking.

All these tips will help you create a private equity platform MVP that delivers a clean experience and secure workflows from day one.

Budget for tech, marketing, team and compliance

When it comes to money talks, it’s hard to get a ballpark figure that would make sense and set up clear expectations, but you could research it to some extent and break it down into sections.

| Category | Budget range (USD) | Notes |

| Product development | $100,000 – $400,000 | The final cost depends on whether you choose a ready-made solution, a white-label software with some adjustments or a custom-made platform developed from scratch. |

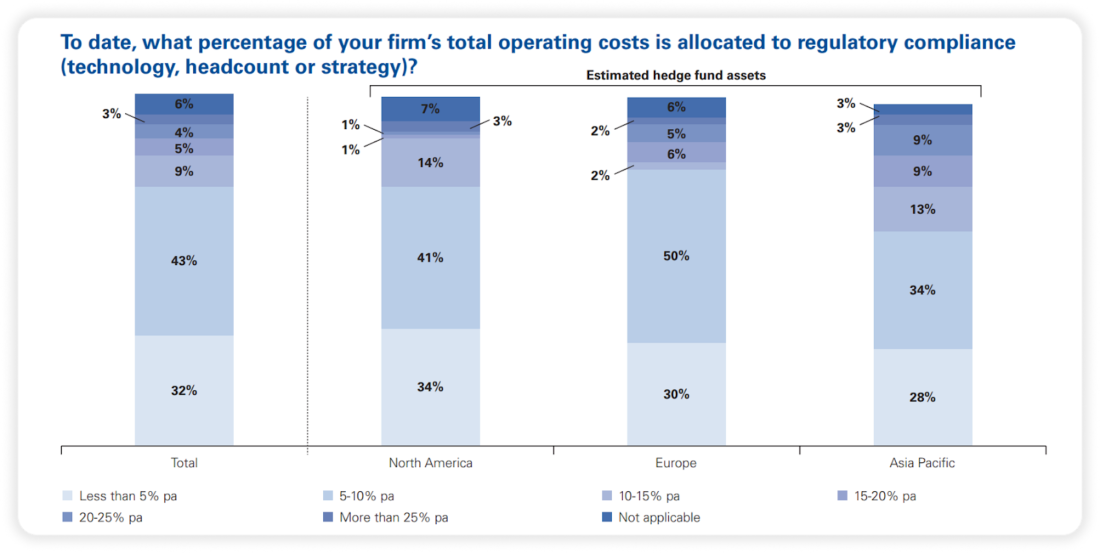

| Compliance & legal | 0.01% – 0.5% AUM10 – 25% management fees or operating budget | There’s a nice report by KPMG11 outlining the costs. Additionally, Apperio12 also wrote an insightful article on deal management costs. |

| Marketing & content | 9.49% annually13 | Content, SEO, LP outreach, events, PR |

| Security & infrastructure | 9.6% of your budget14 | Here, you calculate cloud costs, encryption, and SOC 215 among other expenses |

A rule of thumb is to add 10-20% of your planned budget for emergencies, such as regulatory snags, delays in implementing features, unexpected integration costs, etc.

Choose a private equity software provider or development firm

Spreadsheets are alright, but they may not provide real time analytics and proper automation. So, at some point, you may need to research a private equity software provider or hire developers to build a private equity platform.

If you opt for a custom-made platform, you have total control over everything: UX, features, database structure and so on. However, it will take more time, cost more, and require maintenance.

In contrast, white-label private equity software is brandable and requires no heavy engineering. However, it comes with ongoing license costs and potentially limited flexibility. This is why a white-label solution is good if you want a compliance-ready solution that works right away.

However, as the market of white-label solutions grows, there are more options available that provide the best of both worlds — custom-like flexibility and product readiness of a packaged solution.

