How to Start a Crowdfunding Business in UAE

No time to read? Let AI give you a quick summary of this article.

Starting your own crowdfunding platform involves a series of steps:

- Identifying your area of interest & crowdfunding model

- Choosing the right market segment and target audience

- Deciding on the use of technology like crowdfunding software

- Making sure your business adheres to regulations

- Applying to the Regulatory Sandbox & testing your business model

- Registering your business & figuring out the taxes

- Establishing strong revenue stream and growing your market presence

When it comes to crowdfunding business in UAE, the general sequence of events is similar, but there are a number of nuances that you need to consider.

What you will learn in this post:

Why start a crowdfunding business in UAE?

In the early 2010’s, UAE’s GDP growth rate was at an astounding 7% 1due to real estate and oil export, but over the past decade, GDP rate decreased down to 2%.

Understanding the need to increase the market value and find new ways to diversify the country’s economy, UAE implemented the 2030 Economy Vision2 strategy to build a competitive ecosystem.

Today, the largest players in the country’s macroeconomy are tourism and small and medium-sized enterprises3, and diversification of the market accounts4 for the current economic growth. UAE also focuses on the digitalization and Fintech technology and alternative sources of financing, including crowdfunding.

SMEs are the key to stability of any country’s economy as they provide the majority of jobs, thus combating unemployment. Many of these firms emerge from successful crowdfunding campaigns to boost company’s financing.

Crowdfunding is a relatively new entity in developing countries’ markets – these include Eastern Europe and Southern Asia in addition to the Middle East. Of all of these, UAE is the furthest down the line due to their highly developed regulations.

The country’s government has well-established priorities and knows how to manage risks – 50-70%5 of projects in the UAE are blocked from investment by banks and investment organisations. This is why the need for investment crowdfunding platforms is so sharp.

The UAE government is striving to achieve the best for the crowdfunding market:

Financial Inclusion Strategy6 launched by the Securities and Commodities Authority (SCA) aims to lower the cost of financial services, recruit more companies into the local ecosystem and introduce more advanced regulatory devices.

A sneak peek into the UAE crowdfunding platforms

A number of platforms have already witnessed a huge success, Eureeca and Beehive to name a few.

In 2014, Humming Crowd Realty became the first UAE real estate crowdfunding platform. It was followed by others, such as Durise and Zoomaal. One of the leaders of real estate crowdfunding in Dubai is SmartCrowd.

Several large companies, including Amazon, Twitter and Microsoft, have branches in the UAE in order to search for new ideas and finance startups. However, because it’s an emerging market, there is far less competition for investors’ money than there would be in larger crowdfunding hubs such as the Silicon Valley.

Therefore, an attractive startup idea can gain capital faster than anywhere else – you will find that there is lots of investor money ready to finance SMEs.

UAE’s free economic zones

One must not forget about the free economic zones, which are very attractive for business.

One of the most important parts of managing a company is taxes – this especially applies to the initial stages of business growth.

Launching a company in a free economic zone can mean paying as little as 5%, so you can save some resources and instead spend the money on expanding the enterprise. In comparison, the majority of other countries have around 20-25% tax rate, and France asks for as much as 40%.

Overall, owning a crowdfunding business in the Emirates guarantees that you will have to do less paperwork and accounting. That doesn’t mean that you get to do whatever you want – everything must be clear and transparent due to strict regulations.

What you need to know about crowdfunding regulations in the UAE

When it comes to regulatory devices, there is one that entrepreneurs need to be particularly aware of – Loan-Based Crowdfunding Activities Regulation7 by UAE Central Bank. Both equity- and debt-crowdfunding can be subject to regulation by CBUAE with respect to banking. Here are some highlights from the document:

- Crowdfunding platforms must be grouped by volume – Category 1 (more than 5 million AED in loans per year) and Category 2 (up to 5 million per year)

- The platform’s category determines the company’s minimum capital requirement – this can range 300,000 AED to 1 million AED.

- The borrower must be a company registered in the UAE.

The SCA, in turn, regulates crowdfunding activities with respect to any financial services, including security and fund operation.

