The Ultimate Guide to Embedded Lending

No time to read? Let AI give you a quick summary of this article.

Embedded lending is when a loan is built into another product or service.

For example, an online store, SaaS tool or marketplace lets users take a loan directly inside it, without using a bank app.

Let’s dive deeper into the embedded lending definition and explore use cases.

What you will learn in this post:

What is embedded lending?

Embedded lending refers to credit or loan services that are built directly into a non-lending platform.

Instead of users going to a bank or lender separately, they apply for and receive financing at the point of need inside an app or platform they already use.

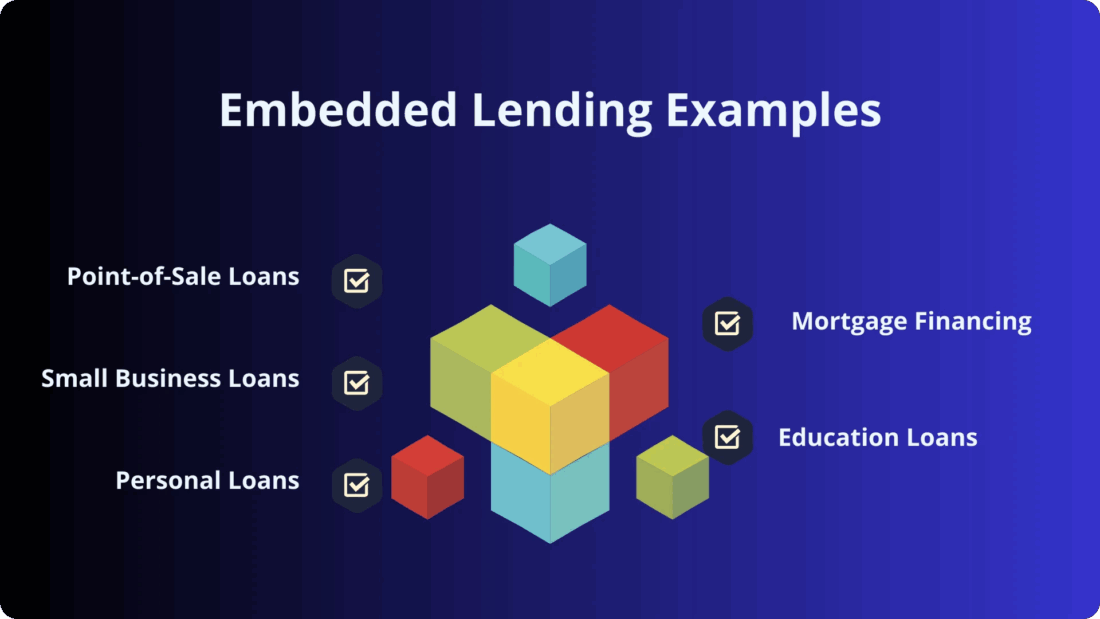

Source: Ulan Software1

Users may interact with embedded lending at an e-commerce checkout, a business software dashboard, a real estate marketplace or an education platform. So, credit becomes part of the user experience rather than a separate application process.

For example, an online store can offer “buy now pay later” options at checkout through services like Affirm2 or Splitit3, allowing customers to split payments without leaving the site.

Marketplaces and commerce platforms such as Shopify4 and Amazon5 go even further than that. They offer small business loans directly to merchants, using real-time sales data to assess eligibility and release funds quickly.

Fintech platforms also embed personal loan offers. For example, some providers, such as LendingClub6 and Upstart7, use automated approval models to give users fast access to credit.

In real estate, platforms such as Zillow8 and Redfin9 integrate mortgage financing into property listings, so buyers can explore homes and financing in one place. Education platforms follow the same model by embedding student loan options directly into the enrollment process.

In all cases, the goal is the same: frictionless access to credit10 at the moment the customer needs it.

Why embedded lending matters

Embedded loans deliver clear benefits11 for platforms, lenders, and users.

For platforms

Embedded financing strengthens retention, unlocks new revenue streams and deepens data-driven relationships with users.

