The Ultimate Guide to Asset Tokenization

No time to read? Let AI give you a quick summary of this article.

Asset tokenization converts assets such as property, artwork, commodities, or company shares into digital tokens on a blockchain. These tokens can represent a whole asset or just a small fraction of it, which is why tokenization opens the door to more investors. People can buy smaller pieces of valuable assets while benefiting from the transparency and fast settlement that blockchain provides.

In this guide, we will examine real platforms that already utilize tokenization and demonstrate how the process works in practice. We will review regulated providers, such as NYALA1, whose tokenized securities can be verified on Polygonscan, explore how networks like Polymesh2 organize the tokenization workflow in a secure and compliant way, have a look at Tokeny3, which focuses on legal compliance, and check how issuer-focused tools like Hadron4 by Tether operate.

We will also check platforms that already apply tokenization today: Lofty5 and BlocHome6, which offer fractional ownership of real estate, and Tecra7, which allows startups to raise funds through tokenized offerings. These examples show that tokenization is no longer just an idea, but it is already working in live products.

Tokenization makes it easier for more people to participate in previously hard-to-reach markets. It improves liquidity, increases transparency, lowers costs, and opens investment opportunities that used to be available only to a few.

What you will learn in this post:

How asset tokenization works

Source: Hackernoon8

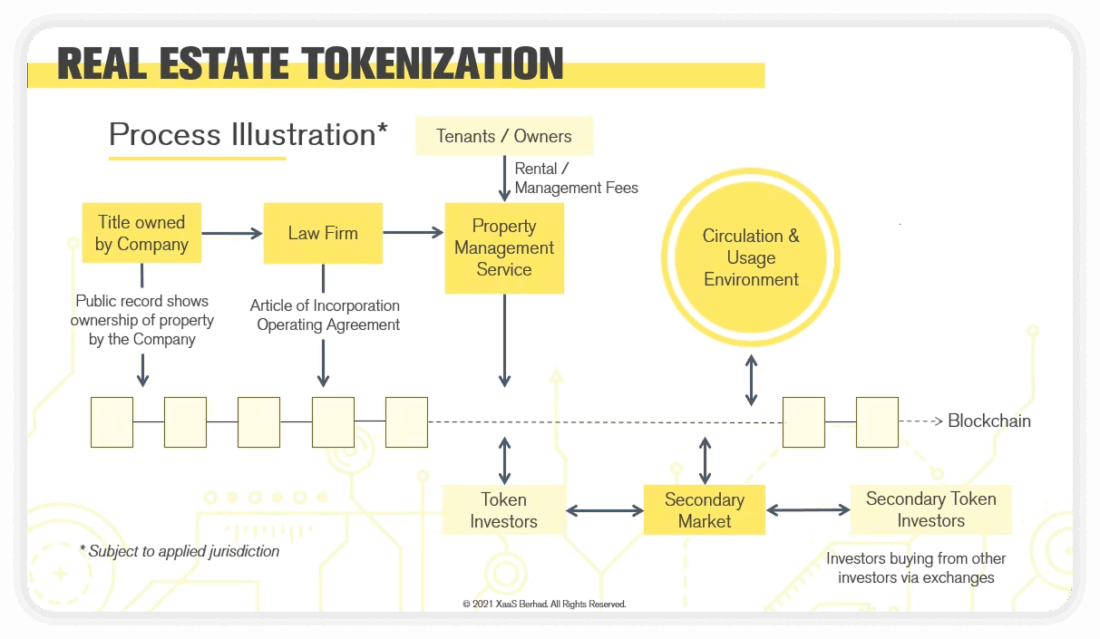

To understand how tokenization works, let’s check an example with real estate.

The process starts with a company that owns a house, building, or piece of land. To prepare the asset for tokenization, the company creates a separate legal entity called a Special Purpose Vehicle (SPV). This SPV becomes the formal owner of the property, so the asset can be divided and represented on a blockchain in a clean, regulated structure.

