Crowdfunding for Real Estate Development: How Does it Work?

No time to read? Let AI give you a quick summary of this article.

Traditional real estate development often relies on large upfront capital, bank loans or private investors — all of which can be difficult to secure, especially for new or mid-sized developers. These financial barriers can stall promising projects before they even begin.

To overcome these challenges, many developers are turning to alternative funding models. One such model gaining traction is crowdfunding — a flexible, digital-first approach that opens up investment to a broader pool of backers. But how exactly does crowdfunding work in the context of real estate development?

Real estate crowdfunding can be broadly categorized into two main types:

Let’s dive deeper into each real estate crowdfunding type, consider the pros and cons as well as check out the existing real estate investment platforms and what models they are using.

What you will learn in this post:

Equity Crowdfunding

In equity crowdfunding, multiple investors contribute funds to purchase an asset through an entity that is set up specifically for owning that asset — a single-purpose entity (SPE). In exchange for their money, investors get shares of this SPE and sign an agreement where investors’ and investee’s rights and responsibilities are defined, and that explains how the invested funds will be returned to investors and with what share of profit.

The income is generated by renting the property or when the appreciated property is sold.

Equity crowdfunding for real estate development is considered risky because investors don’t have any impact on how the property is managed and they carry part of the risk of failure.

Equity crowdfunding can further be divided into two types:

- Preferred equity

- Common equity

Preferred equity1 investors are paid income before common equity investors, this is why this investment type is considered lower risk than common equity, and this is why the interest paid to investors may be slightly lower than the interest paid to common equity investors. Also, preferred equity investors receive a fixed interest rate and do not share the profit that can be generated when the asset is sold.

Common equity2 investors receive income distributions after preferred equity investors are paid. However, common equity investments can generate additional income when the asset is sold for a profit, or if the income generated by the asset grows.

Debt Crowdfunding

Debt crowdfunding allows developers to get the capital without sacrificing a share of the project. All loans are secured by real estate being developed and are typically repaid to investors within a couple of years. This is why investors may prefer this option rather than equity crowdfunding.

Debt crowdfunding can be further split into syndicated debt and direct debt crowdfunding.

Syndicated debt

By using this type, a developer receives a loan from a lender, and the lender sells portions of this debt to a group of investors. This loan type may come with a higher interest rate than a bank would offer because it involves an intermediary. Thus, it is suitable for developers who have issues with getting a loan from a bank or need money faster than a bank would give.

Direct debt crowdfunding

Developers also can use an online debt-based crowdfunding platform to get a loan directly from investors. Such platforms allow developers to list their projects and connect directly with individual investors to pull funds.

Some platforms offer additional benefits to developers by backing the project with their own funds and then trying to back-fill those funds with the money raised from individual investors.

Top Real Estate Crowdfunding Platforms

Here are the best real estate crowdfunding platforms where developers can raise a part of the required capital or the entire sum needed for the project.

Realty Mogul

RealtyMogul3 is a platform that caters to the needs of accredited and non-accredited investors by allowing them to invest in a range of REITs that allow spreading funds across various properties. An average investment minimum is around $5,000, with the fees varying greatly depending on the investment vehicle.

Investment opportunities in private real estate and commercial properties are open to accredited investors only, with a typical investment horizon varying from 3 to 7 years, and a minimum investment of around $25,000 – $30,000.

Since its launch, the platform has been providing investors with an average internal rate of return (IRR) of 20.6% which is higher than many competitors.

Crowfunding the Lakeside at Town Center apartment complex4 in the Atlanta suburb of Marietta, Georgia, is one of the examples of how RealtyMogul works. The platform’s investors contributed $1.2 mln to buy a share in the apartment complex from Arenda Capital Management, a project sponsor.

The property is a 358-unit apartment community consisting of 14 garden-style apartment buildings, along with several garages and storage buildings, a tennis court, several playgrounds, a swimming pool, etc. It was planned to upgrade the facilities and make further improvements to add potential value for investors.

Fundrise

Fundrise5 is a real estate crowdfunding platform that allows accredited and non-accredited investors to participate in the best real estate deals by teaming up with other investors. The invested money is pooled in a REIT and used to buy real estate, land, develop real estate, and participate in promising deals.

Average returns on investment are around 2% after 2 years, and up to 73% after 7 years.

Fundrise charges a yearly 0.15% advisory fee, and a yearly 0.85% fee is charged to Fundrise’s real estate funds.

The minimum to invest varies from $10 for beginners, and the maximum is $100,000 for accredited investors.

$25 mln was invested6 into this multifamily apartment block in 2021 through the Flagship Real Estate Fund and Balanced eREIT II, with $22,500,000 and $2,500,000 invested by each fund respectively. Since then, the market rent growth rate in these apartments has grown by 2.2% which means that all investors who contributed to this purchase got a 2.2% return on their investment.

CrowdStreet

CrowdStreet7 is one of the most known crowdinvesting platforms for real estate. It lists the available commercial real estate projects on the Marketplace for accredited investors to view and invest in individual properties or in diversified funds. The minimum investment is $25,000, and the majority of projects are co-sponsored which means that a big part of the needed funding is already provided.

The fees charged by the platform vary depending on the investment and portfolio type but may go as high as 2.5% for a tailored portfolio.

