Reg D Private Placements vs Crowdfunding

No time to read? Let AI give you a quick summary of this article.

Private placements and crowdfunding are used to finance startup development projects. Through private placement deals, startups sell securities to a limited number of accredited investors and organizations to raise capital for the startup development. A private placement doesn’t imply extensive financial information disclosure, doesn’t have to be registered with Securities and Exchange Commission (SEC) and allows companies to raise unlimited amounts of money compared to Reg A+, for example, which caps at $75 million.

In contrast, investment-based crowdfunding platforms market to a much broader audience combining both non-accredited and accredited investors. Under a regulation crowdfunding, Reg CF, companies are able to fundraise up to $5 million [updated1], have to be registered with SEC and disclose extensive information through the Form C2. StartEngine talks a lot about Form C, so you can check out their explanation for more details.

What you will learn in this post:

Accredited Crowdfunding or Private Placements

If your funding appetite is large and you don’t feel like registering your offering of securities with the SEC, then consider a private placement.

Investopedia says that a private placement3 is a sale of stock shares or bonds to pre-selected investors and institutions.

It means your securities can’t go public. It’s true if you offer and sell securities under Rule 506(b) of Regulation D.

Quoting the SEC4:

“The company cannot use general solicitation or advertising to market the securities.

The company may sell its securities to an unlimited number of “accredited investors” and up to 35 other purchasers.”

Unlike Rule 506 (b), Rule 506 (c) implies that you can broadly solicit and generally advertise the offering (in plain words, attract the funds of the crowd).

But there’s always a but. According to this rule, all investors in the offering should be accredited.

On the other hand, the benefits of fundraising through private placements include:

- unlimited maximum offering

- no pre-filing requirements; Form D is obligatory to fill in and hand over to the SEC

- no financial disclosure if only raising from accredited investors

- no annual individual investments limits

Private placements are also possible under Reg D Rule 5045 with the max offering limit of up to $10 million, but this is another story.

For whom: companies/startups looking for sufficient financial support from venture capitalists and institutional investors.

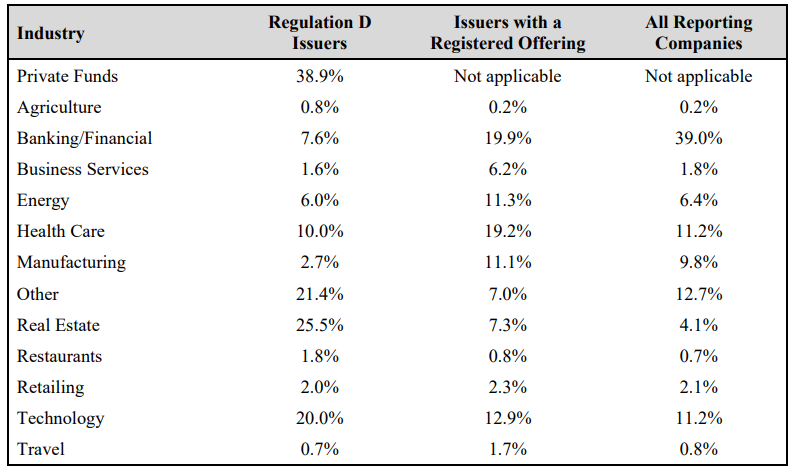

Private placements are widely used in health care, real estate, technology, and private funds.

Reg A+ or Mini-IPO

In regards to startup financing, it’s worth mentioning the Reg A and A+ regulations as well.

It’s said that they’re like IPOs, but less challenging. Companies can raise up to $75m not just from the accredited investors but also from retail investors.

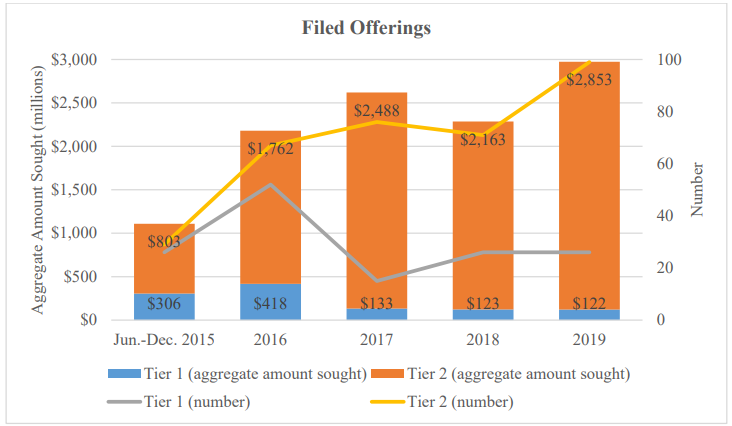

Reg A+ has two tiers and is open to US and Canadian issuers. The maximum size of offerings under Tier 1 is $20m and $75m– for Tier 2.

