Trends in Crowdfunding: The Future of Alternative Finance

No time to read? Let AI give you a quick summary of this article.

Trends in crowdfunding can be anything that generates money, attracts attention and creates public resonance. Depending on whether you are an investor, fundraiser or even a platform owner, trends in crowdfunding can be different.

As a white-label crowdfunding software provider, LenderKit is constantly monitoring the main areas of interest and so here’s our take on the future of crowdfunding:

- Asset tokenization

- Fractional ownership

- AI development

- Renewable energy

- Social impact investing

- Sukuk crowdfunding

Let’s dive deeper into these concepts and explore whether they can be considered real trends in crowdfunding.

What you will learn in this post:

The rise of blockchain and asset tokenization

The growing adoption of blockchain technology1 is transforming alternative finance and crowdfunding in particular. Blockchain provides a secure infrastructure for all types of crowdfunding platforms and allows for transparent and more efficient peer-to-peer transactions, increasing trust and lowering potential fees.

Asset tokenization

Asset tokenization significantly enhances equity-based crowdfunding by enabling the creation of tokens that represent equity or participation in a project. Selling a token is equivalent to selling equity, but transferring tokens is much easier than transferring traditional equity. The entire transfer process is automated by smart contracts, which eliminate intermediaries and human errors. Additionally, tokenization turns illiquid assets, such as real estate, into liquid ones because tokens are easily tradable on secondary markets.

Fractionalization

Fractional ownership in crowdfunding is a process of dividing an asset into several equal parts (fractions). Fractionalization enables the democratization of equity and debt-based investment by allowing retail investors to participate in top-tier deals with smaller amounts of money.

Even though regulation about tokenization and fractionalization is still not completely clear or even absent at all, tokenization and fractionalization can expand the boundaries of equity- and debt-based crowdfunding.

Application of AI for crowdfunding

AI is a rising star in many fields, and crowdfunding is no exception. Even though AI tools are still far from perfect, they can be applied for multiple purposes by crowdinvesting platforms of all types.

AI for content creation

Creating content – text, graphics, and videos, is one of the most popular AI use cases. There are AI tools that can write narratives for crowdfunding campaigns, create landing pages, write emails, and perform other content-related tasks. These tools are good for donation- or reward-based campaigns to reduce costs.

AI for due diligence

Due diligence is an important part of the operations of every equity- or debt-based investment platform. It implies collecting and analyzing a lot of information to find possible inconsistencies and filter out projects and investors that, for one or another reason, do not comply with the platform requirements.

AI employs advanced data analytics, machine learning, and language processing to process and analyze huge volumes of data in a very short time and represent it in an easy-to-use form. With it, AI can perform the most tedious part of due diligence and allow human specialists to concentrate on tasks that require a custom approach.

AI for risk assessment

AI can collect vast volumes of previous projects’ data and assess the risks of each specific campaign as well as the project’s potential in the long term. Even though such AI tools are still imperfect, in the future, they may become crucial for investment advising.

Even though AI tools are still not perfect and cannot completely replace human specialists, they can perform laborious and time-demanding tasks. With it, they can save time for teams thus enabling them to focus on more urgent things that require human attention, reduce the possibility of human error, and save costs for platforms and projects.

Crowdfunding for social impact

Crowdfunding platforms are increasingly being used to raise funds for projects that aim at solving environmental issues, healthcare, social justice, and other meaningful cases. This trend aligns with the general shift toward conscious consumerism and social responsibility. Additionally, crowdfunding for social impact attracts an increasing number of investors because it offers them an opportunity to drive social impact and community development.

Renewable energy investing

Projects focusing on renewable energy are normally perceived as risky, this is why traditional investing ways do not always work for them. This is why historically, the government2 was the main funding source. In Europe, renewable energy projects can not only get funding but also receive technical assistance and advisory services3.

But in times of global warming and long-term plans of leading countries to reduce carbon emissions by 2050, equity-based crowdfunding has started playing an important role in raising funds for renewable energy projects.

Many governments implement investment and production tax credits, impose bans and targets for fossil fuels, introduce standards according to which a part of sourced energy shall be provided from renewable sources, and take other measures to incentivize investment in renewable energy sources to further promote this sector. This is why it is expected that the interest of investors will increase, and the investing share in renewable energy projects will grow.