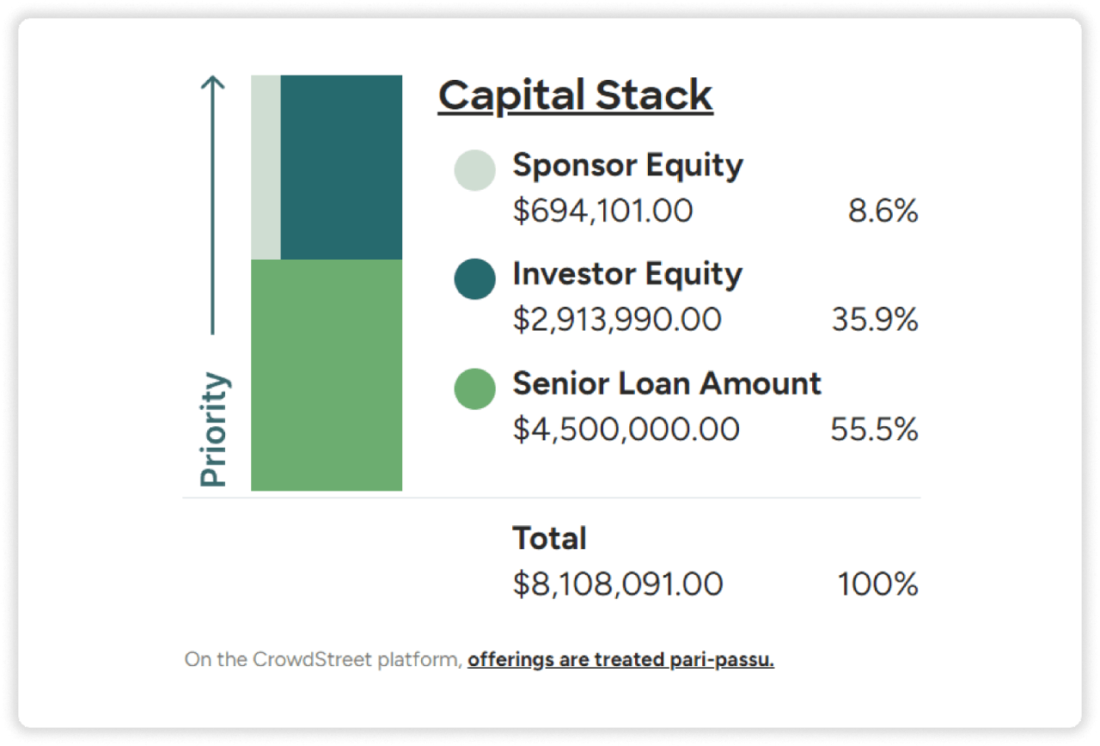

CrowdStreet completed raising funds8 for the development of a Class A Boat & RV Storage facility surrounded by 1,000 new homes and recreational areas. The facility is located in Orlando, Florida.

The total cost of developing the facility is $8,108,091, with the project sponsor providing $694,101, which makes up 8.6% of the equity, and investors providing $2,913,990 which accounts for 35.9%. The rest of the funding was received as a senior loan.

EquityMultiple

EquityMultiple9 allows accredited investors to invest in privately managed commercial holdings with as little as $5,000. Senior debt investments with target returns of 8-12%, preferred equity investments with target returns of 10-14%, value add and opportunistic equity with target net IRR of 18%+ are just some investment options available on the platform.

EquityMultiple charges an annual management fee of 0.5% – 1.5%. All investments on the platform are unique and have their own fee structure.

Investors contributed through the platform $1.25 mln to enable the purchase and repositioning of The Stomegrove Fall Creek10, a 322-unit multifamily community in Houston.

The sponsor was buying the property and looking to create value through increasing rents and optimizing expenses.

After the effective 14-month term, EquityMultiple exited the investment and distributed $1.88 mln in profits to investors for a net realized IRR of 117%.

YieldStreet

YieldStreet11 is an innovative alternative investment platform with a focus on real estate. It allows accredited and non-accredited investors to invest in a real estate investment fund, public or private, or directly in private real estate opportunities with as little as $5,000.

With over $900 million raised to date in more than 100 offerings, the platform promises a net IRR of around 9.6%.

The platform charges a management fee of up to 2.5%, the fee varies depending on the investment type.

YieldStreet invested $9.8 mln12 to buy out two non-performing loans – a mezzanine and a first mortgage, that were secured by a mixed-use property in Brooklyn. The loans were collateralized, and the price was attractive.

The expected investment term was 36 months, with a 15-17% target net annualized return. The sponsor managed to negotiate a loan settlement that led to the loan repayment which resulted in a 41% net annualized return to investors.

How to launch a real estate crowdfunding platform with LenderKit

If you are thinking about launching your own real estate crowdinvesting platform, consider using a white-label crowdfunding software from LenderKit.

LenderKit offers real estate investment software for managing real estate deals, onboarding retail and professional investors, managing transactions, documents and generating payout schedules.

The platform has all you need to launch a real estate investment platform prototype or build a robust and competitive real estate crowdfunding platform.

Article sources:

- Preferred equity

- Return on Common Equity - ROCE Calculation, Formula

- RealtyMogul.com™ | Real Estate Crowdfunding & Investing

- RealtyMogul.com™ | RealtyMogul Funds Institutional Quality Property

- Fundrise

- Williamson at the Overlook

- Your Direct Access To Private Market Investing - Crowd Street

- Access Private Market Opportunities with Crowd Street

- EquityMultiple | Welcome to Modern Real Estate Investing

- Asset Management Case Studies - Q3 '22

- Willow Wealth - Leading Private Markets Investments Platform

- - Willow Wealth