Tier 1 is less popular than Tier 2. Meanwhile, the SEC has recently offered to increase the funding amount under the Reg A Tier 2 up to $75m7.

Both accredited and non accredited investors can participate in schemes based on Reg A. Companies must meet SEC filing requirements and provide financial disclosure.

Mini-IPOs are less expensive than IPOs, but they still imply significant legal fees.

For whom: mature companies attracting investments to fuel growth.

Regulation Crowdfunding

Provided that a startup needs no more than $5m, it might go to a crowdfunding platform to conduct a raise.

Highlights of Regulation Crowdfunding:

- no restrictions on investor type, but they must show understanding of investment and limit in dollar amount

- investment limits in all offerings depending on an investor’s annual income or net worth

- marketing and disclosure via an online platform

- pre-filing with SEC required and file Form C preparation

- the offer must be listed on a FINRA approved funding portal or with a broker-dealer

- securities generally can’t be resold for one year

For whom: startups who are between Seed and Series A stages. Startups may already have a large community of supporters or get access to a highly engaged audience via a crowdfunding platform.

Let’s sum up the difference between regulation D private placements and crowdfunding

Reg D private placements vs regulated crowdfunding

| Private placements (Reg D) | Regulated Crowdfunding | |

| Max Offering | No limit | $5m |

| Investors | unlimited accredited investors | unlimited accredited investors and up to 35 non-accredited backers |

| Investment Limits | no | depends on an investor’s annual income or net worth |

| Solicitation | no restrictions | marketing and disclosure via an online platform |

| Pre-filing | no requirements | pre-filing with SEC required |

| SEC filing | file form D | file form C |

| Financial Disclosure | no (if only raising from accredited investors) | yes (depending on a funding size) |

| Resale | “restricted” securities can’t be sold | limited resale |

| Intermediary | no | funding platform/broker-dealer |

LenderKit – crowdfunding and private placement software

Investment management firms may use software for private placements and crowdfunding, depending on their target market. Technically, the difference between the two investment software solutions is not too big. This allows an investment company to approach a crowdfunding software development firm and provider like LenderKit, consider the existing software solutions for private placements and decide on the potential customisations.

LenderKit is a white-label investment management and business automation software that can be tailored for your equity crowdfunding, p2p lending or alternative investment management business.

Our team can customize the software to fit your industry, country’s regulations, and business needs. We can set up LenderKit for you, so you can pitch to your stakeholders and raise capital for further development. In addition to that, we can help you build a unique private placements software or crowdfunding platform.

LenderKit works well for SMEs, green energy crowdfunding, tech projects, agriculture fundraising projects and real estate private placements.

What’s under the hood:

- ready-made design themes for your online platform

- investor and fundraiser dashboards

- functionality for the automated KYC/AML and due diligence checks through a third-party provider

- secondary market

- API to connect with third-party providers (payment solutions, electronic signatures, and identity verifications)

- admin back-office and more

Startups and companies that us LenderKit

Camly is a fundraising platform from Vietnam for everyday and sophisticated backers. Its portfolio includes real estate projects from the USA.

Forus is a pioneer in business loans and investment opportunities in the Kingdom of Saudi Arabia.

Final thoughts

To recap:

- Mini-IPOs, private placements and crowdfunding all refer to securities exemptions available to U.S. issuers.

- The main difference between them lies in the max offering size, type of investors, SEC filing and financial disclosure requirements.

- Private placements are for large funding needs with minimum disclosure of information for as few investors as possible. Crowdfunding works well for startups with the financial appetite below $5m and a will to attract and work with retail backers.

- White-label software like LenderKit is to help you build a fully-fledged portal for private placements or crowdfunding business.

Article sources:

- SEC Harmonizes and Improves “Patchwork” Exempt Offering Framework

- PDF (https://www.sec.gov/about/forms/formc.pdf)

- What Is a Private Placement? Definition, Examples, Pros, and Cons

- Rule 506 of Regulation D

- Rule 504 of Regulation D

- PDF (https://www.sec.gov/files/report-congress-regulation-a-d.pdf)

- SEC Proposes Rule Changes to Reg CF, Reg A+, and Reg D - Bull Blockchain Law