Once the SPV is established, the property is professionally valued. That valuation determines the number of digital tokens to be issued. These tokens do not represent pieces of the physical building itself, but rather shares of the SPV that owns it.

Once the structure is set, tokens are minted on a blockchain. Each token mirrors a small percentage of the SPV’s equity. Now, the tokens can be offered to investors.

While tokens are distributed, the SPV continues to manage the property. It may work with a property management service to oversee tenants, handle maintenance, and collect rental income. All revenue flows into the SPV.

Token holders gain a financial interest in the SPV. When the property generates income, a portion of that revenue can be distributed to token holders. Smart contracts often automate these payouts so token holders receive their share directly and transparently.

Once issued, tokens can move freely on secondary markets. This creates liquidity. And with it, real estate, which is traditionally a slow and illiquid asset, can be bought and sold more easily.

Eventually, the property may be sold. When that happens, the proceeds return to the SPV and are distributed to token holders according to the number of tokens they own. At that point, the lifecycle comes full circle: the property is placed into an SPV, transformed into tokens, purchased by investors, and ultimately liquidated, with all value returned to the stakeholders.

Benefits of asset tokenization

- Increased liquidity: Converts traditionally illiquid assets (like real estate or art) into tradable digital tokens.

- Fractional ownership: Enables investors to buy smaller portions of high-value assets.

- Global accessibility: Allows 24/7 trading across borders without intermediaries.

- Lower entry barriers: Opens investment opportunities to a broader range of investors.

- Faster settlements: Smart contracts automate transactions, reducing delays and costs.

- Enhanced transparency: Blockchain records provide clear, verifiable ownership and transaction history.

- Reduced administrative costs: Automation cuts down on manual processing and paperwork.

- Flexible liquidity options: Asset owners can sell partial stakes without full divestment.

Challenges of asset tokenization

- Custody risk: Token value depends on proper management of the underlying asset; poor custody or fraud can cause total loss.

- Asset-backing uncertainty: If the real-world asset isn’t accurately or transparently linked to its token, ownership claims may be disputed.

- Regulatory ambiguity: Global laws on tokenized securities remain inconsistent, which complicates compliance for issuers and investors.

- Legal enforcement issues: Enforcing ownership rights across jurisdictions can be difficult when disputes arise.

- Technical vulnerabilities: Smart contract bugs or blockchain exploits can lead to theft or permanent loss of funds.

- Market fragmentation: Tokenized assets often trade on small, isolated platforms, which reduces investor confidence.

- Limited secondary markets: Despite 24/7 trading, real liquidity may remain low until institutional adoption grows.

- Operational risk: Custodians, platforms, or oracles may fail. This may disrupt access or settlement of tokenized assets.

- Reputational and trust concerns: Without strong oversight and verified asset audits, investor trust can decrease.

Asset tokenization software providers

Asset tokenization software providers offer the tools needed to issue and manage digital tokens in a compliant way. These platforms help handle the technical and regulatory steps involved in creating regulated digital securities.

NYALA

NYALA1 is a fully regulated platform that enables the tokenization of financial securities, such as bonds and shares, under the German Electronic Securities Act (eWpG)9. 10

Through its subsidiary Smart Registry GmbH, NYALA runs a BaFin-supervised crypto securities registry. It means that tokens issued via NYALA are not just digital assets. They are legally recognized, regulated securities.