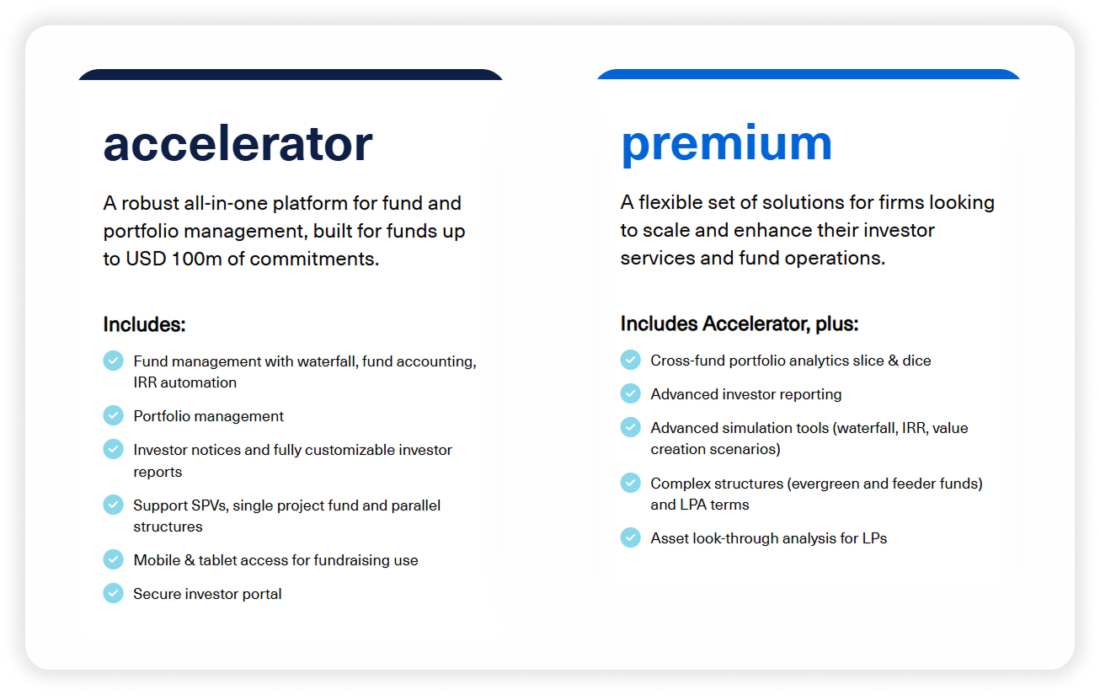

At LenderKit, we provide customisable white-label investment software for private equity companies, VCs, investment managers, crowdfunding firms and alternative finance businesses.

We have experience of launching fund of funds and private investment platforms by modifying our product to custom requirements and business needs. Here’s a quick overview of our offer and features:

For more information, don’t hesitate to reach out to us.