Dubai Financial Services Authority8 supports the activities within the Dubai International Financial Centre. This regulatory body aims specifically to improve the experience of the users and providers of financial services by means of innovations. Some of the key practices it includes are:

- The Innovation Testing License Programme – a regulatory sandbox allowing the license holders to test their financial products and services within a controlled environment.

- Constantly modifying the existing policies and frameworks.

- Engaging with the network of SMEs and stakeholders.

- International relations.

All three of the regulatory bodies prohibit crowdfunding activities without an appropriate license, obtaining which can be a long and expensive process. In order to bypass the otherwise daunting paperwork, some jurisdictions have established their own regimes to assist small business owners.

Also read: "Crowdfunding in Saudi Arabia"Most Optimal Locations to Launch a Crowdfunding Platform in the Emirates

Crowdfunding and Angel investors are less strictly regulated in the UAE than in first-world countries such as the UK and US, yet the regulations that are set create characteristic ecosystems that only allow specific kinds of businesses to flourish in each separate Emirate.

Dubai

Dubai is the most cosmopolitan, international Emirate in the union. Starting a crowdfunding platform in this city provides endless opportunities for global networking. Moreover, the politics imposed by the Emirate’s sheikh Hamdan bin Mohammed Al Maktoum is the most accepting towards foreign cultures in order to attract investors and businesses.

Most Emirates have their own free economic zones9 – select physical locations that allow the businesses operating there to pay very low tax rates. However, each FEZ has its own list of areas of specialisation, and only the businesses that work in those industries will fall under the low tax umbrella.

Dubai has numerous free economic zones specialising in a variety of fields. Here are just a few examples:

- Dubai International Financial City

- Dubai Logistics City

- Dubai Science Park

- Dubai Cars and Automotive Zone

- Dubai Silicon Oasis

- Dubai Gold and Diamond Park

- Dubai Industrial City

- Dubai Internet City

- National Industries Complex

- Dubai Production City

There is one area that requires special attention in terms of crowdfunding- the Dubai Media City10. The hub is the largest free zone in the Emirate, housing some of the biggest corporations, including Microsoft and Twitter. These giants are always looking to fund new projects and exciting ideas.

Abu Dhabi

Although this Emirate is a far more conservative area than Dubai, it is the second largest hub for crowdfunding activities in the union. The Abu Dhabi crowdfunding financial regulator, ADGM, has recently launched11 their own sandbox – Digital Lab, in order to support online banking and encourage the development of fintech in a safe environment. The cloud-based service provides a framework for businesses to improve their services and products.

Moreover, the city houses seven free economic zones fit for various business goals:

