Investment software for VCs, private equity and crowdfunding

Automate private placements deal flow

LenderKit offers software for private fundraising to help private placement agents and private equity firms close more deals faster. LenderKit provides robust out-of-box and custom functionality such as:

- secondary market

- debt, equity and donation flows

- permissions module which allows to create custom user roles

- make capital calls and have investors allocate interest in the offerings, etc.

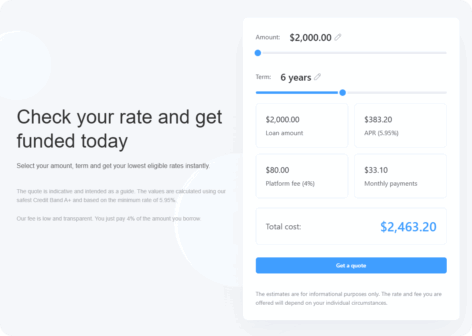

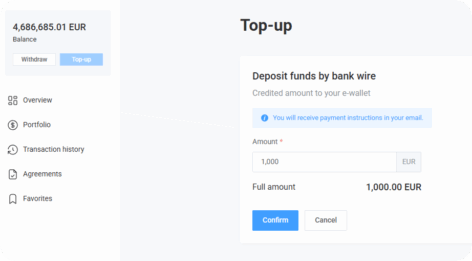

Build a robust loan management platform

Power up your lending business with a tailor-made loan management system that automates money processing, facilitates KYC/AML compliance, integrates credit scoring, and provides insightful data and analytics.

- manage borrowers and lenders

- monitor transactions

- set up custom fees

- manage documents and reports

Scale your investment business

Whether you’re in private equity, venture capital or angel investing, LenderKit can help you automate your investment business operations and manage deals more effectively.

Regardless of the deal value size you’re working with — below 5 million USD or over 75 million USD — we can help you tailor the platform to fit your needs, audience types and regulations.

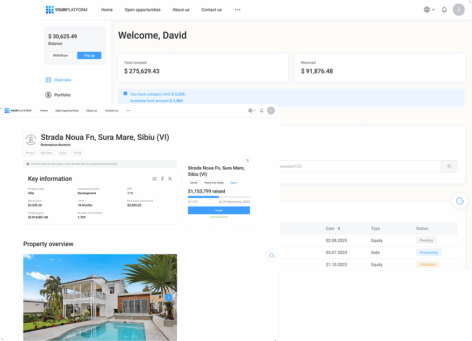

Launch a real estate crowdfunding business

Whether you’re operating in the UK, USA or in the MENA region, LenderKit can help you launch a crowdfunding platform fast. Our system provides extensive functionality for real estate developers and investment firms which will help you:

- manage investors and fundraisers

- create offerings, portfolios, etc.

- automate KYC/AML and money processing

- facilitate reporting

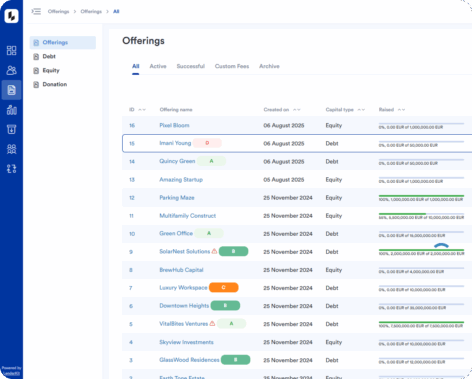

Transform your equity crowdfunding business

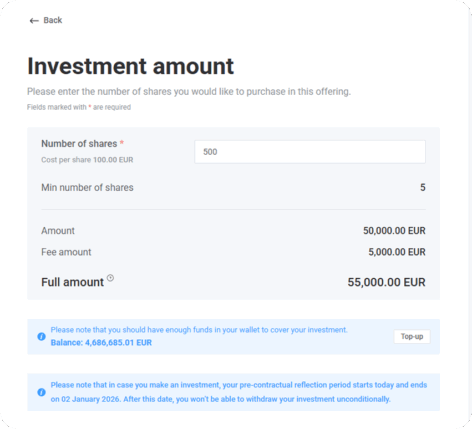

Set up an online equity crowdfunding platform and allow investors to invest in startups or real estate projects. LenderKit can become a good software choice if you’re an existing business or a startup because it has plenty of features:

- secondary market

- auto-investing

- payout schedules

- fees management and more

Digitize your P2P lending business

If you’re focused on debt crowdfunding or P2P lending and want to match backers and borrowers to facilitate lending operations, LenderKit’s P2P lending software may help you achieve your business goals:

- Conduct online KYC/AML and credit scoring

- Close deals faster

- Manage documents and reports online

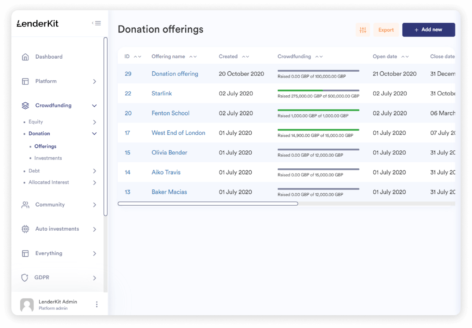

Set up a donation crowdfunding platform

If you’re looking a Kickstarter, Indiegogo or GoFundMe close and want to set up a large donation platform or maybe an industry-specific platform for your own audience, LenderKit can help you automate donor management operations.

- Provide gifts and receipts

- Automate tax form filing

- Monetize your crowdfunding portal