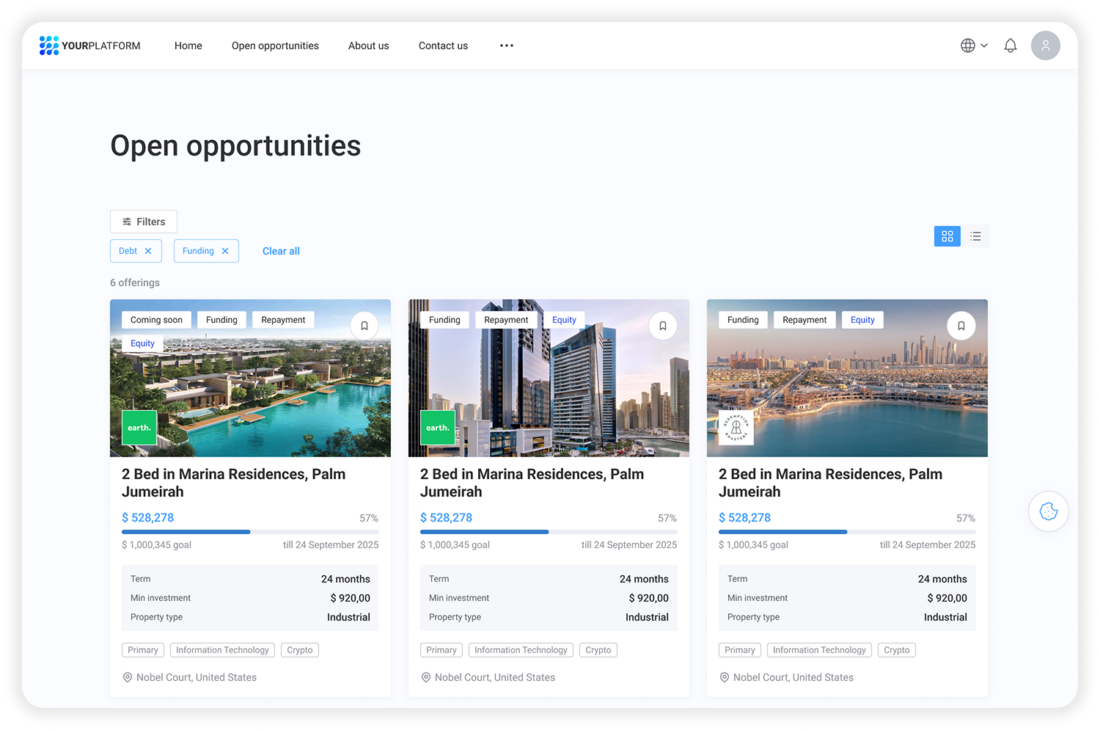

Build with investor UX in mind

Alright, so the next step is to build with the investor experience in mind. In 2025, users expect modern, responsive interfaces, ease of use, fast feedback and clarity. This is why a clean dashboard is one of the main priorities when building a private equity platform.

Here are some must-haves for your investor dashboard:

- Provides investment summaries per deal, shows cumulative commitment, unfunded capital and other investment-related data.

- Includes visuals such as timeline views for distributions and capital calls and dynamic charts.

- Offers individual investment-level detail such as projected returns with options to download CSV or PDFs.

- Comes with an embedded chat, request forms or support system for communication and issue resolution.

- Enables secure login and 2-factor authentication natively or with the help of integrations like Auth016.

Streamline onboarding, KYC, and document signing

Ensure seamless and secure onboarding, because investors may not tolerate multiple portals or disjointed verification.

Here are the main integrations that will help you build a streamlined onboarding, KYC and document signing process.

- For KYC & AML: Jumio, Alloy, Persona

- For document signing: DocuSign

- For accreditation verification: VerifyInvestor or Parallel Markets17

Additionally, consider adding private equity CRM tools

Automate capital calls, payments, and reporting

Private equity operations are complex, and manual capital calls and payment processing could work, you need to think about a scalable solution.

Automating payment processing, distributions and reporting will help you ensure accuracy and investors’ satisfaction.

- For payment flows: Modern Treasury18 or Stripe Treasury19

- For fund data and cap table management: Anduin or Carta

To automate capital calls, set up a call amount per investor along with the due date. The system will calculate pro rata amounts and send email notifications. The investor can then click a payment link via Stripe and pay immediately. Then, the platform updates the dashboard to show whether the amount is paid or not.

For distributions, the flow may look like this.

The investor requests distributions via the platform’s dashboard. The system calculates pro rata distribution, allocates amounts, and initiates payouts. Then, the automated NAV4 is updated and becomes visible to investors.

To make reporting easy, enable the generation of quarterly statements, waterfall outputs, and LP-level breakdowns. Make sure downloadable exports are available in XLS, CSV or PDF formats. Enable multi-currency accounting.

Keep your data safe — and know who has access

Security is no longer an optional feature. It is a requirement built into the foundation of any serious private equity platform. Regulators enforce strict data protection rules, while investors increasingly look for transparency and control over how their information is handled.

Start with ensuring data is encrypted, not just during transmission but always. From login to capital deployment, every user interaction must be shielded against tampering or interception.

Compliance frameworks such as SOC 2 Type II20 are expected. With it, the platform not only demonstrates audit readiness but proves that it maintains controls over system availability, processing integrity, confidentiality, and privacy. These controls shall be applied in operational practice. Session logging, user activity monitoring, and automated alerts form part of that operational layer and give teams visibility into who did what, and when.

