Top 3 Reg CF Crowdfunding Portal Software

No time to read? Let AI give you a quick summary of this article.

Regulation crowdfunding, commonly known as Reg CF1, is a regulatory framework introduced in 2016 to democratize the investment industry by expanding investment opportunities to unaccredited investors. This regulatory framework allows anybody who complies with specific requirements to invest in privately-held securities.

The main principles of Reg CF are the following:

- all transactions are to be conducted online through an SEC-registered platform2 such as a funding portal.

- Businesses may raise a maximum of $5 million within one year.

- There are limits3 on how much non-accredited investors may raise.

- Companies shall provide transparent information about the offering to investors, the Commission, and the platform that manages the crowdfunding offering.

Since crowdfunding under Reg CF is regulated, platforms must comply with the SEC requirements to operate, usually registering as funding portals2.

Developing and launching a SEC/FINRA compliant investment platform is a complex task, so it’s better to rely on a knowledgeable software provider that can provide you with a compliant platform that can be easily customized to match your business.

Here are the top 3 Reg CF crowdfunding portal software providers to choose from.

What you will learn in this post:

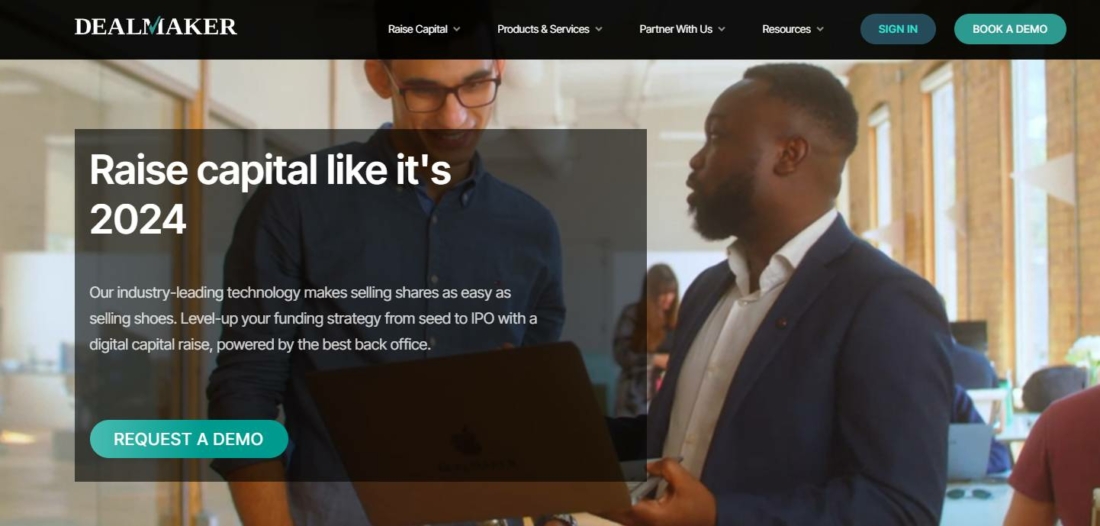

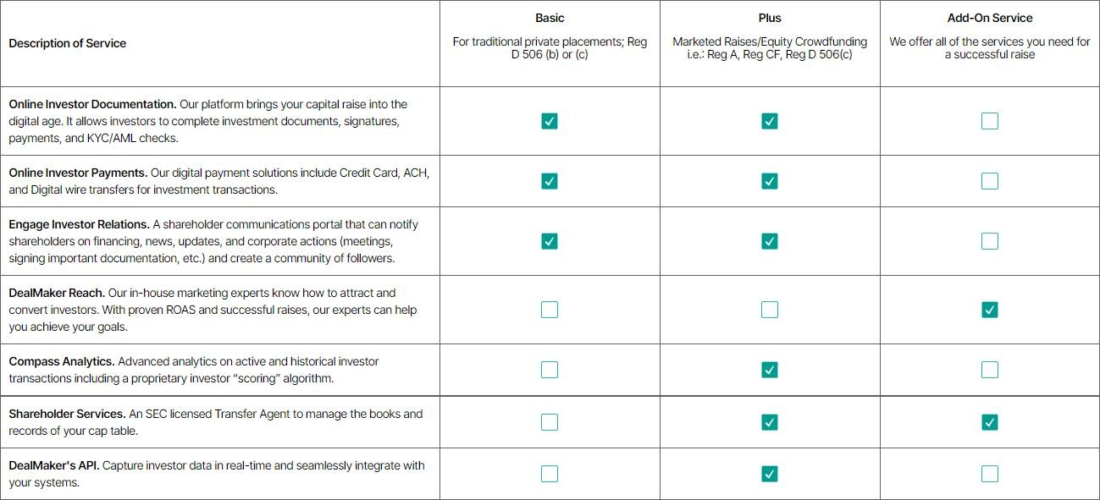

Dealmaker

DealMaker4 is a cloud-based investment platform that helps growing companies get funded by hosting and managing their fundraising campaigns and inviting investors to deals. DealMaker allows businesses to place their campaigns on their infrastructure, thus leveraging SaaS investment software capabilities.