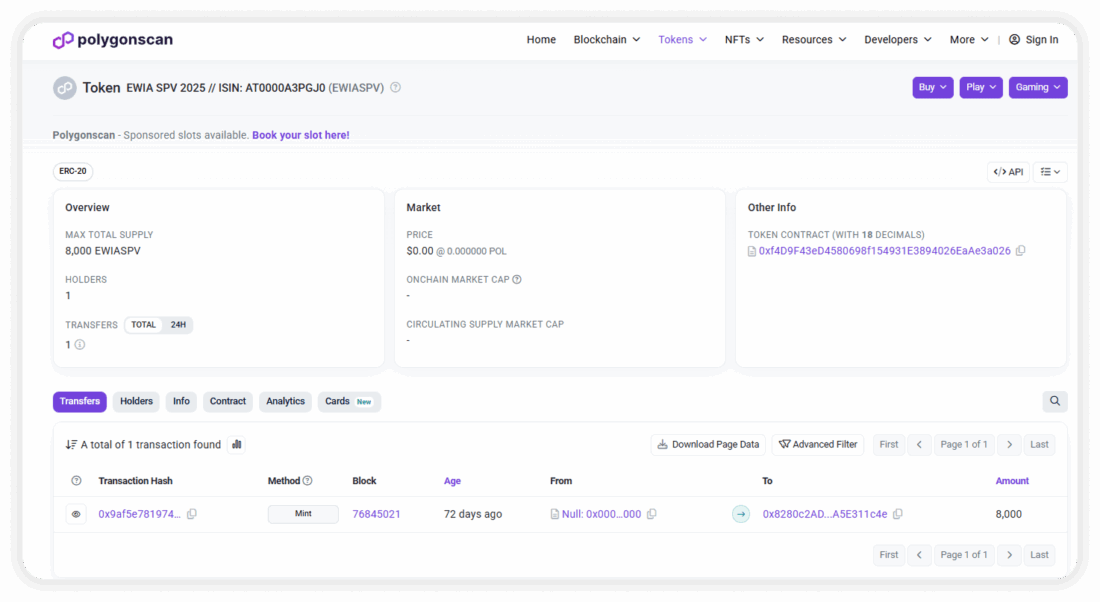

NYALA’s securities are publicly available on Polygon. So, everyone can check the token balances and activities with the tokens.

Source: Polygonscan11

NYALA allows companies to structure and design their security tokens, register them with NYALA’s regulated registry, and distribute them via either a web portal or API.

NYALA holds ISO 27001 certification and supports multi-signature custody solutions, offering strong, bank-level protection for tokenized assets. 12

This platform can serve a wide range of issuers, including crowdfunding platforms, real estate developers, banks, and fund managers.

