Why Loan-Based Crowdfunding May Be the Preferred Model for New Platforms

No time to read? Let AI give you a quick summary of this article.

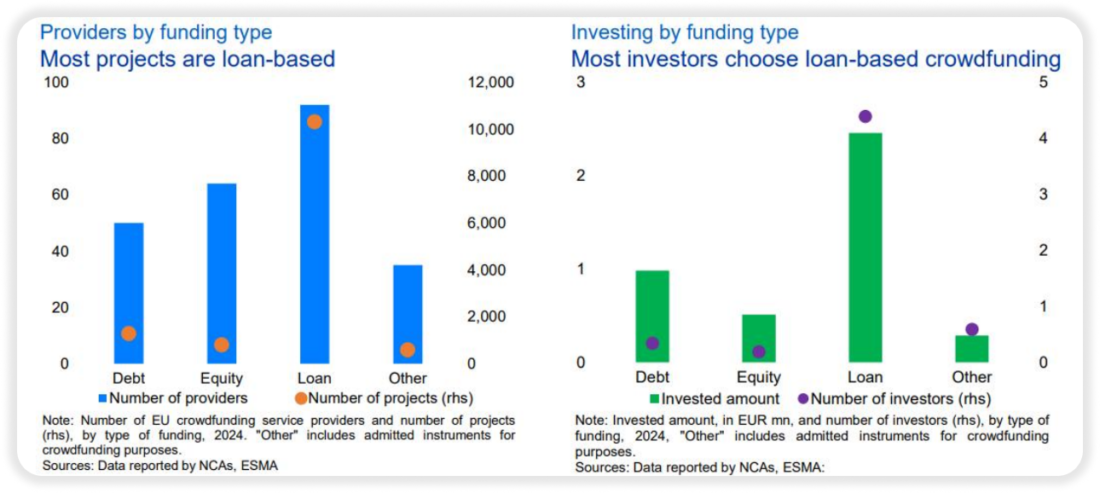

In 2024, Loan-based crowdfunding accounted for 58% of total crowdfunding activity,1 according to ESMA, rising to 91% among providers raising under EUR 100k.

Does this mean that smaller investment platforms may choose loan-based crowdfunding despite the growing maturity of the European crowdfunding market? As the industry matures, regulation is getting clearer, investors are more active, and platforms operate more professionally than before, but what’s the catch?

Let’s take a look at the major reasons why loan-based crowdfunding may be the preferred model for investment platforms.

What you will learn in this post:

More repeat fundraisers

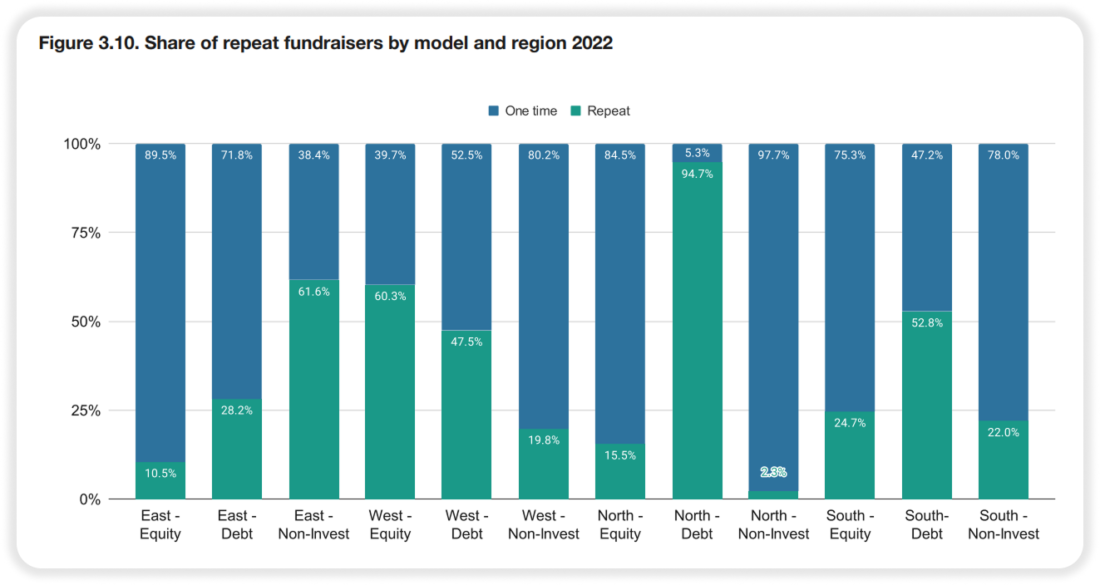

Our 2023 research with industry partners offers an early hint: repeat fundraisers are often more drawn to loan-based campaigns than equity-based ones.

When comparing one-time and repeat fundraisers, the study shows that lending models consistently attract a much higher share of repeat fundraisers than equity models across most European regions.

- In Northern Europe, nearly 95% of lending fundraisers were repeat borrowers

- In Southern and Western Europe, repeat borrowers accounted for more than 45% of lending activity

- By contrast, equity crowdfunding in most regions was dominated by one-time fundraisers, with repeat activity typically ranging between 10% and 25%

The study also found a strong relationship between repeat fundraisers and platform growth. In lending models, the share of repeat fundraisers explained over 20% of the variation in volumes raised in 2022, while the relationship was much weaker in equity crowdfunding.

