Real estate crowdfunding software for your business

Launch your property crowdfunding platform with a flexible, proven and market-ready white-label crowdfunding software for real estate investing. Whether you focus on buy-to-let, buy-to-sell, property renovation or real estate syndication — our solution will help you close more property deals worldwide.

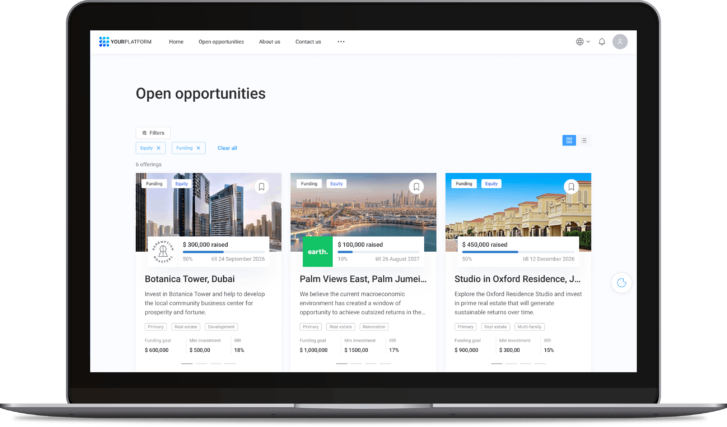

Expand investor access

Democratize access to capital for retail investors and allow them to invest in prime real estate with lower capital requirements.

Bring together high-net-worth individuals, corporate investors, retail investors and project owners — all in one real estate investment platform.

With a highly-customizable real estate investor portal, you can support various property fundraising models, including debt and equity.

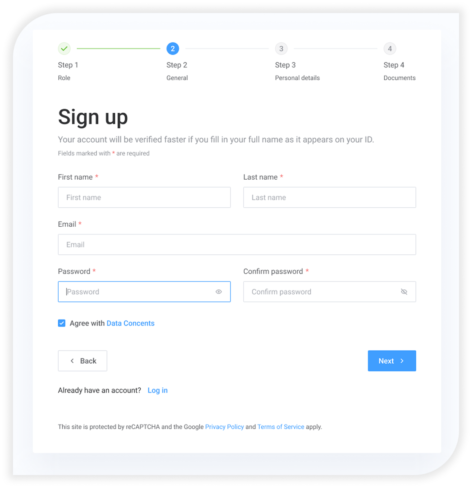

Streamline real estate fundraising and deal management

Are you a real estate asset manager, property developer or a real estate investment company looking to increase brand awareness, build trust and foster your investment community? We’ve got you covered.

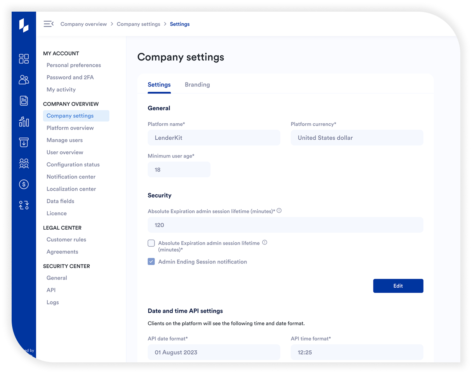

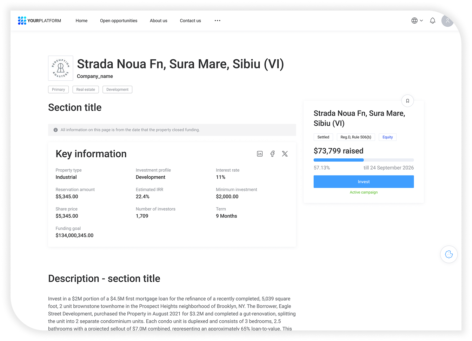

LenderKit provides customizable property investment software that helps you automate investor onboarding, KYC/AML checks, document management, and more.

From integrated payment solutions for seamless transactions to a structured deal room to showcase projects and track investor commitments — your platform will become the true real estate investment powerhouse.

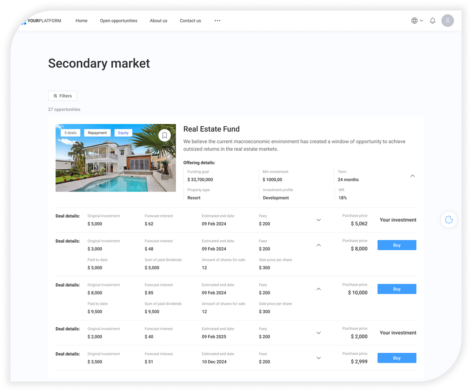

Provide more liquidity to investors through the secondary market

One of the biggest challenges in real estate investing is the lack of liquidity. LenderKit helps investment firms address this by enabling a secondary market where investors can buy and sell their shares, unlocking capital before the typical exit period.

Take a look at how LenderKit works

Ensure compliance and regulatory alignment

Our white-label real estate crowdfunding software covers many jurisdictions and use cases. We offer in-built functionality to facilitate your compliance, but we can also fully customize the platform to make sure we’re aligned.

Out-of-box, we cover:

- SEC/FINRA in the US

- ECSPR across Europe

- FCA in the UK

- Saudi Arabia & MENA region

While you still need to get your business approved and licensed, on the tech side, you can easily run a global investment platform in compliance with regulations.