Polymesh

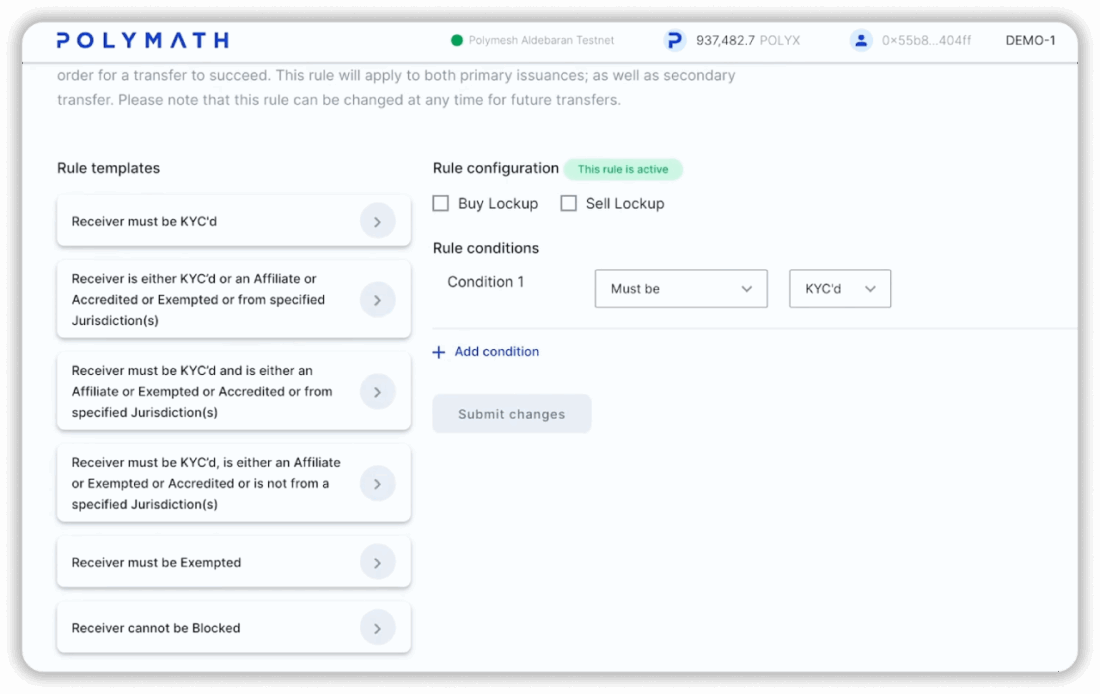

Polymesh2 is an institutional-grade blockchain built for real-world tokenized assets, such as securities, real estate, and other regulated financial instruments. It embeds identity verification, compliance controls, confidentiality, and on-chain governance directly into the protocol. This helps to remove the need for external compliance layers and keeps the entire lifecycle of a token governed on-chain.

Source: Polymesh Youtube Channel13

This design gives issuers precise control over how their assets move. For example, an issuer can define transfer rules that require every holder to be KYC-verified, accredited, or meet any other eligibility criteria. These rules can be updated at any time and applied to all future transfers.

Hadron

Hadron4 is Tether’s tokenization platform. It is designed for issuers who want to bring real-world assets, equity, or other financial instruments onto the blockchain. Its main strength comes from Tether’s reputation and infrastructure, which gives the platform a level of trust and operational reliability that many smaller tokenization projects cannot offer. For companies that want to tokenize shares or structured assets in a compliant environment, Hadron offers a solid institutional foundation.

For now, Hadron fits best as a service for issuers rather than a tool for developers or consumer-facing applications. It can work well for organizations that need a controlled environment for token creation, but it is less suitable for ecosystems that depend on open architecture and seamless connection with external products.

Hadron has the potential to become a major player in the tokenization space, thanks to its backing and issuer-oriented design.

Tokeny

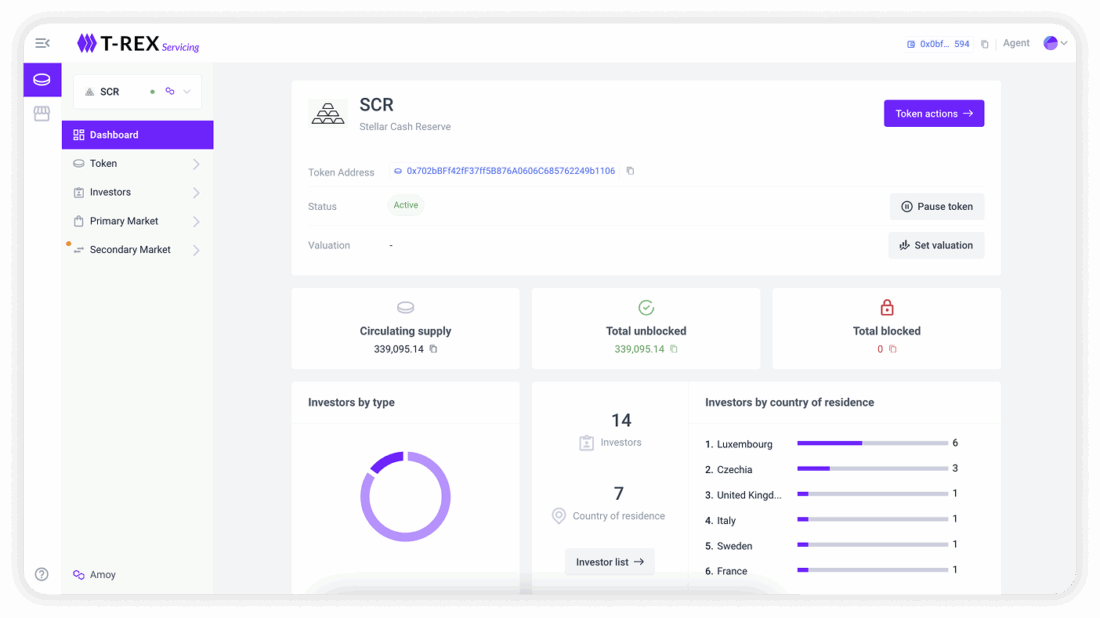

Tokeny3 is one of the most established tokenization infrastructure providers. It is built specifically for regulated financial institutions (banks, fund managers, issuers) that want to launch security tokens or other compliant digital assets.

