Launch your crowdfunding business in Europe

Scale your startup investing or property crowdfunding business, apply to get the ECSP crowdfunding license and build a custom crowdfunding platform.

Start or scale your investment business with LenderKit

Enter the impact crowdfunding niche

Impact investing, as a part of the sustainable finance program, is a growing and profitable niche to start your crowdfunding business in Europe and the UK.

Launch direct investment platform

If you’re looking to build a direct investment platform from investor to fundraiser, consider the LenderKit crowdfunding software

Build loan-based or equity platform

LenderKit provides solutions for loan-based crowdfunding platforms as well as equity crowdfunding portals in the UK and Europe.

Property crowdfunding in the UK and Europe

Build a property crowdfunding platform, REIT or mutual fund to finance property development, buy-to-let or buy-to-sell projects in Europe.

Explore our property crowdfunding software tiers for small, medium-sized companies and large corporations.

LenderKit offers many out-of-box features tailored specifically for the real estate crowdfunding.

SME crowdfunding

Launch an equity crowdfunding platform to finance startups in the UK or Europe. Provide investors with direct investing opportunities and facilitate full-cycle fundraising for startups.

And if you’re looking to tap into the business lending market, we can help you set up a loan management platform according to your requirements.

LenderKit allows you to combine several flows in one platform including debt, equity and donations, so you can have a 360 crowdfunding solution.

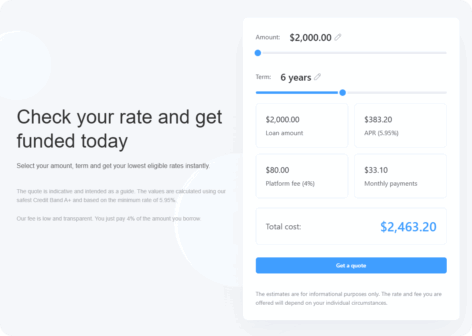

Empower your platform with integrations

If you want to automate money processing on your crowdfunding platform, you may need to integrate with a reliable payment gateway. There are many systems that could potentially support crowdfunding such as Online Payment Platform, Lemonway, Mangopay, Secupay, ConnectPay, Ebury and others.

Apart from transaction processing, many payment gateways also provide KYC/AML services, so you don’t need additional tools, but if you do, you can always consider something like Jumio, iDenfy, Onfido, etc.

While LenderKit has already got Lemonway, Mangopay and Jumio integrated, if you have a custom integration in mind and what to discuss the requirements, reach out to us for more details.