Start a crowdfunding business in the UK

Launch your UK crowdfunding platform faster with a proven technology foundation built for regulated investment models. LenderKit helps founders and investment companies move from idea to market-ready platform with reliable UK crowdfunding software.

Compliance-ready, customizable and built for scale

Get started with a prototype

With LenderKit, you can launch a crowdfunding platform prototype, so you can register your business with the FCA, pitch your idea to investors or test the waters before committing to a full scale platform.

Upgrade as your business grows

LenderKit comes with a package of ready-made features and integrations, and we can also fully customize the platform as your business develops and matures.

Build a custom crowdfunding platform

Ready for something bigger? We’ve got you covered. At LenderKit we worked with UK-based crowdfunding platforms from concept to full launch in both community crowdfunding and investment-based models.

Launch an FCA-compliant crowdfunding platform

LenderKit offers white-label crowdfunding software that has stood the test of time and is used by multiple businesses operating in the UK.

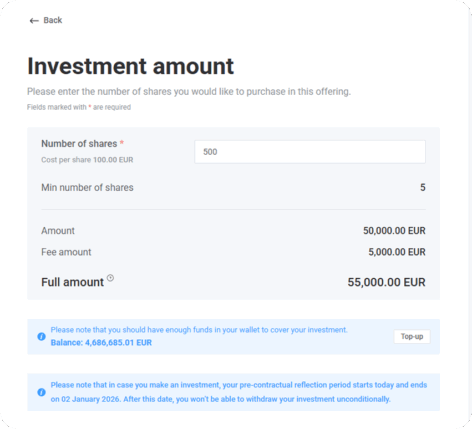

Our software supports full capital raising cycle from investor onboarding to offering creation, fundraising, closure and repayments.

- Crowdfunding software

- FCA-ready

- Proven case studies

- Customisable

- Equity, debt, donation

Set up a property crowdfunding platform in London

Whether you want to start a real estate investment platform, trust or fund to finance property development, buy-to-let or buy-to-sell projects in the UK, you can use LenderKit to start off on the right foot.

Explore our UK property crowdfunding software packages for startups and established investment companies.

LenderKit offers many out-of-box features tailored specifically for the real estate crowdfunding, so book a demo to check them out.

Build a UK startup crowdfunding platform

Want to focus on the UK startup financing and launch an equity or debt crowdfunding platform? LenderKit may become your reliable UK crowdfunding software provider.

With our white-label UK crowdfunding solution, you can combine multiple investment flows in one platform including debt, equity and donations. You can use this feature to target different investor groups and crowdfunding projects or focus on one which fits you best.