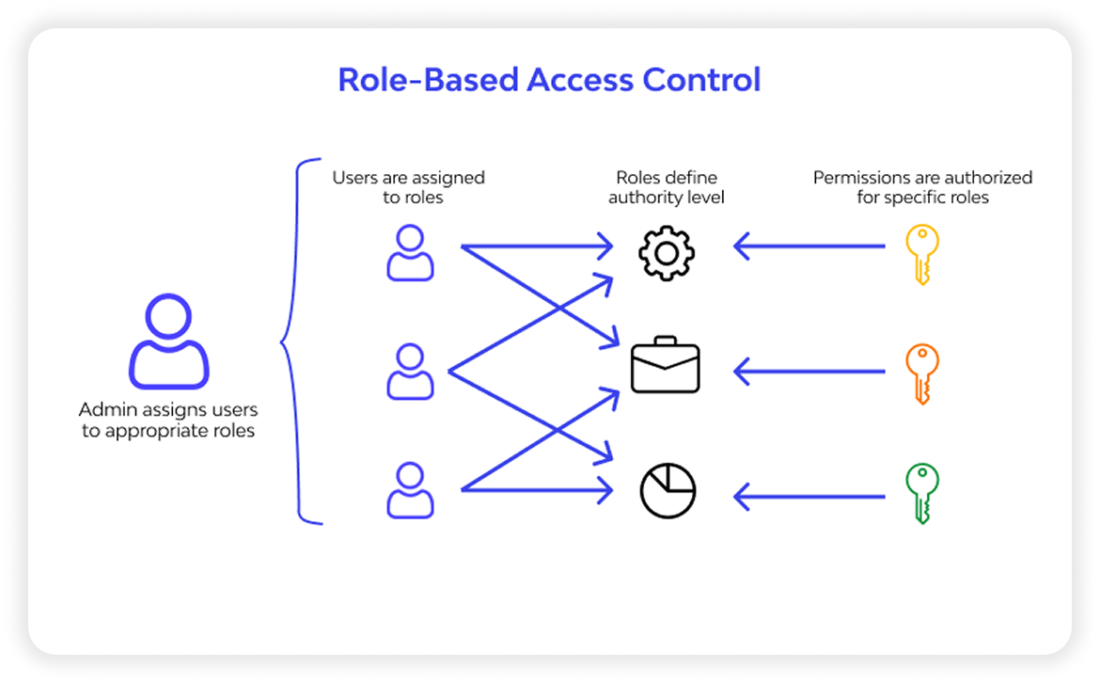

User access must be tightly governed.

Role-based access control (RBAC)21 ensures users are granted only the permissions appropriate to their role, whether they’re general partners, limited partners, fund administrators, or external auditors. This not only mitigates internal risk but is a mandatory requirement to be compliant with regulations, such as GDPR22 and CCPA23, where data minimization and user rights are core principles.

A platform must also document and report every key interaction. Audit logs should capture all login events, document views, capital commitments, and payment activities. These logs are crucial during security reviews or legal discovery and serve as evidence that the platform complies with industry standards.

To meet the expectations of institutional investors and regulators, security must also extend to infrastructure. This is why penetration testing conducted by certified third parties, secret management with tools such as HashiCorp Vault24 or AWS KMS25, and network isolation using virtual private clouds (VPCs) shall be a standard practice.

Data sovereignty is another point to consider. If a platform serves European LPs, their data should be stored in EU-based data centers to ensure compliance with regional privacy laws.

Launch quietly, iterate quickly

Don’t rush a public launch. Begin quietly and focus on developing a product that works well for a small group before expanding it.

The most effective way to start is by inviting just a handful, perhaps 5 to 10, trusted limited partners to join your platform in a closed beta. This initial group should include individuals or firms you already know and who are willing to give honest, constructive feedback.

During this early phase, closely monitor how these users move through the onboarding process. Pay attention to where they hesitate, where they ask for help, and whether any errors occur in document signing or payment flows. These friction points are indicators of what needs to be refined.

