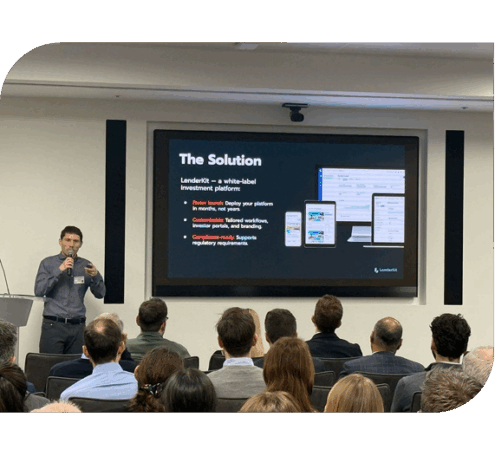

In 2021, we tailored LenderKit software to help our clients ease up compliance requirements worldwide. More precisely, we released the US and EU compliance modules.

For the US market, we released new functionality that supports Reg CF, A, D and S regulation types.

Also this year, European Commission adopted new crowdfunding rules for ECSPs. To prepare for the market changes, we updated LenderKit and were the first to launch a regulatory compliance module for European crowdfunding platforms and investment marketplaces.

We’ve also significantly improved the out-of-box package and included support of payment gateways such as Lemonway, FundAmerica and MANGOPAY and also KYC providers such as Jumio. Apart from that, we’ve built a blockchain integration with Polymath.

On the features side, we added private data room, appropriateness test, wallet-based and direct investing, multi-language support and more.

With the updated software architecture and more flexibility, we also introduced better pricing options to new customers worldwide.