Start or scale your crowdfunding business in Saudi Arabia

Establish your investment or crowdfunding platform, digitize your offline business to democratize access to capital for startups, real estate companies or SMEs and grow your investment company in Saudi Arabia and beyond.

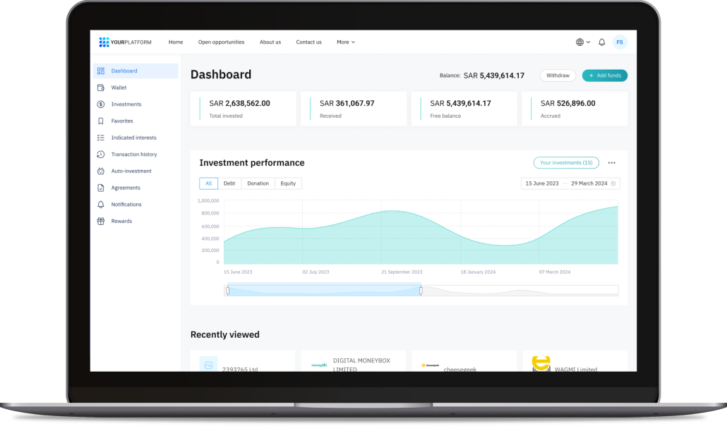

Your end-to-end white-label crowdfunding software

LenderKit has collaborated with over a dozen of customers in Saudi Arabia since 2018 and has brought a unique blend of global and local experience to the market.

We know your business challenges first-hand, so we adapted our solution to make the launch of your competitive crowdfunding platform as seamless as possible.

Get started with a ready-made crowdfunding software or request to build your own custom investment platform to offer unique products and services to your clients.

Empower your platform with integrations

Add powerful integrations to your crowdfunding or investment platfrom to streamline transactions, user verification and onboarding.

Throughout our collaboration with clients, LenderKit has integrated with some of the leading service providers in Saudi Arabia, including:

How to use LenderKit for your crowdfunding business in Saudi Arabia

Launch a crowdfunding platform prototype

Start quickly with a scalable prototype of your crowdfunding platform, test the waters, pitch to investors and explore further growth opportunities.

Expand and automate your operations

Launch a white-label crowdfunding platform for startups, SMEs or Real estate financing and grow your business with our out-of-box solution.

Create a unique investment platform

Build a custom crowdfunding, crowdlending, investment or invoice factoring platform for your specific needs, and outperform competitors.

Get ready to apply for your SAMA or CMA license

CMA – Capital Market Authority and SAMA – Saudi Central Bank regulate different investment businesses.

If you want to start a debt crowdfunding platform consider applying to CMA or SAMA.

And if you are looking to launch an equity crowdfunding platform or a investment marketplace check out CMA.

Have a quick look at how LenderKit works

Why should you use LenderKit?

With LenderKit you can launch a competitive Islamic finance platform be it equity or debt investing for startups or real estate.

We can help you grow your Shariah-compliant investment platform by providing powerful technology such as the website, investor portal and back-office.

Everything is customizable, so you can achieve a truly unique and fully white-labelled platform that will help you scale your online investment business.