One of Tokeny’s main offerings is its ERC-3643 (T-REX) token standard. It is a permissioned token protocol designed to embed compliance rules (like KYC/AML and investor eligibility) directly into the lifecycle of the token. Using this, issuers can restrict who can hold or transfer tokens, freeze or burn tokens, and enforce compliance on each transaction.

Their Servicing App14 lets non-technical issuers manage token issuance, token holder operations, and compliance without needing deep blockchain skills. Tokeny supports minting, burning, freezing, and other token-supply operations, and allows you to define compliance rules from the start.

On the asset side, Tokeny is already being used in real-world tokenization use cases. For example:

- Fasanara Capital15 tokenized a money market fund via Tokeny, using Polygon, combining compliance with DeFi composability.

- BlocHome16 uses Tokeny to fractionalize real estate, lowering entry costs for investors and streamlining corporate actions.

Platforms that work with tokenized assets

Below, we check a few platforms that already utilize tokenization in practice and demonstrate how it adds value in everyday markets. They provide investors with a way to buy, trade, or manage real-world assets through digital tokens

BlocHome

BlocHome6 is a Luxembourg-based platform that democratises real estate investing by tokenizing fractional ownership of residential properties. Rather than buying an entire property, investors can buy “slices” of real estate through blockchain-based tokens representing shares in an ownership company.

To issue these real estate tokens, BlocHome uses Tokeny’s T-REX tokenization platform17. With Tokeny’s technology, BlocHome links digital identities to tokens and enforces compliance rules (via the ERC-3643 standard), which helps automate investor eligibility checks and ensures regulatory control.

The minimum investment required to join BlocHome is €1,000. This makes it much more accessible than traditional real estate investing. New investors must complete a KYC process, and investments are made via bank transfer.

One of the biggest advantages of using Tokeny with BlocHome is cost efficiency: they claim up to 90% savings on compliance and administrative costs because Tokeny handles onboarding, identity verification, and token servicing.

Lofty

Lofty.ai5 enables fractional real estate investing by tokenizing rental properties on the blockchain. The platform allows people to invest in real estate for as little as $50 per token.

When a property is listed, Lofty establishes a dedicated LLC (DAO-LLC). Token holders own “membership interests” in that LLC. This gives them both a share of the property and a vote in its governance. Lofty uses the Algorand blockchain18 to issue its tokens because of its low fees, fast transaction times, and finality.

One of Lofty’s standout features is daily rental income: once you hold tokens, you begin receiving rent distributions every day. There is also a secondary marketplace, so investors can buy and sell their property tokens more freely than in typical real estate. 19

On the governance side, Lofty gives token holders voting rights: each token equals a vote in decisions about the property’s management, such as choosing property managers or maintenance strategies. Property management is handled by professional third-party firms, but the investors (via their tokens) have a say in how things are run.

