Automate your loan management operations with LenderKit

LenderKit offers debt crowdfunding and P2P lending software for businesses that are looking to launch their own platforms. We also provide custom platform development services to ship unique platforms tailored for customer business requirements.

- Loan origination software

- Real estate lending software

- SME lending software

- Debt crowdfunding software

Launch your lending business from scratch or expand operations

Use a prototype to test your ideas

If you’re early-stage and looking for white-label software to attract investors and test ideas, check out our “Basic” package.

Automate your existing operations

If you need lending software for going through a regulatory sandbox or provide to you users, consider “Professional” package.

Grow your business with LenderKit

If you want to go with a lifetime license, source code access or multiple licenses for different regions, explore “Enterprise” tier.

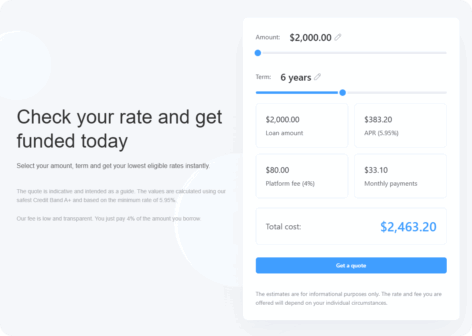

Allow users to request loans through a loan configurator on your site

One of the effective ways to source new deals and onboard borrowers through your P2P lending website is to have an in-built configurator. It allows borrowers to apply for loans and get a rough estimate on how much they can get and for what period and percentage.

This feature will empower your loan management software for real estate or SME lending. As per your request, you can either collect data right into your CRM or redirect users to the registration form to make your sales operations more efficient.

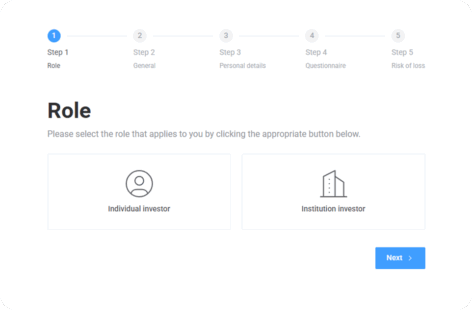

Screen new users and check their loan eligibility through registration form

A KYC/AML-ready registration form allows you to collect the required data from borrowers, loan originators, or investors and hand it over to an authorized third-party service provider or your internal department.

The registration form is an essential part of any loan management software because it helps you source only highly engaged and qualified deals and investors.

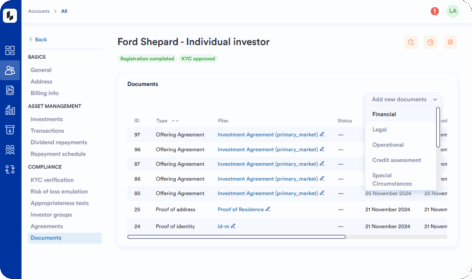

Manage documents and reports

LenderKit integrates with any e-signature and document management service providers. A reliable e-sign provider will help you reduce the paperwork and automate operations.

You may look into HelloSign, DocuSign, or other digital signature services.

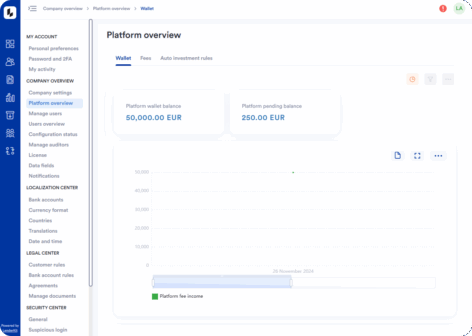

Process payments online

You can use LenderKit as an online ledger for financial history record keeping or you can integrate with a payment processing provider that will handle the compliance and money management burdens for a fee.

Payment gateways for P2P lending often deal with both KYC/AML and money processing, however, you can decide on separate providers or handle some operations on your own.

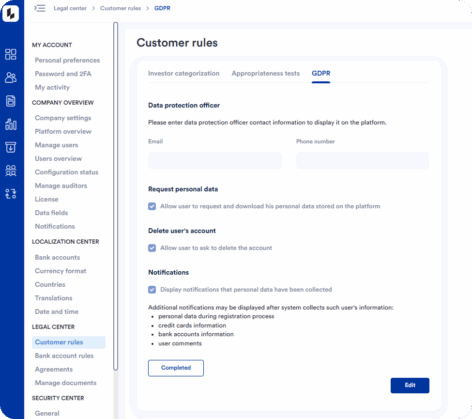

Stay GDPR compliant

We have an in-built GDPR module which facilitates your data regulation compliance requirements. You can appoint a data processing officer (DPO) and assign permissions and rights to a particular staff member who will be responsible for managing user data on your platform in a secure and compliant way.

Apart from that, GDPR module also allows you to:

- Send notifications

- Delete user accounts

- Enable cookies on your lending platform