Clearer operational path and more market certainty

New platforms may consider starting with loan-based crowdfunding because it may be simpler and more predictable for both operators and investors.

Unlike equity crowdfunding, which involves shareholder rights, dilution, and uncertain exit paths, loan-based campaigns rely on enforceable debt obligations with fixed repayment schedules. This predictability makes day-to-day operations easier, from accounting to cash flow management.

Recent market evidence underscores this difference. For example, in the UK, investment crowdfunding deals dropped by almost 50%2between 2021 and 2024, falling from 569 rounds to just 297, with total funding shrinking from £773M to £324M.

Analysts attribute the decline to factors such as:

- Difficulty for retail investors in calculating expected ROI

- Illiquidity and long exit timelines

- Economic pressures, including inflation and rising cost of living

By contrast, loan-based crowdfunding provides repeatable campaigns with clearer timelines and risk profiles, making it easier for early-stage platforms to:

- Build a reliable pipeline of fundraisers

- Attract retail investors who understand interest rates and repayment schedules

- Operate efficiently with small teams and limited resources

In short, the structural simplicity of loans — predictable returns, standardized contracts, and repeatable campaigns — gives new platforms a practical foundation to gain traction, build investor trust, and scale operations before expanding into more complex models like equity or hybrid offerings.

Faster deal cycles and capital turnover

Speed is especially important for new platforms, and loan-based crowdfunding often has a clear advantage.

Debt-based campaigns typically run for 6–24 months, from listing to full funding and repayment, allowing platforms to build a track record quickly.

Completed deals, regular repayments, and visible returns help increase investor trust and platform credibility. Faster capital turnover also supports the business model: fees are earned sooner, giving platforms cash flow to invest in marketing, compliance, and technology.

By contrast, equity crowdfunding tends to lock capital for over 5 years, with no guaranteed returns or clear exit timelines.

Platforms relying on equity may see slower growth, as investors wait for long-term outcomes, and fewer completed deals are available to demonstrate credibility.

Real-world examples include BrikApp3, where debt investments dominate and repayments are short-term, and Crowdcube4, where equity campaigns often involve long holding periods before returns materialize.

Clearer expectations for retail investors

Retail investors play an important role in crowdfunding, particularly at the smaller end of the market.

Most retail investors understand how loans work5.

They are familiar with concepts such as interest rates, maturity dates, and repayment schedules. They know what they are putting in and what they expect to get back.

That familiarity makes decisions easier. It also makes it simpler to compare opportunities across different platforms without needing deep financial analysis.

For new platforms, this is very important, because people understand the product quickly, and platforms can attract users and grow faster.

Equity crowdfunding works differently and demands more from investors. Instead of lending money, investors are buying into a business.

They need to assess the company’s idea, growth plans, competition, and long-term prospects. Returns are uncertain and often depend on future events such as acquisitions or listings.

For many retail investors, especially those new to crowdfunding, this seems to be complex and risky.

Easier risk communication and transparency

Another advantage of loan-based crowdfunding is clearer risk communication.

Risks in loan-based models, such as borrower default or delayed repayment, are relatively easy to explain and quantify.

Platforms can present historical default rates, collateral structures, and recovery processes in a transparent manner.

This not only helps investors to make more informed decisions but also facilitates the process of reporting to platforms.

Equity investments involve more abstract risks, including market competition, management execution, and macroeconomic shifts.

Outcomes are harder to forecast, and performance data may take years to materialize. For a young platform, it may be difficult to communicate these risks clearly and consistently.

Equity as a strategic development path

As long as new platforms start small, work with limited resources, and depend mainly on retail investors, loan-based crowdfunding will continue to be the natural first choice.

That said, starting with loans does not mean staying there forever. Many successful platforms, such as FundedByMe6, follow the same path. They begin with loan-based campaigns7, use them to build trust, and prove their model. Once that foundation is established, the platform expands the product range.

Equity crowdfunding can support larger fundraising rounds, attract more experienced investors, and fund more complex projects. This is why loan-based platforms may add an equity-based model.

However, it usually happens later, not at launch. By then, the platform has mature compliance processes, a stable and engaged investor base, and enough operational experience to handle more complex structures.

Starting simple, building for the future with LenderKit

Loan-based crowdfunding is more than just an “easy” way to get started. For most new platforms, it is the most practical foundation for building something that lasts.

This is why the choice of technology matters early on.

At LenderKit, we provide white-label crowdfunding and investment platform software with a clear progression in mind.

You can start with a loan-based crowdfunding platform, then add equity or hybrid offerings as you scale — all within the same infrastructure.

Why does LenderKit work well for your business?

Our software comes with a set of robust capabilities:

- Ready made features that can be customized on demand

- Rich list of integrations and partners

- Optional secondary market and much more

To find out how the product works and discuss details, please get in touch with our team.

Article sources:

- PDF (https://www.esma.europa.eu/sites/default/files/2026-01/ESMA_webinar_crowdfund...)

- UK Investment Crowdfunding Deals Tanked In 2024. Why Did This Happen? | Crowdfund Insider

- Debt vs Equity Investments in Real Estate Crowdfunding - BrikkApp Learn

- Equity Crowdfunding 101: A Guide For Investors

- Comparing Equity vs. Debt Crowdfunding: Which is the Better Investment? - Money Talks HQ

- FundedByMe — Invest in Growth Companies & Pre-IPO Opportunities

- FundedByMe - Wikipedia