Double your deals with alternative investment software

White-label investment platform software helps you attract retail and accredited investors, automate full-cycle capital raising and close investment deals more effectively.

- Private debt and equity

- For real estate & SMEs

- Fully-customizable

- Crowdfunding platform

- Regulations-friendly

Digitize your alternative investment management business

Market alternative investment offerings

A search-optimized website allows you to quickly showcase your investment opportunities and start attracting investors and fundraisers.

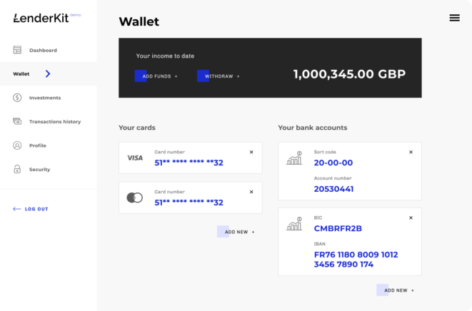

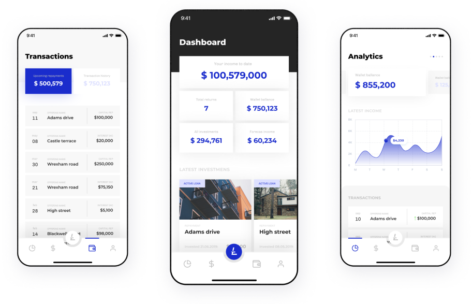

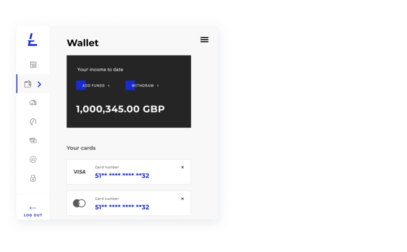

Provide an alternative investment portal

Offer professional investment dashboards for retail and accredited clients to monitor and manage their payments and returns.

Track your investment business performance

A fully-customizable white-label investment platform to manage investors and fundraisers, reporting and compliance.

How LenderKit investment software works

Why use white-label investment software?

LenderKit investment software enables asset managers, private investment networks and angel investment groups to streamline capital raising operations and close more deals.

The alternative investment software provides out-of-box and custom functionality and solves various business needs from offering marketing and money processing to reporting and data management.

Launch an alternative investment platform

With LenderKit, you can easily launch and maintain your investment marketplace:

- Deal origination

- Investor onboarding

- Identity verification

- Investor qualification

- Document management

- Campaign marketing

- Money processing

- Fees settings

- Reporting