The Ultimate Guide to Online Crowdfunding

No time to read? Let AI give you a quick summary of this article.

Online crowdfunding is a fundraising instrument that business owners use to push their ideas and products to the market.

Crowdfunding can be used as a standalone source of funds or in addition to other available options such as bank loans, financial support from friends and family and personal investments.

The ultimate goal is to sell your business idea to the “crowd” or a network of retail or accredited investors and get money to fund your dream venture.

Normally, online crowdfunding happens on a third-party website or a crowdfunding platform that offers a designated crowdfunding campaign page for a particular business project.

In this case, the crowdfunding platform plays the role of a facilitator or a manager who helps businesses access alternative finance instruments and also provides investors with pre-vetted investment opportunities.

The word “pre-vetted” is quite important because this isn’t super easy to get listed on a crowdfunding platform, let alone succeed in hitting the funding goal.

Let’s talk about how online crowdfunding works in more detail.

What you will learn in this post:

What online crowdfunding models exist?

There are several crowdfunding models that are available to entrepreneurs including donation, rewards, debt, equity or mixed-type crowdfunding.

Donation crowdfunding

Donation crowdfunding is used by schools, students, churches, medical institutions or individuals as well as innovators. Donation crowdfunding is the best way to test the waters and see if there’s a market for your product and how people will respond to what you are offering. It allows fundraisers to get the initial feedback from real audiences and obtain the necessary funding to develop the idea further.

A peculiar thing about donation crowdfunding is that backers do not expect any monetary benefits in return.

The average success rate of donation crowdfunding projects is 22.4%1. However, the best way to find the donation crowdfunding success rate is to research a particular platform because it’s difficult to assess what is behind the “average” number. For example, Statista claims that the success rate on a popular donation crowdfunding platform – Kickstarter – is 40.62%2.

Reward-based crowdfunding

Reward-based crowdfunding is different from donation crowdfunding even though it can be leveraging the same fundraising method. The idea is that there’s a reward for backers which may come in form of a product or service that is offered by the fundraising company.

Some of the most common use cases of reward-based crowdfunding include artists, movie makers, musicians, innovators and actually any other individual or company that is willing to build a closer relationship with their audience and turn supporters into regular customers.

Debt crowdfunding or P2P lending

Debt crowdfunding or P2P lending is basically taking a loan from the “crowd” and having debt obligations that need to be paid. P2P lending platforms screen businesses carefully, assign a credit score and allow them to raise money with a custom campaign page. Investors are more interested in P2P lending than bank deposits because it offers higher returns of over 10%3, but also comes with an extra risk.

Equity crowdfunding

Equity crowdfunding is another type of investment-based crowdfunding where investors expect monetary returns in the long run. Companies sell their shares or common stock with no voting rights to investors and raise money for their project development. Unlike P2P lending which is more popular in real estate projects, equity crowdfunding is usually the best bet for startups.

The success rate of P2P lending and equity crowdfunding also depends on the platform where you are raising capital. For example, StartEngine claims to have had 90.8%4 of their funding round success rate in 2022.

When compared to donation platforms where the average success rate is only 22 – 40%, it can seem crazy, but StartEngine also says that only 1% of all startups make it to the platform. This is why “pre-vetted” is rather important in the P2P lending and equity crowdfunding business.

The number of projects on the debt or equity crowdfunding platform is usually smaller compared to donation and rewards-based platforms, but funding goals are much higher.

Mixed crowdfunding

Mixed crowdfunding is the use of debt, equity, donation and reward-based crowdfunding in any combination to provide the best offers for investors and fundraisers.

Is online crowdfunding regulated?

Donation and rewards-based crowdfunding is not as heavily regulated as P2P lending and equity crowdfunding. In some sources, you can even find that donation and rewards-based crowdfunding is not regulated at all.

Equity crowdfunding falls under the securities regulation and varies by region or country.

P2P lending usually comes across as loan-based, investment-based, investment brokerage sort of type of regulation.

As crowdfunding conceptually focuses on the retail investors or amateur investors, regulators impose rules to ensure some protection of people who may invest their last penny and lose everything. If a crowdfunding platform is focusing on accredited or sophisticated investors, the regulation may be lighter and less strict.

US crowdfunding regulations

Crowdfunding platforms in the US are normally regulated under the Reg CF exemption of the Securities Act, however, this also limits their operations to a very narrow segment of the market, so most of the platforms may choose Regulation A/A+ or even Regulation D.