- Abu Dhabi Airport Free Zone

- Abu Dhabi Global Markets

- Khalifa and Industrial Zone Abu Dhabi

- Twofour54

- Industrial City of Abu Dhabi

- Higher Corporation of Specialised Economic Zones

- Masdar City Free Zone

Crowdfunding software for UAE based businesses

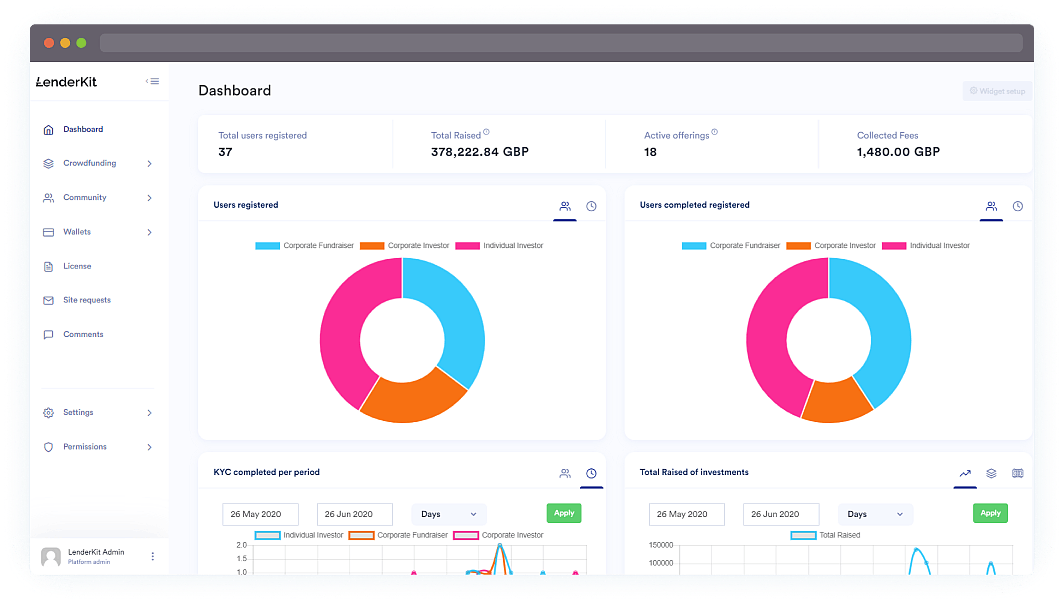

There aren’t many crowdfunding software providers in the UAE. LenderKit is among the few providers in UAE that can help you launch a crowdfunding business relatively quickly and cost effectively.

LenderKit provides 3 product tiers that fit early-stage crowdfunding platforms and large investment firms that focus on SME financing or Real Estate.

LenderKit worked with projects like NEOM, Forus and Matrix Capital in Saudi Arabia and helped them set up a crowdfunding platform to apply to SAMA, CMA and complete many other business milestones.

By leveraging the white-label crowdfunding software with ability to fully or partially redesign and customize it, LenderKit can help you build a unique crowdfunding platform for the UAE market and apply to the Regulatory Sandbox and scale your investment business.

Conclusion

The UAE is the most progressive of all the prospective crowdfunding markets in the Middle East. The biggest benefits of launching a crowdfunding platform in one of the Emirates are:

- Low tax rate

- Stable economy

- Sandbox applications

- A large pool of investors’ money

- Regulations that protect businesses

- Multinational community of entrepreneurs

If you need support setting up your own platform, our UAE crowdfunding software is here to help. Contact us to book a consultation or request a demo.

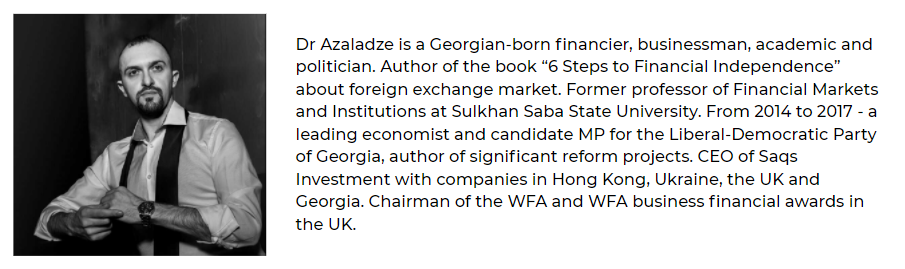

This article features financial expertise by Dr Amiran Azaladze12 who spent 6 months in UAE on a business trip learning about the investment market, regulatory framework, and the business ecosystem.

Article sources:

- United Arab Emirates GDP Annual Growth Rate

- PDF (https://www.actvet.gov.ae/en/Media/Lists/ELibraryLD/economic-vision-2030-full...)

- SMEs' GDP input set to hit 70% by 2021 | Khaleej Times

- UAE’s Economic Diversification Efforts Continue to Grow

- 50-70%

- SCA launches a roadmap for its financial inclusion strategy | News...

- PDF (https://www.centralbank.ae/sites/default/files/2019-09/BSD-%20Loan%20Based%20...)

- DFSA | THE INDEPENDENT REGULATOR OF FINANCIAL SERVICES | DFSA Innovation and Crypto

- 45 Free Zones in UAE (All Emirates)

- Dubai Media Hub - Freezone Company Setup | Dubai Media City

- Abu Dhabi Global Market (ADGM) launches ‘Digital Sandbox’ - The Sovereign Group

- Amirani A. - A-Registry | LinkedIn