DealMaker enables managing all the paperwork and processes on a powerful and highly secure digital platform that can be accessed from anywhere. To launch a fundraising campaign5, a company shall purchase a plan, fill in the subscription agreements, and digitize the documentation requested by the platform.

To run Reg CF campaigns, companies may need to select the Plus Plan, but the prices of the plans are not disclosed, so you should contact the vendor for more details.

When using Dealmaker, the company will help you to set up online payments for investors, enabling a plethora of payment options:

- credit card

- mobile wallet

- Express Wire

- wire transfer

US-based companies can use ACH payments, and Canadian ones can rely on ACSS.

To manage investments, you need to apply to DealMaker to open an escrow account6. During the application process, you will be requested to provide the documentation of the company that will manage the escrow account.

And finally, you can start inviting investors7 to fund your project.

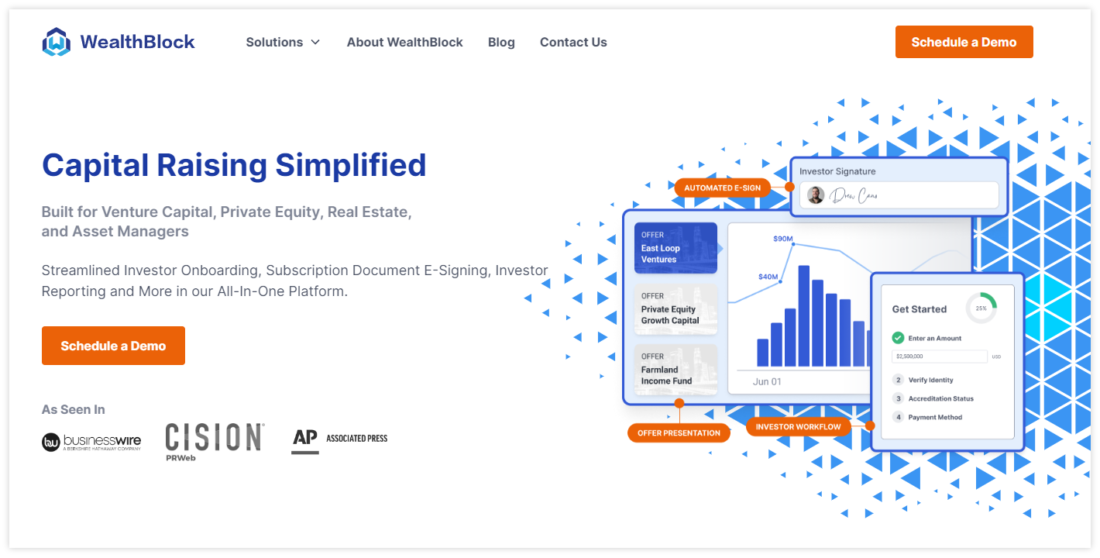

WealthBlock

WealthBlock Inc8 is one of the leading providers of Reg CF white-label investment software built for private capital raising. WealthBlock solutions include such key tools as CRM, data room, tools for investor verification, e-signature tools, investor reporting, and other tools and functionalities.

Currently, the white-label investment solutions of the company are used by venture capital, private equity, private placement, investment banking and broker-dealer companies that use them to market offerings under Reg D, A+, CF, debt, and equity across different asset classes (technology, farmland, real estate, and similar).

The main features of the white-label solutions by WealthBlock include:

- Security & compliance: KYC/AML, accreditation checks, offering documents storage

- Payment processing: payment gateways, including those accepting funding in Bitcoin and Ethereum

- APIs to connect all the services a client needs

- Offer builder

- E-signature template builder

- Tools for communication with investors: email automation, messaging, portfolio monitoring, and investment reporting

- CRM, and some others

A one-year subscription to WealthBlock is $90009, a trial or a free version is not available, but the company offers a 30-day money-back guarantee, if a customer cancels the subscription within this period, the company gives a full refund, no questions asked.