The fundraising limits under different exemptions in the US range from $5M to $75M and higher. Usually, project owners try to max out the amount that is available under a certain exemption, so this could be the answer as to what the average funding goal is on crowdfunding platforms in the US.

UK crowdfunding regulations

In the UK, crowdfunding platforms are regulated under loan-based and investment-based rules6. The crowdfunding fundraising amount for project owners is £5M. In fact, the five million cap is what the usual amount is for investment-based crowdfunding projects.

European crowdfunding regulations

The crowdfunding regulations in Europe have long been distributed among the local authorities. However, in recent years the European Securities and Markets Authority introduced the new crowdfunding framework – ECSPR.

European Crowdfunding Service Provider Regulations7 aim to unite the market and allow for healthier competition and crowdfunding development in Europe. The fundraising limit is also €5M.

The regulations across different countries aim to make crowdfunding easily accessible, secure and less risky. However, investors should clearly understand the potential risks of crowdfunding.

Who are typical clients of a crowdfunding platform?

Crowdfunding investors can be divided into three groups:

- Donors or backers on donation and rewards-based crowdfunding platforms

- Retail, amateur, non-accredited or non-sophisticated

- Accredited, sophisticated or high-net-worth individuals

These investors have different profiles and financial literacy levels. Most importantly, they have their own comfortable amount of money to allocate to investments.

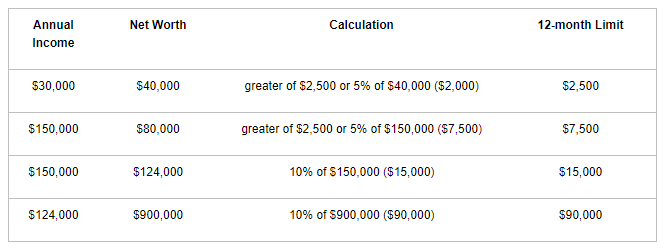

Crowdfunding regulations try to limit the number for retail investors in a 12-month period and separate them from accredited investors by introducing a net worth and annual income requirements.

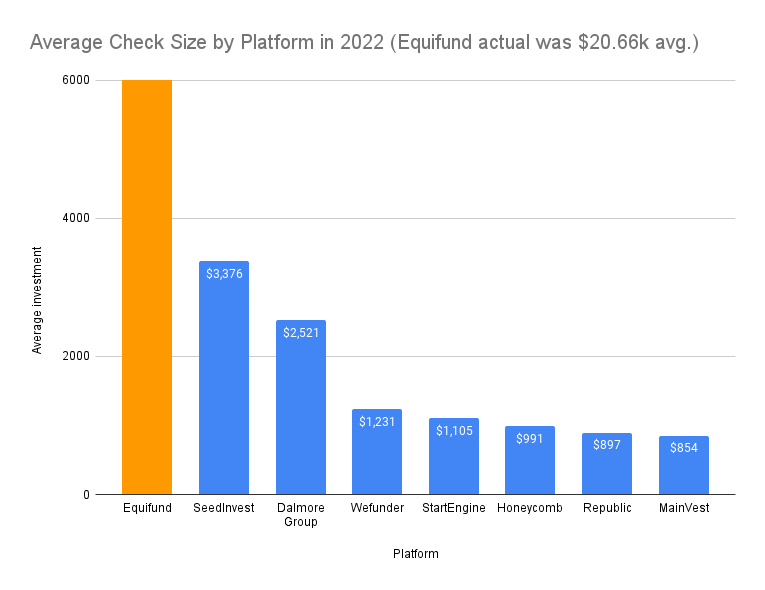

The investment limits may vary from $2,500 to $90,000 annually. Investors that are more financially advanced than shown in the table above are considered accredited investors9.

Speaking about fundraisers, the client profiles vary greatly. A typical startup owner may be raising only $10,000 to buy new equipment for a local coffee shop or be a real estate developer who needs $50M and considers crowdfunding a supplementary source of funds.

Of course, depending on the project owner profile, the audience that a crowdfunding platform is attracting will be different. Because financing huge real estate projects with $1 transactions will not be viable.

How does a crowdfunding platform work?

An online crowdfunding platform is a web portal that has technical facilities to host and promote crowdfunding campaigns.

The crowdfunding platform has a team of legal, financial, management, underwriting and marketing professionals who use the platform to help project owners raise capital online from a public or private audience.

The onboarding process of an investor or a fundraiser is different, but some things are common and include identity verification also called KYC, KYB or even KYX which is a collective term for all identity verification of either individuals or businesses. This helps platforms comply with the regulations and protect platform’s users from money laundering and fraud.

