5 Challenges New Crowdfunding Platforms Face

No time to read? Let AI give you a quick summary of this article.

While crowdfunding is not new, launching a new crowdfunding platform is still connected with many challenges. On behalf of CrowdSpace, we have surveyed different crowdfunding platforms and found the major crowdfunding challenges they are facing:

- Regulatory challenges

- Payment processing

- Identity verification

- Technological challenges

- Marketing channels and challenges

What are they in detail and how to handle them efficiently? Let’s take a closer look at the challenges and find out how you can minimize the effort when building your own crowdfunding platform.

What you will learn in this post:

Regulatory challenges or why crowdfunding platforms are heavily regulated

The biggest regulatory challenges for crowdfunding platforms include investment and capital raising limits, reporting requirements and ever-changing regulatory frameworks in different jurisdictions.

Requirements to a platform depend not only on the country but also on the type of financial activities the platform performs.

The Financial Conduct Authority (FCA), ESMA or SEC do not regulate donation and reward-based crowdfunding platforms, however, they regulate certain payment services provided in connection with these crowdfunding types. Regulators focus on investment crowdfunding rather than on donation or reward-based platforms.

That is to say, P2P lending, debt and equity crowdfunding platforms that work with the public are the ones that get regulated more heavily compared to investment portals for a private community.

The pool of investors in the “public” crowdfunding type includes accredited and retail investors, as well as venture capitalists and angel investors.

Also read: Can You Rely on Crowd Only to Finance ProjectsThey all are exposed to direct risks in the crowdfunding system such as:

- The project failure

- The platform closure

- The lack of an exit option

- Fraud

- Money laundering, etc

On the other hand, there are indirect risks, too, including:

- Cyberattacks

- Lack of transparency

- Stealing personal or financial data

Regulators pay close attention to making sure the above-mentioned risks are mitigated, so they impose strict regulations regarding identity verification, payment processing and marketing messages. So, the main reasons why P2P lending, debt and equity crowdfunding is regulated is to protect investors and borrowers and reduce the mentioned risks of investment crowdfunding.

Payment processing

The biggest challenge with money processing is finding the right balance between security, costs to end customers, speed of transactions and finally profits of the crowdfunding platform itself.

Crowdfunding platforms process money differently depending on the platform type and transaction size. The main ways to process funds are:

- Through a bank – the platform needs special authorization to manage the clients’ money. The platform is responsible for anything that can happen with the stored funds.

- Through an intermediary such as a payment service provider, for example, Lemonway, FundAmerica, or MangoPay. The integrated payment service provider is responsible for the clients’ money. The platform doesn’t require any special authorization to manage the money of investors.

The first scenario is more difficult to implement because a special license is needed. Also, the platform takes more responsibilities. But it allows the business to cut costs by avoiding the fees of payment service providers. However, integrating with a banking API is more costly than integrating with a payment gateway.

The second scenario might be suitable for crowdfunding businesses at the early stages of their development. A reliable payment processor allows the platform to manage payments automatically and work with lots of investors and transactions which would be impossible to manage manually.

Later, platforms opt for getting a client money management license and add an option to process payments directly.

Identity verification

The major challenge with identity verification in crowdfunding is that businesses need to have a straightforward investor onboarding process while compiling with the KYC requirements. If the sign-up on a crowdfunding platform is too complicated, you’re losing the audience, so finding the right balance is key.

Identity verification is a part of the KYC (Know Your Customer) procedure which is vital to a crowdfunding business. In crowdfunding, the KYC procedure can be:

Fully automated: platforms collect IDs, investors self-accreditation status through a questionnaire and a proof-of-address to allow investors to use the platform. After that, they collect financial information regarding the networth of investors and their paying capabilities through an authorised service provider: either payment gateway or a bank to ensure the investor’s self-accreditation status matches the investment limits in the regulatory requirements.

This financial verification step is required to allow investors to invest on the platform.

However, in some niches/business models, fully automated solutions cannot be applied because they are unable to ensure the needed level of verification and comply with all the requirements at the same time. Approximately 39% of crowdfunding businesses rely on automated payment processing and verification solutions.

Manual: it is applied by smaller P2P lending and equity platforms. Such businesses have a small client base and work with a limited number of offerings. Also, platforms frequently use manual verification and payment processing if the investment sums are large from $10,000 to $100,000. Around 10% of crowdfunding businesses use manual verification. However, they are considering automating it at least partially.

Semi-automated: this approach offers an opportunity to reverify the entire process by a human and is applied by around 51% of crowdfunding businesses.

Technology applied by crowdfunding businesses

Here, under technology, we mean everything that crowdfunding platforms use to run their business. Alternative financing platform run on:

- SaaS – these solutions are the rarest and are used by approx. 3% of platforms only. Their functionality is limited, and the scalability level is low. SaaS solutions are fine for platforms at the initial stage of their development. Further, though, they may not be able to provide the functionality required for the platforms to develop. Oftentimes, it’s used for single-raise cases.