Main benefits

- Higher revenue per user

Platforms offering embedded lending typically see a 10-30 percent increase in average revenue12 per user, driven by interest margins, fees, or revenue sharing with lending partners. - Stronger user retention

Access to financing inside the platform can improve retention by 20–30 percent13, as users are less likely to leave an ecosystem that supports their growth. - Better conversion rates

Financing at the point of need increases checkout or activation conversion rates by 15–35 percent14, especially in e-commerce and B2B SaaS. - Monetization of first-party data

Real-time transaction and performance data enables more accurate credit decisions15 without additional user friction. - Low operational complexity

Platforms avoid balance-sheet risk, licensing, and underwriting by partnering with regulated lenders while keeping the user relationship.

For investors and lenders

Embedded lending creates access to high-quality, data-rich borrowers and improves capital efficiency.

Main benefits

- Lower acquisition costs

Customer acquisition costs can drop by 40–50 percent16 compared to traditional lending channels. - Improved credit performance

Loans underwritten using platform data often show 10–25 percent lower default rates17 due to better risk assessment. - Scalable deal flow

Lending opportunities grow in line with platform usage, enabling predictable and diversified loan origination. - Faster deployment of capital

Automated underwriting and instant offers reduce time-to-funding from weeks to minutes or hours. - Better risk segmentation

Continuous access to real-time data18 allows dynamic credit limits and pricing adjustments.

For customers

Embedded lending removes friction and makes access to capital faster, simpler, and more relevant.

Main benefits

- Instant access to financing

Loan offers appear exactly when needed, cutting approval times from days to seconds or minutes19. - More fair and personalized offers

Pricing and limits are based on actual platform activity rather than broad credit categories. - Improved cash flow management

Small businesses gain working capital aligned with real sales cycles, reducing liquidity stress. - Higher trust and transparency

Financing is delivered by a platform the user already knows, which boosts confidence.

Challenges and considerations

While embedded lending offers clear benefits, there are some challenges to address.

Regulatory compliance

Platforms offering embedded loans must consider financial regulations, consumer protection rules, and lending laws in each jurisdiction. This often requires strong compliance infrastructure20 or partnerships with licensed lenders.

Risk management

Lending always involves credit risk21, and embedded setups must integrate risk scoring, fraud prevention, and often guarantees or risk-sharing models.

Integration complexity

Adding lending options requires secure data sharing, identity verification (KYC), and proper API integration. Choosing the right tech partner or provider can reduce complexity.

How embedded lending works

Embedded lending usually relies on APIs and integrations between a platform and a lending provider. The typical flow looks like this:

- Trigger point

A user interacts with a product where credit might be useful. That could be a merchant marketplace, a booking checkout, an invoice dashboard, or an inventory management tool. - Real-time data use

The platform shares relevant data (such as transaction history, sales volumes, or user behavior) with the embedded lending engine through APIs. This data helps assess creditworthiness quickly. - Credit offer presented

Based on risk scoring and automated underwriting, the system presents one or more loan options directly to the user within the platform’s interface. - Loan acceptance and disbursement

The user accepts the offer, and the funds are delivered without redirecting to a separate lender portal. - Repayment integration

Repayments are handled through the embedding platform or via integrated payment systems.

This embedded flow eliminates traditional loan applications and reduces manual documentation.

The best embedded lending solutions for fintech

The best embedded lending solutions typically combine real-time data access, automated underwriting, and API-first integration. They let fintechs offer products such as point-of-sale loans, working capital financing, invoice and receivables financing, and consumer credit without building a lending infrastructure from scratch. So, let’s check who leads in the embedded lending B2B marketplaces.

Stripe

Stripe22 is widely known for payments, and its embedded lending capabilities build on that foundation. It allows fintech platforms to integrate credit and lending products at key user touchpoints using the same infrastructure they already use for payments, billing, and treasury.

Why do fintechs like it?

- Unified platform: Lending, payments, and financial products work together, reducing integration complexity.

- Strong developer tools: Clear APIs, documentation, and SDKs help teams launch fast without deep lending expertise.

- Compliance support: Stripe handles several regulatory and operational components, which simplifies risk and compliance for fintechs.

Who is Stripe for?

Fintechs that want credit integrated seamlessly alongside payments and financial services.