When all things come together and the crowdfunding campaign is live investors will enter into an agreement with the project owner or the platform depending on the platform’s type.

Some crowdfunding platforms operate as a fund of funds while others focus on direct lending or investing opportunities. In either case, the platforms charge fees for their services.

How crowdfunding platforms charge fees is an art in itself, but the standard practice is to charge a success fee of around 3-10% and some transaction fees.

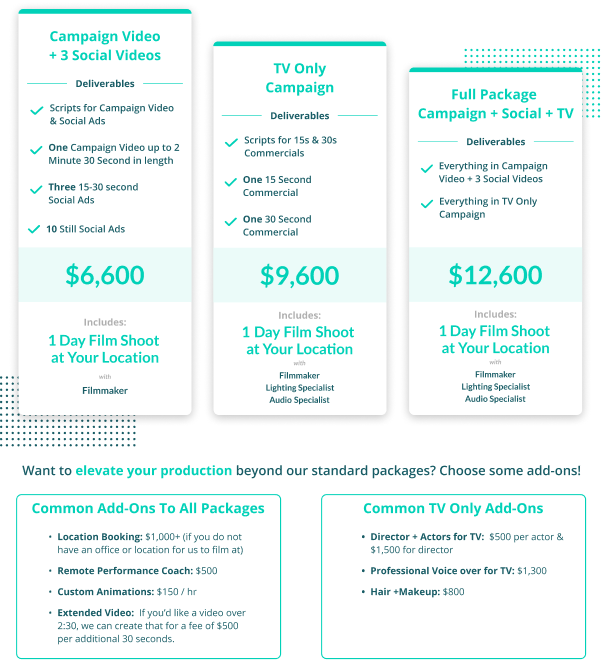

Usually, investment platforms make money on a whole range of services provided to project owners and startups. The service packages may include marketing and promotion, document filing, legal consulting, campaign preparation, post-launch support, etc.

Trends in online crowdfunding

Every year, the crowdfunding market is growing and becoming more competitive. Crowdfunding platforms try to niche out and diversify by finding new ways and segments to tap into.

Some of the major trends in crowdfunding include:

- Web3 and asset tokenization

- Green energy and tech

- Gaming, music, films and videos, art

- Mergers & acquisitions into bigger platforms

- Partnership with banks, startup accelerators, fintech companies, etc.

These trends are a mix of popular industries in crowdfunding as well as some of the actions that crowdfunding platforms take to grow bigger in the competitive market.

However, the market is far from being oversaturated and there’s definitely room for new crowdfunding platforms that may decide to join the game.

How much does it cost to start an online crowdfunding platform?

Even though a decent crowdfunding platform costs more than $100,000 – $200,000 project-wise, the monthly subscription costs and a range of available solutions on the market makes it easier for investment platforms to find the right fit.

Generally, crowdfunding platform costs include:

- Software subscription or one-time purchase

- Compliance costs

- Third-party fees (KYC, payment gateways, etc.)

- Maintenance costs

- Marketing & promotion

- Salaries, etc.

The costs of operating an online investment marketplace really depend on the scale of the platform, its crowdfunding model, investor profiles and many other factors.

Crowdfunding software for online investment businesses

If you’re looking for white-label crowdfunding software to launch your online crowdfunding platform, check out LenderKit.

The company has been on the market for years and helped many customers in Europe, UK, USA and the MENA region to start and maintain an online investment platform.

LenderKit investment software is also a service-based company meaning that you can count upon quick support, easy-going communication and ad-hoc development of your investment marketplace.

The company provides out-of-box crowdfunding software with all crowdfunding models and has many features that will ease up your investment onboarding, campaign management and compliance with the major regulations such as ECSPR, SEC/FINRA, FCA and others.

Don’t hesitate to discuss your crowdfunding platform requirements with a fintech strategist and book an online demo.

Article sources:

- 404 - Page Not Found

- 40.62%

- How to invest $10,000: Top 11 ways to allocate it right now | Money Under 30

- 90.8%

- 2022 Equity Crowdfunding Stats and Top Platforms - Crowdwise

- PS19/14: Loan-based (‘peer-to-peer’) and investment-based crowdfunding platforms: Feedback to CP18/20 and final rules | FCA

- PDF (https://www.esma.europa.eu/sites/default/files/library/esma35-42-1088_qas_cro...)

- Updated Investor Bulletin: Regulation Crowdfunding for Investors

- SEC.gov | Accredited Investors

- Promote Creative Package — StartEngine