- White-label software – normally, white-label crowdfunding platform software is suitable for match-funding platforms and investment portals. Companies like LenderKit, provide highly-customizable white-label solutions that can function and scale at the needed level.

- Custom-made crowdfunding software – it is used by approx. 90% of crowdfunding businesses, and many platforms are planning to shift to bespoke solutions in the future. While custom solutions are not cheap, they provide your business with the required functionality and flexibility level. For a new platform though, the cost of such a solution might be an obstacle.

Blockchain in crowdfunding

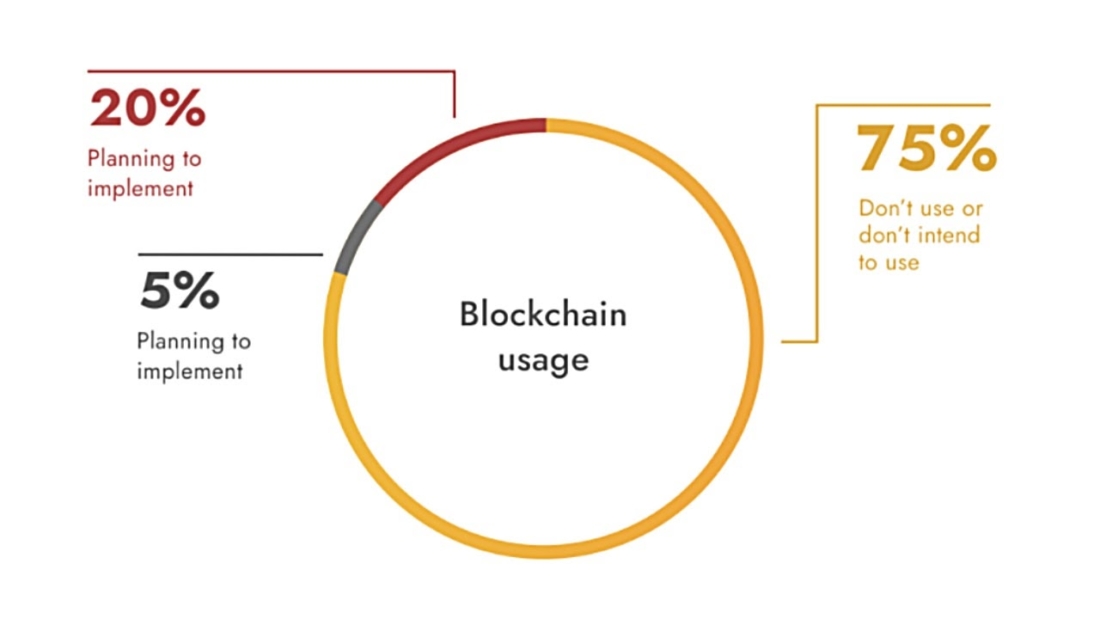

Many believe that blockchain is going to disrupt fintech. For now, the majority of crowdfunding platforms (75%) do not use blockchain and aren’t planning to switch to it in any near future.

While the technology itself, and specifically, tokenization and cryptocurrency transactions, have some potential for application in crowdfunding, especially in real estate or other less liquid asset classes, the wide application of blockchain in crowdfunding is yet to be explored.

Marketing channels and challenges

Crowdfunding platforms use different channels to promote their services and products:

- Organic search – 17%

- Referral programs and partnerships – 15%

- LinkedIn – 13%

- Personal networks – 12%

- Online events – 12%

- Blogs of investors – 10%

- Webinars – 10%

Along with these types of marketing in crowdfunding, paid advertising, podcasts, social media, email marketing, and other marketing approaches are used.

However, crowdfunding marketing is forced to struggle with many limitations. In the first line, we shall mention regulatory restrictions in crowdfunding marketing. So, crowdfunding platforms can work with those clients only who meet specific criteria1 such as taking regulated advice, investing less than 10% of their net assets.

All marketing materials shall be clear and fair. And the platform should verify the clients understand the risks connected with such investments.

While these limitations are imposed to protect investors, they also limit the marketing possibilities of crowdfunding platforms. The most prominent example of marketing restrictions is probably the ban on marketing of the mini-bonds in the UK2.

Along with the regulatory limitations, we shall mention a low level of customer awareness and financial discipline. In most cases, people do not understand how things work and what they can expect. Therefore, they’d rather avoid crowdfunding and address their needs to a bank.

LenderKit is your solution to launch and manage your crowdfunding business efficiently

LenderKit is an investment management and crowdfunding software that can help you to manage investment deal flow and tackle crowdfunding platform challenges more effectively. The in-house white-label software has plenty of out-of-box features and includes several product tiers that you can choose from depending on your business stage

The crowdfunding software or investment management platform helps our clients ease up compliance requirements, reduce crowdfunding business risks, and provide as much flexibility as possible. You can start with an out-of-box solution or customise the software including front-end and back-end to meet your specific industry, workflows, or business needs.