Pipe

Pipe23 originally made a name for itself by letting SaaS and subscription businesses convert future revenue into upfront capital. This is one of the recommended embedded lending companies because it provides fintechs with access to growth financing based on predictable revenues, rather than traditional credit scores.

Why do fintechs like it?

- Revenue-backed financing: Works well for fintechs and platforms with predictable, recurring income streams.

- Alternative underwriting: Uses usage and revenue data instead of traditional credit history alone, making it accessible to more businesses.

- Fast access to capital: Approvals and funding can happen quickly via automation and real-time data.

Who is Pipe for?

Fintechs with subscription billing, recurring revenue, or predictable business models looking to embed working capital options.

ChargeAfter

ChargeAfter24 offers a white-label embedded lending marketplace that lets fintechs present loan and financing options from multiple institutional lenders inside their own interface. Users see offers without leaving the host platform.

Why do fintechs like it?

- Multi-lender access: A single integration exposes users to multiple financing partners, increasing approval chances.

Marketplace model: Fintechs can display competitive options and help users compare offers in one place. - Custom branding: Lenders’ offers are shown within the fintech’s UI, retaining user engagement.

Who is ChargeAfter for?

Fintechs and commerce platforms that wish to offer diversified credit options at the point of need, particularly point-of-sale financing.

Embedded lending and crowdfunding

Embedded lending is less common in crowdfunding compared with e-commerce or SaaS, but the trend is emerging. Some crowdfunding platforms that focus on SME loans or marketplace lending use embedded models where credit options are made available within the platform itself, simplifying the investor and borrower experience.

For example, Iwoca25 partners with business platforms (like Tide26) to offer business finance directly within partner apps. This lets merchants access lending products without leaving the ecosystem they already use.

Similarly, Kriya27 (formerly MarketFinance) embeds PayLater28 financing within partner checkout experiences and B2B payments. This lets SMEs get extended payment terms or credit without needing a separate application process.

These examples illustrate how embedded lending can intersect with alternative finance and crowdfunding ecosystems, giving platforms an opportunity to expand their services beyond traditional campaign-based fundraising.

How to launch an embedded lending platform

If you’re looking to build an embedded lending platform, LenderKit has got you covered.

While our core services include crowdfunding and investment software, we’ve also got decades of experience of building various fintech applications and launching alternative finance platforms.

We could either adapt our software to your needs, powering it up with the required integrations or build a custom embedded lending platform.

If you’d like to learn more about our product and services, don’t hesitate to reach out and schedule a call.

Article sources:

- Top 9 Embedded Finance Examples and How They Work

- Affirm | Pay over time with flexible payment plans and no fees

- Buy Now Pay Later - Using Your Own Credit Card - Splitit

- Shopify: The All-in-One Commerce Platform for Businesses - Shopify

- Amazon

- Online Personal Loans + Full-Service Banking | LendingClub

- Upstart

- Zillow: Real Estate, Apartments, Mortgages & Home Values

- Redfin | Real Estate & Homes for Sale, Rentals, Mortgages & Agents

- Embedded Lending: How Integrated Financing Empowers SMBs

- Embedded lending 101: A guide | Stripe

- Embedded Lending Boosts SME Growth In Poland - Report | Crowdfund Insider

- Embedded finance is no longer just for banks | Tap

- Embedded finance: How banks and customer platforms are converging

- Embedded Finance in Lending - Begini

- Embedded Financial Solutions Market

- Embedded Lending The Future of Digital Lending in 2025 and Beyond

- What is Embedded Lending? Its Key Components and Benefits

- What Is Embedded Finance? A Simple Guide

- 2025 Lending Trends: Automation, Embedded Finance, and Economic Shifts - FinWise Bank

- 2025 Embedded Lending & Finance: A Lender’s Roadmap

- Stripe | Financial Infrastructure to Grow Your Revenue

- Pipe | Embedded Financial Solutions

- ChargeAfter: Embedded Financing & Consumer Finance Solutions

- Business Loans - Flexible Funding from £1K to £1,000,000

- Business banking made better | Tide Business

- Kriya | B2B PayLater | Invoice Finance | Working Capital Loans

- PayLater | Split Payments. Shop Smarter