Crowdfunding for social justice

Handling legal issues is a difficult and costly task, this is why achieving social justice is not accessible to many people. Crowdfunding for social justice can take care of funding legal costs for an individual or an organization. Specialized donation-based platforms handle all the processes including transferring the raised funds directly to a lawyer.

For funding, such platforms rely on their own network of investors and community members. In most cases, those who invest in social justice cases can count on tax relief4 – a fact that serves as an additional incentive to donate to such campaigns.

Crowdfunding for art, education and healthcare

Social investment attracts investors who not only look for returns but also for an opportunity to make a difference. By tapping into a desire for positive change, activists, non-profits, charities, and purpose-driven businesses can raise funds without relying solely on governmental support. By investing in art projects, educational and healthcare campaigns, and similar causes, investors get tax relief, acknowledgment by community members, and an opportunity to become catalysts of social change.

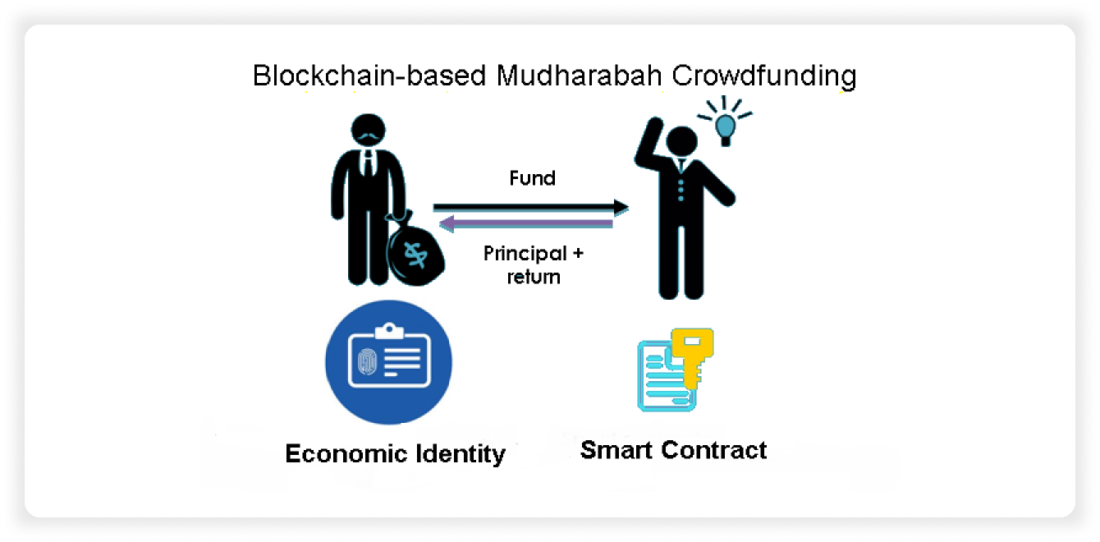

Sukuk crowdfunding

Sukus crowdfunding is growing in importance not only in Islamic world but also globally. It offers a unique investment model that complies with the Shariah law. Under Shariah, it is prohibited to charge interest5 on any funds or assets lent to another person because this practice causes distrust or resentment. All financial activities6 must be supported by tangible assets and real economic activities.

Sukuk investors earn income if the underlying asset generates a profit from its economic activity. For example, by investing in real estate, investors get their share from rental payments, or if the asset is sold at a profit.

The Sukuk market is growing because of the trend to align the Islamic Sukuk towards common ESG goals7.

Crowdfunding software to embrace the trends

If you are inspired by the development of the crowdfunding sector, interested in the trends or simply want to join the alternative investment market and become a market leader – LenderKit offers white-label crowdfunding software to help you launch your own platform.

With LenderKit, you get a powerful all-in-one crowdfunding software that allows you to test the waters, onboarding investors, create campaigns, manage deals, export data for reporting and so much more.

If you need a reliable tool to enter the crowdfunding market and scale as your business grows, LenderKit can offer the right crowdfunding software solution for your investment business.

Article sources:

- Just a moment...

- InvestEU Portal

- The InvestEU Advisory Hub

- Features - Why People Choose Chuffed | Non-profit charity and social enterprise fundraising

- Is Crypto Staking Halal or Haram? Introducing M.I.R.O. - MRHB Network

- How Sukuk is shaping the future of ethical investing globally

- ESG Goals: 15 Simple Examples