Conduct interviews with participants, and if possible, observe their sessions if possible. The goal is to spot where the user experience breaks down, whether that’s confusion over instructions, bugs during capital call execution, or mismatched document templates.

Once you’ve identified the issues, move fast to address them. Release updates frequently and communicate changes clearly to your test users. This shows responsiveness and builds trust while helping you improve the platform before more users join.

When things run smoothly for your beta group, begin a soft launch. Expand your reach gradually, onboarding 50 to 100 LPs while continuing to gather feedback and data. During this stage, it’s useful to track performance through measurable indicators. Ideally, at least 85% of new users should complete onboarding. The entire onboarding journey, from invite to full activation, should take under 48 hours. Capital call payment compliance should exceed 90% within a week, and your LP Net Promoter Score (a signal of user satisfaction) should land at +30 or higher.

These early users are more than testers. If they have a good experience, they become advocates for your platform.

Plan for growth: Tokenization, secondary markets and scaling

Forward-looking private equity platforms are already integrating tokenization and secondary markets.

If you consider tokenization, you can use platforms like Securitize and Tokeny to increase the liquidity and traceability of investments.

If you decide to invest in your own bulletin board solution, consider partnering with trading platforms, such as ADDX26.

Look for connections with wealth platforms and banks, and allow them to integrate with your investment offerings through APIs.

To ensure the proper scaling of your platform, utilize microservices for features such as onboarding, tax reporting, and waterfall calculations. Additionally, automate repetitive work, including KYC, calls and distributions to minimize manual effort.

How to launch a private equity platform with LenderKit

For firms looking to enter or expand within the private markets space, LenderKit provides a robust foundation for launching a compliant, investor-ready private equity platform.

Whether you need a white-label investment solution for faster deployment or a fully custom-built product tailored to your exact workflow, LenderKit supports both paths.

It covers all key elements: investor onboarding, deal management, KYC/AML via third-parties, document signing and analytics — all with secure infrastructure and a modular architecture. You can start small, then scale and extend as you grow, without rebuilding the core platform from scratch.

To find out how it all works or discuss details, please get in touch with our team.

Article sources:

- Internal Rate of Return (IRR): Formula and Examples

- Multiple on Invested Capital (MOIC) | Formula + Calculator

- Total Value to Paid-In Capital (TVPI Multiple) | Formula + Calculator

- Net Asset Value (NAV): Definition, Formula, Example, and Uses

- Anduin - Empower Lasting Investor Relationships

- Carta’s

- Passthrough | Automate fund workflows from start to finish

- Identity & Fraud Prevention Platform for financial services | Alloy

- Know Your Business Solutions | Integrated KYB-KYC | Persona

- Docusign | #1 in Electronic Signature and Intelligent Agreement Management

- PDF (https://assets.kpmg.com/content/dam/kpmg/pdf/2014/07/Cost-of-Compliance.pdf)

- Typical M&A deals cost US private equity $353k in legal spend (and other outside counsel statistics from US-based PE firms) | Apperio

- Determining the Right Investment: B2B Marketing Budget Benchmarks

- Optimizing Cybersecurity Budgets in 2025: A Strategic Guide

- System and Organization Controls (SOC) 2 Type 2 - Microsoft Compliance | Microsoft Learn

- Secure AI Agent & User Authentication | Auth0

- Parallel Markets

- Money Movement APIs | Modern Treasury | ACH, RTP, Wires and more payment methods

- Stripe Financial Accounts for Platforms | Financial Services APIs

- What is SOC 2? Complete Guide to SOC 2 Reports | CSA

- What is Azure role-based access control (Azure RBAC)? | Microsoft Learn

- General Data Protection Regulation (GDPR) – Legal Text

- California Consumer Privacy Act (CCPA) | State of California - Department of Justice - Office of the Attorney General

- Vercel Security Checkpoint

- AWS Key Management Service - AWS Key Management Service

- Manage your wealth, your way