Investor Relations Management: Best Practices

No time to read? Let AI give you a quick summary of this article.

Investor relations management is a set of activities to keep investors happy and startups funded in time. Over the years, investment and wealth management platforms developed the best investor relations management practices to keep both parties engaged.

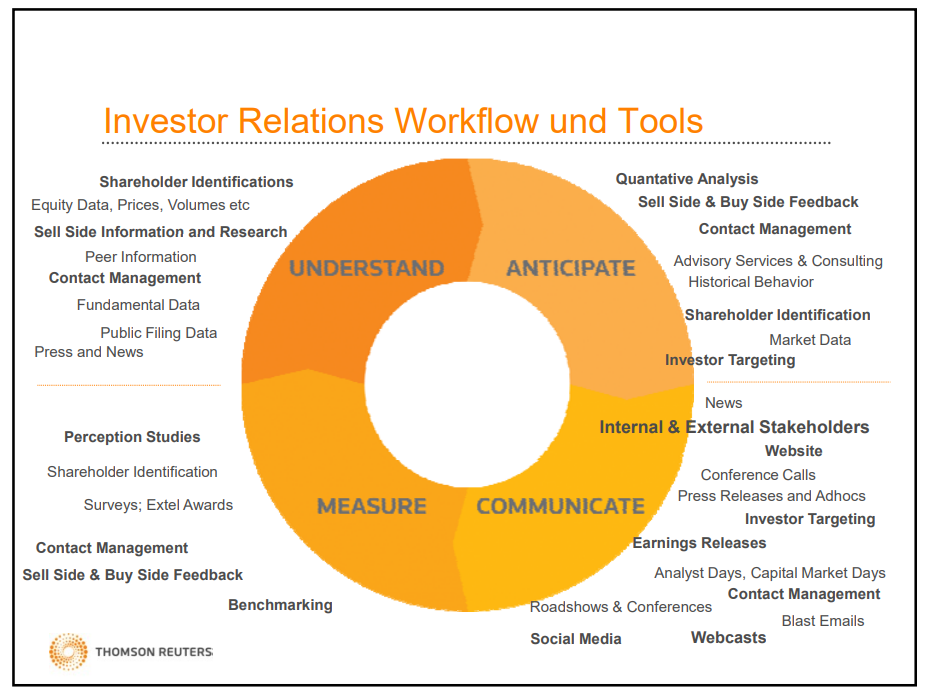

The world of investment relations lies on four principles:

- Anticipate – know your investor types, investment preferences and budgets and give them the right companies to invest into

- Communicate – provide investors with information about selected startups, including how much money they need, what for, who is on the team and how they will pay when they succeed

- Measure – assess the results, make sure the fundraisers hit their funding goal and receive the required support and experience. Check the investment performance and get feedback from investors.

- Understand – think about how relations with the investor and the fundraiser can evolve further. Investors are not only a source of capital, they can also share their experience and network to help the business to move forward.

What you will learn in this post:

Why build and manage investor relations

Businesses communicate with investors constantly to ensure long-term productive collaboration. This is what investor relations is needed for – to establish communication between the company, investors, and stakeholders. Correctly built investor relations can help to boost equity performance by 10-15%1.

Building investor relations requires time and work. We have collected the main highlights to help crowdinvesting business founders to build a proper strategy of communication with investors.

Keep your investors updated

Companies that constantly communicate with investors are more likely to receive funding in the future. Institutional investors that employ capital to invest it in a business are also interested in the company’s success. However, investors have more than one company in a portfolio. Most likely, they cannot track all the companies enough to see where they can help. Building strong relations is a way for a business to stand out. Sending monthly updates will help to communicate with investors and build relations based on trust and transparency.

Sharing metrics and data is one of the most common ways to keep investors updated about the current state of the business. The type of metrics and their number depends on what investors want to see. But the main principles to follow when preparing this information are the following.

- Share the same metrics monthly, so that investors can track performance.

- Discuss with investors what metrics they want to see and what background information they expect.

- Don’t forget that some information cannot be disclosed because it can make the business vulnerable.

From an investor’s point of view, the communication shall be mostly focused on the stock’s value2. That’s why communication revolves around financial matters. This is the main reason why a financial manager plays a special role in this type of communication. The areas where investors expect some information are:

- Revenue

- Cash flow

- Burn rate

- Margins

- Churn rate

- Customer acquisition cost

Conduct regular board meetings

While monthly updates are fine to keep investors informed about what’s going on in the business, board meetings are an opportunity to look back and analyze what happened and how it impacted the business. Such meetings are also great for thinking about strategies and plans.

Board meetings can make a difference in the seed funding round. Along with their other functions such as building the company’s governance system, maintaining relations with executives, etc., board meetings are great for building trustful relationships with investors.

Bigger companies practice such meetings every 4-6 months every year. Smaller companies can organize board meetings more frequently.

Some tips for a successful board meeting:

- Having an established and focused board agenda enables you to maximize the meeting efficiency, and accuracy, and not forget about details.

- Make sure you mention any big wins for the past period and if there are details that may impact the business negatively, talk about them, too.

- Assign a special section in your agenda to KPIs and metrics. These data shall be agreed upon beforehand and shared with everybody in the room so that all participants understand what you’ll be talking about.

- Towards the end of the meeting, include its main purpose – the business strategy. Be ready that this part may take approx. 50% of the meeting time. Make sure you have all your points well prepared to use this part to the full extent.

Individual meetings

Sometimes, investors may have questions that don’t fit in a board meeting. That’s why it is recommended to find time for one-to-one meetings with investors. During such meetings, you can discuss things that cannot be discussed publicly or ask questions and advice. Such meetings are a great way to build more trustful relationships with investors.

Investor relations management tools

Properly selected investor relations CRM or wealth management software will help you double your performance with the same headcount.

The investment management platform is the very first tool investors come in contact with. It helps you market your investment business and provides a platform for investing.

Using investor relations management software is not only about the first impression, it’s also about professional online deal facilitation, identity verification, compliance, reporting and payment distribution.

It’s basically a powerhouse for the online investment business.

Take white-label investor relations management software from LenderKit, for example. Along with options for fundraisers, you’ll have a comprehensive kit of functionalities for efficient investor management.

With investor relations CRM, we enable platform owners to keep and manage information about fundraisers and investors in the system according to the data protection rules and compliance requirements such as SEC / FINRA or ECSPR.

The investor relations platform offers a dedicated investor portal – an area where investors can allocate their interests and invest. They get their own tool to monitor investment performance, top-up e-wallets, and trade investments on secondary markets.