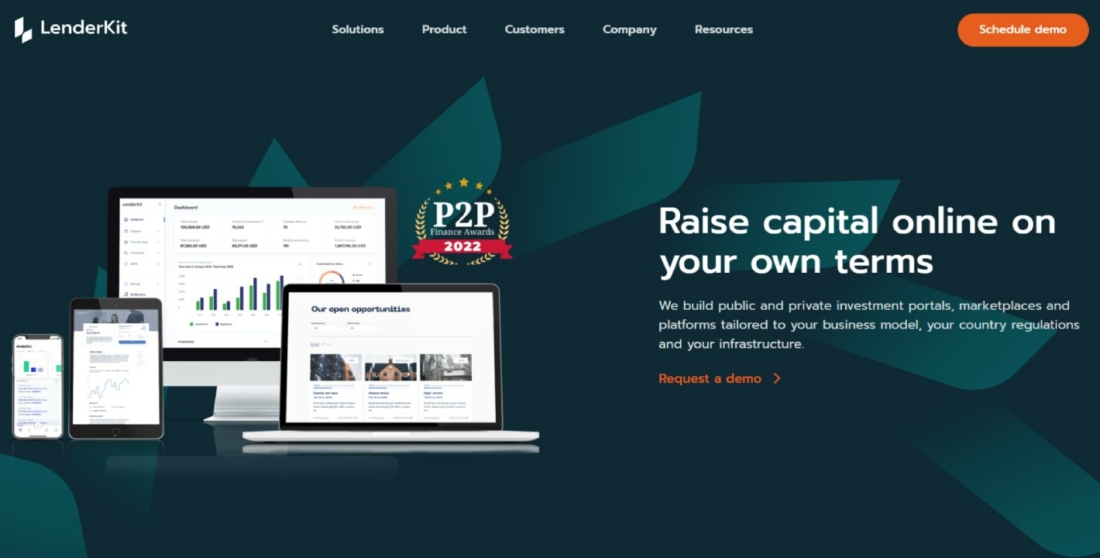

LenderKit

LenderKit provides comprehensive white-label investment software for VCs, private equity, and crowdfunding that allow you to launch a funding portal in the USA under the Reg CF, Reg A, Reg A+, or Reg D.

You can start with white-label crowdfunding software that comes with all the required features for the platform to operate as a funding portal or a broker-dealer.

As your business grows, the platform can further be customized to your specific needs as this is not a typical SaaS solution, but rather a proprietary investment software.

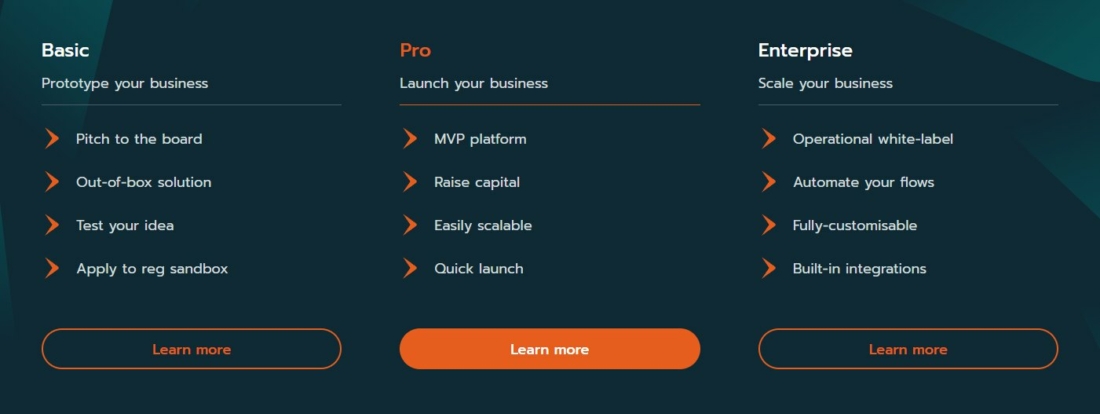

The cost of your crowdfunding portal will include the payment for the LenderKit license depending on the Basic, Pro or Enterprise package, and the customization costs if you believe that the white-label crowdfunding software needs additional polishing and fine-tuning for your business model.

When it comes to the actual software, here’s what you can expect to get from LenderKit:

An investor portal

It allows fundraisers to create their campaigns, and investors to invest. Each type of user (investors and fundraisers) has their designated area from where they can manage offerings, handle their crowdfunding campaigns, manage wallets or make investments.

An admin back-office

The admin dashboard displays all the KPIs and allows monitoring the platform’s performance. There, you can check:

- Users who signed up and completed KYC checks on the platform (investors and fundraisers)

- The total number of offerings

- The total amount of funds raised

- Amount of fees collected by the platform

- Configure risk questionnaire

- Manage investment campaigns

- Create offerings

- Manage investor roles

- Export data and more

Marketing site layouts

If you don’t have your own website yet, LenderKit offers a set of ready-made unique crowdfunding website designs with content builders that will allow you to get your business up and running in no time, while also providing you tools to make it visible for search engines and attract more clients.

LenderKit integrations

LenderKit’s Reg CF investor portal software can integrate any third-party services such as payment providers, digital signatures & compliance automation, and identity verification/AML providers.

If you want to learn more about LenderKit investment software, how it works, and how it can help you build your investment platform be it a funding portal or a broker-dealer, don’t hesitate to fill in the contact form and schedule an online demo.

Article sources:

- SEC.gov | Regulation Crowdfunding

- SEC.gov | Registration of Funding Portals

- Updated Investor Bulletin: Crowdfunding Investment Limits Increase

- DealMaker | Raise Capital Online

- Step 1: Getting Set up on DealMaker - Knowledge Center

- Escrow Account Opening

- When should I add an investor to DealMaker? For example, can I upload my entire mailing list to DealMaker?

- Investor Onboarding Platform - Subscription Electronic Document Signing - WealthBlock Inc. - Serving USA - Canada - UK

- Just a moment...