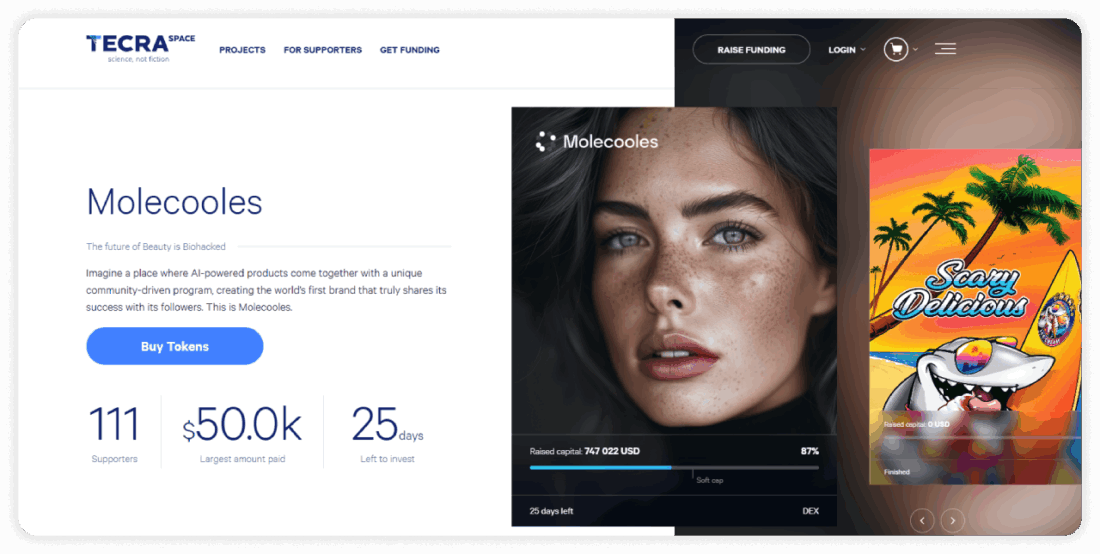

Tecra Space

Tecra Space7 is a blockchain-powered crowdfunding and tokenization platform that helps creators launch high-tech and intellectual-property projects. Projects issue their own “Space Tokens” on the Tecra blockchain, which investors buy using TecraCoin (TCR) or other supported currencies. 20

One of the most interesting features of Tecra’s model is tranche-based funding: funds are released to creators only after reaching predefined milestones, which helps align project progress with investor protection. The platform also commits creators to a long-term token repurchase plan: according to their white paper, part of each creator’s revenue is used to buy back tokens from investors. 21

How to launch an investment platform into tokenized assets with LenderKit

Building a platform for tokenized investments requires both traditional financial infrastructure and modern blockchain integration. LenderKit provides the foundation for the first part: a fully functional investment platform that supports fundraising, investor onboarding, compliance, and transaction management. While LenderKit itself does not issue or manage tokens directly, it enables businesses to launch a compliant investment platform that can later integrate tokenization through third-party providers.

With LenderKit, companies can set up a custom investment portal that supports different asset classes, investor verification (KYC/AML), and automated workflows for offers, payments, and reporting. This forms the “traditional base” of the system: the legal and operational framework where investors interact, review offerings, and manage their portfolios.

To enable tokenization, specialized blockchain providers are connected to the platform through APIs or middleware solutions. These partners handle the creation, issuance, and management of digital tokens that represent ownership in the underlying real-world assets.

For example, solutions like NYALA (Germany) provide a compliant digital securities infrastructure that can be integrated into platforms built on LenderKit.

To find out how you can launch a platform or discuss details, please get in touch with us.

Article sources:

- The All-in-One Platform for Tokenization of Securities - NYALA

- Polymesh | The Blockchain Purpose-built For Real World Assets

- Tokeny - Documentation

- Sign in ・ Cloudflare Access

- Fractional Real Estate Marketplace | Lofty

- BlocHome | Own Real Estate in Luxembourg from €50/month

- Tecra Space - Blockchain Fundraising Platform

- Real Estate Tokenization Guide: How Does it Work? | HackerNoon

- EWpG: Everything you need to know

- The All-in-One Platform for Tokenization of Securities - NYALA

- Just a moment...

- Frequently Asked Questions - NYALA

- - YouTube

- Servicing App

- Tokeny - Documentation

- Industry Case Studies

- Overview

- Welcome to Algorand

- Ultimate Guide to Real Estate Tokenization 2025 | Lofty | Real Estate Blog

- PDF (https://tecra.space/files/Tecra_Space_Light_Paper.pdf?utm_source=chatgpt.com)

- PDF (https://tecra.space/files/Tecra_Space_White_Paper.pdf?utm_source=chatgpt.com)