Start a Crowdfunding business in MENA

Use our crowdfunding software for Saudi Arabia, UAE, Qatar, Oman, and North Africa regions. Apply to the regulatory sandbox with a prototype or launch a fully-custom platform.

Build a shariah-compliant crowdfunding platform

Use a prototype to apply to Regulatory Sandbox

Set up crowdfunding portal prototype to apply to SAMA, CMA, DFSA, DIFC or pitch to the board to raise capital.

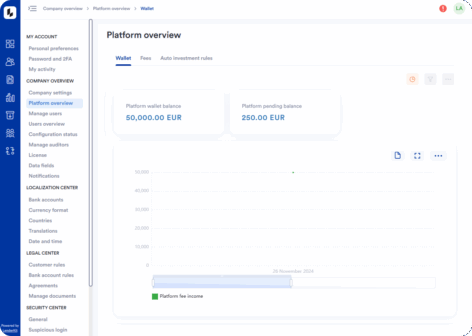

Expand and automate your operations

Build your investor and fundraiser base and automate operations or grow your business.

Launch a fully-custom investment platform

Build a unique crowdfunding platform with complex integrations and international focus.

Set up a crowdfunding platform in your region

We work with many countries in the MENA region and have experience helping new crowdfunding platforms to obtain the licensing and register their platforms.

Our team will work with you from the prototype to a fully standalone crowdfunding platform. We provide flexible white-label crowdfunding software in Saudi Arabia, UAE, Qatar, Oman, Egypt, Morocco and other countries.

The best thing about our crowdfunding solution is that it’s fully customizable both on the front-end and back-end which allows you to build a unique crowdfunding platform.

- Saudi Arabia

- UAE

- Oman

- Qatar

- North Africa

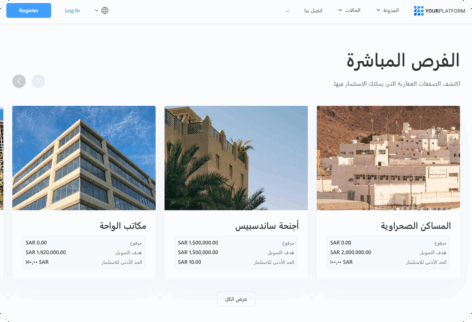

Streamline investing

Allow accredited and non-accredited investors register on your crowdfunding platform, pass KYC/AML verification and invest in offerings or portfolio.

Connect a payment system such HyperPay, ANB or other system to enable online-money processing and escrow accounts.

Let investors top-up wallets, withdraw funds and trade securities on the secondary market.

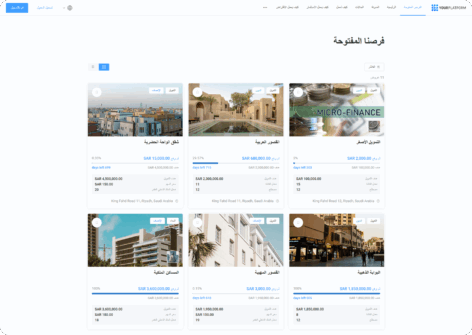

Facilitate fundraising

Automate deal sourcing and allow fundraisers to raise capital by issuing debt, equity securities or both.

Set-up online KYC/AML processes via Yakeen or other system to help you with the customer verification.

Create offerings yourself in the admin panel or delegate it to the capital raising company which can create offerings in the fundraiser portal.

Use crowdfunding software suitable for small and large teams

LenderKit fits small, medium-sized businesses and large investment corporations.

Configure permissions and create different user roles for advisors, accountants, lawyers and investment managers to reflect your company’s structure and run various operations securely and efficiently.

Our KSA and UAE crowdfunding software allows you to build a 360 solution which includes donation, rewards, debt and equity investment flows.

Implement custom integrations in your crowdfunding platform

Automate your payment processing, KYC/AML verification and other flows. LenderKit integrates with different software and services providers to help you facilitate crowdfunding operations.

Streamline customer onboarding, manage online transactions and integrate with providers that you’re familiar and comfortable working with.